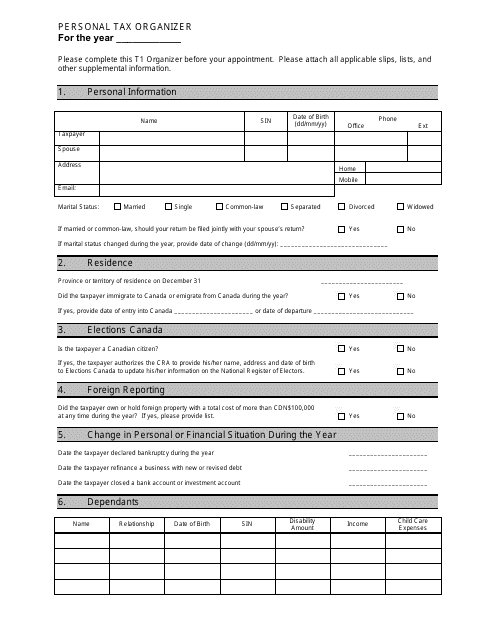

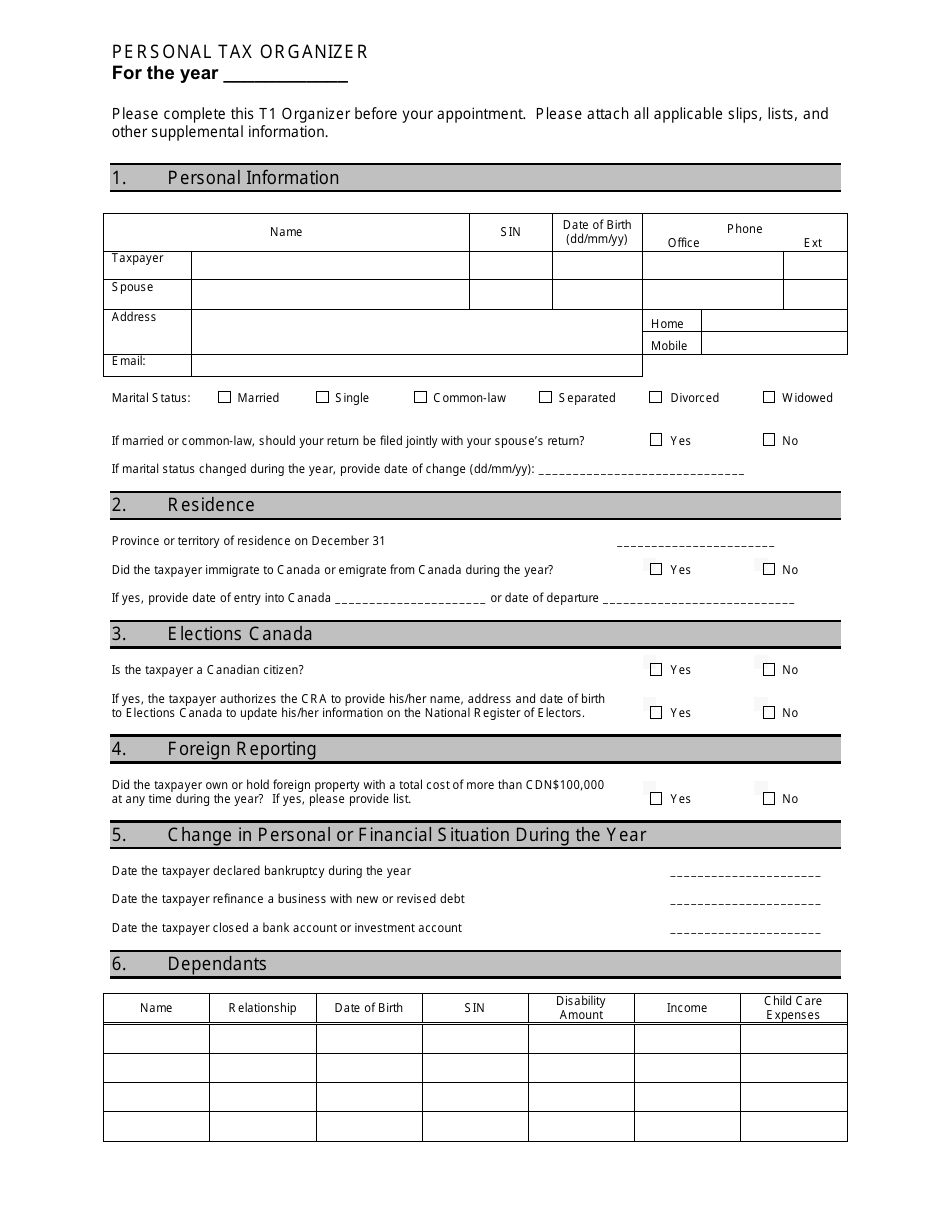

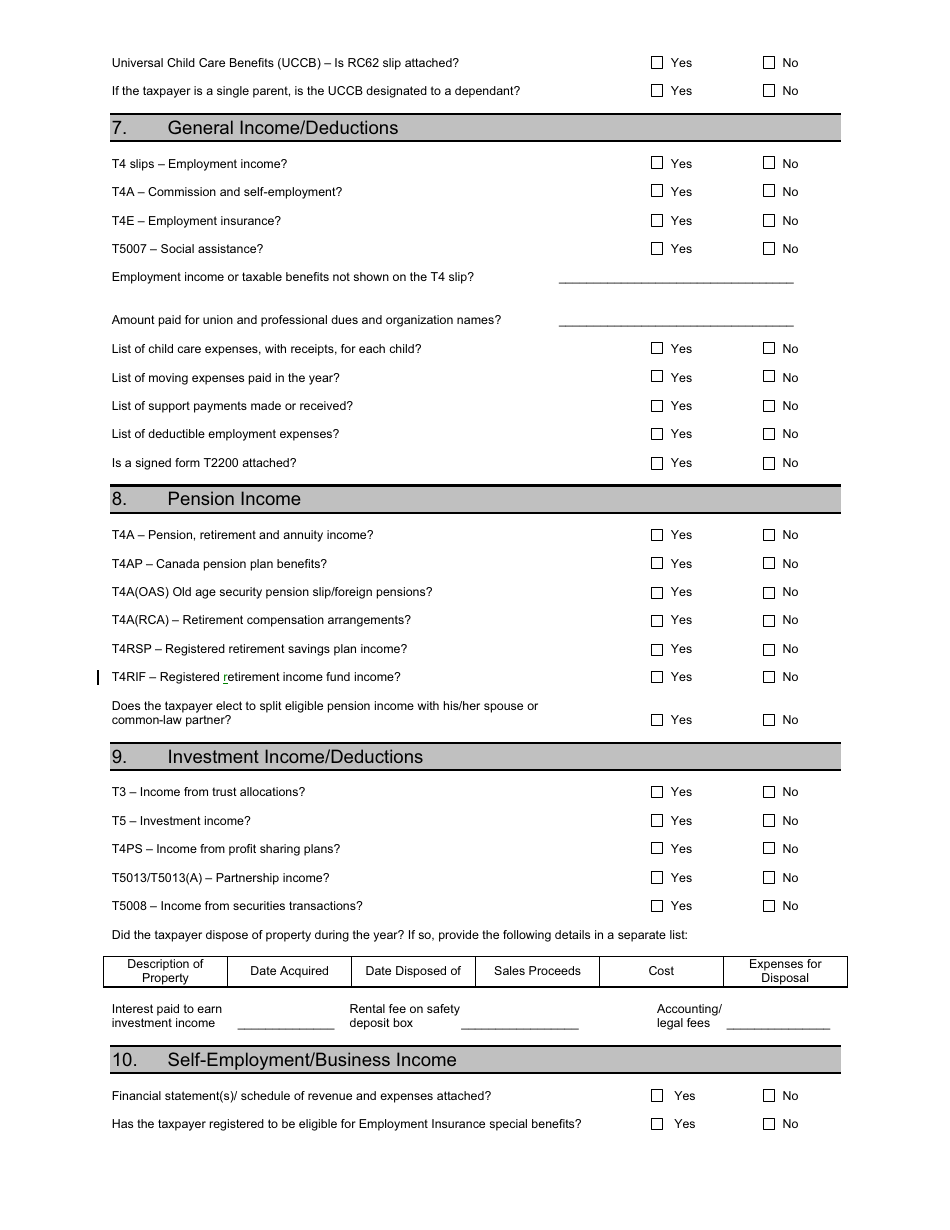

Personal Tax Organizer Template

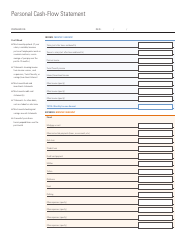

The Personal Tax Organizer Template is a tool used to help individuals organize their tax-related information and documents in preparation for filing their personal income tax returns. It helps gather all relevant information, such as income sources, deductions, and credits, in a structured format, making the tax filing process easier and more efficient.

The personal tax organizer template is typically filed by individuals to organize their personal tax information before filing their income tax return.

FAQ

Q: What is a Personal Tax Organizer?

A: A Personal Tax Organizer is a tool or template that helps individuals organize their personal income and expense information for tax filing purposes.

Q: Why should I use a Personal Tax Organizer?

A: Using a Personal Tax Organizer can help you ensure that you have all the necessary information and documentation to accurately file your taxes and claim all eligible deductions and credits.

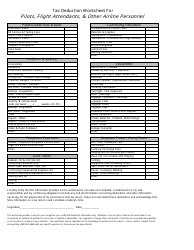

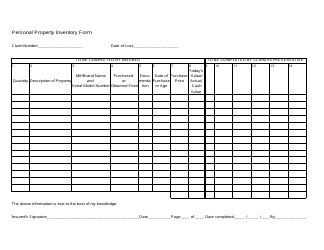

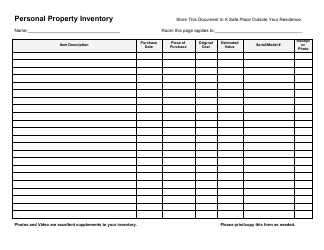

Q: What information should I include in a Personal Tax Organizer?

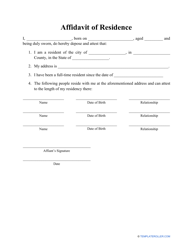

A: A Personal Tax Organizer should include details such as personal information, income sources, deductions and credits, expenses, and any other relevant financial information.

Q: How should I organize my tax documents using a Personal Tax Organizer?

A: You can organize your tax documents by categorizing them based on income sources, deductions, and credits. You can also use separate sections or tabs within the organizer for different types of documents.

Q: Can a Personal Tax Organizer help me save money on my taxes?

A: Yes, a Personal Tax Organizer can help you maximize your tax deductions and credits by ensuring that you have comprehensive records and can claim all eligible expenses.

Q: How often should I update my Personal Tax Organizer?

A: It is recommended to update your Personal Tax Organizer regularly, such as on a monthly or quarterly basis, to ensure that you have up-to-date and accurate information for tax filing.

Q: Is a Personal Tax Organizer mandatory for tax filing?

A: No, a Personal Tax Organizer is not mandatory for tax filing. It is simply a tool to help you organize your financial information, but you can still file your taxes without one.

Q: Can I use a Personal Tax Organizer for both personal and business taxes?

A: Yes, you can use a Personal Tax Organizer to organize both your personal and business tax information, as long as you separate and clearly label the different categories of income and expenses.

Q: What should I do with my completed Personal Tax Organizer?

A: Once your Personal Tax Organizer is completed, you should keep it in a safe and easily accessible place along with your other tax documents, such as W-2s and 1099s, for future reference and tax audits.