How to Convert Personal Use Property to Business Use?

What Is Business Personal Property?

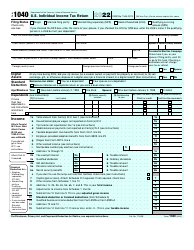

When you decide to buy land for commercial use or start your own business with personal use property, it's important to understand how much you have to pay in taxes and how to report them to avoid possible trouble with the both IRS and your local taxation department. These things are especially important when it comes to business property, that is usually divided into real estate property and personal property.

Any movable property not associated with the land is considered business personal property. Basically, it is everything not qualified as real estate property This includes computers, machinery, furniture, and supplies.

On the other hand, if you decide to rent out your house for profit, it will be considered real estate property.

Converting Personal Use Property to Business Use

Starting a small business, you may see the chances to transfer some of your personal property to business use. This can not only save you some money but also makes you eligible to claim a deduction for depreciation of the equipment. The transfer can be done in three steps:

- Determine the original costs (adjustable basis) and fair market value of the property you want to use for your business;

- Donate or sell it to your business to transfer ownership;

- Adjust the accounting records to reflect converting personal assets to business use and do not forget to indicate it on the forms you usually fill out (e.g., SBA Form 413).

This applies to personal property converted from personal use to business use. If you want to claim a tax deduction as a homeowner due to using your home for business purpose, check Publication 587, Business Use of Your Home (Including Use by Day-Care Providers) distributed by the Internal Revenue Service (IRS).

Business Personal Property Taxes

The majority of states require you to pay business personal property tax not only at the time of purchase or transfer but on a yearly basis. The details regarding annual report filings, taxable items, and amount of taxes may vary according to state and county. At the same time, the IRS may regard the purchase of personal property for business as the basis for deductions if the purchased items are necessary. Check IRS Publication 334 for detailed information regarding the federal tax laws.

The personal use property converted to business use does not qualify for Section 179 allows you to deduct the costs of depreciable property in one year, instead of stretching the whole process in several years. However, it is subject to annual depreciation. The cost recovery basis for property converted from personal use to business use is the fair market value of the property at the time of conversion or the adjusted value of the property, whichever less. After determining the depreciable basis, figure out the annual depreciation amount for each piece of property you converted taking into account the depreciation method chosen, the depreciation convention, and the recovery period for each item.