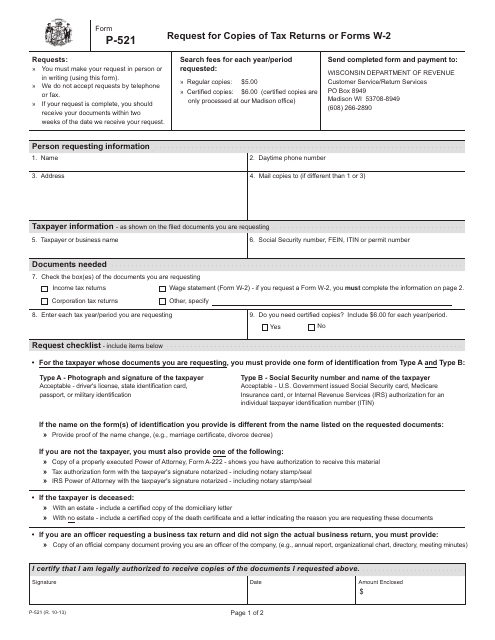

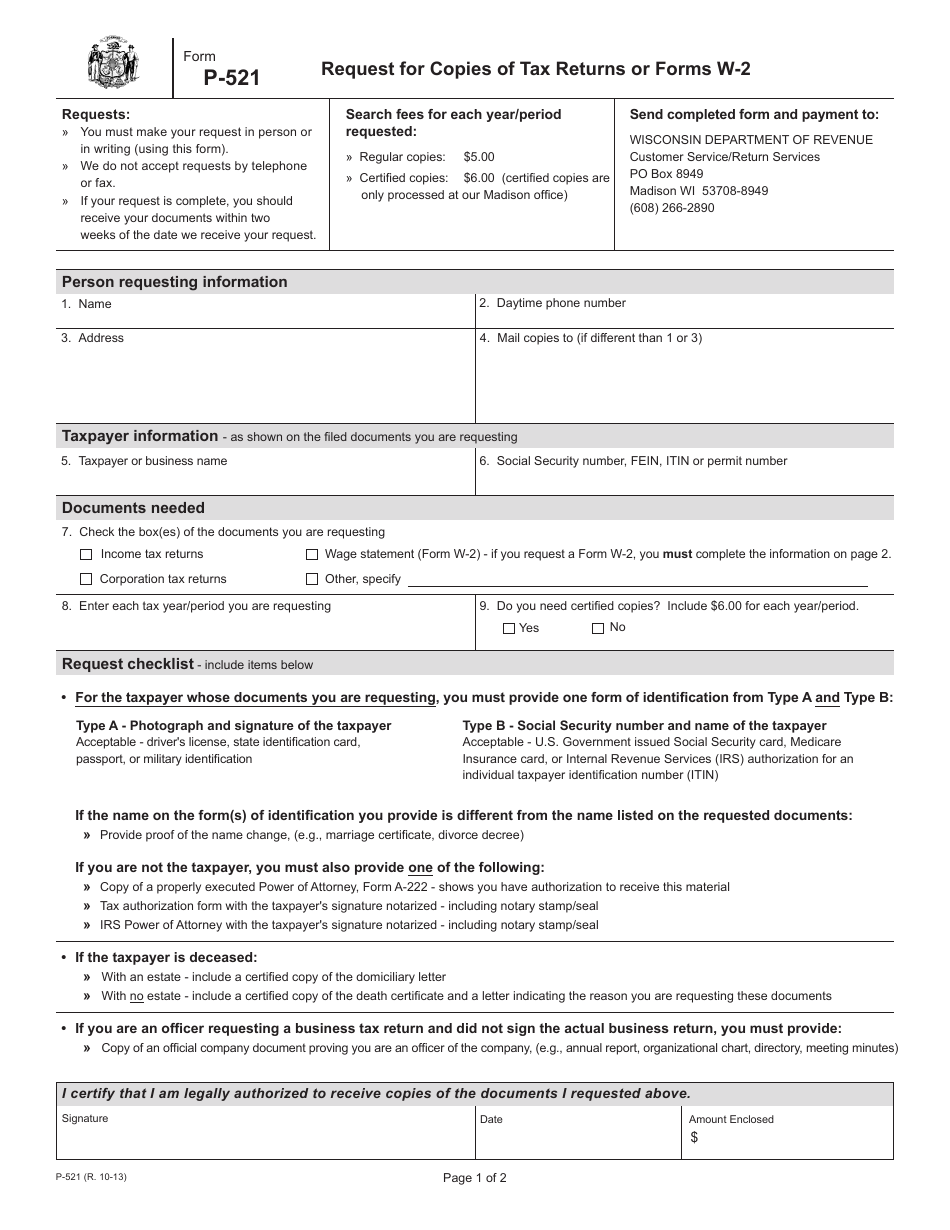

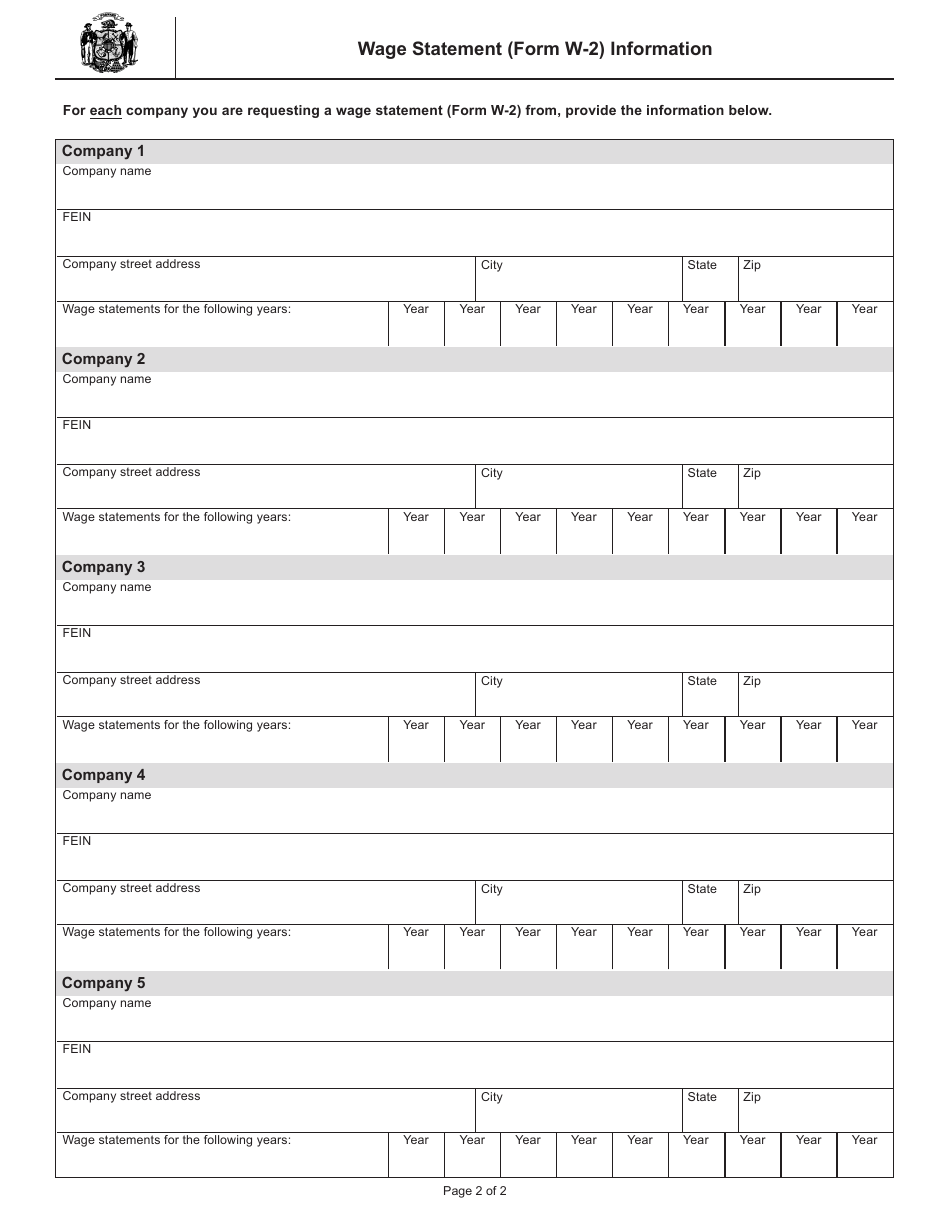

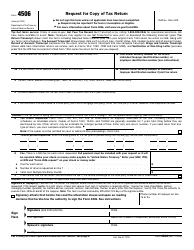

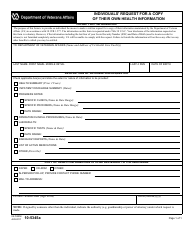

Form P-521 Request for Copies of Tax Returns or Forms W-2 - Wisconsin

What Is Form P-521?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form P-521?

A: Form P-521 is a request for copies of tax returns or Forms W-2 in Wisconsin.

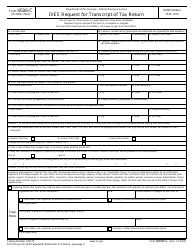

Q: Who can request copies of tax returns or Forms W-2 using Form P-521?

A: Any individual or authorized representative can request copies using Form P-521.

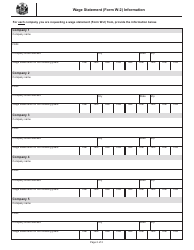

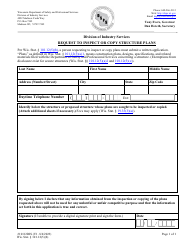

Q: What information is required to be filled in Form P-521?

A: You need to provide your name, address, Social Security number, and the tax years or periods for which you need the copies.

Q: How can I submit Form P-521?

A: You can submit Form P-521 by mail or in person at the Wisconsin Department of Revenue.

Q: Is there a fee for requesting copies with Form P-521?

A: Yes, there is a fee of $10 per copy requested.

Q: How long does it take to receive the copies requested with Form P-521?

A: It may take up to 6 weeks to process your request and receive the copies.

Form Details:

- Released on October 1, 2013;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form P-521 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.