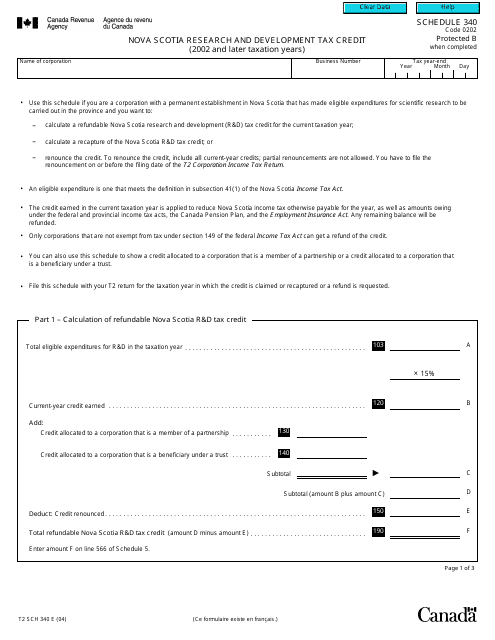

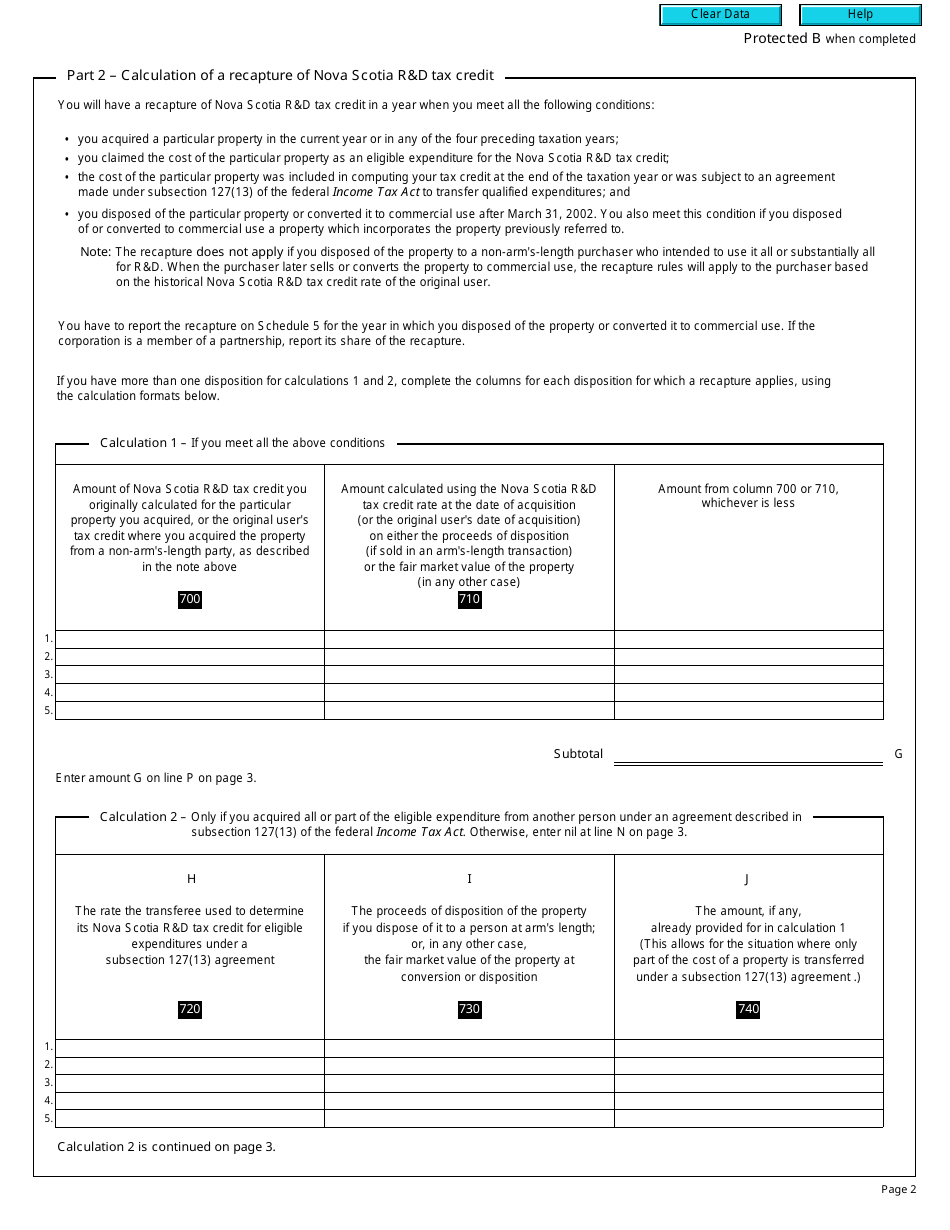

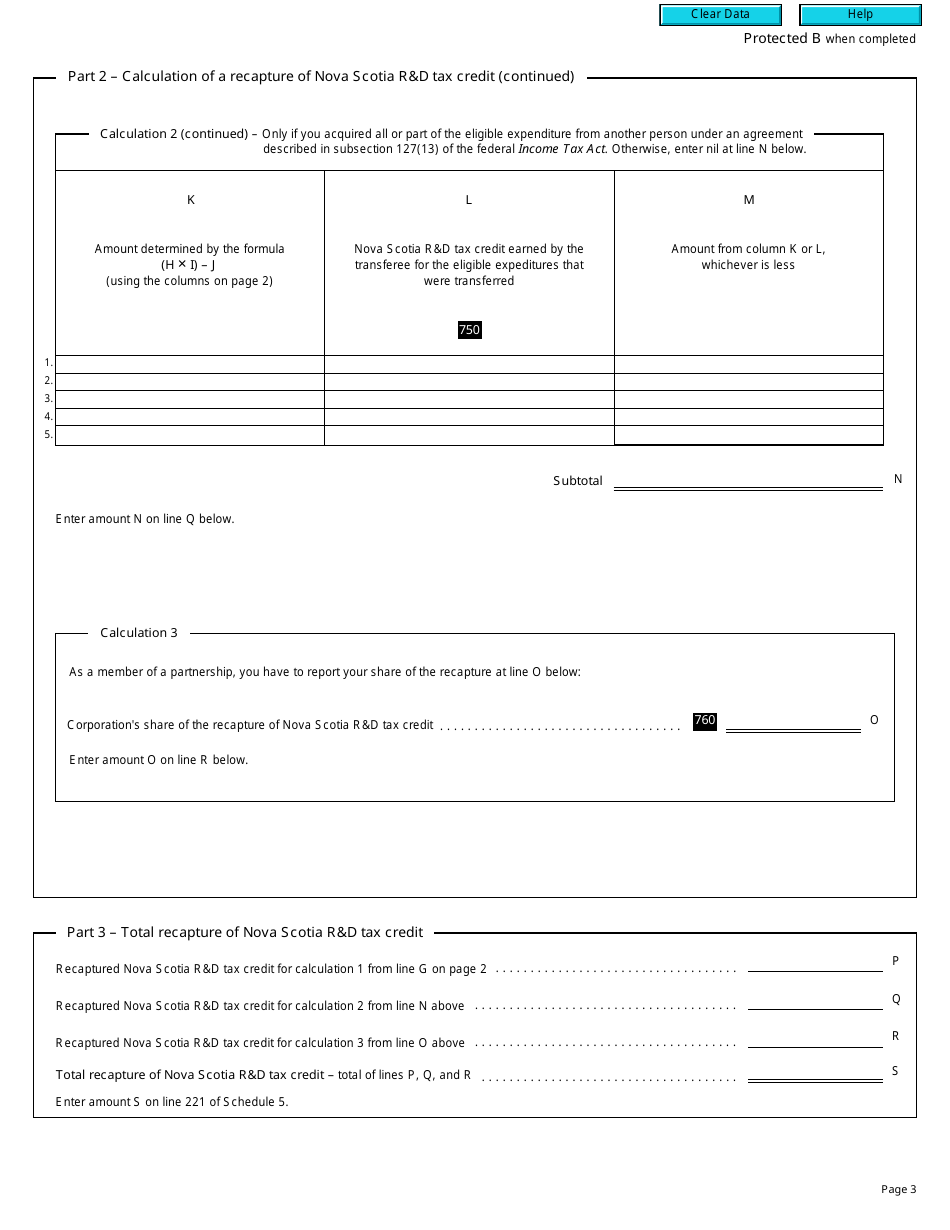

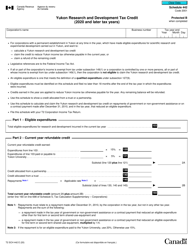

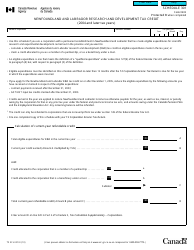

Form T2 Schedule 340 Nova Scotia Research and Development Tax Credit (2002 and Later Taxation Years) - Canada

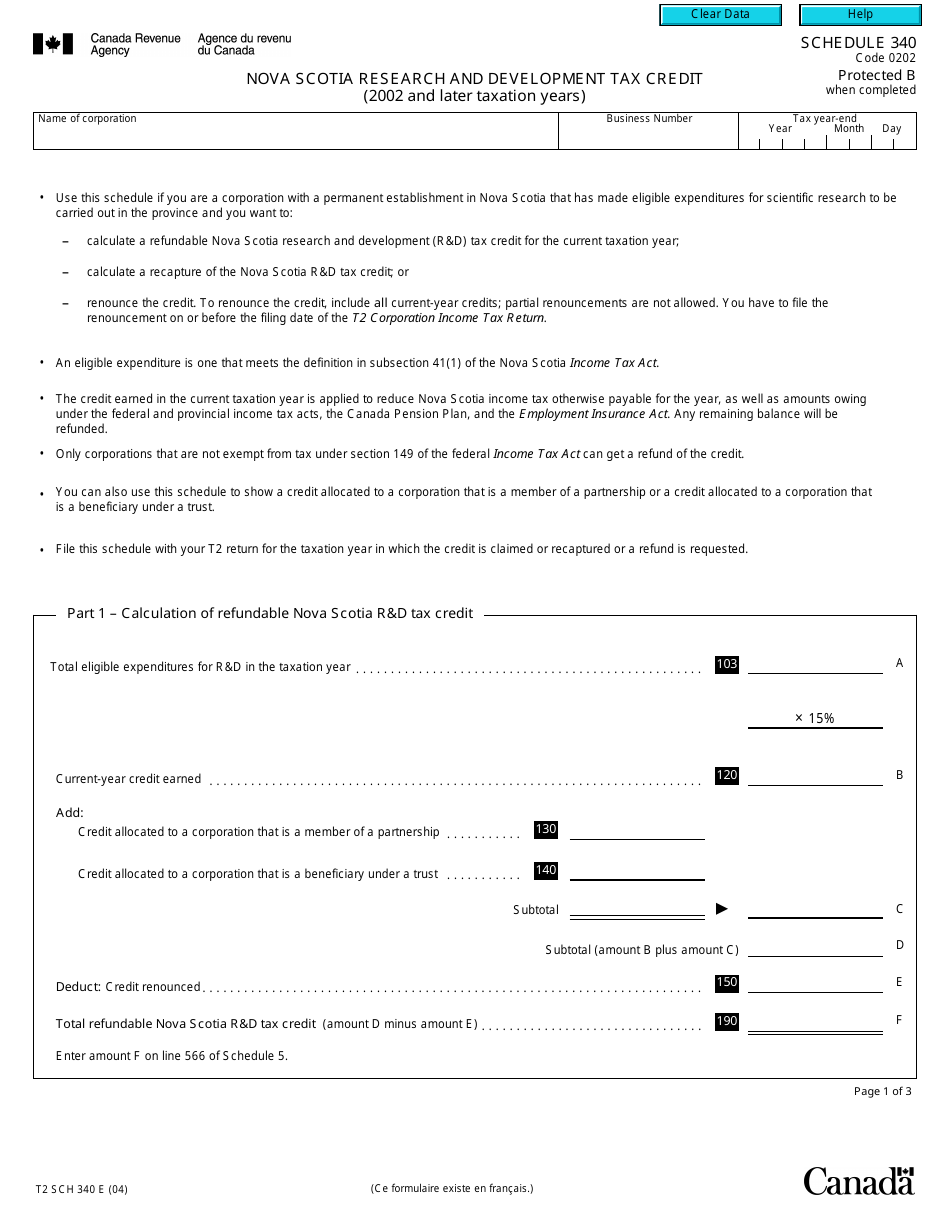

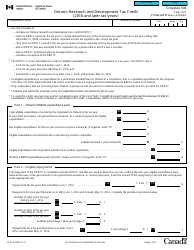

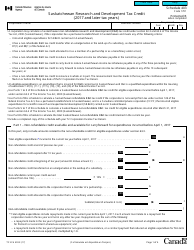

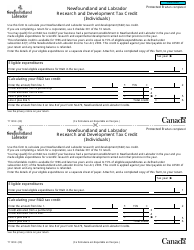

Form T2 Schedule 340 is used to claim the Nova Scotia Research and Development Tax Credit for the years 2002 and later, in Canada. This credit is available to businesses in Nova Scotia that invest in research and development activities. It incentivizes companies to innovate and conduct R&D work by providing tax relief.

The Form T2 Schedule 340 Nova Scotia Research and Development Tax Credit is filed by corporations in Canada that are eligible for this tax credit in the province of Nova Scotia.

FAQ

Q: What is Form T2 Schedule 340?

A: Form T2 Schedule 340 is a tax form used in Canada for claiming the Nova Scotia Research and Development Tax Credit.

Q: What is the purpose of the Nova Scotia Research and Development Tax Credit?

A: The purpose of the Nova Scotia Research and Development Tax Credit is to encourage companies to conduct research and development activities in Nova Scotia.

Q: Who can claim the Nova Scotia Research and Development Tax Credit?

A: Companies that have incurred qualified research and development expenditures in Nova Scotia may be eligible to claim the tax credit.

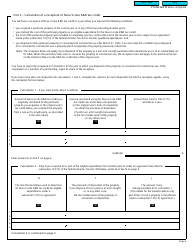

Q: What are qualified research and development expenditures?

A: Qualified research and development expenditures include expenses related to scientific research, experimental development, and certain engineering activities.

Q: When can Form T2 Schedule 340 be used?

A: Form T2 Schedule 340 can be used for tax years starting in 2002 and later.

Q: Are there any deadlines for claiming the Nova Scotia Research and Development Tax Credit?

A: Yes, there are specific deadlines for claiming the Nova Scotia Research and Development Tax Credit. It is recommended to consult the CRA or a tax professional for the exact deadlines and requirements.