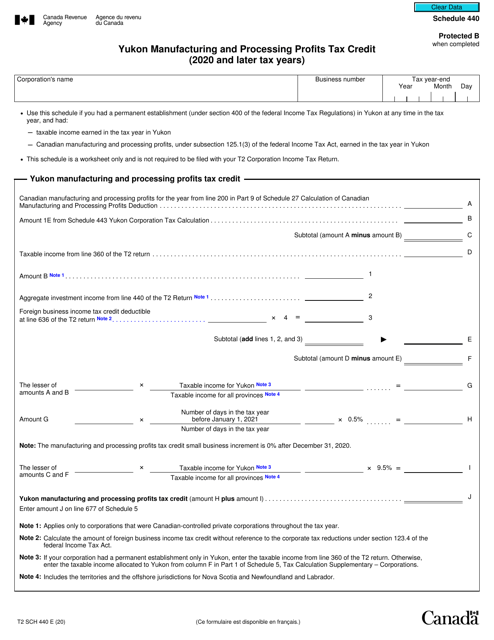

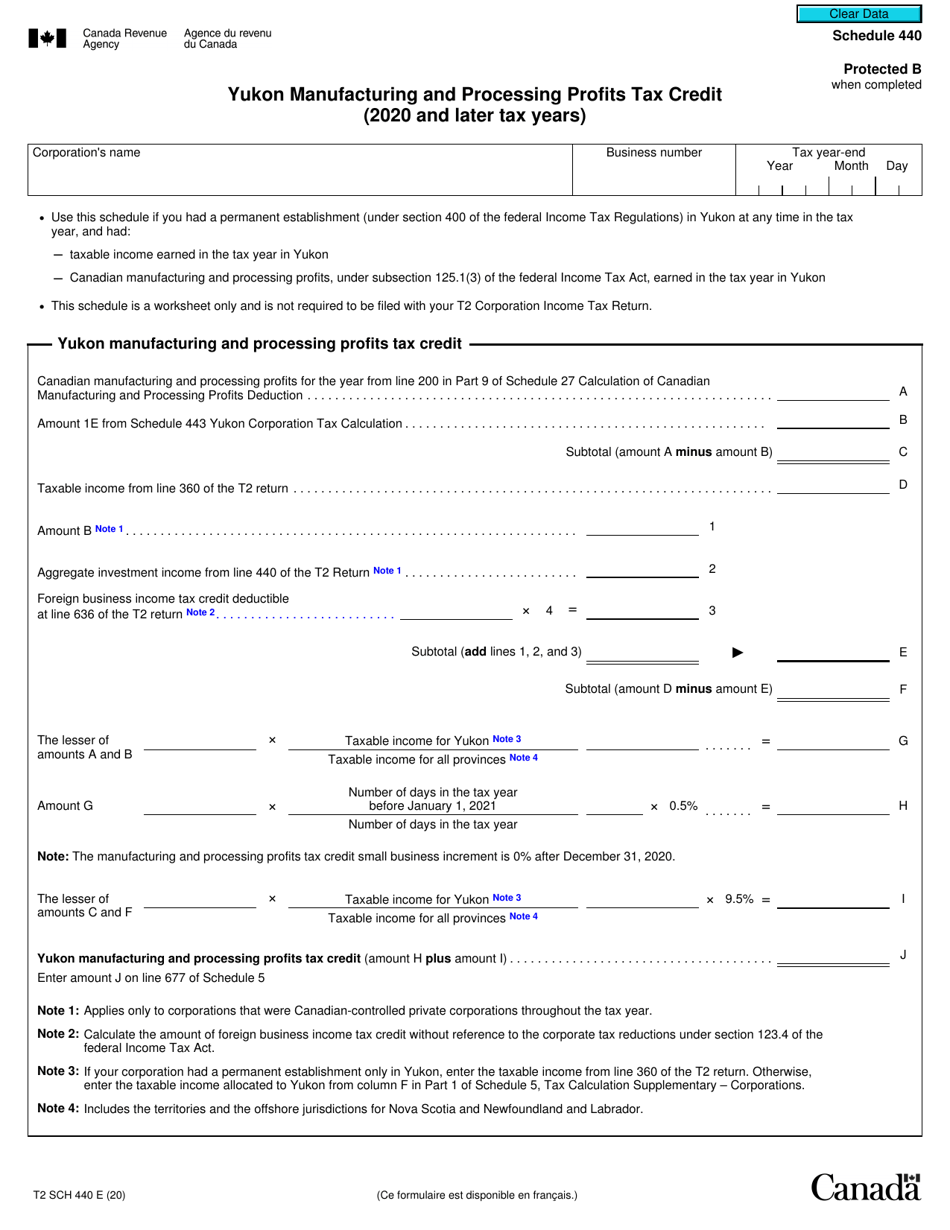

Form T2 Schedule 440 Yukon Manufacturing and Processing Profits Tax Credit (2020 and Later Tax Years) - Canada

Form T2 Schedule 440 is used in Canada to claim the Manufacturing and Processing Profits Tax Credit specific to the Yukon province. It is applicable for tax years 2020 and later. This credit is designed to support and encourage manufacturing and processing activities in the Yukon region.

The Form T2 Schedule 440 Yukon Manufacturing and Processing Profits Tax Credit (2020 and Later Tax Years) in Canada is filed by corporations that are eligible for the tax credit.

Form T2 Schedule 440 Yukon Manufacturing and Processing Profits Tax Credit (2020 and Later Tax Years) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2 Schedule 440?

A: Form T2 Schedule 440 is a tax form used in Canada to claim the Yukon Manufacturing and Processing Profits Tax Credit.

Q: What is the purpose of the Yukon Manufacturing and Processing Profits Tax Credit?

A: The purpose of the tax credit is to encourage manufacturing and processing activities in the Yukon territory.

Q: Who is eligible to claim the Yukon Manufacturing and Processing Profits Tax Credit?

A: Canadian corporations engaged in eligible manufacturing and processing activities in the Yukon may be eligible to claim the tax credit.

Q: What tax years does Form T2 Schedule 440 apply to?

A: Form T2 Schedule 440 applies to tax years starting in 2020 and later.

Q: How do I fill out Form T2 Schedule 440?

A: To fill out Form T2 Schedule 440, you will need to provide information about your corporation and its eligible manufacturing and processing activities in the Yukon.

Q: Are there any important deadlines for filing Form T2 Schedule 440?

A: The deadline for filing Form T2 Schedule 440 is generally the same as the deadline for filing your corporate tax return, which is within six months of your corporation's fiscal year-end.