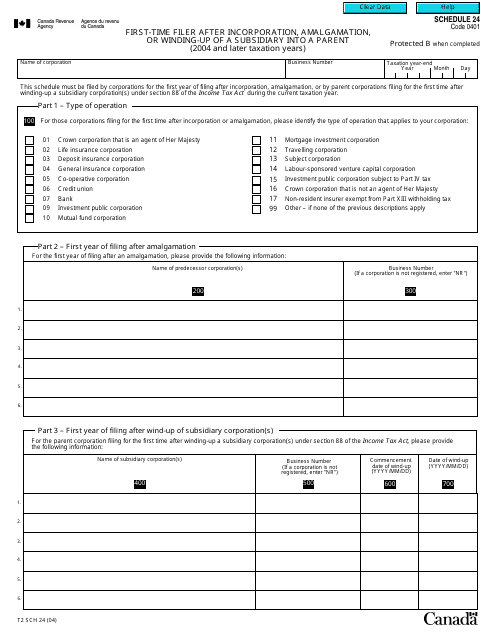

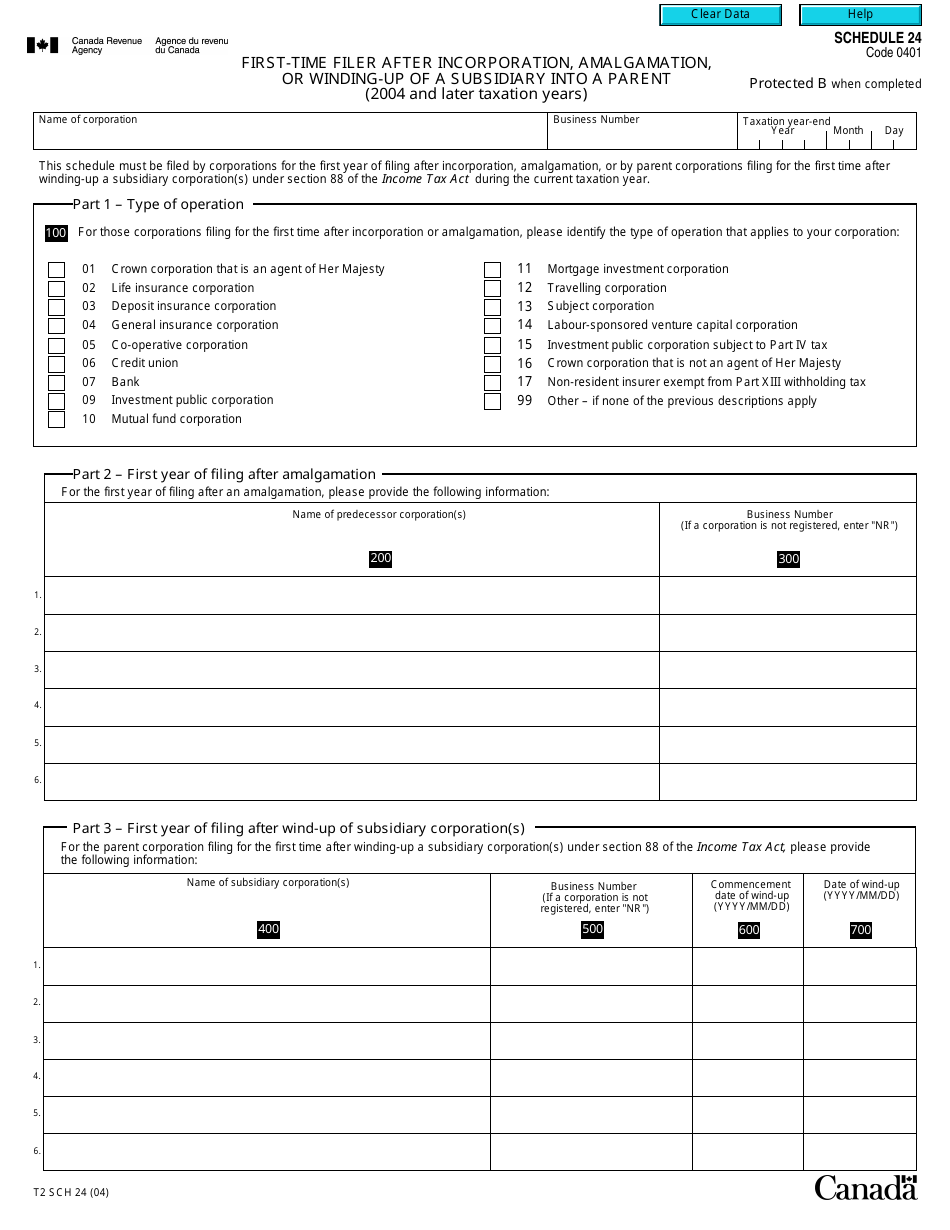

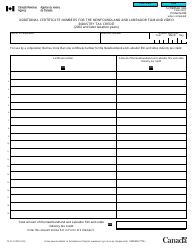

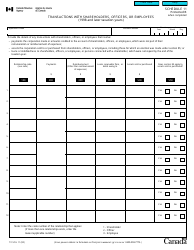

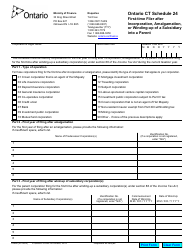

Form T2 Schedule 24 First Time Filer After Incorporation, Amalgamation or Winding-Up of a Subsidiary Into a Parent (2004 and Later Taxation Years) - Canada

Form T2 Schedule 24 is a tax form in Canada that is used by corporations to report their income and expenses for the first tax year after the incorporation, amalgamation, or winding-up of a subsidiary into a parent company. This form helps the Canada Revenue Agency (CRA) gather information about the financial activities of the corporation.

The parent corporation files the Form T2 Schedule 24 for the first time filer after the incorporation, amalgamation, or winding-up of a subsidiary into a parent in Canada.

FAQ

Q: What is Form T2 Schedule 24?

A: Form T2 Schedule 24 is a tax form used in Canada by corporations that have incorporated, amalgamated, or wound up a subsidiary into a parent company. It is used for the first time filers after these events in the tax years 2004 and later.

Q: Who needs to file Form T2 Schedule 24?

A: Corporations in Canada that have gone through the process of incorporating, amalgamating, or winding up a subsidiary into a parent company and are filing their taxes for the first time after these events in the tax years 2004 and later, need to file Form T2 Schedule 24.

Q: What is the purpose of Form T2 Schedule 24?

A: The purpose of Form T2 Schedule 24 is to report the details of incorporating, amalgamating, or winding up a subsidiary into a parent company, along with any associated tax implications.

Q: When should Form T2 Schedule 24 be filed?

A: Form T2 Schedule 24 should be filed when a corporation in Canada has gone through the process of incorporating, amalgamating, or winding up a subsidiary into a parent company and is filing its taxes for the first time after these events in the tax years 2004 and later.

Q: Are there any penalties for not filing Form T2 Schedule 24?

A: Yes, there may be penalties for not filing Form T2 Schedule 24 or filing it late. It is important to comply with tax filing requirements to avoid potential penalties.

Q: What information do I need to complete Form T2 Schedule 24?

A: To complete Form T2 Schedule 24, you will need information regarding the incorporation, amalgamation, or winding up of the subsidiary into the parent company, including dates, details, and any associated tax implications.

Q: Do I need to include any supporting documents with Form T2 Schedule 24?

A: It is always recommended to keep supporting documents in case of an audit, but you do not need to submit them with Form T2 Schedule 24 unless requested by the Canada Revenue Agency.

Q: Is there a deadline for filing Form T2 Schedule 24?

A: The deadline for filing Form T2 Schedule 24 is generally the same as the deadline for filing the corporation's annual tax return, which is usually within six months after the end of its taxation year.