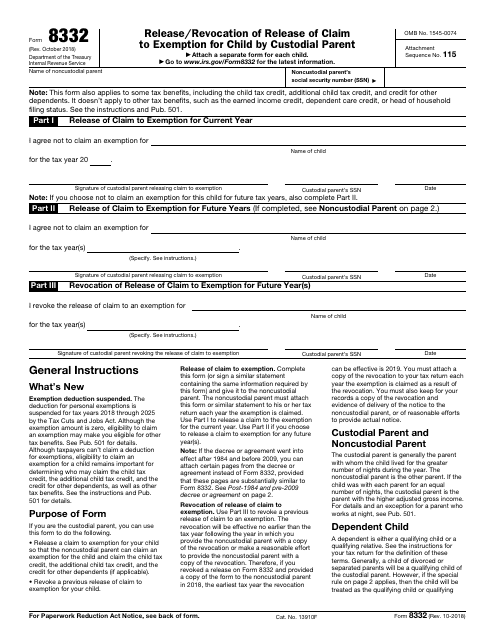

IRS Form 8332 Release / Revocation of Release of Claim to Exemption for Child by Custodial Parent

What Is IRS Form 8332?

IRS Form 8332, Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent , is a formal instrument prepared by a parent who wants to give the other parent the right to receive various tax benefits from the government.

Alternate Name:

- Tax Form 8332.

If you have a child with an individual who submits a separate tax return, you can allow them to request benefits you would otherwise ask for yourself.

This document was released by the Internal Revenue Service (IRS) on October 1, 2018 - older editions of the form are now outdated. An IRS Form 8332 fillable version can be downloaded below.

What Is Form 8332 Used For?

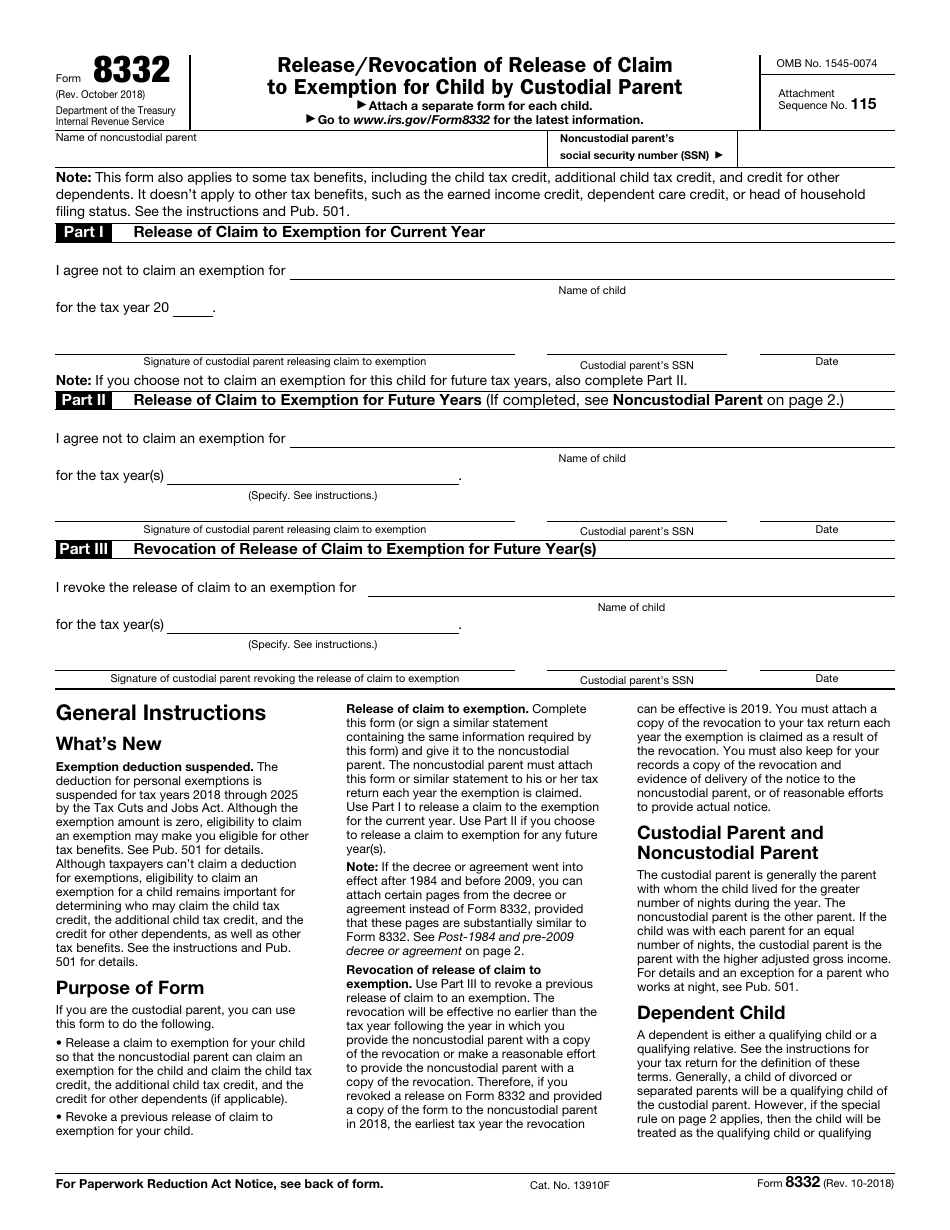

If you are a custodial parent, fill out IRS Form 8332 to let the other parent include the child on the tax documentation they file. Whether the presence of the kid on the income statement is required for the other individual to qualify for tax benefits in the first place or it increases the amount of benefits they are entitled to, your permission is necessary for them to request these tax benefits. If you share several children with the other parent, you are obliged to fill out a separate document for every kid.

Alternatively, you can prepare this instrument to withdraw the permission you granted to the other parent in the past - whatever the reasoning behind your decision is. The revocation of your consent is possible at any time. Just like the form you may sign with a contrary intention, this document has to be submitted for every child.

Who Files Form 8332?

An IRS 8332 Form is certified by a custodial parent - the person with whom the child spends the majority of their time. This rule applies to parents that have sole custody which means they get to reside with the child full-time. The custodial parent can also be defined as the taxpayer that earns more if the parents have equal custody and the child is allowed to spend equal time with either of them.

As for the filing of the form, it depends on the objective of the document:

-

If the goal of the custodial parent is to give the other parent a chance to file for tax benefits, they must sign the paperwork and give it to the noncustodial parent who then attaches a copy to their tax return.

-

In case the custodial parent wishes to revoke the previously certified authorization, they submit the papers themselves - enclose a copy of the revocation to your annual income statement. It is also the duty of the custodial parent to inform the other individual about their choice to withdraw the permission - you either send them a copy of the document or obtain proof that you tried to do so. For instance, you can keep a receipt that demonstrates you sent a copy of the revocation to the noncustodial parent via certified mail - the IRS and other authorities will review the evidence to see you have done your best to communicate your choice.

Form 8332 Instructions

Follow these Form 8332 instructions to allow the other parent of your child to apply for tax benefits they want:

-

Identify the noncustodial parent - write down their full name and social security number.

-

Confirm you are not planning to apply for tax benefits for the tax year indicated in the form and specify the name of your child . Sign the document, add your social security number, and enter the actual date of signing.

-

If you are planning to give the other parent permission to identify the child as someone they take care of financially in the future, you do not have to certify the same form again - simply fill out the second section of the instrument to inform the IRS you will not use your right to apply for benefits for the kid identified in writing later on. The time period covered in the form will be enough for the other parent to ask for certain credits until the child becomes an adult. While the decision is up to you, you have to know your relationship with the other parent of the kid is solid and they will not stop helping you out especially if they are expected to assist you and the child in line with any financial settlement you signed in the past.

-

Once you have determined to revoke the permission, complete the third section of the statement . You need to record the name of the child and list the years during which the noncustodial parent will not be allowed to mention the kid on their tax returns.

Where to Mail Form 8332?

Enclose Tax Form 8332 with the income statement you are supposed to file annually - the mailing address will depend on your current residence. Note that noncustodial parent is required to attach a copy of the instrument to their income statement every year until the child is eighteen or the permission is revoked by the other parent.

As for the filing method, you are free to choose between a traditional printed-out version of the form and e-filing. Electronic filing remains the safest choice since tax authorities will receive your documentation without delay. However, make sure you complete and submit IRS Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file Return, if you opted for online filing.

It is a good idea to retain a copy of the document in your personal records in case you ever have a custody dispute with the other parent - besides, it is also recommended to keep full records that contain all the tax documentation you have ever filed.