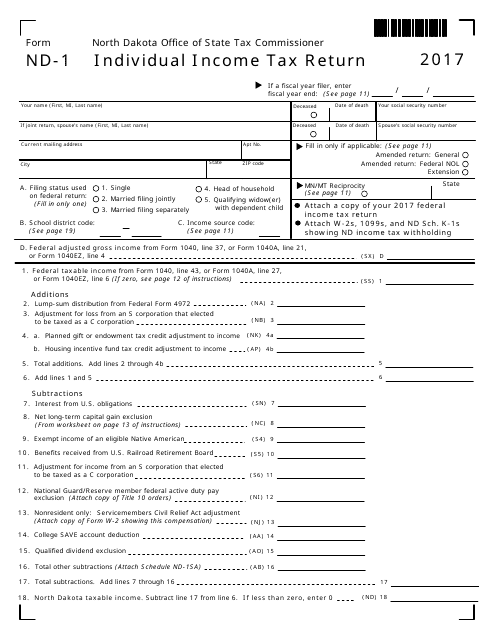

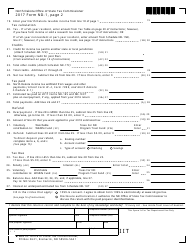

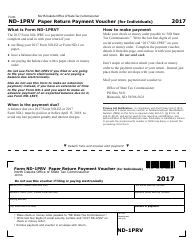

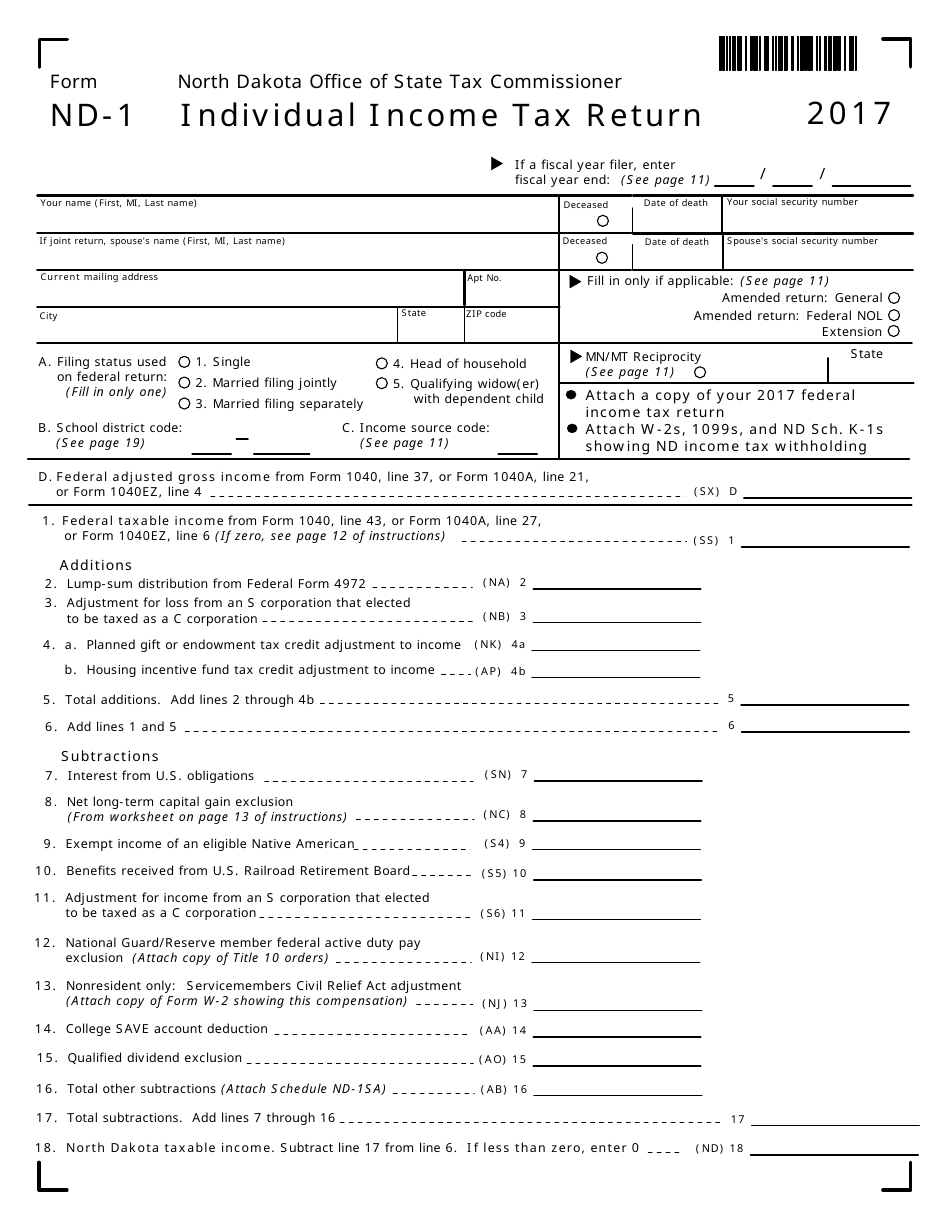

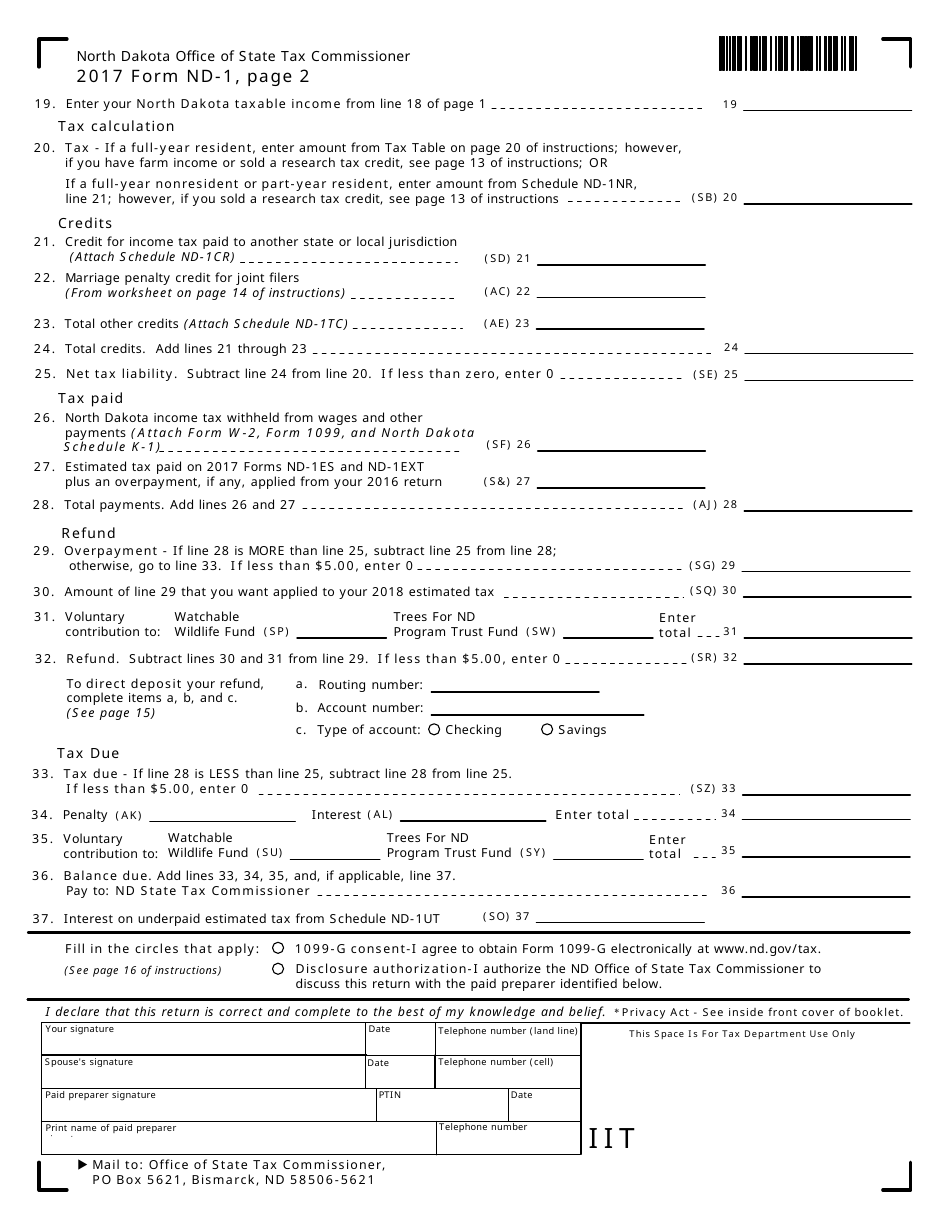

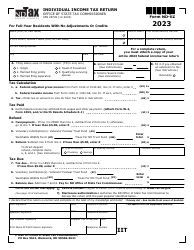

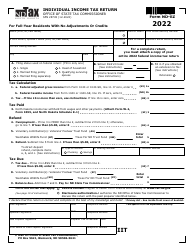

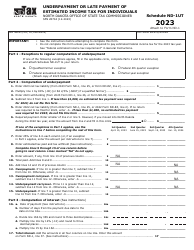

Form ND-1 Individual Income Tax Return - North Dakota

What Is Form ND-1?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ND-1?

A: Form ND-1 is the individual income tax return form used in North Dakota.

Q: Who needs to file Form ND-1?

A: Residents of North Dakota who earn income are generally required to file Form ND-1.

Q: What information do I need to complete Form ND-1?

A: You will need information about your income, deductions, and credits to complete Form ND-1.

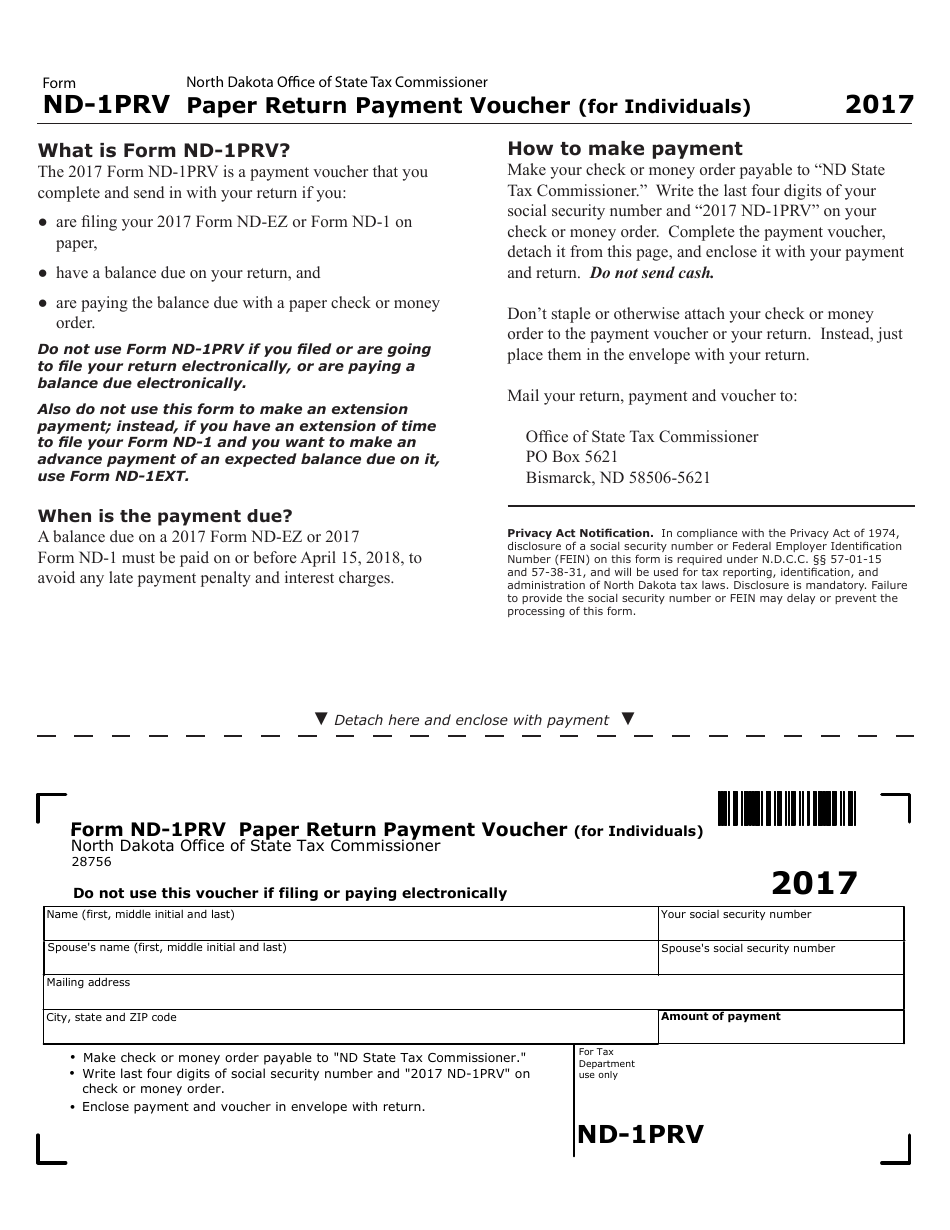

Q: When is the deadline to file Form ND-1?

A: The deadline to file Form ND-1 is April 15th, or the next business day if April 15th falls on a weekend or holiday.

Q: Are there any special considerations for military personnel?

A: Yes, military personnel have certain tax benefits and considerations in North Dakota. It is recommended to consult the instructions or a tax professional.

Q: What if I can't file my Form ND-1 by the deadline?

A: If you are unable to file your Form ND-1 by the deadline, you may request an extension, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Form Details:

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ND-1 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.