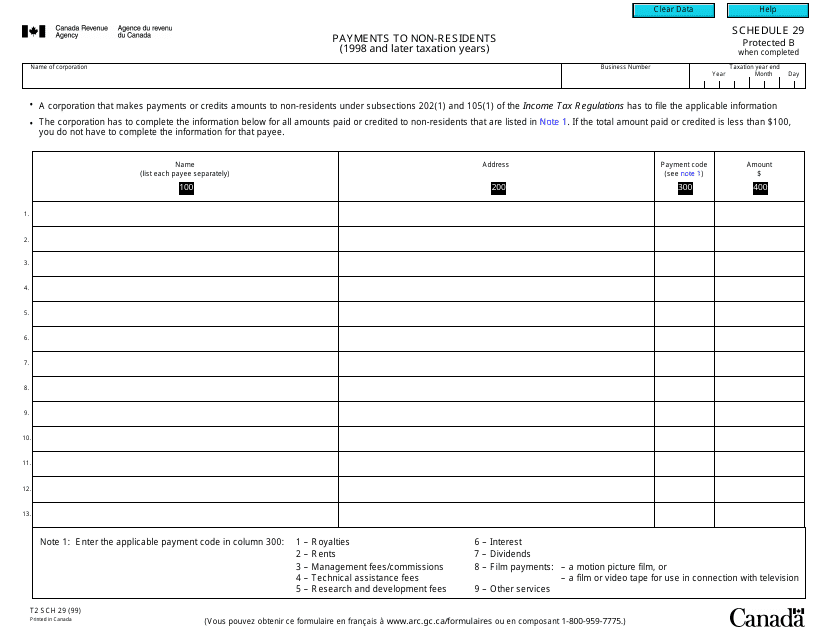

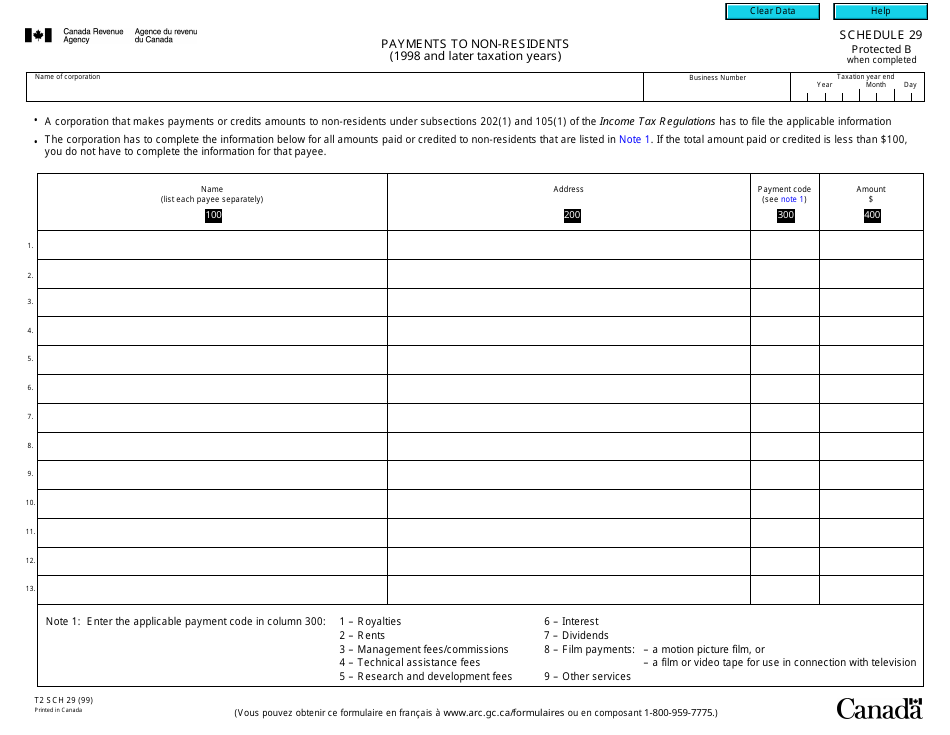

Form T2 Schedule 29 Payments to Non-residents (1998 and Later Taxation Years) - Canada

Form T2 Schedule 29 Payments to Non-residents (1998 and Later Taxation Years) in Canada is used for reporting payments made to non-residents for services. It helps the Canadian government track and tax income earned by non-residents in Canada.

The Form T2 Schedule 29 Payments to Non-residents (1998 and Later Taxation Years) in Canada is filed by Canadian corporations that make payments to non-residents.

FAQ

Q: What is Form T2 Schedule 29?

A: Form T2 Schedule 29 is a tax form used in Canada to report payments made to non-residents.

Q: When is Form T2 Schedule 29 used?

A: Form T2 Schedule 29 is used for taxation years starting from 1998 and onwards.

Q: Who needs to file Form T2 Schedule 29?

A: Any individual or corporation in Canada who has made payments to non-residents needs to file Form T2 Schedule 29.

Q: What kind of payments are reported on Form T2 Schedule 29?

A: Form T2 Schedule 29 is used to report various types of payments made to non-residents, such as fees, royalties, and dividends.

Q: Do I need to provide supporting documents with Form T2 Schedule 29?

A: Yes, you need to include a detailed breakdown of the payments made to non-residents along with your Form T2 Schedule 29.

Q: Are there any penalties for not filing Form T2 Schedule 29?

A: Yes, there can be penalties for failing to file Form T2 Schedule 29 or for providing incorrect information.