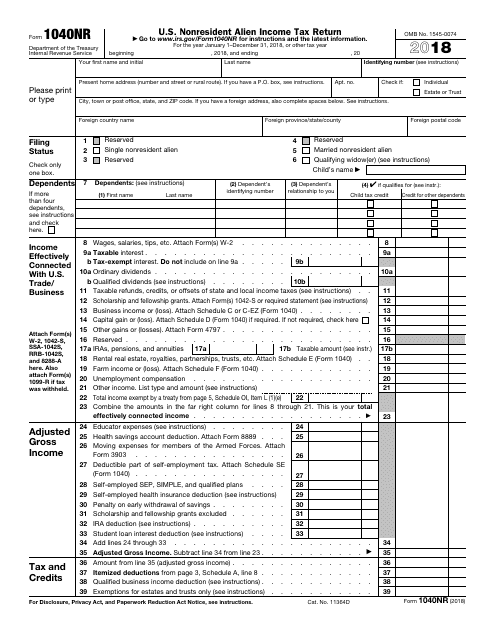

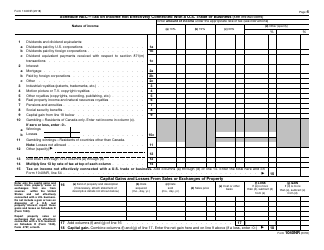

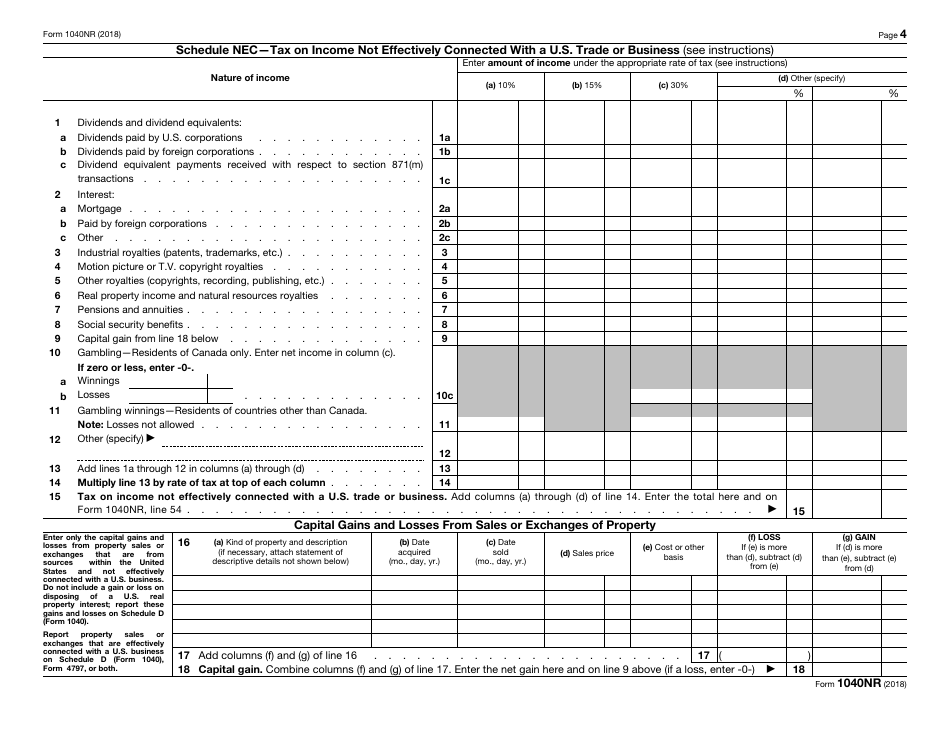

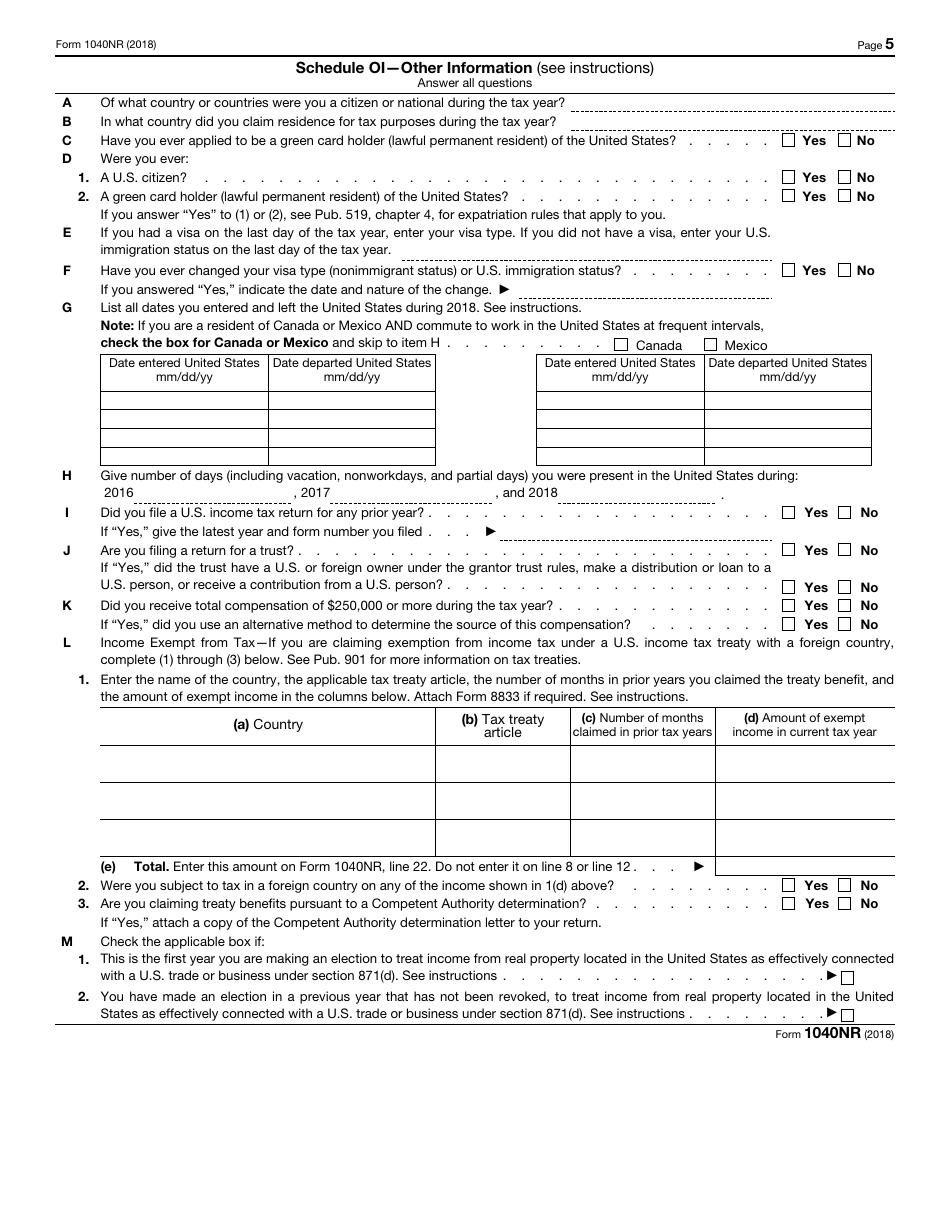

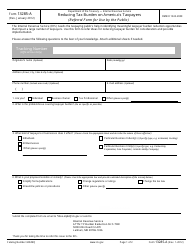

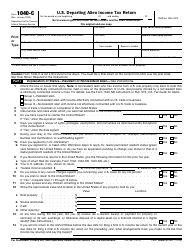

IRS Form 1040NR U.S. Nonresident Alien Income Tax Return

What Is IRS Form 1040NR?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1040NR?

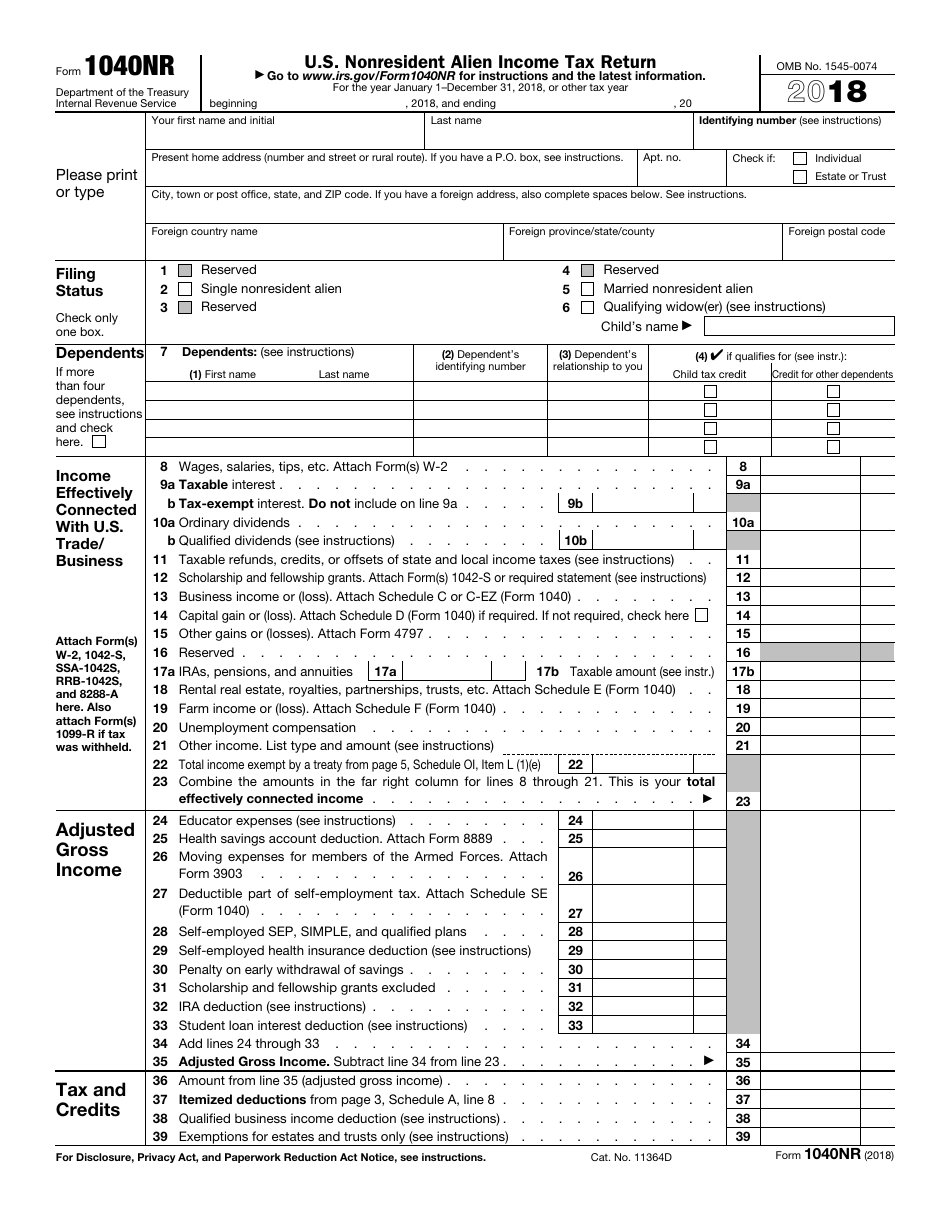

A: IRS Form 1040NR is a tax form specifically for nonresident aliens who have income from U.S. sources.

Q: Who should file Form 1040NR?

A: Nonresident aliens who have income from U.S. sources and are not eligible to file a regular Form 1040 should file Form 1040NR.

Q: What is the purpose of Form 1040NR?

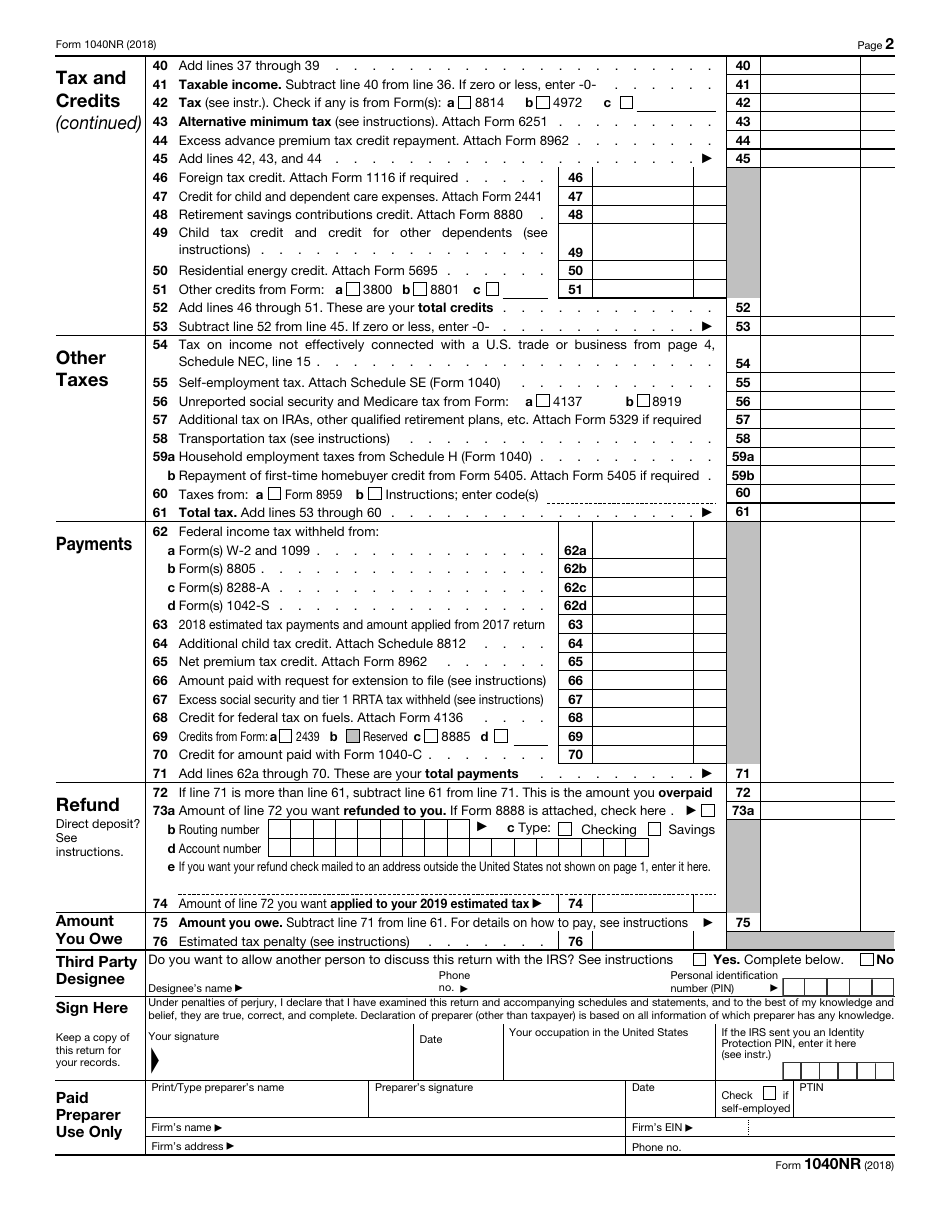

A: The purpose of Form 1040NR is to report and pay taxes on income earned by nonresident aliens from U.S. sources.

Q: Can I use Form 1040NR if I am a U.S. citizen?

A: No, Form 1040NR is specifically for nonresident aliens. U.S. citizens should use different tax forms.

Q: What income should be reported on Form 1040NR?

A: All income from U.S. sources, including wages, salaries, tips, and rental income, should be reported on Form 1040NR.

Q: What is the deadline for filing Form 1040NR?

A: The deadline for filing Form 1040NR is generally April 15th, but it may vary depending on individual circumstances.

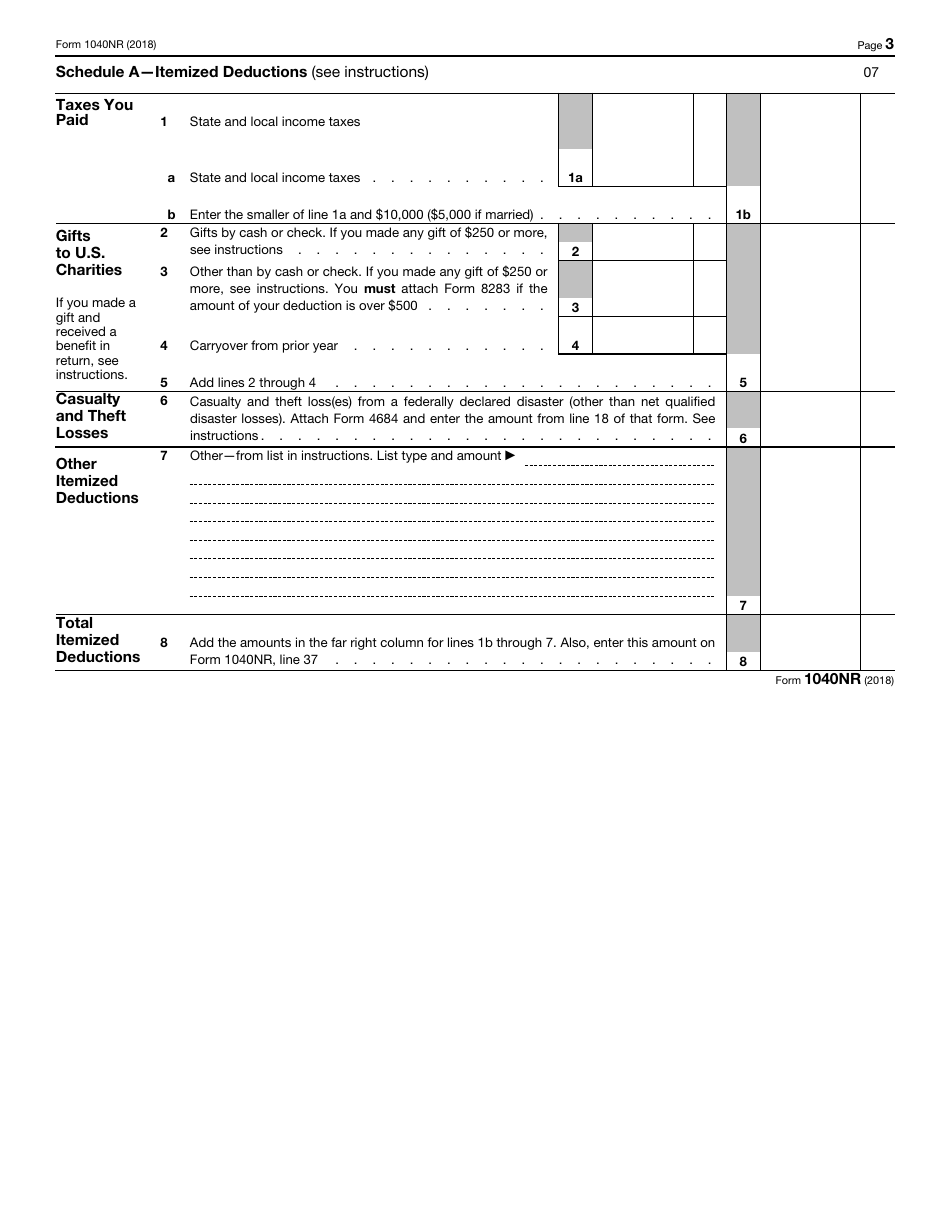

Q: Are there any deductions or credits available on Form 1040NR?

A: Yes, nonresident aliens may be eligible for certain deductions and credits on Form 1040NR. It is important to review the instructions and eligibility requirements.

Q: Do I need to attach any additional documents to Form 1040NR?

A: Yes, depending on your individual circumstances, you may need to attach additional documents such as W-2 forms or 1099 forms.

Q: Can I e-file Form 1040NR?

A: Yes, you can e-file Form 1040NR. However, certain restrictions may apply, and it is recommended to check with the IRS or a tax professional.

Form Details:

- A 5-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040NR through the link below or browse more documents in our library of IRS Forms.