Foreign Earned Income Exclusion: Do I Have to Pay Taxes as an American Living Abroad?

As a U.S. person living abroad, you are obliged to pay United States taxes on your worldwide income.

What Is Foreign Earned Income Exclusion?

The foreign earned income exclusion, the foreign housing exclusion, and the foreign housing deduction all go under the foreign earned income tax. The income you receive abroad is taxed by the foreign country and can be taxed again by the Internal Revenue Service .

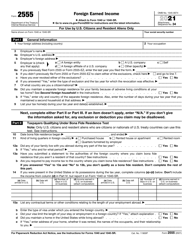

The Foreign Earned Income Exclusion (FEIE) is an exemption from the double IRS income taxation for qualified taxpayers, as long as they meet certain criteria, by attaching IRS Form 2555, Foreign Earned Income, to their annual tax return. In addition, you can qualify to exclude or deduct certain foreign housing amounts.

The foreign housing exclusion and deduction allows taxpayers who live and work abroad to exclude an amount related to housing expenses. The foreign housing exclusion or deduction is claimed in parts VI, VIII, and IX of IRS Form 2555.

The housing exclusion applies only to the funds that the employer allocates for housing. The housing deduction applies only to amounts paid for with self-employment earnings.

Which Is Better: Foreign Earned Income Exclusion or Foreign Tax Credit?

You can choose to apply the Foreign Earned Income Exclusion (FEIE) or the Foreign Tax Credit (FTC) .

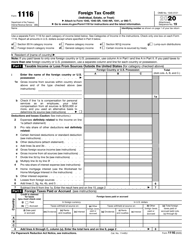

The main difference between the FEIE and the FTC is that the FTC is a tax credit for income taxes paid to a foreign country as a result of foreign income tax withholdings. To claim the FTC you need to file IRS Form 1116, Foreign Tax Credit.

The Foreign Tax Credit allows you to reduce your tax owing to zero, which makes it a better option compared to the FEIE. Since the tax rate in most countries is greater than the one in the United States, it makes it a better choice. If this is not the case, the FEIE could be the preferred choice.

The FTC is better for the first year of living in the foreign territory because you do not have to pass the residency tests. Besides, it can be applied to both passive and general income. If you are eligible, it is better to prepare your tax return under both the FEIE and the FTC to see which one is more beneficial.

Which States Allow Foreign Earned Income Exclusion?

Most states let qualifying taxpayers claim the FEIE, which prevents taxpayers from double taxation.

Note that six states do not accept the FEIE: Alabama, California, Hawaii, Massachusetts, New Jersey, Pennsylvania.

How to Qualify for Foreign Earned Income Exclusion?

If you qualify, you can exclude from US taxation more than $100,000 on your taxes. The amount of exclusion increases each year because it's indexed for inflation. In order to be eligible for the FEIE, you must work and reside outside the U.S., and you’ll need to qualify using either the bona fide residence test or the physical presence test.

The bona fide residence test requires that you have been in a foreign country for an uninterrupted period that includes an entire tax year. You will pass the physical presence test if you had physically resided abroad for 330 full days during 12 consecutive months.

Select which test helps you qualify; you are not able to use them both.

How to File?

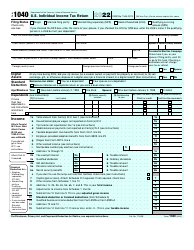

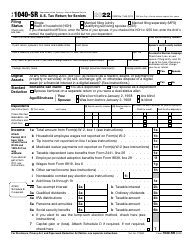

You need to fill out IRS Form 2555 and attach it to your IRS Form 1040 (Federal Tax Return). Attach IRS Form 2555 to IRS Form 1040 or Form 1040-SR when filed. Enter the following:

- General information: name, address, occupation and other personal details.

- Qualify using one of the tests: the physical presence test or the bona fide residence test.

- Determine which form you need to file.

- Complete the form with your foreign income earnings statements.

When to File?

Using the regular IRS Form 2555, you can claim the Foreign Housing Exclusion and Deduction at the same time, and potentially save more money.

Beginning with the tax year 2019, IRS Form 2555-EZ, Foreign Earned Income Exclusion, is no longer available for making the application to exclude foreign earned income and the foreign housing cost amount.

Note that you must not include any taxes an employer withheld from your wages and paid to the foreign country's tax authority instead of paying the U.S. Treasury on IRS Form 1040 or 1040-SR, line 17 (Federal income tax withheld). Check two more IRS Forms which may also be useful for determining the amount of taxes you need to pay:

- IRS Form 673, Statement for Claiming Exemption from Withholding on Foreign Earned Income Eligible for the Exclusion(s) under Section 911. The purpose of this form is to certify to your employer that you claim an exemption from U.S. income tax on wages earned abroad and the foreign earned income exclusion and foreign housing exclusion.

- IRS Form 6251, Alternative Minimum Tax Individuals is a tax form used to deduct the sum of alternative minimum tax (AMT) a taxpayer has to pay or to determine if they are subject to it.