IRS Form 2441 Child and Dependent Care Expenses

What Is IRS Form 2441?

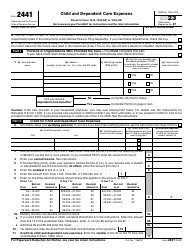

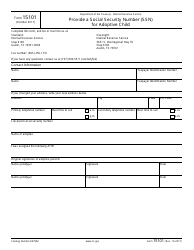

IRS Form 2441, Child and Dependent Care Expenses , is a statement developed especially for those taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work. The purpose of the document is to let taxpayers apply to receive credit for child and dependent care expenses. The document was issued by the Internal Revenue Service (IRS) and was revised in 2023 .

Check the official IRS-issued instructions before completing and submitting the form. Download a fillable version of IRS Form 2441 through the link below.

How to Fill Out IRS Form 2441?

-

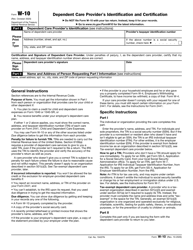

In Part I ("Persons or Organizations Who Provided the Care"), the filer must indicate information about an entity or individual who provided the care. In order to do that, the filer must know a care provider's name, address, identifying number (employer identifying number or social security number), and the amount of money paid to them. If the filer does not have this kind of information, then for obtaining it they should use IRS Form W-10, Dependent Care Provider's Identification and Certification, which was developed by the IRS specifically for these purposes.

-

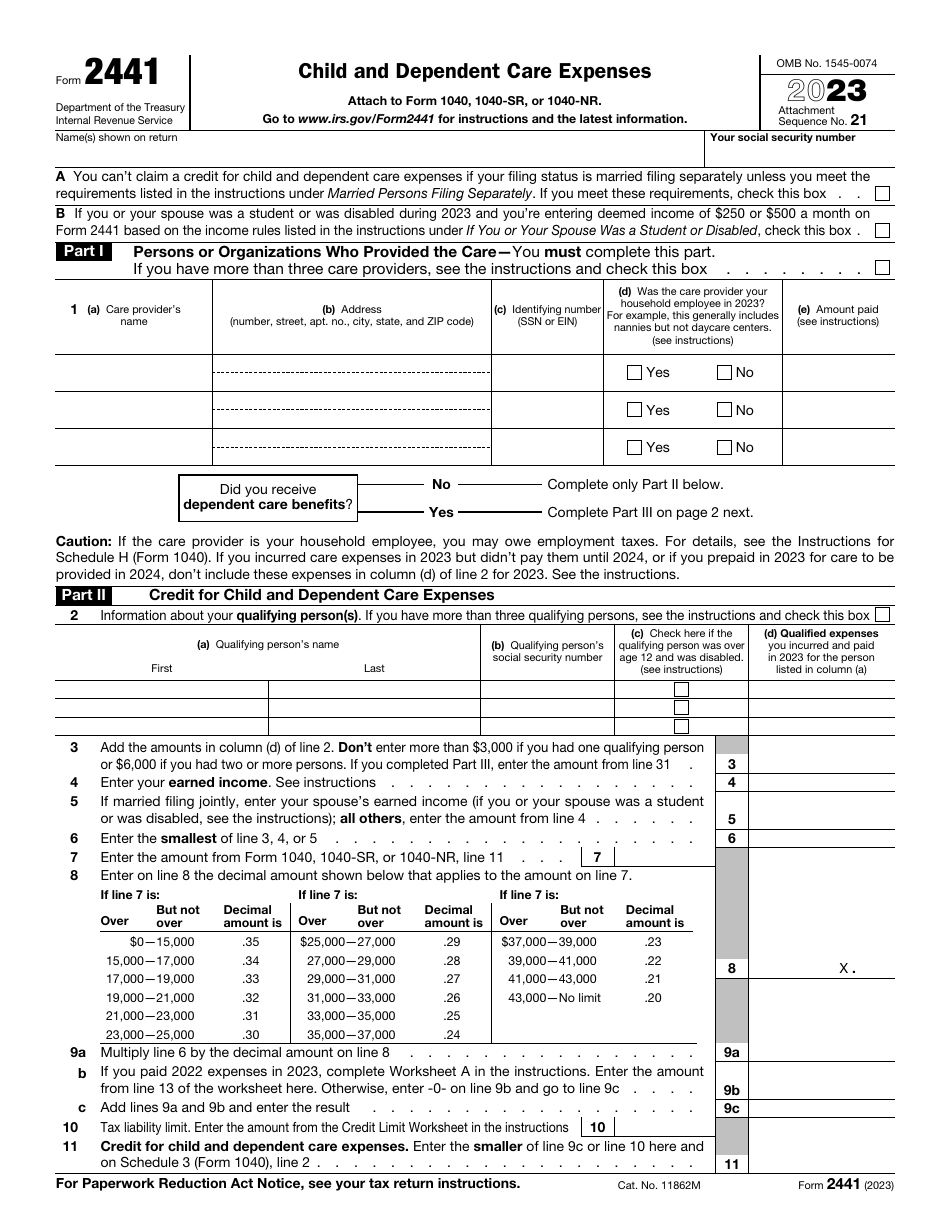

Part II ("Credit for Child and Dependent Care Expenses") is dedicated to several topics, such as information about the filer's qualifying person, earned income, amounts of money from different lines of the form, tax liability limit (the amount from the Credit Limit Worksheet), etc. According to the Form 2441 instructions, a qualifying person is:

- Any child under age 13 whom the filer can claim as a dependent. If the child turned 13 during the year, the child is a qualifying person for the part of the year they were under age 13;

- The filer's disabled spouse who wasn't physically or mentally able to care for their self;

- Any disabled person who wasn't physically or mentally able to care for themselves whom the filer claim as a dependent or could claim as a dependent. However, this statement has exceptions. Such as:

- The disabled person had a gross income of $4,200 or more,

- The disabled person filed a joint return,

- The filer (or filer's spouse if filing jointly) could be claimed as a dependent on another taxpayer's 2019 return.

-

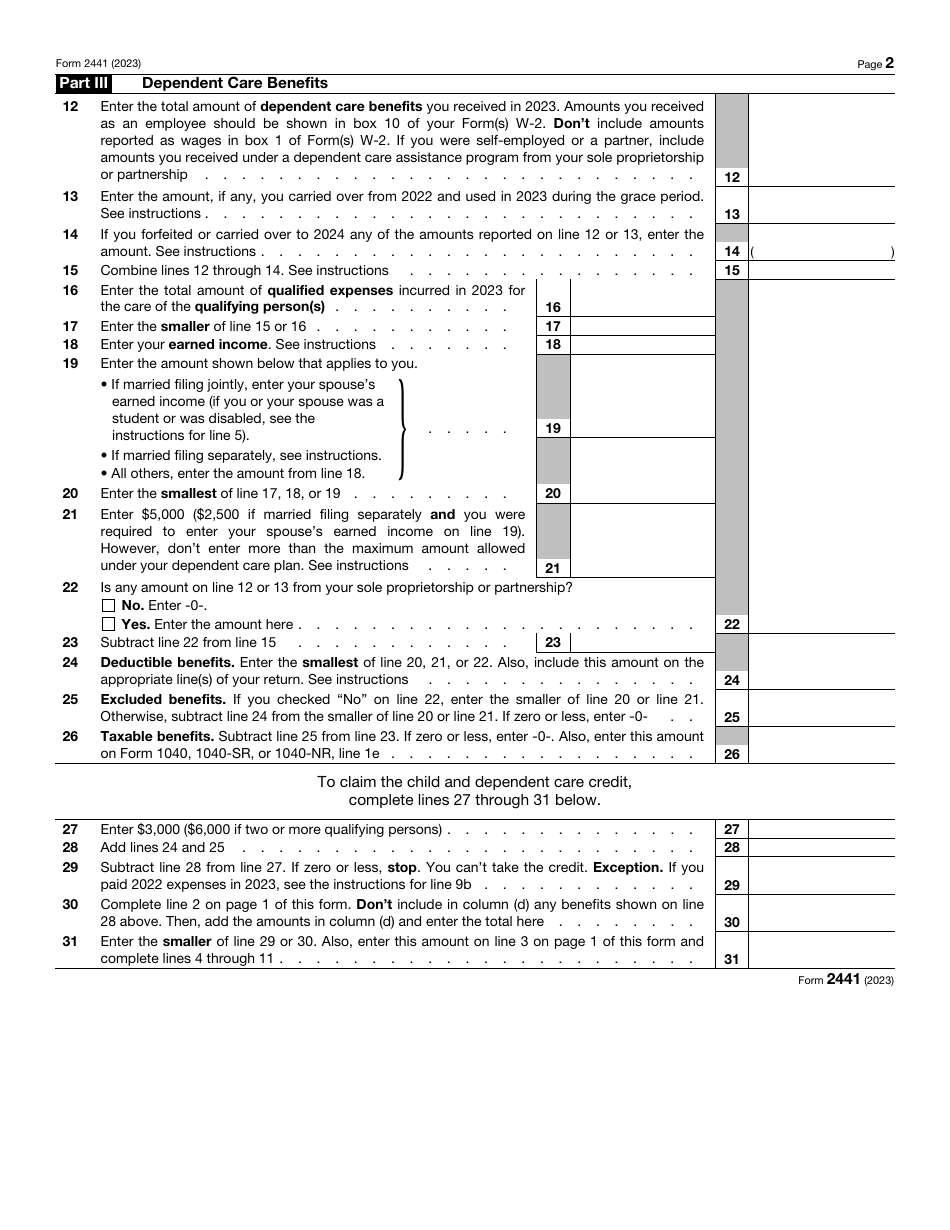

Part III ("Dependent Care Benefits") is supposed to be filled out if an applicant has received Dependent Care Benefits before. Here they must indicate the total amount of care benefits received in the previous year, the amount forfeited or carried forward to the next year, deductible benefits, excluded benefits, taxable benefits, etc.

-

For all of the numbers that are supposed to be counted by the filer, the IRS provides formulas under each line specifically or provides directions and links to other lines of the form, where the filer can find useful information.

-

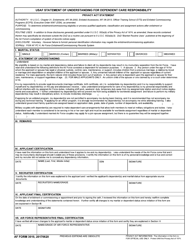

Generally, married people are supposed to fill out the application jointly, however, if the filer claims the credit and their filing status is married filing separately, there are certain requirements in the form instructions that they must meet in order to be considered unmarried for the purpose of the form.