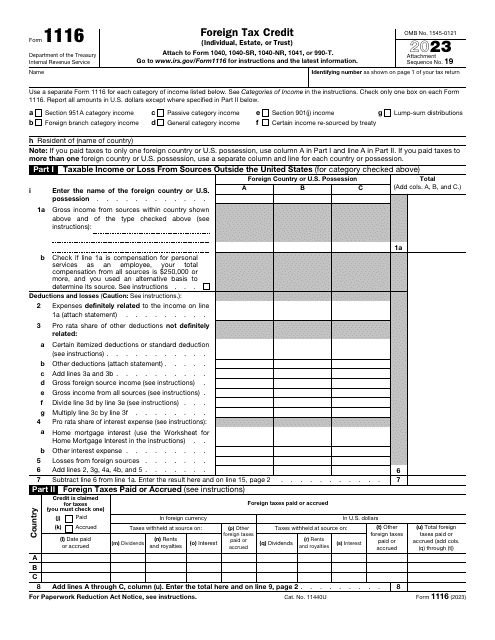

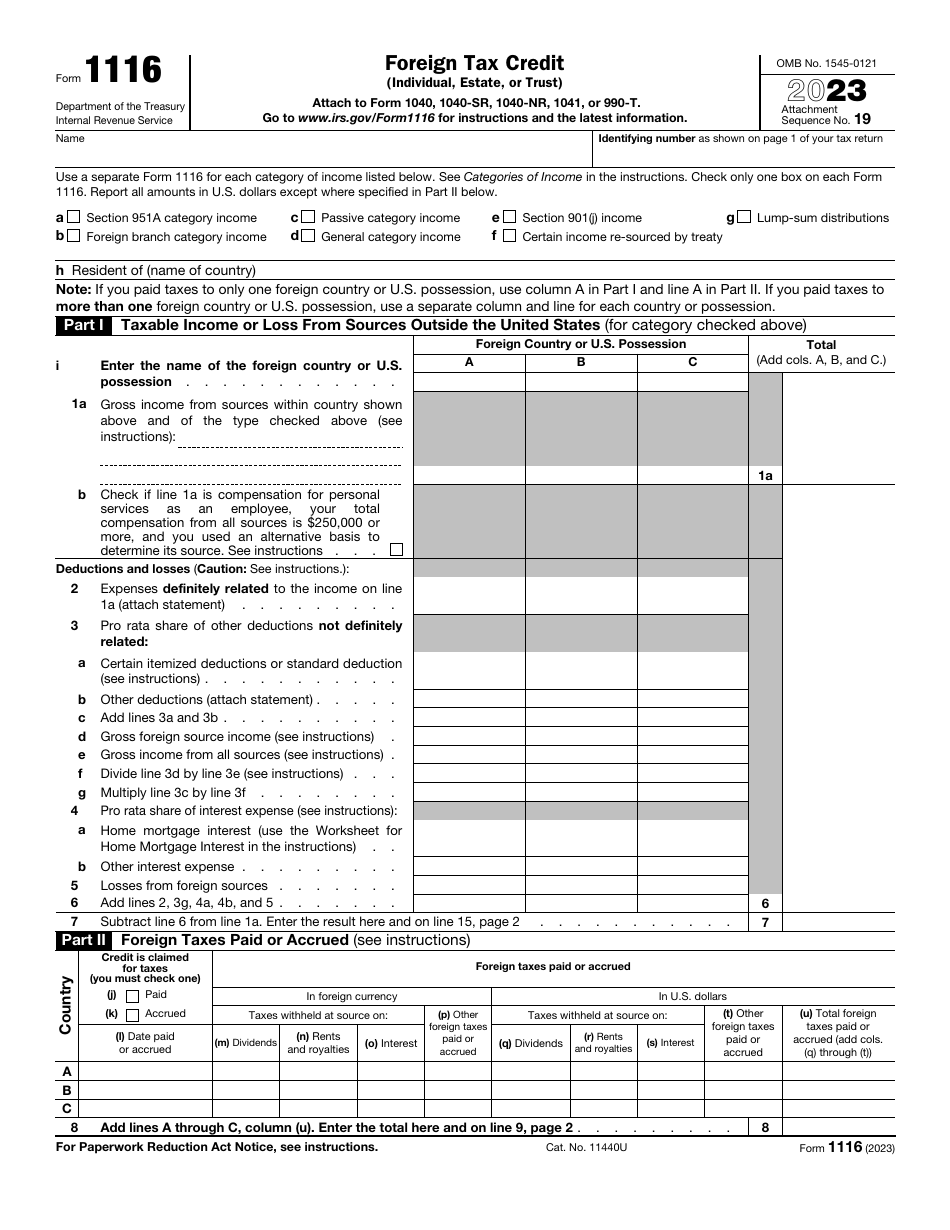

IRS Form 1116 Foreign Tax Credit (Individual, Estate, or Trust)

What Is IRS Form 1116?

IRS Form 1116, Foreign Tax Credit (Individual, Estate, or Trust) , is a formal document that allows American taxpayers that reside, work, and manage businesses overseas to lower the amount of tax they owe to the U.S. government.

Alternate Names:

- Tax Form 1116;

- Foreign Tax Credit Form.

If you file taxes on behalf of a trust or estate or you are an individual that paid or will pay taxes abroad, you may qualify for this tax credit under certain terms - the tax in question was imposed on you or your entity, there is an actual tax liability, and the tax you owe is imposed on your income.

This statement was released by the Internal Revenue Service (IRS) in 2023 , rendering previous editions obsolete. Download an IRS Form 1116 fillable version through the link below.

When Is Form 1116 Required?

If you live and work outside of the United States, you may deal with a double burden - paying taxes to the country of your origin as well as dealing with tax responsibilities in the state you are currently residing in. In order to minimize your expenses, you have an opportunity to file a tax credit claim and scale down your liability to the American tax system - avoid double taxation while properly reporting all your income on a regular tax return. As long as the credit you claim is not bigger than the amount of tax liability imposed by the United States, you are permitted to use IRS Form 1116.

Form 1116 Instructions

Follow the Form 1116 Instructions to calculate and deduct your overseas taxes from the American ones:

-

Indicate your name, a taxpayer identification number - the same number you enter on your tax return - and the country you live in at the moment. Check the box to specify what kind of income you are describing in the form. Note that Form 1116 requirements oblige the taxpayer to prepare a separate document for every category of income they have earned.

-

Record your gross income subject to U.S. taxation if it was earned in the country you have identified in writing . Check the appropriate box if you received payment for personal services, earned a quarter million dollars, and it is reasonable to point out the source of your income on an alternative basis.

-

Calculate the income (or loss) that is taxable - you need to take several numbers into account and comply with the calculation rules offered by the form. Make sure you clarify the expenses related to the income and enclose a statement that describes them as well as consider possible home mortgage interest or losses you have incurred during the tax year.

-

State the accurate amount of taxes you accrued in a different country - both U.S. dollars and local currency are supposed to be listed in the document. Divide the taxes by countries the same way you did in the previous part of the form and enter the total amount of tax you owe on dividends, rents, royalties, and interest - mention other taxes you have already paid or accrued and calculate their total amount.

-

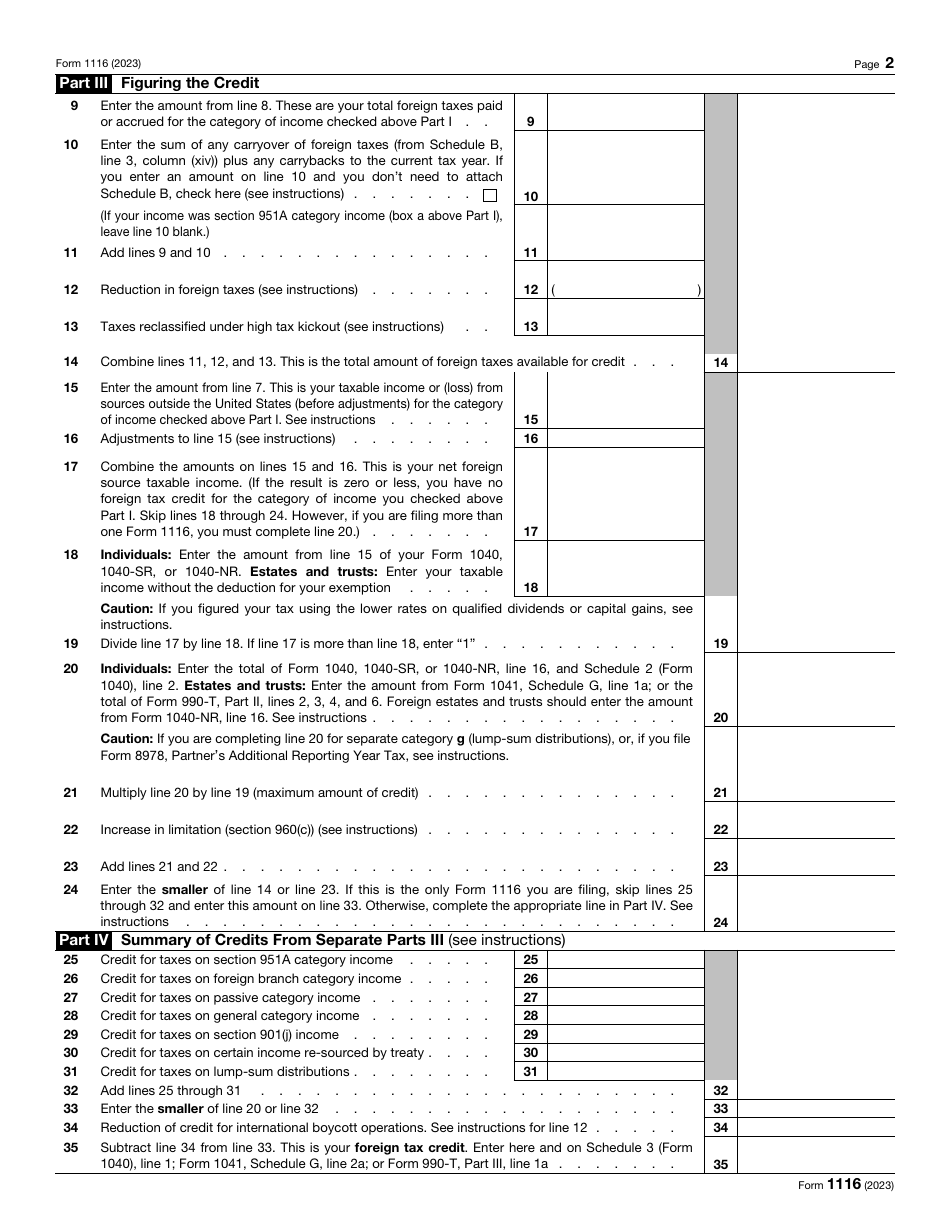

Find out the tax credit you are eligible to claim . Figure out the tax reduction that applies in your scenario, enter the taxes covered by the high tax kickout, and implement adjustments if necessary (for instance, you can recognize a gain on the disposition of certain property). There are different guidelines for diverse categories of taxpayers - ensure you read the description of every field carefully to compute the right amount of credit you are able to claim.

-

Summarize the information the instrument contains . You need to indicate the credit for taxes on different income categories only if you fill out more than one claim; otherwise, there will be a single number. Determine whether the latest number is smaller than the amount of tax you report on the main tax return and record a smaller number. Apply the reduction of credit in line with the international boycott operations and state your total tax credit.