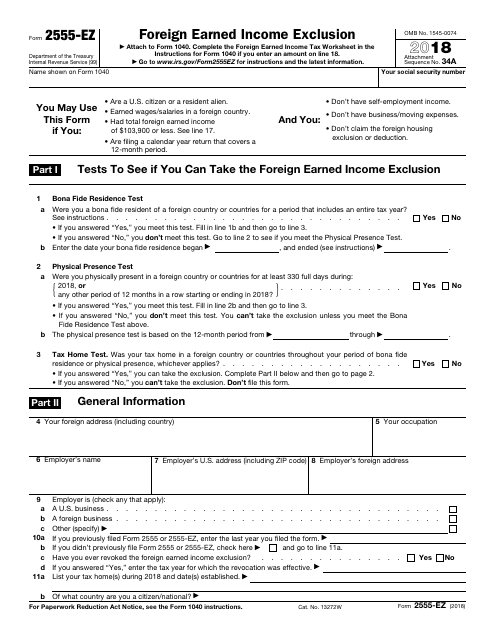

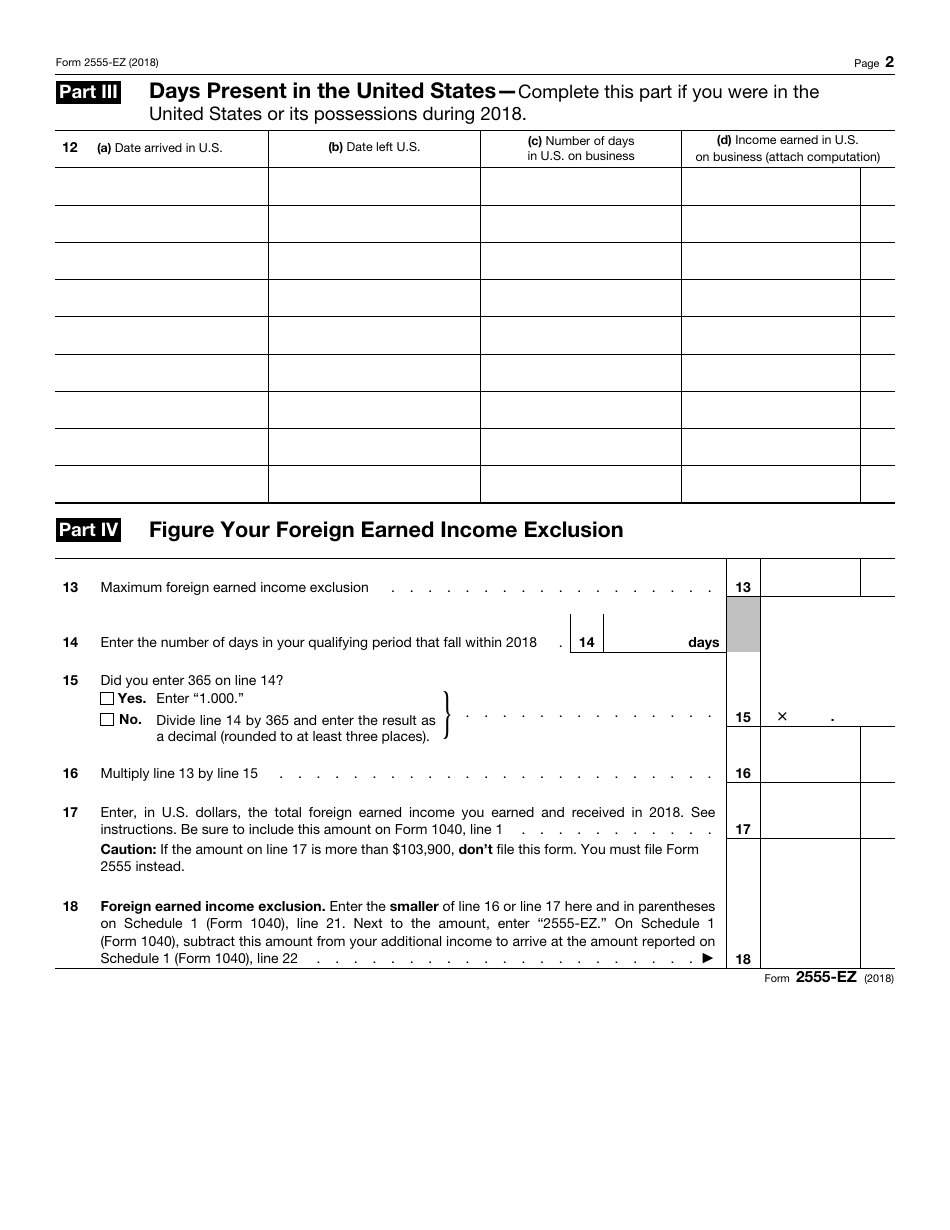

IRS Form 2555-EZ Foreign Earned Income Exclusion

What Is IRS Form 2555-EZ?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 2555-EZ?

A: IRS Form 2555-EZ is a form used to claim the Foreign Earned Income Exclusion.

Q: What is the Foreign Earned Income Exclusion?

A: The Foreign Earned Income Exclusion is a tax benefit that allows qualifying taxpayers to exclude a certain amount of their foreign earned income from their taxable income.

Q: Who is eligible to use Form 2555-EZ?

A: Taxpayers who meet certain criteria and have less complex foreign earned income situations can use Form 2555-EZ.

Q: What is the difference between Form 2555 and Form 2555-EZ?

A: Form 2555 is for taxpayers with more complex foreign earned income situations, while Form 2555-EZ is for taxpayers with simpler situations.

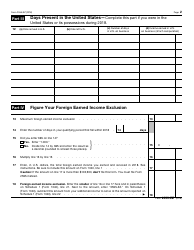

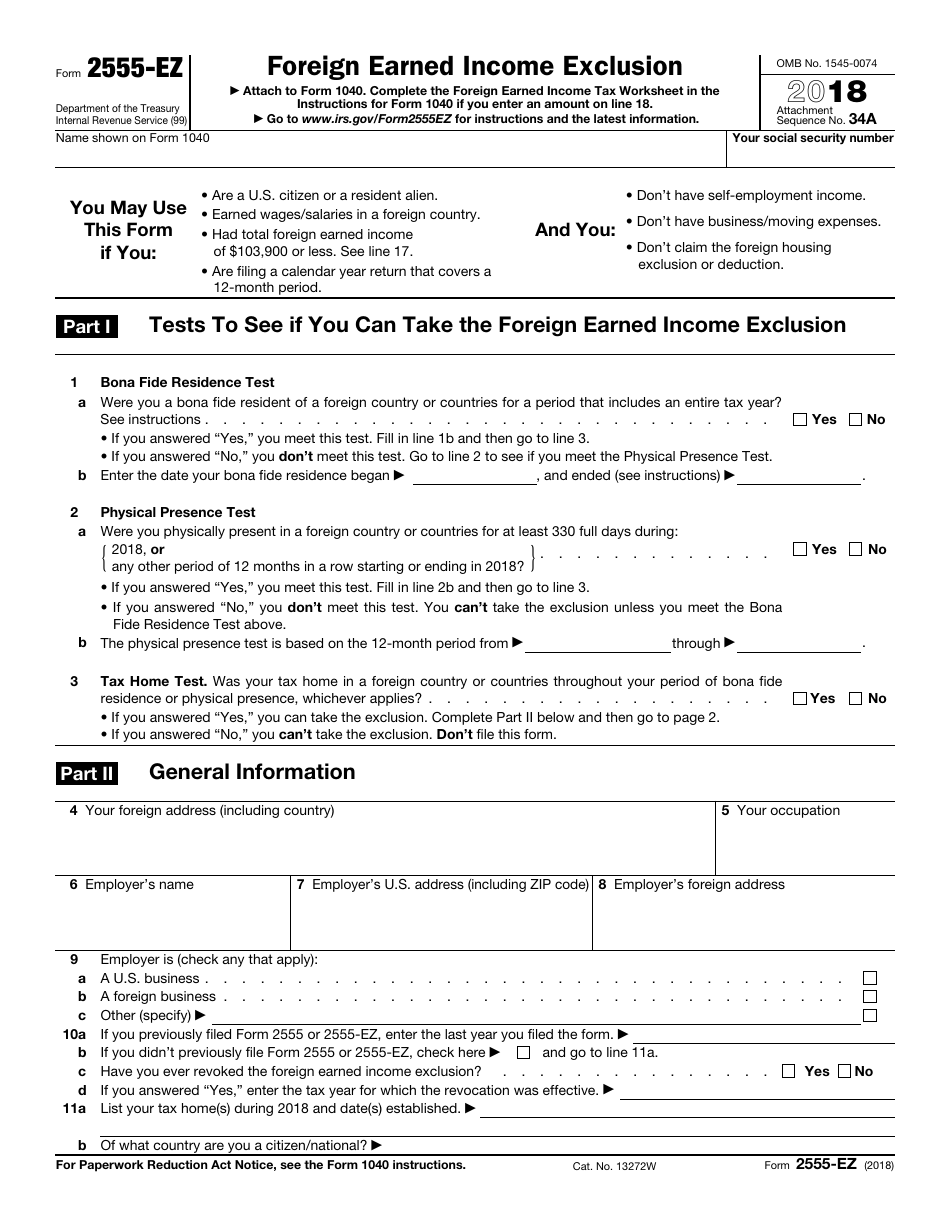

Q: What information is required on Form 2555-EZ?

A: Form 2555-EZ requires information such as the taxpayer's name, address, and taxpayer identification number, as well as details about their foreign earned income.

Q: When is the deadline to file Form 2555-EZ?

A: Form 2555-EZ is typically filed with the taxpayer's annual income tax return, which is due by the regular filing deadline, usually April 15th.

Q: Are there any limitations to the amount of income that can be excluded?

A: Yes, there are certain limitations to the amount of income that can be excluded using the Foreign Earned Income Exclusion. The specific limits vary each year and are adjusted for inflation.

Q: Do I need to include any supporting documents with Form 2555-EZ?

A: No, taxpayers who use Form 2555-EZ do not need to attach any supporting documents with their tax return. However, they should keep records and supporting documentation for their own records.

Q: Can I e-file Form 2555-EZ?

A: No, Form 2555-EZ cannot be e-filed and must be filed by mail with the taxpayer's paper tax return.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 2555-EZ through the link below or browse more documents in our library of IRS Forms.