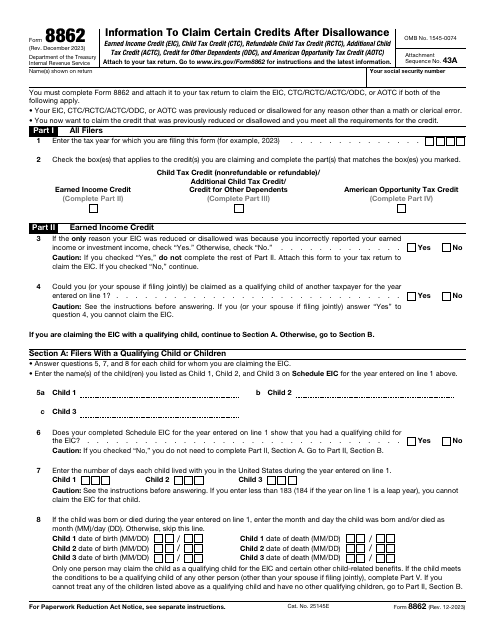

IRS Form 8862 Information to Claim Certain Credits After Disallowance

What Is IRS Form 8862?

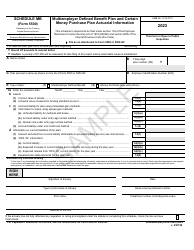

IRS Form 8862, Information to Claim Certain Credits After Disallowance , is a fiscal document used by taxpayers to request the payment of a tax credit that was disallowed in the past.

Alternate Name:

- Tax Form 8862.

In case your original tax credit claim was denied yet you have fixed the errors and dealt with issues that led to the rejection, you can complete yet another claim and submit it later on.

This statement was issued by the Internal Revenue Service (IRS) on December 1, 2023 , rendering previous editions of the form obsolete. An IRS Form 8862 fillable version is available for download below.

Form 8862 Instructions

Follow the IRS Form 8862 Instructions to claim a credit if your initial request to obtain this tax credit was unsuccessful:

-

Ensure you fit the criteria for taxpayers entitled to prepare this form - either the amount of credit you got was too low or the credit was disallowed . You must also confirm that now you comply with all the conditions established for filers that may receive the credit.

-

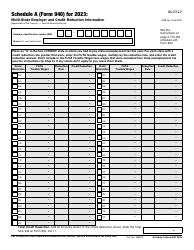

Specify the tax year covered in the document and put a tick in the box that identifies the credit you want to claim . The rest of the preparation process will depend on the box you have checked - you need to skip sections that do not apply to you.

-

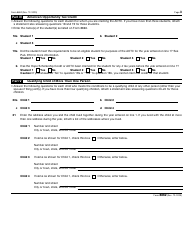

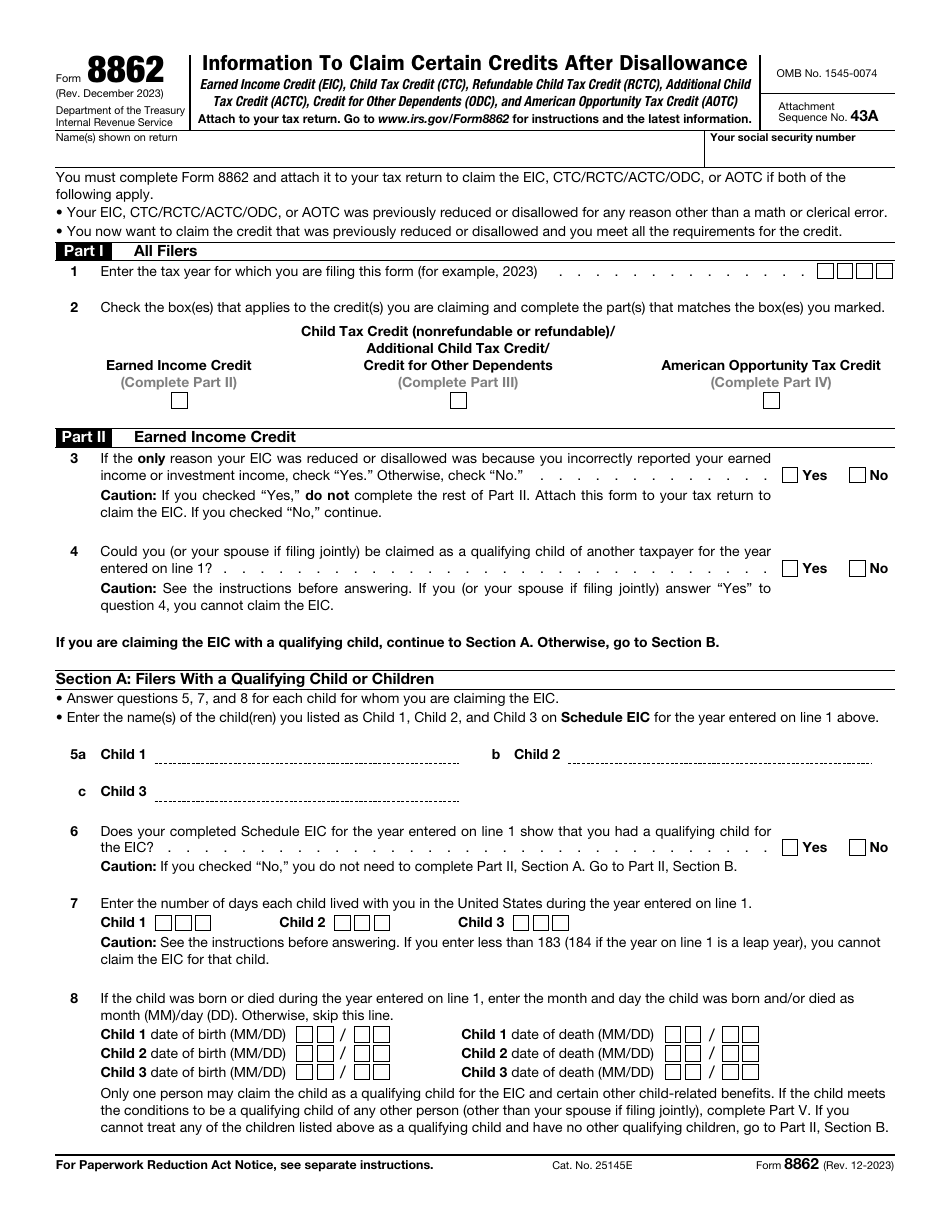

Fill out the second part of the instrument if you are interested in obtaining a tax credit designed for working people with moderate and low income . Explain whether you made a mistake when reporting your income, clarify whether you or your spouse will be claimed as a qualifying child on someone else's tax return, and answer questions to let the IRS know about your qualifying children if necessary. You will have to identify your children and add the number of days you resided together during the course of the year. Taxpayers without qualifying children need to elaborate on their living situation - how old they and their spouse are and how many days they have spent in the United States throughout the year.

-

Provide information about your children and dependents in case you are requesting a child tax credit or a credit for other dependents . You must add the names of all individuals, confirm whether you resided with them for more than half a year, and certify all the people you have identified meet the criteria set for qualifying children and other dependents.

-

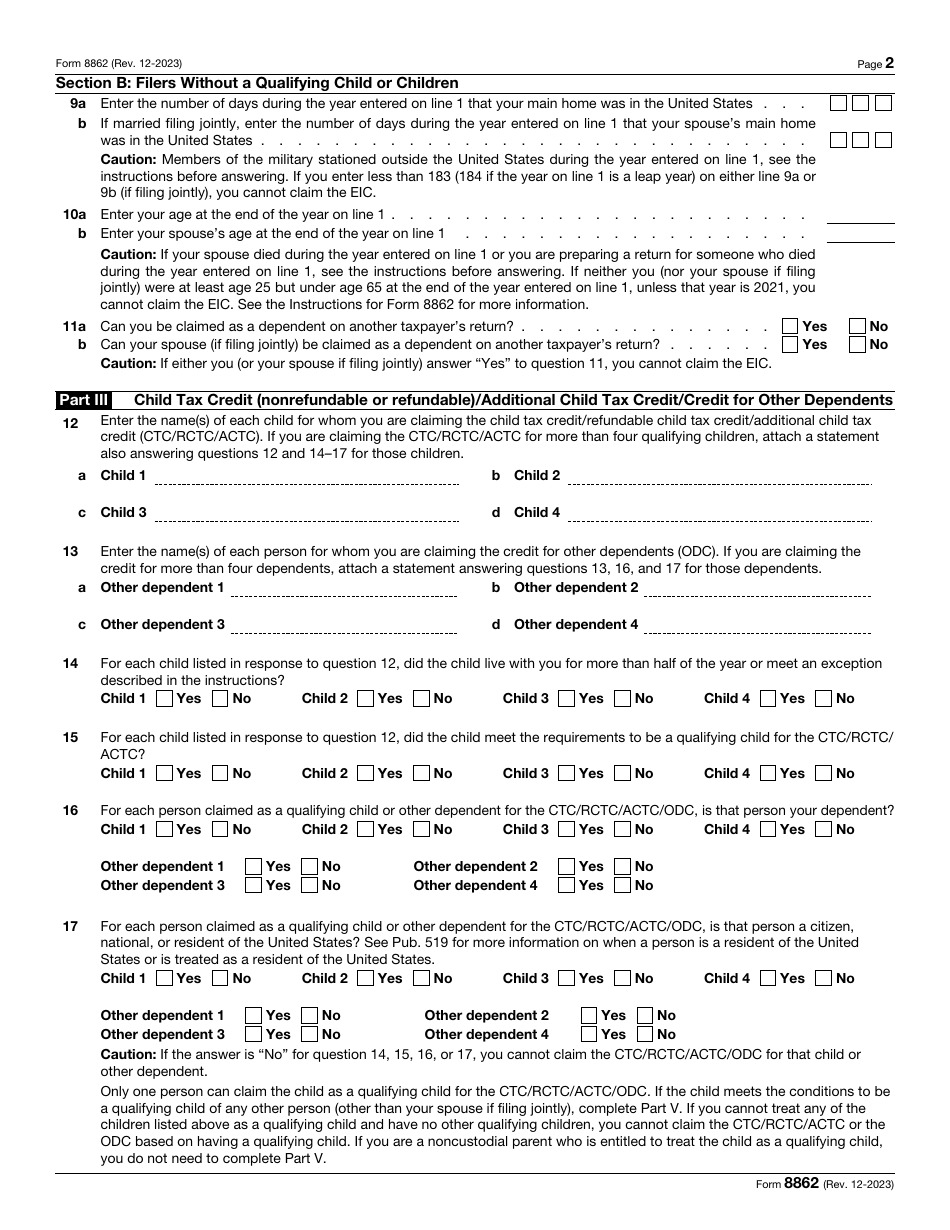

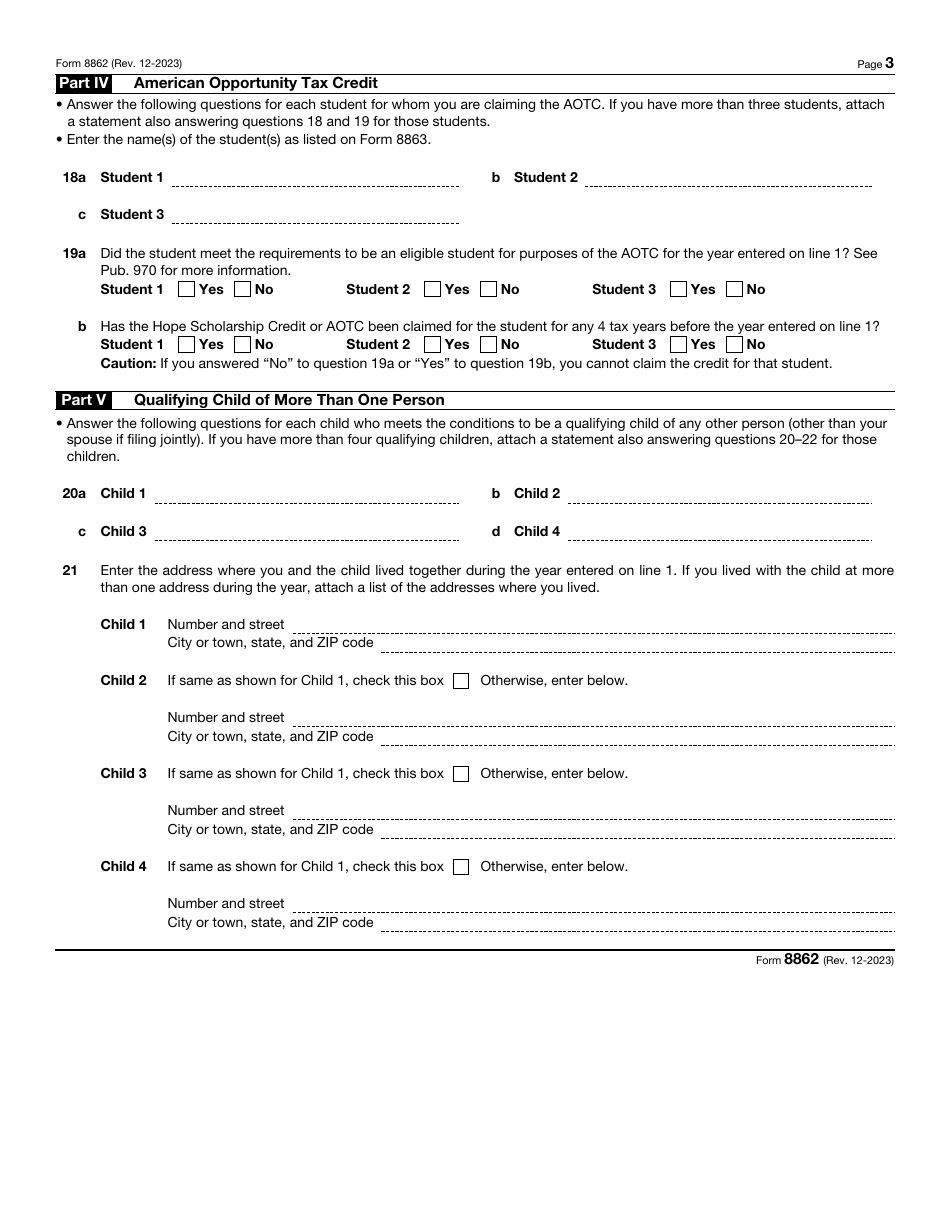

Complete the fourth part of the document in order to qualify for a tax credit that will cover education expenses for three students you financially support . Check the boxes to state they are eligible for you to file such a request and add the full names of those students.

-

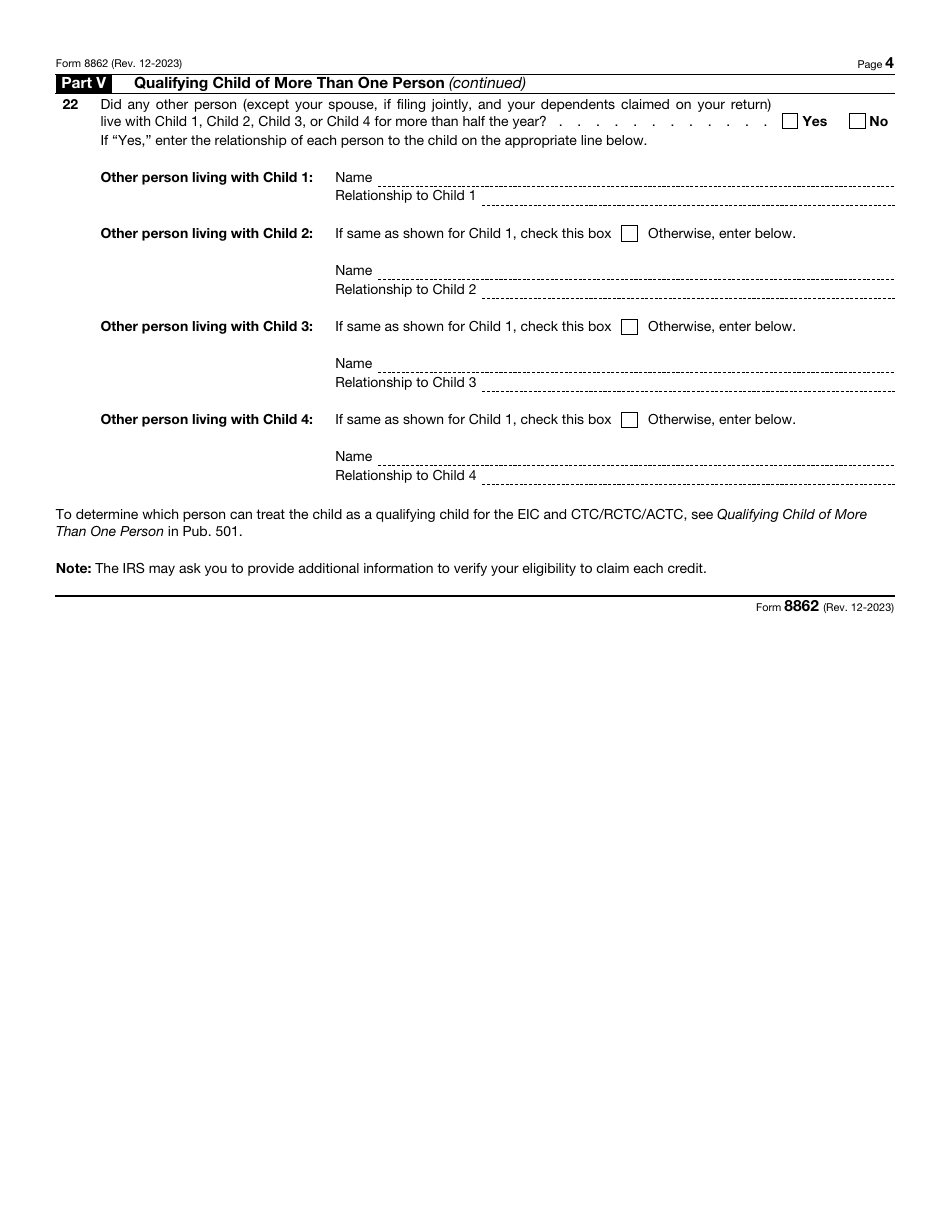

If qualifying children you have listed in writing will also be identified in a tax return of another individual, indicate their names and addresses and outline what kind of relationship other people have with those children.

How Long Does It Take to Process Form 8862?

Attach the 8862 IRS Form to your tax return and file the paperwork before the annual deadline comes. As soon as fiscal authorities receive the documentation, consider yourself included on the payment timetable of the IRS. The majority of taxpayers receive their tax credits within three or four weeks after they submit the claim. It is advised to file the form electronically since e-filing remains the safest way to communicate with tax organs - submit the paperwork online and claim the credit quicker.