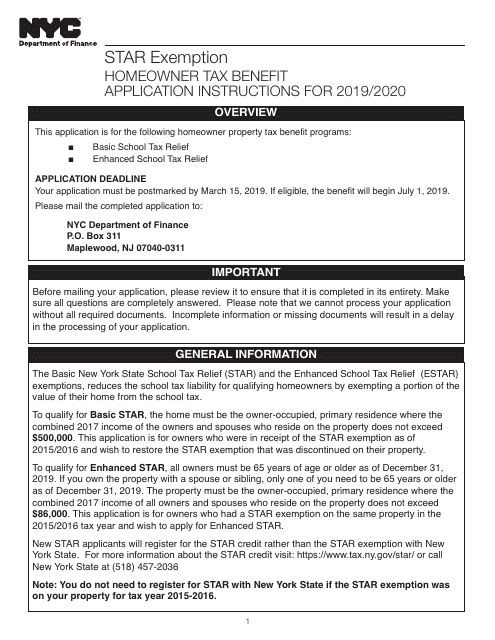

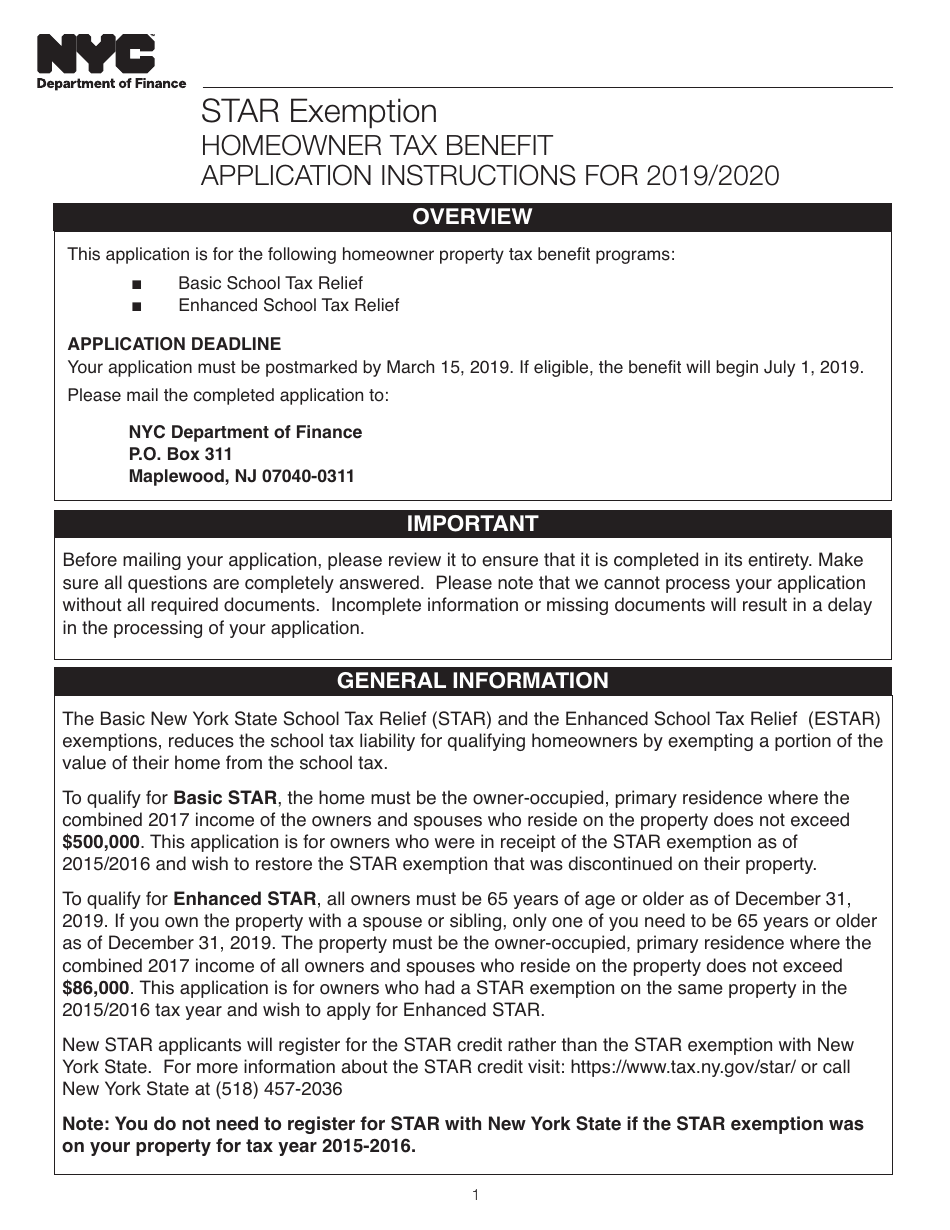

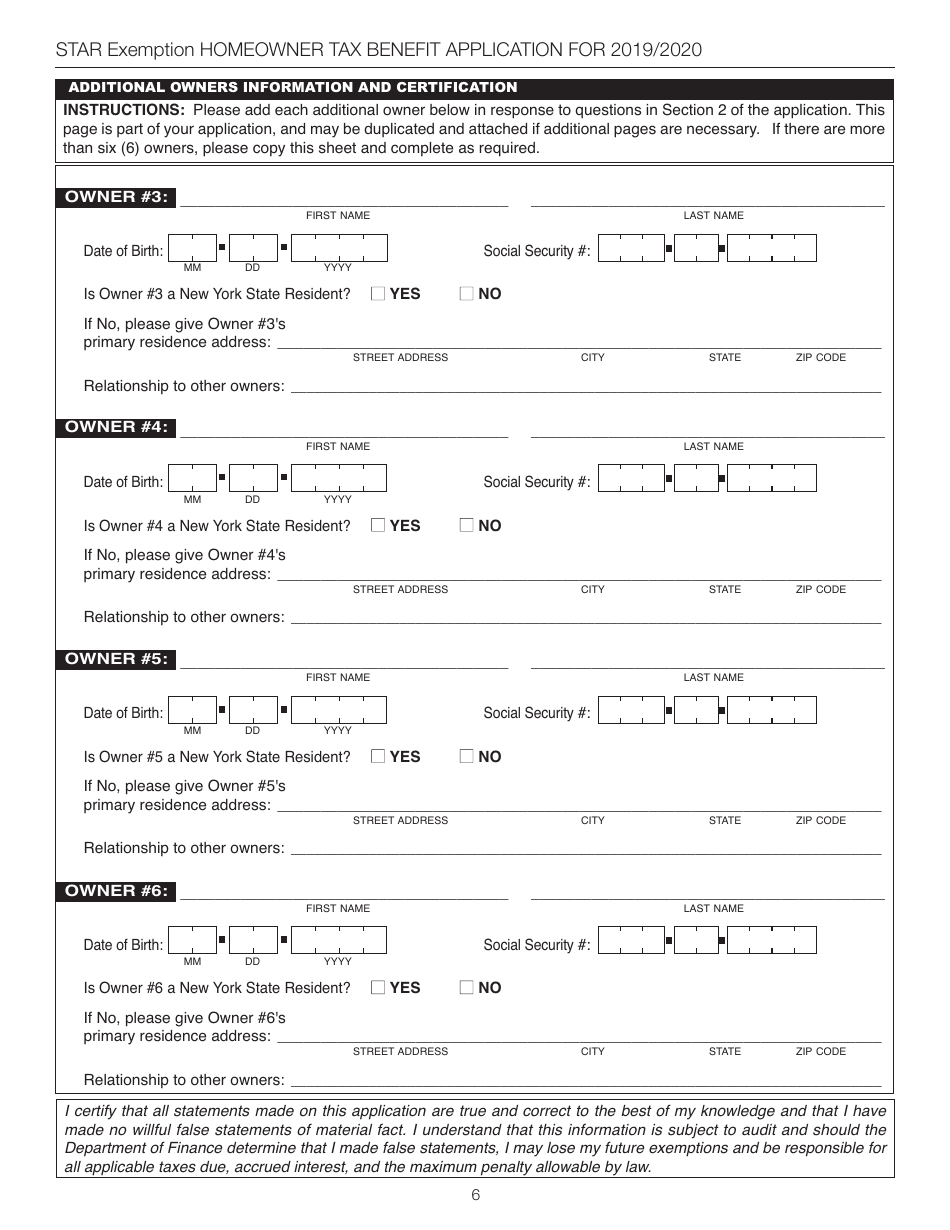

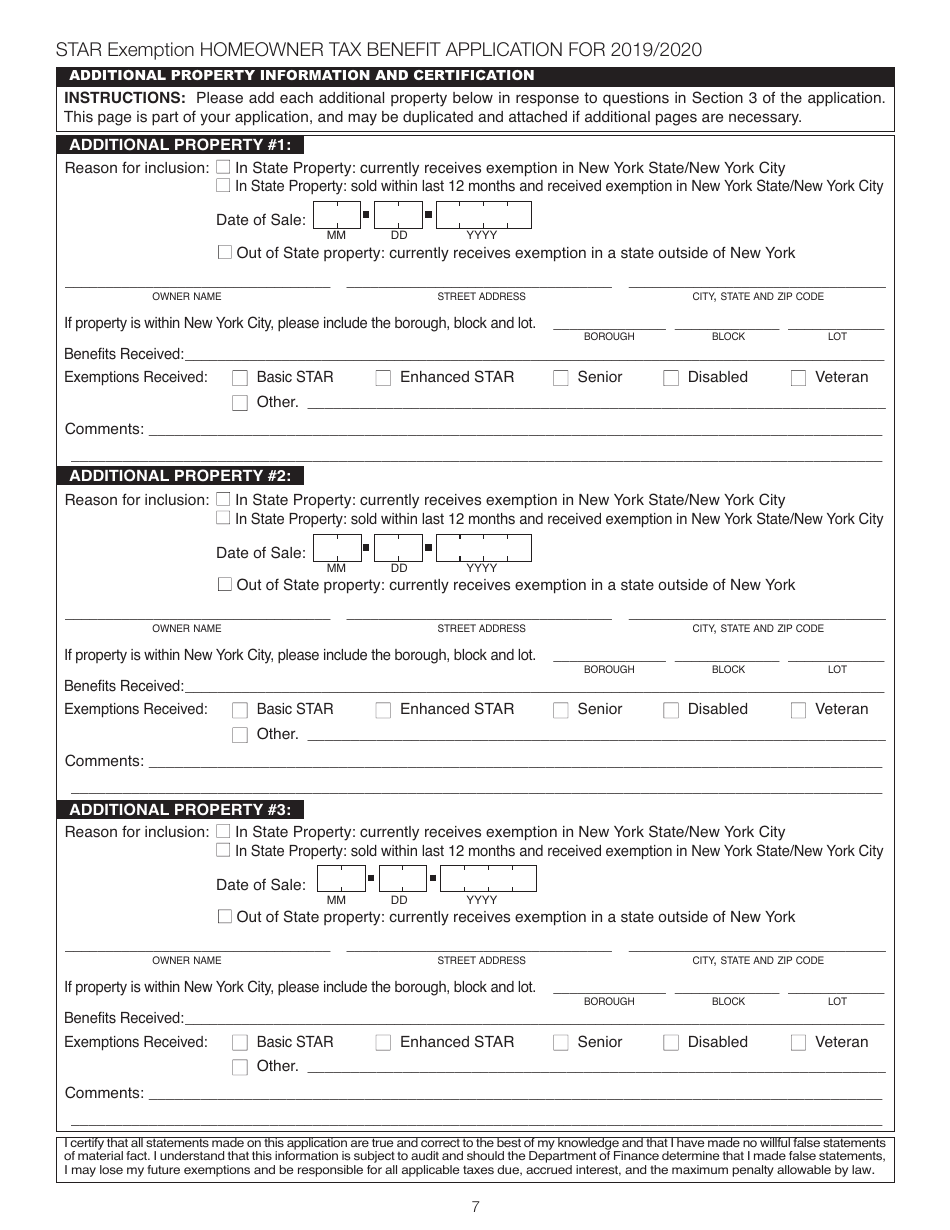

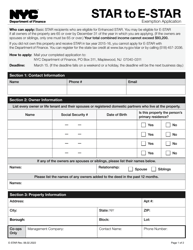

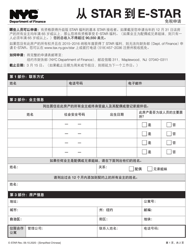

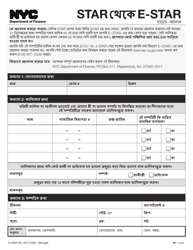

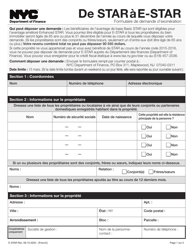

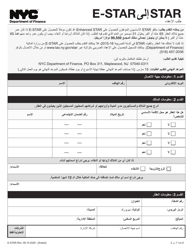

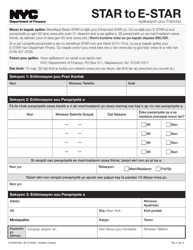

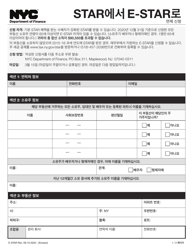

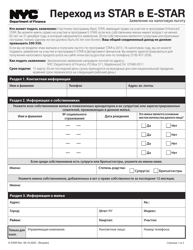

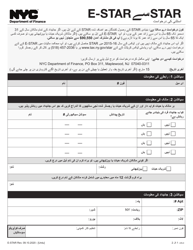

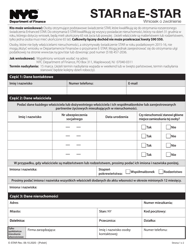

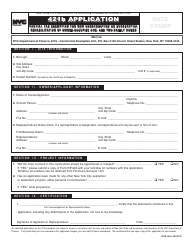

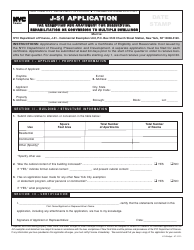

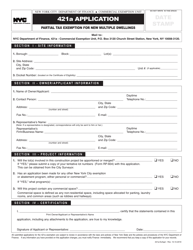

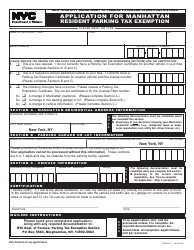

Star Exemption Homeowner Tax Benefit Application for 2019 / 2020 - New York City

Star Exemption Homeowner Tax Benefit Application for 2019/2020 is a legal document that was released by the New York City Department of Finance - a government authority operating within New York City.

FAQ

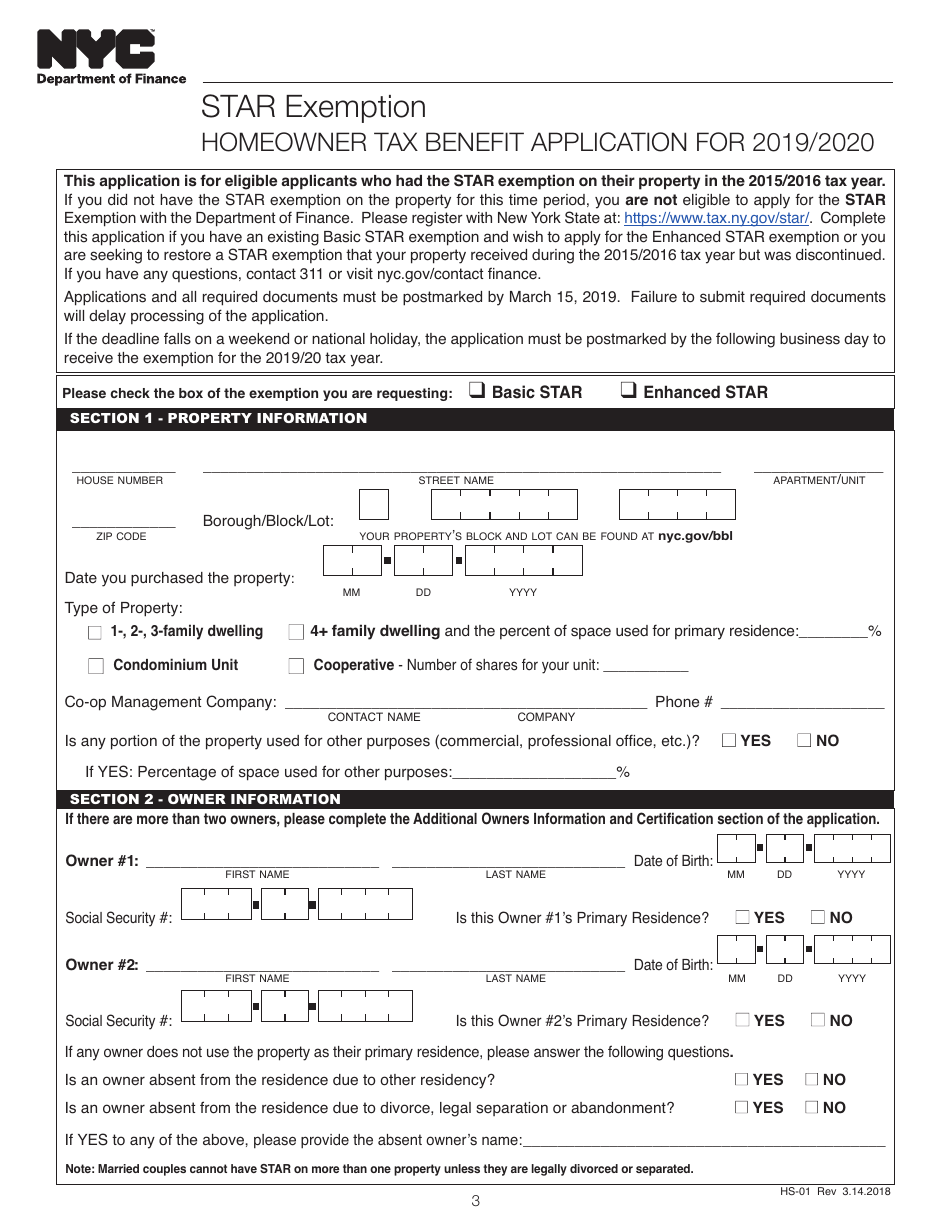

Q: What is the Star Exemption Homeowner Tax Benefit?

A: The Star Exemption is a tax benefit for homeowners in New York City.

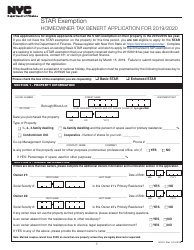

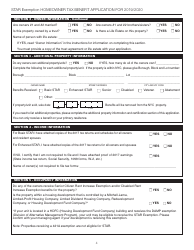

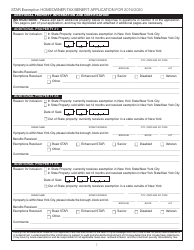

Q: Who is eligible for the Star Exemption?

A: Homeowners in New York City who use their homes as their primary residences may be eligible for the Star Exemption.

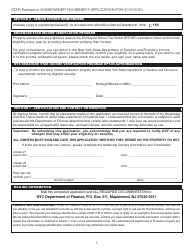

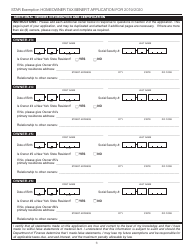

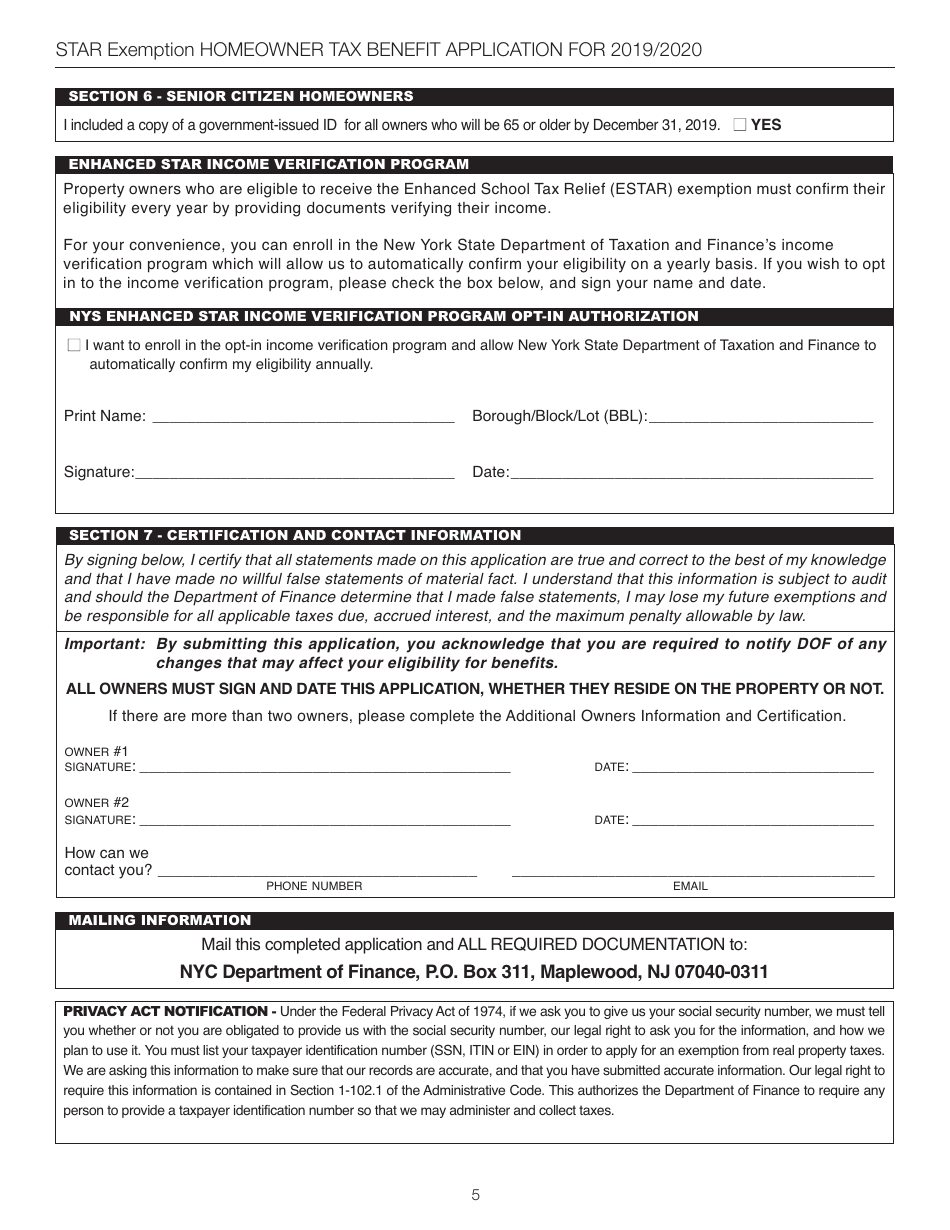

Q: How do I apply for the Star Exemption?

A: You can apply for the Star Exemption by completing the Homeowner Tax Benefit Application for 2019/2020.

Q: What is the deadline to apply for the Star Exemption?

A: The deadline to apply for the Star Exemption is usually March 15th of each year.

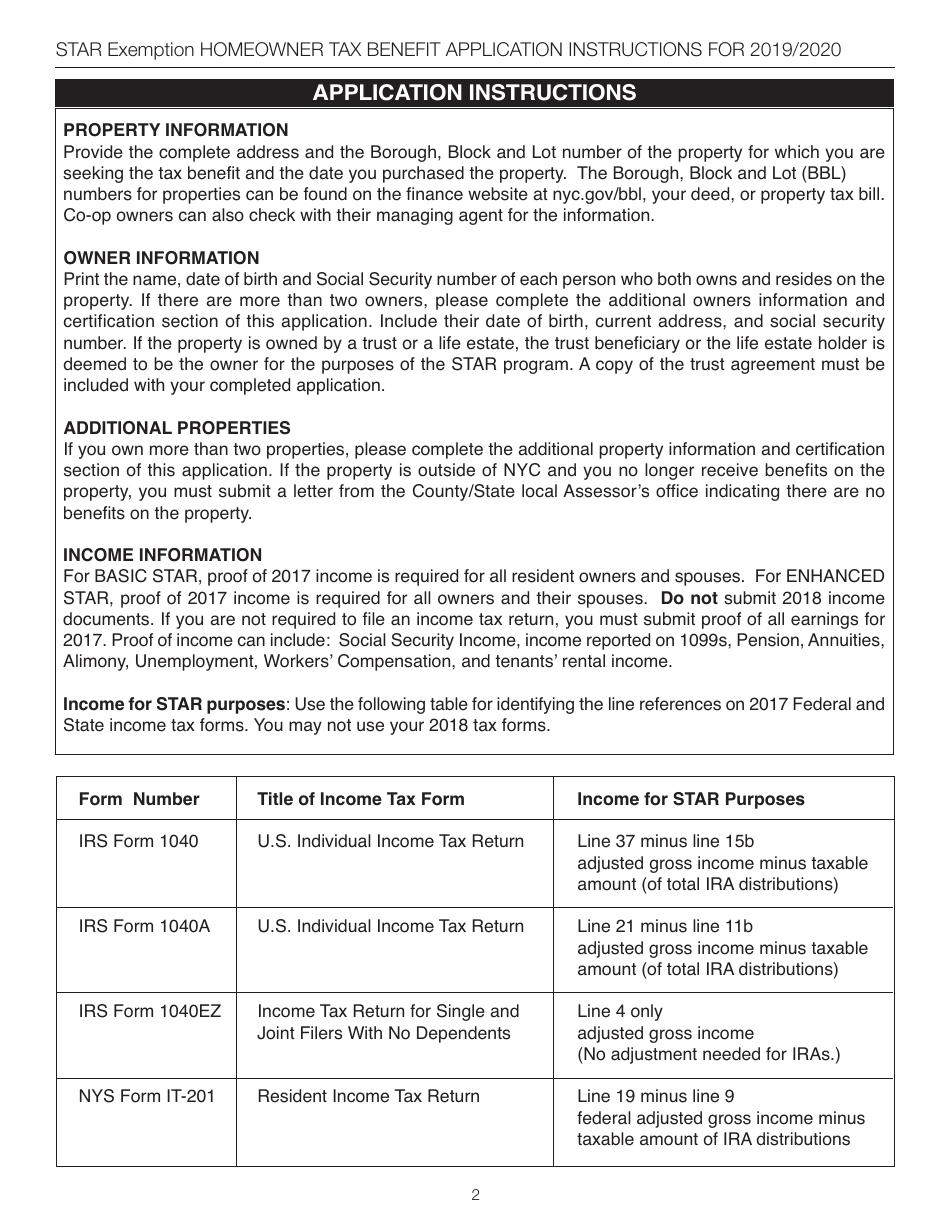

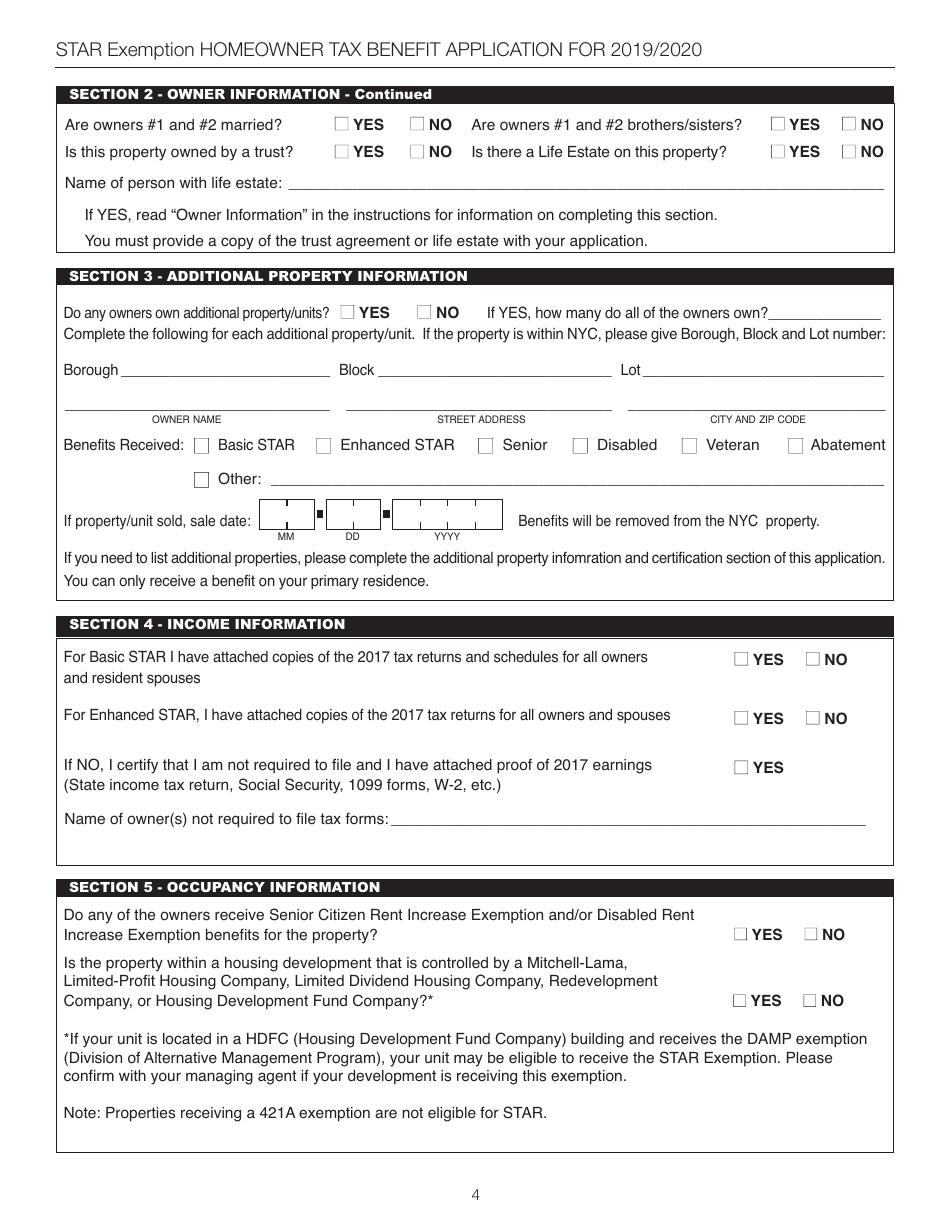

Q: What documents do I need to include with my Star Exemption application?

A: You may need to include documents such as proof of residency and ownership of the property.

Q: How much money can I save with the Star Exemption?

A: The amount of money you can save with the Star Exemption depends on factors such as the assessed value of your property and the applicable tax rates.

Form Details:

- The latest edition currently provided by the New York City Department of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.