IRS Form 8863 Education Credits (American Opportunity and Lifetime Learning Credits)

What Is Form 8863?

IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits) , is a tax form used to claim one of the Internal Revenue Service (IRS) educational tax credits. It will provide a dollar-for-dollar reduction in the amount of tax owed at the end of the reporting year for the expenses incurred to attend educational institutions that participate in the student aid programs.

You can download a fillable Form 8863 through the link below. If you are looking for a more detailed breakdown of the education credits and their calculation, use the official IRS Instructions for Form 8863 - download them here.

What Is Form 8863 Used For?

An IRS 8863 Tax Form is needed to calculate and claim education credits - you may only take one of them for the same student in the same year. Using this document, you will offset the expenses of education by covering the costs of books, tuition, and necessary school supplies and reduce the burden of paying student loan debt back, whether you or your dependent was a student. Currently, there are two education credits available:

- American Opportunity Tax Credit (AOTC). It is a refundable credit - you might get a refund even if you do not owe any tax and otherwise would not file a tax return. This credit is available to eligible individuals who pursue a certain degree and are enrolled in a university or college. To qualify, your income must be $90,000 or less ($180,000 if you are married and filing jointly);

- Lifetime Learning Credit (LLC). It is nonrefundable - your tax might be reduced, but you will not be refunded any excess. You qualify for the LLC if your income is $68,000 or less ($136,000 if you are married and filing jointly). This credit offers more flexibility because it requires the student to be enrolled in at least one course during the reporting year.

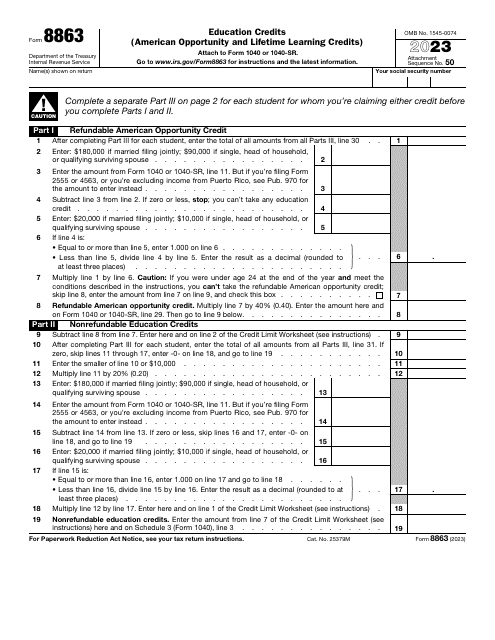

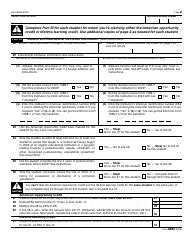

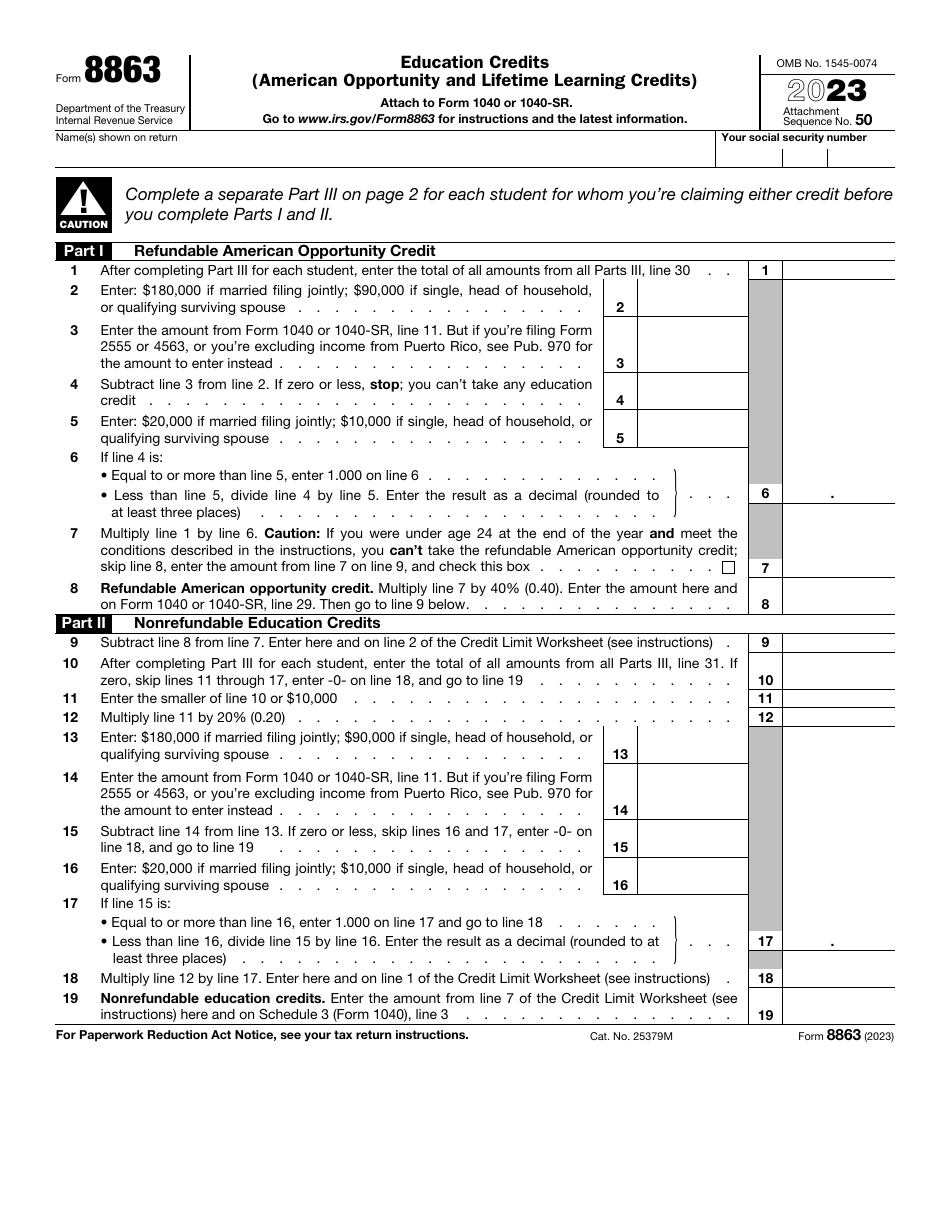

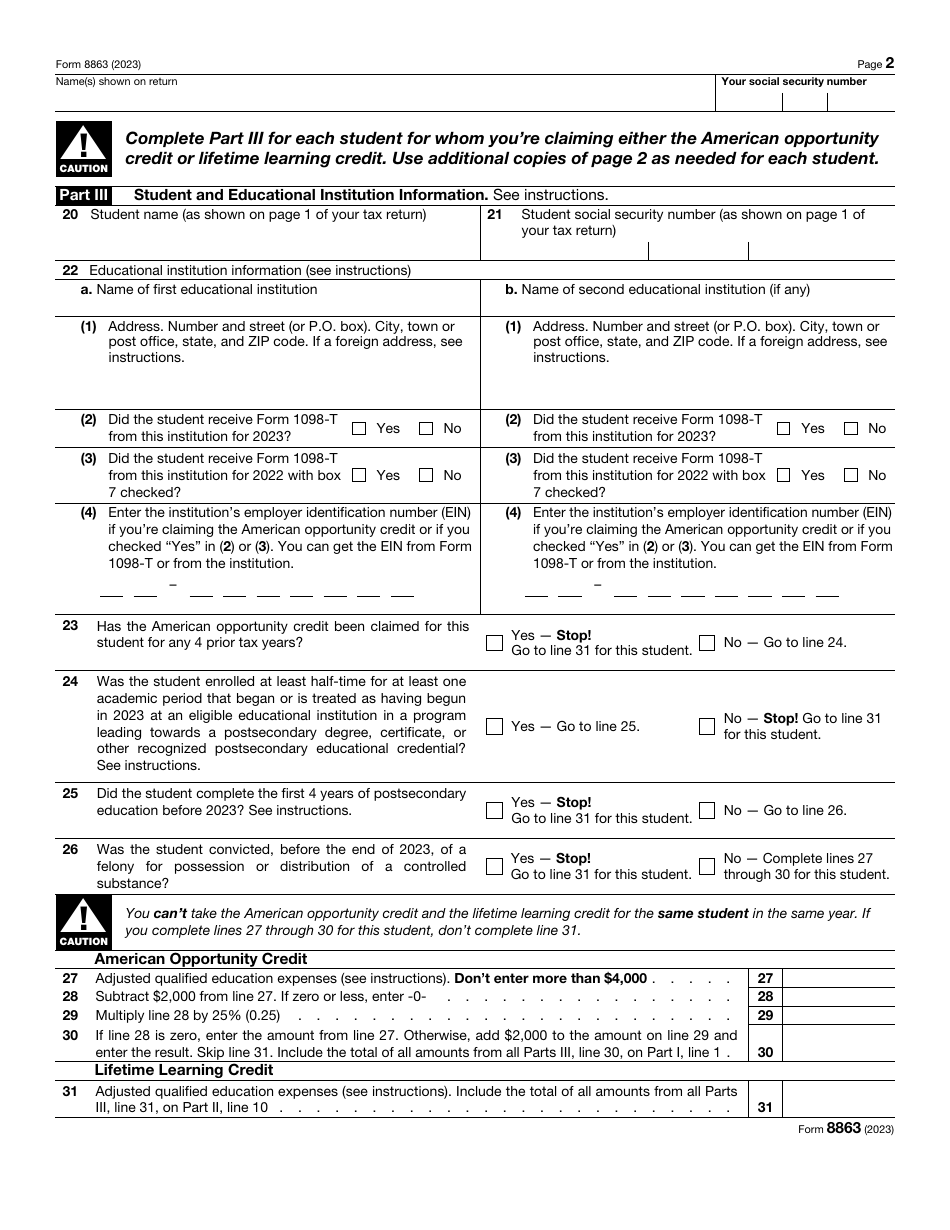

Form 8863 Instructions

Follow these steps to complete the 8863 Tax Form:

- Start with the second page of the form to provide student and educational institution information. Indicate the student's name and social security number. State the name and address of the educational institution. If the student received IRS Form 1098-T, Tuition Statement, from this institution, check the appropriate boxes. Enter the institution's employer identification number;

- Answer questions about the previous claims and student's enrollment in an eligible educational institution. If the student was convicted of a felony for distribution or possession of a controlled substance, answer "yes";

- To figure out the AOTC, enter the amount of qualified education expenses (not more than $4,000) and subtract $2,000. Multiply this amount by 25% and add $2,000;

- To calculate the LLC, write down the total of the education expenses. To do it, you need to complete a separate worksheet from the IRS instructions;

- Go back to the first page, write down your name and social security number;

- Calculate the amount of the refundable AOTC you are eligible for. You will need to enter your adjusted gross income from the Form 1040 and confirm you meet the conditions described in the instructions;

- Figure out the LLC using the Credit Limit Worksheet. For the LLC, you multiply your educational expenses (up to $10,000) by 20%. You also need to enter the amount of the LLC on Schedule 3 attached to Form 1040.

When Can I File Form 8863?

To claim American Opportunity and Lifetime Learning Credits, you need to file an 8863 Form with IRS Form 1040, Individual Income Tax Return, or Form 1040-NR, U.S. Nonresident Alien Income Tax Return. The mailing address depends on your state and whether you enclose the payment. You may apply for the AOTC for the first four years of higher education and get an annual credit of $2,500 for qualified expenses that include tuition. As long as the eligible student is enrolled in any educational university or any course to acquire or improve job skills, you can claim the LLC and receive up to $2,000 for educational expenses that include fees and tuition.