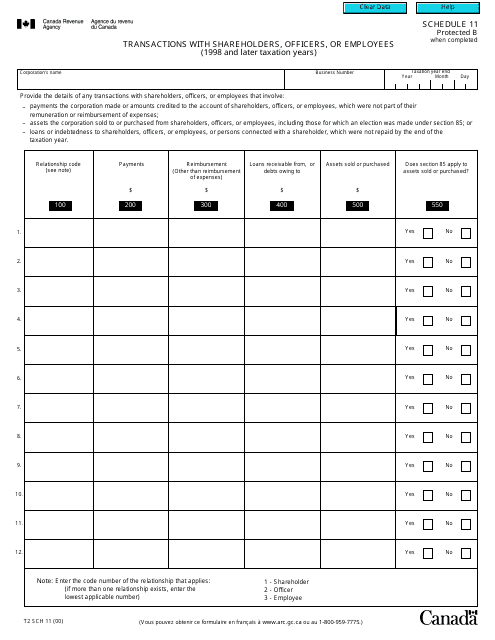

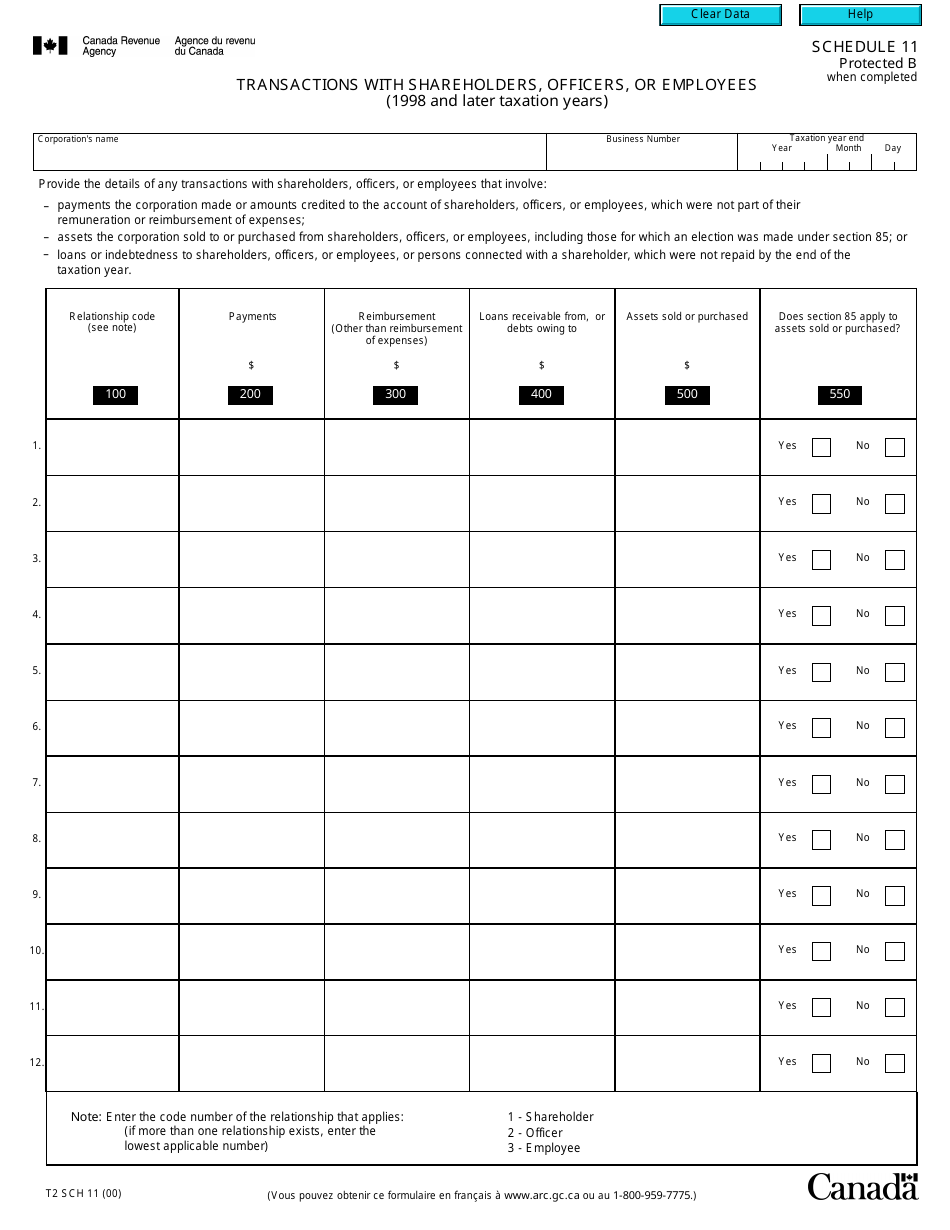

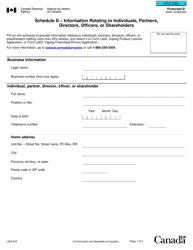

Form T2 Schedule 11 Transactions With Shareholders, Officers or Employees (1998 and Later Taxation Years) - Canada

Form T2 SCH 11 or the "Form T2 Sch 11 Schedule 11 "transactions With Shareholders, Officers Or Employees (1998 And Later Taxation Years)" - Canada" is a form issued by the Canadian Revenue Agency .

The form was last revised in January 1, 2000 and is available for digital filing. Download an up-to-date Form T2 SCH 11 in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2 Schedule 11?

A: Form T2 Schedule 11 is a tax form used in Canada for reporting transactions with shareholders, officers, or employees.

Q: Who needs to file Form T2 Schedule 11?

A: Canadian corporations who have had transactions with shareholders, officers, or employees during the taxation year need to file Form T2 Schedule 11.

Q: What types of transactions are included in Form T2 Schedule 11?

A: Form T2 Schedule 11 includes transactions such as loans, advances, indebtedness, guarantees, and non-arm's length transactions.

Q: When is Form T2 Schedule 11 due?

A: Form T2 Schedule 11 is generally due within six months after the end of the corporation's taxation year.

Q: Are there any penalties for not filing Form T2 Schedule 11?

A: Yes, there may be penalties for not filing Form T2 Schedule 11 or for filing it late. It is important to file the form on time to avoid penalties.

Q: Can I e-file Form T2 Schedule 11?

A: As of now, Form T2 Schedule 11 can only be filed in paper format and cannot be e-filed.

Q: Is there a fee to file Form T2 Schedule 11?

A: No, there is no fee to file Form T2 Schedule 11.

Q: Do I need to keep a copy of Form T2 Schedule 11 for my records?

A: Yes, it is important to keep a copy of Form T2 Schedule 11 and any supporting documents for your records in case of future audits or inquiries.

Q: Can I amend my Form T2 Schedule 11 after filing it?

A: Yes, if you need to make changes to your Form T2 Schedule 11 after filing it, you can file an amended schedule with the CRA.