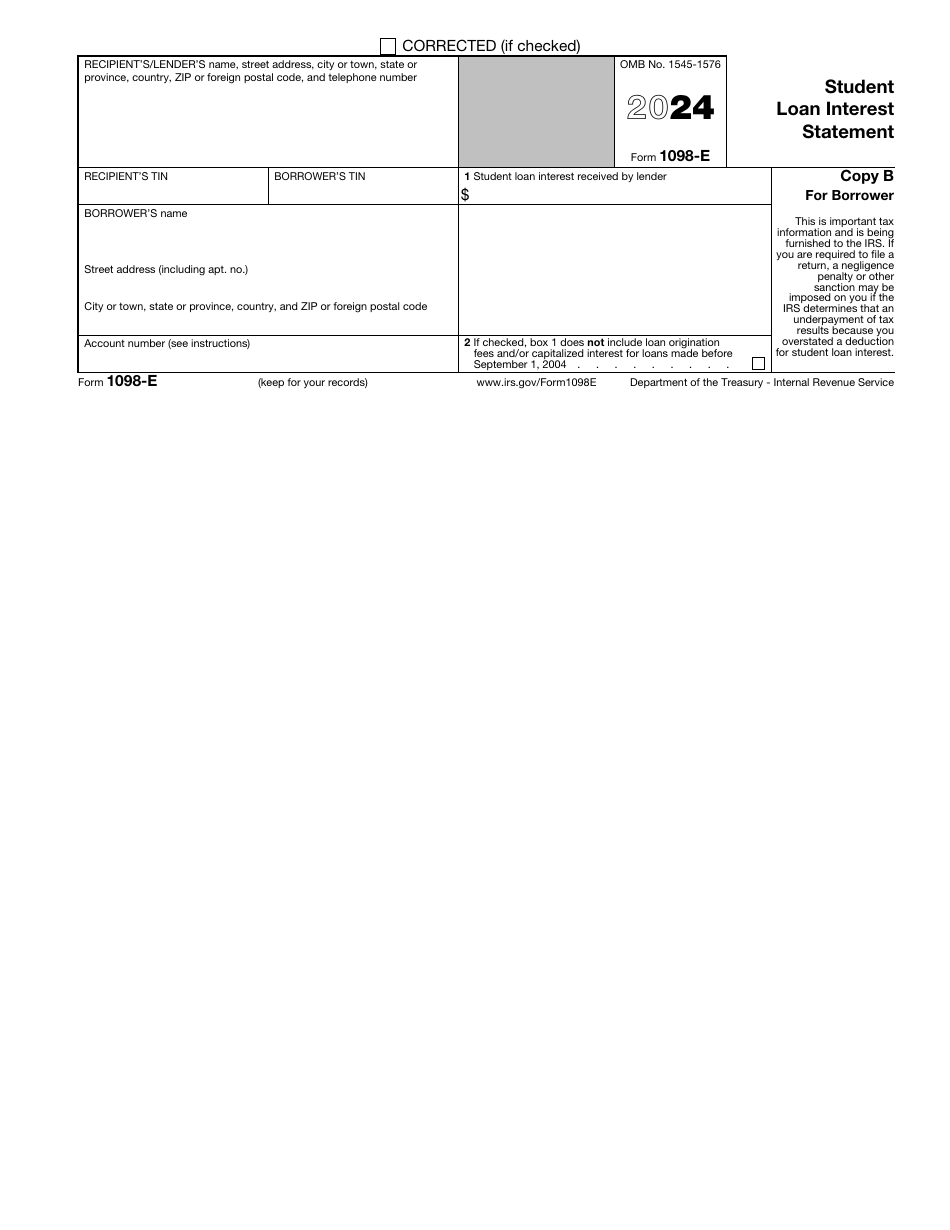

IRS Form 1098-E Student Loan Interest Statement

What Is a 1098-E Form?

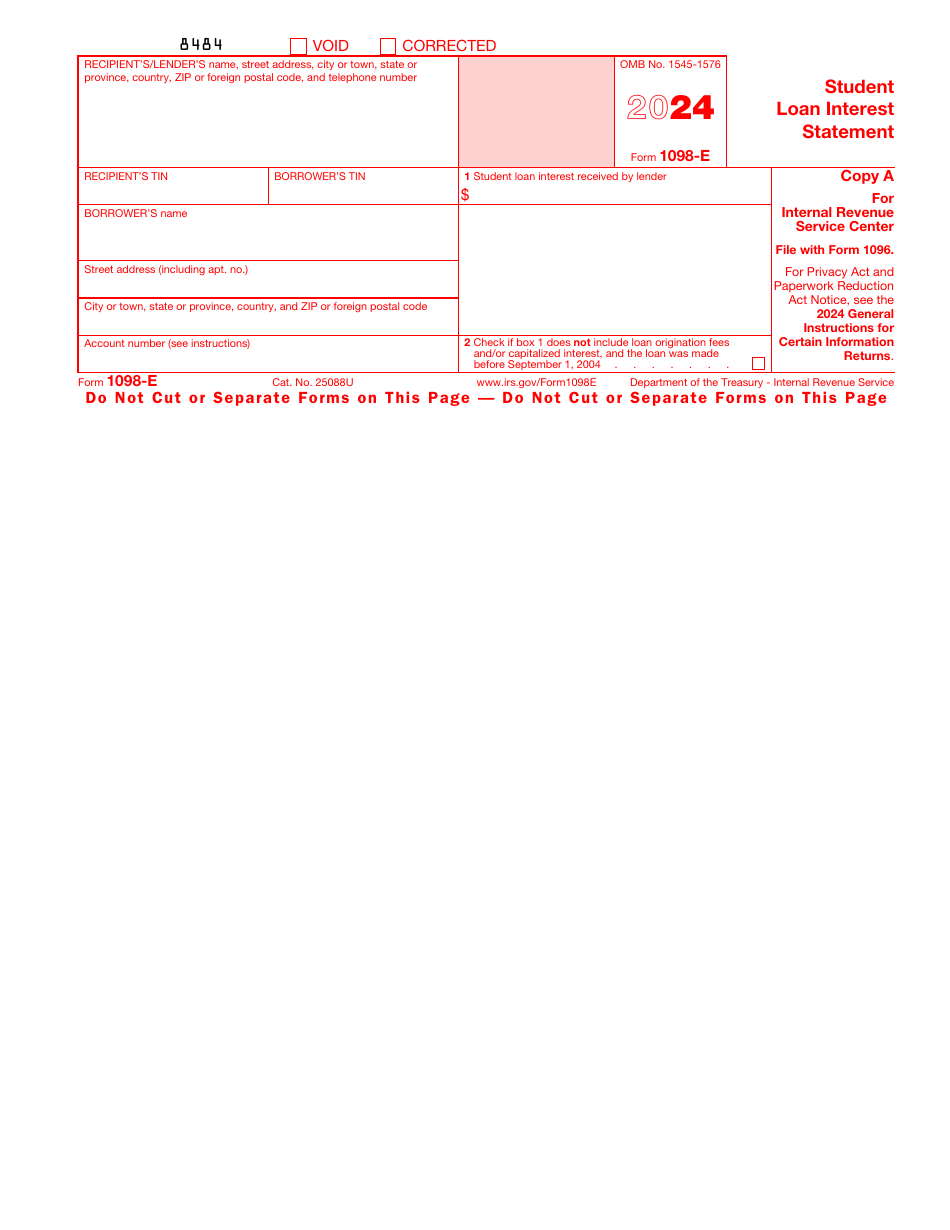

IRS Form 1098-E, Student Loan Interest Statement (also known as the School Tax Form or the College Tax Form), is a form that reports the interest amount that was paid on qualified student loans during the calendar year when the amount exceeds $600. It is filed with the Internal Revenue Service (IRS) by a lending person or a lending institution, which may be either a financial or an educational institution, a governmental unit or a subsidiary agency, among others. The IRS is the department that issues this form every year .

How Do I Get My 1098-E Tax Form?

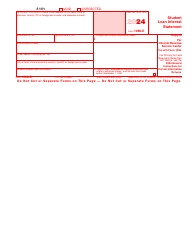

If you are an eligible financial institution or person, you may get an official IRS 1098-E Form Copy A to be filed with the IRS by placing an order through the IRS website to receive it in the mail. Copies B and CA of the fillable Form 1098-E are available below in PDF format or through the IRS website. They may be downloaded, printed, and used to furnish the statement to the borrower.

If you are a student loan borrower, you will receive a copy of this form by the lending institution or person, as long as your interest payment amount during the calendar year adds up to at least $600 on one or more qualified student loans.

What Is a 1098-E Tax Form Used for?

The 1098-E tax form may be used by a student loan borrower to deduct the interest amount paid on their income tax return for the previous year. However, they may not be able to deduct the total amount reported on this student loan tax return. For more information, see IRS Publication 970, as well as IRS Form 1098-E Instructions.

IRS Form 1098-E Instructions

The $600 minimum amount applies to each borrower regardless of the number of student loans obtained by that borrower. However, the financial institution or person may file a separate form for each borrower's student loan or one Form 1098-E for the interest from all student loans of the borrower.

Note that if more than one person is involved with the loan, only the first person to receive the interest payment (i.e. a collection agent who receives payment on behalf of the lender) must file Form 1098-E.

The financial institution or person is required to furnish a copy of this form, on paper or electronically, to the borrower. The due date for providing the student loan borrower with this form is January 31, 2020.

Financial institutions or persons must file electronically if they need to file 250 or more returns. Paper forms shall be filed by February 28, 2020, or March 31, 2020, if filed electronically. Late filing penalties shall apply if the lender fails to file a correct information return by the due date providing no reasonable cause. The penalties are listed below:

- $50 per information return if you file within 30 days;

- $110 per information return if you correctly file more than 30 days after the due date but by August 1; and

- $270 per information return if you file after August 1 or you do not file required information returns.

Taxpayers who mail paper versions of their tax returns are required to enclose a copy of Form 1096 with their Form 1098-E. It is possible to file information returns electronically via the IRS Filing Information Returns Electronically (FIRE) system or the IRS Affordable Care Act Information Returns (AIR) program.

IRS 1098-E Related Forms

- IRS Form 1098, Mortgage Interest Statement. This is a form that reports the amount of interest and related expenses that an individual or sole proprietor paid on a mortgage during a tax year to estimate tax deductions.

- IRS Form 1098-C, Contributions of Motor Vehicles, Boats, and Airplanes. It details the donations of automobiles, boats, and airplanes made to charitable organizations, and it is filed and reported by the recipient organization, so that donor can claim a donation tax deduction.

- IRS Form 1098-T, Tuition Statement. This statement informs the IRS about qualified tuition and related fees during the tax year. It can be used by the student to calculate education-related tax deductions and credits. It also reports any scholarships and grants received that may reduce the deductions or credits.

- IRS Form 1098-Q, Qualifying Longevity Annuity Contract. This form is filed by the person who issues a contract intended to be a Qualifying Longevity Annuity Contract (QLAC), so that the annuity holder can claim distribution taxes deductions based on the income earned on top of the original investment.