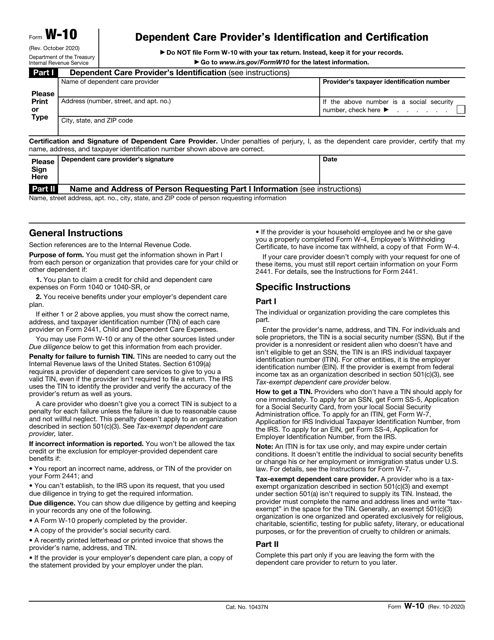

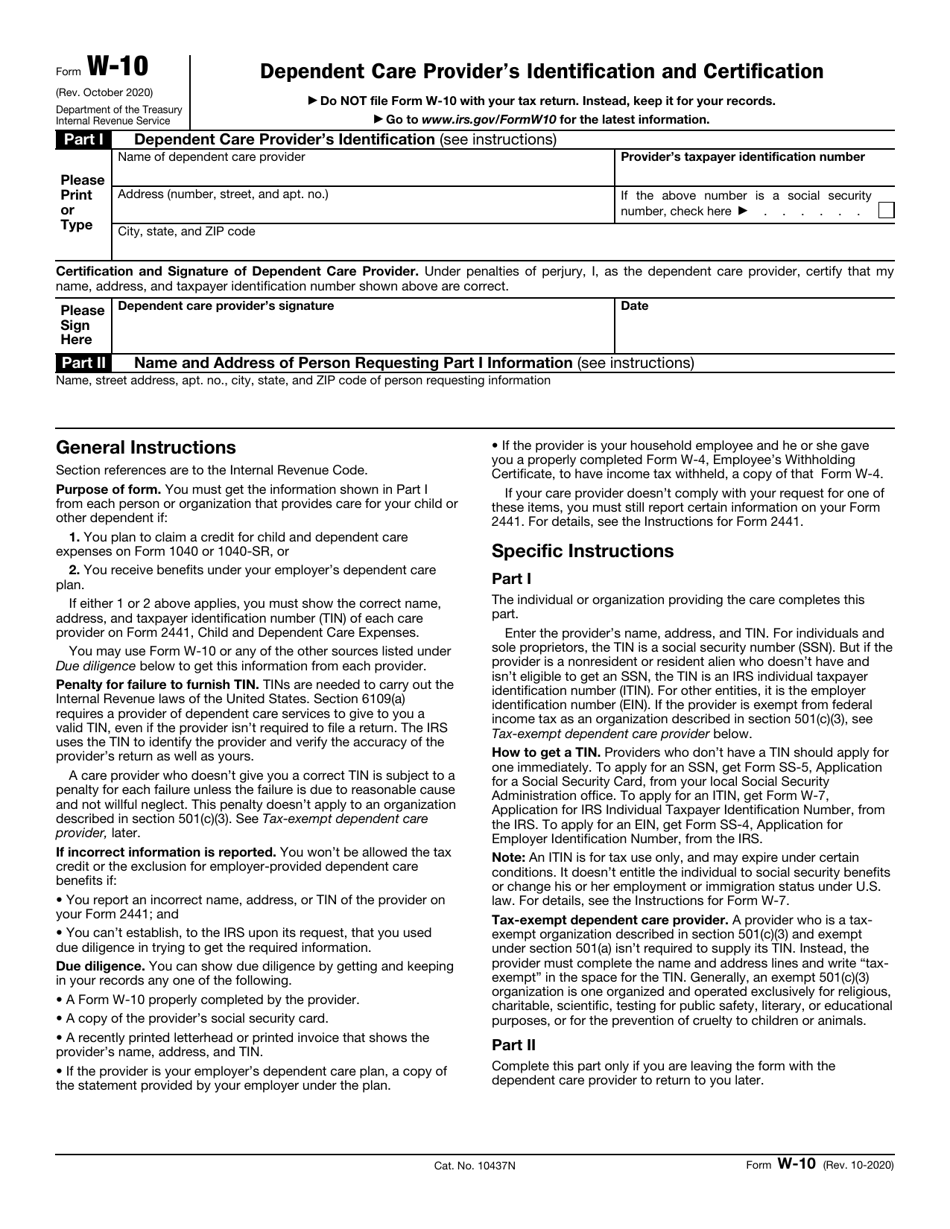

IRS Form W-10 Dependent Care Provider's Identification and Certification

What Is a W-10 Form?

IRS Form W-10, Dependent Care Provider's Identification and Certification , is an application issued by the Internal Revenue Service (IRS) for certain types of taxpayers, who:

- Get benefits under their employer's dependent care plan.

- Want to claim a credit for child and dependent care expenses using Form 1040, U.S. Individual Income Tax Return, or Form 1040-SR, U.S. Tax Returns for Seniors.

If any of the stated above is correct, then a taxpayer must report the correct name, address, and Taxpayer Identification Number (TIN) of the care provider on Form 2441, Child and Dependent Care Expenses. A W-10 Form's purpose is to get the correct information from each entity or individual that provides care for a taxpayer's child or another dependent.

The application was last revised on October 1, 2020 . A fillable W-10 Tax Form is available for download below.

Form W-10 Instructions

Completing a W-10 Tax Form is a pretty straightforward process, however in order to avoid any difficulties the IRS accompanied it with instructions. The form is supposed to be filled out by care providers, any individual or entity which provides care. Taxpayers request care providers fill this form out and afterward they give it back to taxpayers to keep for their records.

Form W-10 consists of two parts. Part I is supposed to be filled out by a care provider. They must show their name, address, and TIN. Depending on their status, a TIN can be presented by:

- Social Security Number (SSN), if a care provider is a sole proprietor or an individual;

- IRS Individual Taxpayer Identification Number (ITIN), if a care provider is a resident alien or nonresident who doesn't have and isn't eligible to get an SSN;

- Employer Identification Number (EIN), if a care provider is none of the above.

The application instructions specifically underline the status of tax-exempt dependent care providers. According to section 501(c)(3) and 501(a) of the Internal Revenue Code, tax-exempt organizations mentioned in the sections stated above aren't required to supply a TIN. They must designate their name and address in the application, however, instead of showing their TIN they must write "tax-exempt" in the space for the TIN.

Part II of the document is only supposed to be filled in by a requester if they are leaving the document with the dependant care provider to return it later.

IRS W-10 Related Forms:

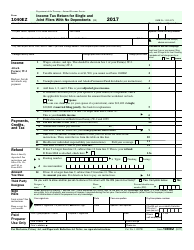

- Form 1040, U.S. Individual Income Tax Return. The application is used by taxpayers for filing an annual income tax return;

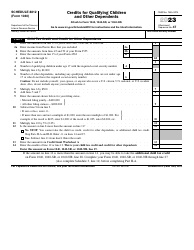

- Form 2441, Child and Dependent Care Expenses. The document covers the possibility of receiving credit for child and dependent care expenses. It's applicable in those cases when a filer has paid someone to take care of their child or another qualifying person so they could work or look for work;

- Form SS-4, Application for Employer Identification Number (EIN). An individual can use this document to apply for an EIN;

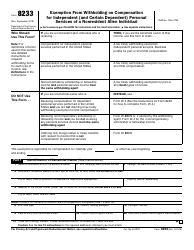

- Form W-4, Employee's Withholding Certificate. An employee completes this application every year (or when their financial or personal situation changes) to let their employer withhold the correct federal income tax from the employee's pay;

- Form W-7, Application for IRS Individual Taxpayer Identification Number. Taxpayers use this document to apply for an Individual Taxpayer Identification Number (ITIN). If a taxpayer's ITIN is expiring or has already expired, then a taxpayer can use this application to renew it.