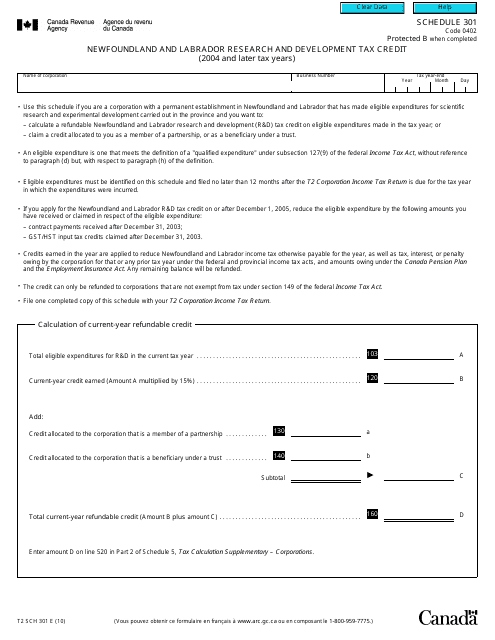

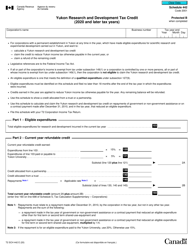

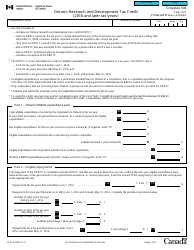

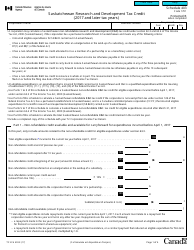

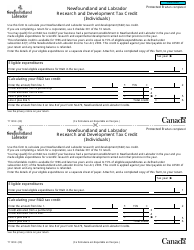

Form T2 Schedule 301 Newfoundland and Labrador Research and Development Tax Credit (2004 and Later Taxation Years) - Canada

The Form T2 Schedule 301 Newfoundland and Labrador Research and Development Tax Credit is used in Canada for claiming tax credits related to research and development activities in Newfoundland and Labrador. It is applicable for taxation years starting from 2004 onwards.

The Newfoundland and Labrador Research and Development Tax Credit is claimed by corporations that are eligible for the credit and have incurred qualifying research and development expenses in Newfoundland and Labrador. They would file the Form T2 Schedule 301 along with their corporate tax return in Canada.

FAQ

Q: What is Form T2 Schedule 301?

A: Form T2 Schedule 301 is a form used by corporations in Canada, specifically in Newfoundland and Labrador, to claim the Research and Development Tax Credit.

Q: Who can use Form T2 Schedule 301?

A: Corporations in Newfoundland and Labrador that have incurred eligible research and development expenditures can use Form T2 Schedule 301.

Q: What is the purpose of the Research and Development Tax Credit?

A: The purpose of the Research and Development Tax Credit is to provide tax incentives to corporations conducting research and development activities in Newfoundland and Labrador.

Q: What are eligible research and development expenditures?

A: Eligible research and development expenditures include salaries, wages, and expenses directly related to scientific research, experimental development, or engineering work done in Newfoundland and Labrador.

Q: What is the taxation year for Form T2 Schedule 301?

A: Form T2 Schedule 301 is for the taxation years starting in 2004 and later.