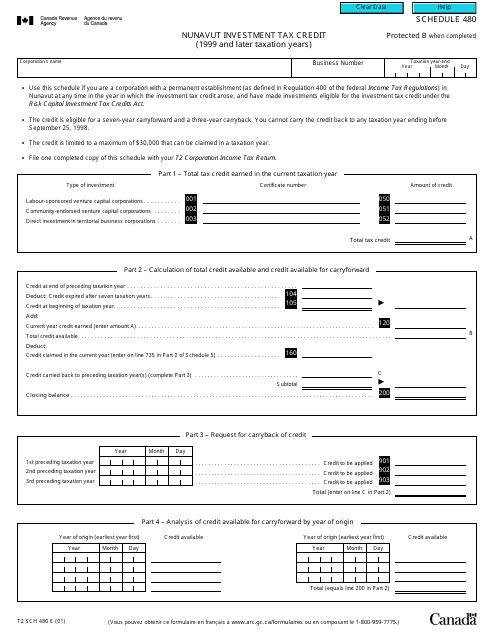

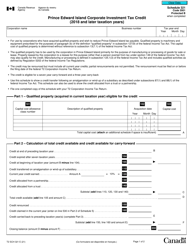

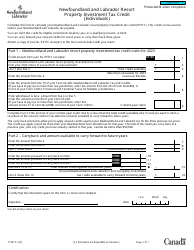

Form T2 Schedule 480 Nunavut Investment Tax Credit (1999 and Later Taxation Years) - Canada

Form T2 Schedule 480 Nunavut Investment Tax Credit is used to calculate the investment tax credit available for businesses operating in Nunavut, Canada. It is specifically for the taxation years starting in 1999 and onwards.

The Form T2 Schedule 480 Nunavut Investment Tax Credit is filed by corporations that are eligible for the Nunavut Investment Tax Credit in Canada.

FAQ

Q: What is Form T2 Schedule 480?

A: Form T2 Schedule 480 is a tax form used in Canada for claiming the Nunavut Investment Tax Credit.

Q: Who can use Form T2 Schedule 480?

A: This form is used by corporations and businesses in Canada that are eligible for the Nunavut Investment Tax Credit.

Q: What is the Nunavut Investment Tax Credit?

A: The Nunavut Investment Tax Credit is a tax credit available to businesses in Nunavut, Canada, to encourage investment in the territory.

Q: What years is Form T2 Schedule 480 used for?

A: Form T2 Schedule 480 is used for taxation years starting in 1999 and later.

Q: Are there any eligibility requirements for the Nunavut Investment Tax Credit?

A: Yes, there are eligibility requirements that businesses must meet in order to claim the Nunavut Investment Tax Credit. These requirements are outlined in the tax form instructions.