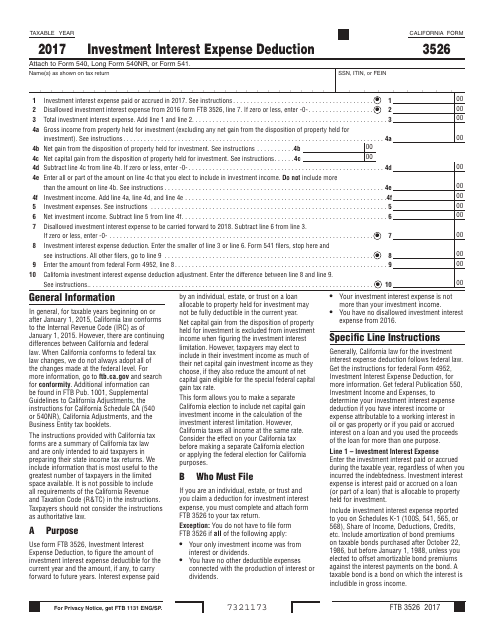

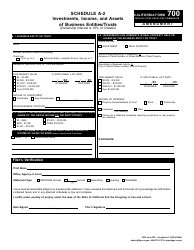

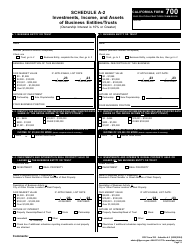

Form FTB3526 Investment Interest Expense Deduction - California

What Is Form FTB3526?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

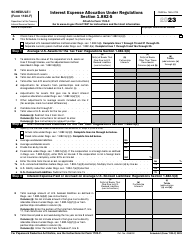

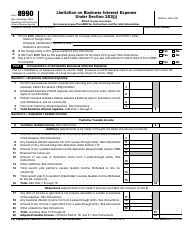

Q: What is Form FTB 3526?

A: Form FTB 3526 is a tax form used in California to claim the Investment Interest Expense Deduction.

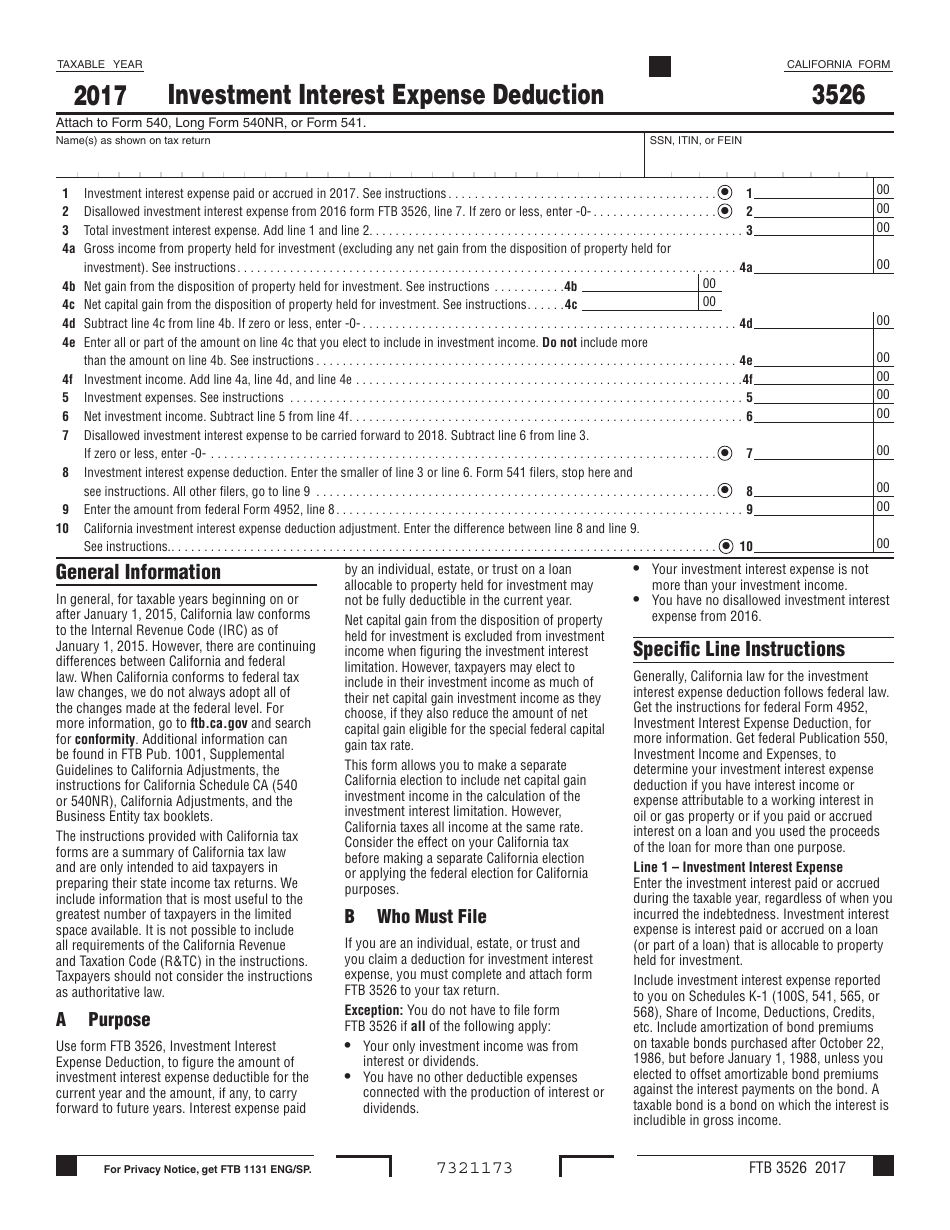

Q: What is the Investment Interest Expense Deduction?

A: The Investment Interest Expense Deduction allows taxpayers to deduct the interest paid on loans used to invest in certain assets.

Q: Who is eligible to claim the Investment Interest Expense Deduction?

A: Individuals, partnerships, and corporations who have investment interest expenses are eligible to claim this deduction.

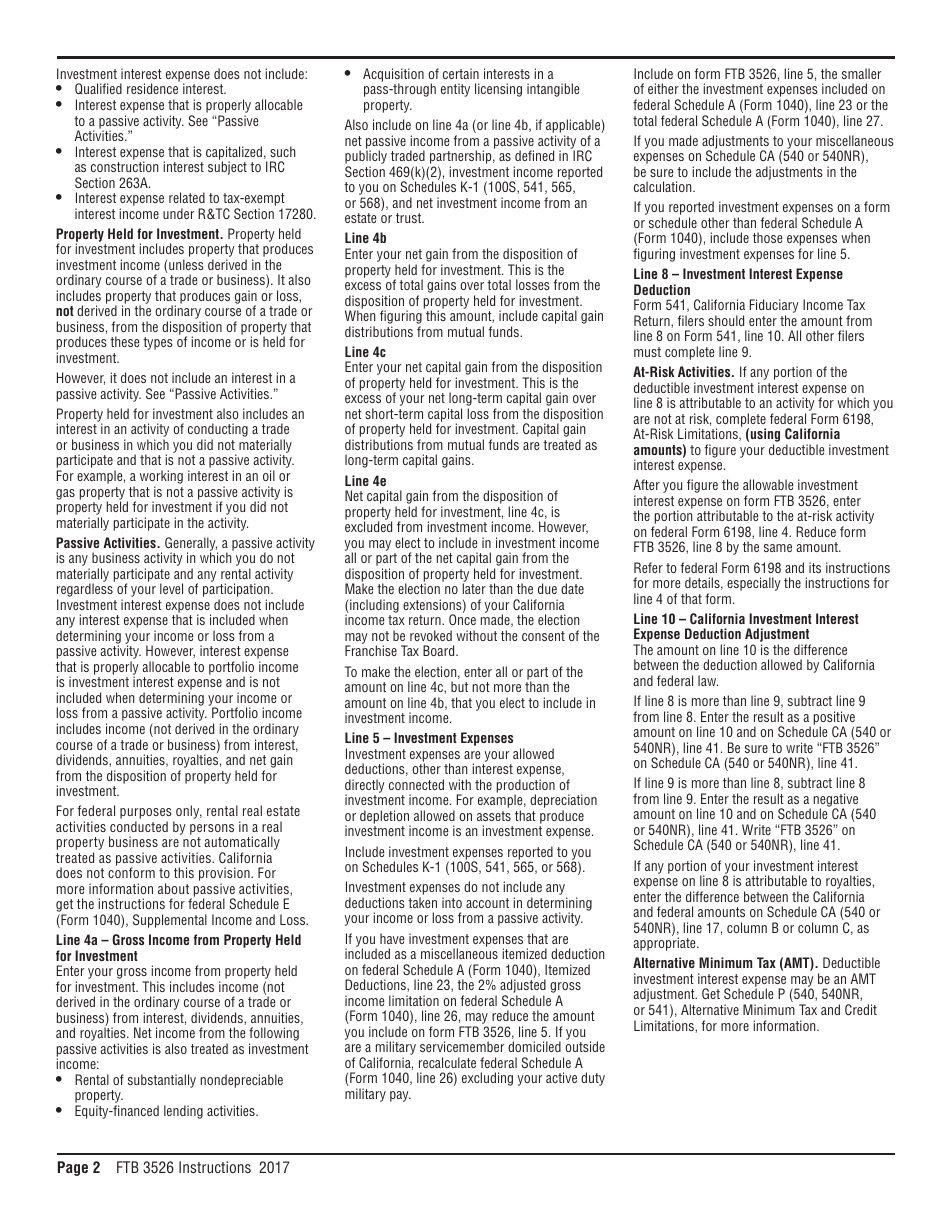

Q: What types of investments qualify for the deduction?

A: Qualified investments include stocks, bonds, mutual funds, and other assets held for investment purposes.

Q: How much can I deduct for investment interest expenses?

A: The deduction is generally limited to your net investment income. Any excess investment interest expenses can be carried forward to future years.

Q: How do I file Form FTB 3526?

A: Form FTB 3526 should be filed with your California state tax return.

Q: Is there a deadline to file Form FTB 3526?

A: Form FTB 3526 must be filed by the due date of your California state tax return, usually April 15th.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FTB3526 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.