Can Foreigners Buy Property in the USA? Tips for Foreign Buyers

Buying property in the United States is a good idea for people who are looking for a new home and for those searching for new investment opportunities. Whether you want to purchase land in the U.S. or are ready to invest in a new place to live, you will find that the market is rather friendly to foreigners. Although the buying process requires a lot of paperwork, rules for foreigners buying property in the U.S. are very similar to those for U.S. citizens.

Can a Foreigner Buy a House in the United States?

Among all the concerns of foreigners buying property in the U.S., the following are the most popular:

1. Do I need to become a citizen to buy a home in the U.S.?

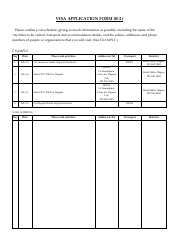

You do not need to have U.S. citizenship, a green card, or even any specific type of visa to buy property in the USA. The first thing you will need is an Individual Taxpayer Identification Number (ITIN). In order to request it, fill out and submit the ITIN application form - IRS Form W-7 to the Internal Revenue Service (IRS). There is also another version of this form called the IRS Form W-7(SP) that is tailored specifically to Spanish-speaking applicants. Depending on your citizenship, you may need your foreign passport, a visa, and an American ID.

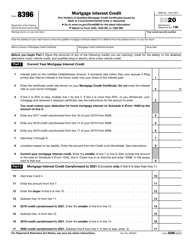

Foreigners also have the right to get a mortgage, including home and land loans, though it requires some preliminary work. Most lenders in the U.S. are ready to give their international clients loans up to 50% of the sales price. At the same time, being a foreigner, you may have to pay a higher interest rate. Besides, before submitting a mortgage application, you need to earn a good credit score.

2. Do I get a green card if I buy a house in the U.S.?

Foreigners cannot obtain a green card if they simply buy a house in the USA. In general, owning land or a home will not give you any special immigration benefits. Foreign investment in U.S. real estate can help you to apply for a visa (E-2 Investor Visa) if you wish to set up a small business in the country, can invest at least $100,000, and meet some other specific requirements.

If you intend to obtain a Green Card through an investment in real estate, the best way to do it is to take part in the EB-5 Immigrant Investor program. According to this program, you and your immediate family can qualify for a green card if you invest a minimum of $500,000. Note that the EB-5 visa requires investment into third-party Regional Centers and is not connected with buying a house or real estate for your family.

3. Is there a type of property I can't purchase in the United States?

The U.S. government does not restrict foreigners from buying property in America. You are eligible to purchase duplexes, single-family homes, townhomes, triplexes, land, and other property. However, housing cooperatives (co-ops) may have separate internal rules intended to deter foreigners from purchasing their apartments. The main reason for this is their concern that a foreign buyer can leave the property or rent it out; the owners of the building, on the other hand, prefer buyers who regard the bought apartment as their primary residence. Moreover, holding a foreign owner liable in the court is more complicated. Even if the judgment is in favor of the co-op, it is almost impossible to collect on the judgment since the foreign buyer’s assets are in a foreign country.

That is why most real estate agents will advise you to look for individual houses or condominiums instead. If you still wish to buy an apartment in a co-op, you will have to prove that your main income is from an American source and that you have considerable assets in the U.S.

Even in this case, the co-op board may disapprove of your purchase without an explanation.

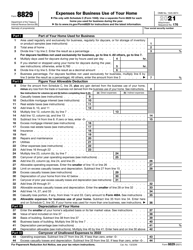

When you buy a property in the USA, you should remember about the taxes. The tax question is complicated and depends on your country of origin. In the U.S., you usually have to pay the same taxes as citizens. The exception is the FIRPTA – Foreign Investment in Real Property Tax Act. FIRPTA regulates withholding and taxations you may be subject to when selling your property.

Looking to read more on this topic?

- Find out how to buy land to build a house;

- Learn more about the types of property ownership available to buyers;

- Get information about buying a house through a land contract.