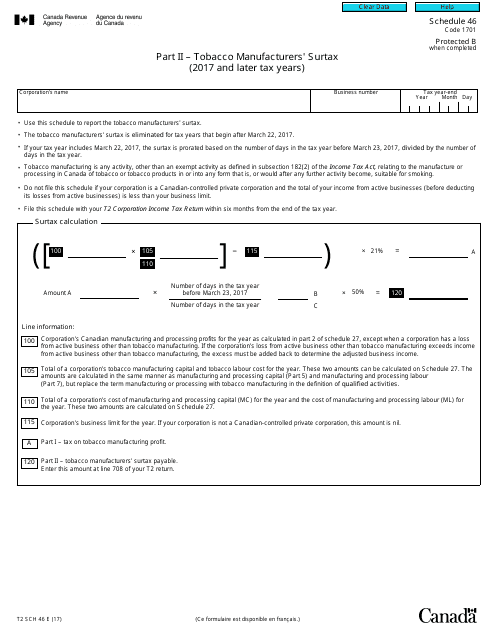

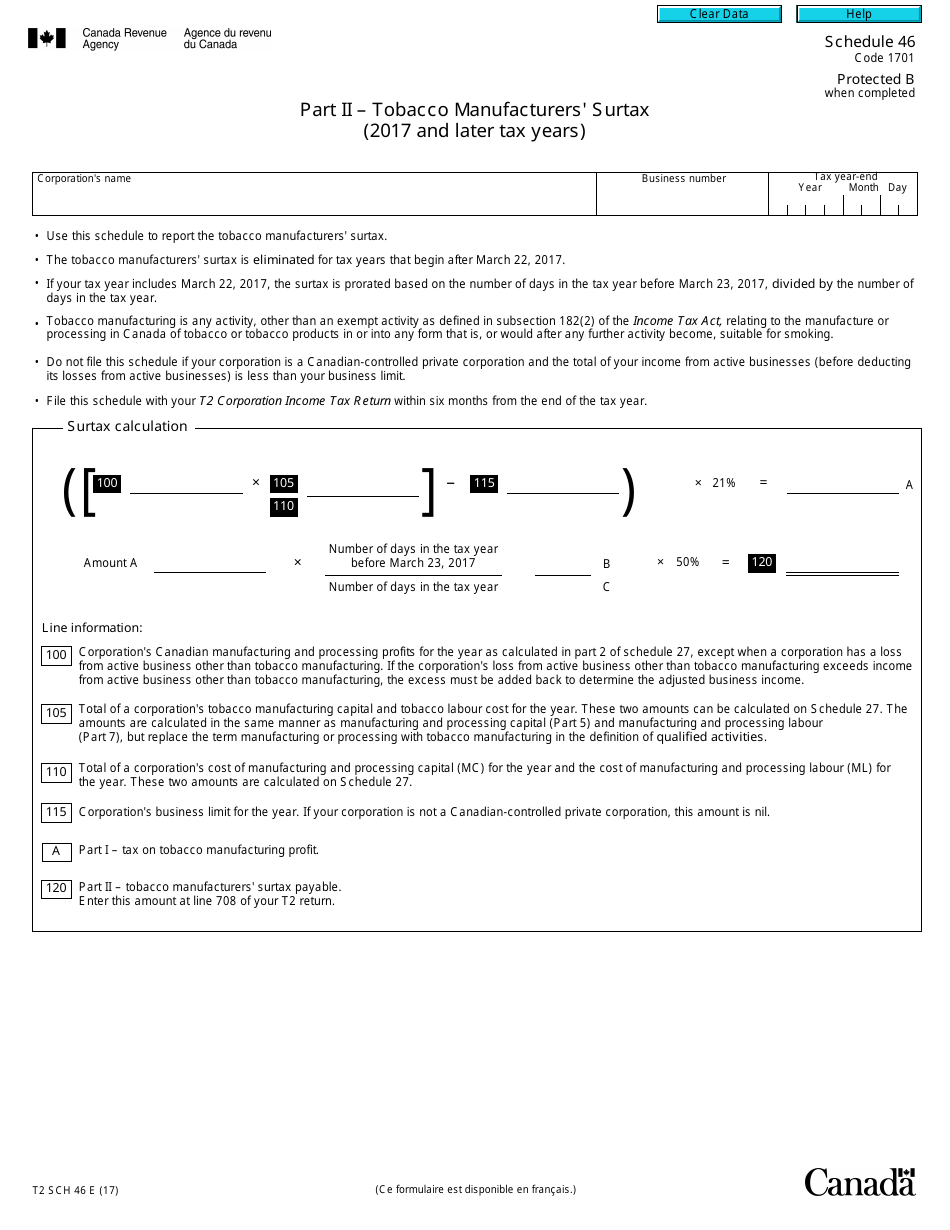

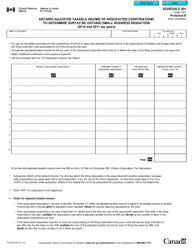

Form T2 Schedule 46 Part II - Tobacco Manufacturers' Surtax (2017 and Later Taxation Years) - Canada

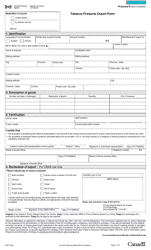

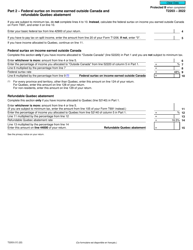

Form T2 Schedule 46 Part II - Tobacco Manufacturers' Surtax (2017 and Later Taxation Years) is used by tobacco manufacturers in Canada to calculate and report their surtax liability. The surtax is an additional tax imposed on certain tobacco products.

The tobacco manufacturers in Canada are responsible for filing the Form T2 Schedule 46 Part II.

FAQ

Q: What is Form T2 Schedule 46 Part II?

A: Form T2 Schedule 46 Part II is a form used by tobacco manufacturers in Canada to calculate and report the surtax owed for the taxation years 2017 and later.

Q: Who needs to fill out Form T2 Schedule 46 Part II?

A: Tobacco manufacturers in Canada are required to fill out Form T2 Schedule 46 Part II to calculate and report the surtax owed.

Q: What is the purpose of Form T2 Schedule 46 Part II?

A: The purpose of Form T2 Schedule 46 Part II is to calculate and report the surtax owed by tobacco manufacturers in Canada for the taxation years 2017 and later.

Q: What are the taxation years covered by Form T2 Schedule 46 Part II?

A: Form T2 Schedule 46 Part II is used for the taxation years 2017 and later.

Q: Is Form T2 Schedule 46 Part II specific to tobacco manufacturers?

A: Yes, Form T2 Schedule 46 Part II is specifically for tobacco manufacturers in Canada.