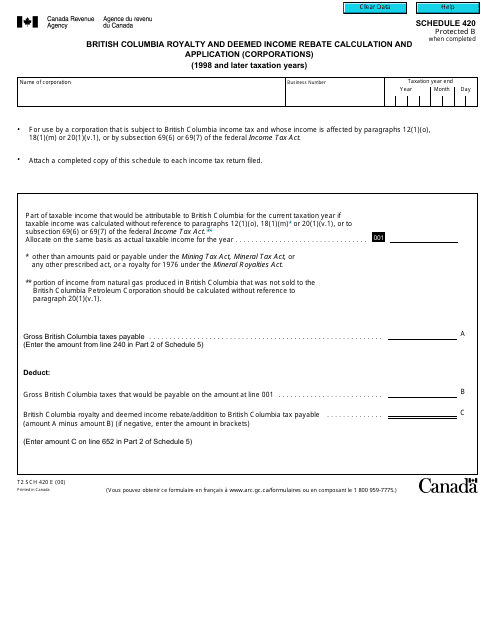

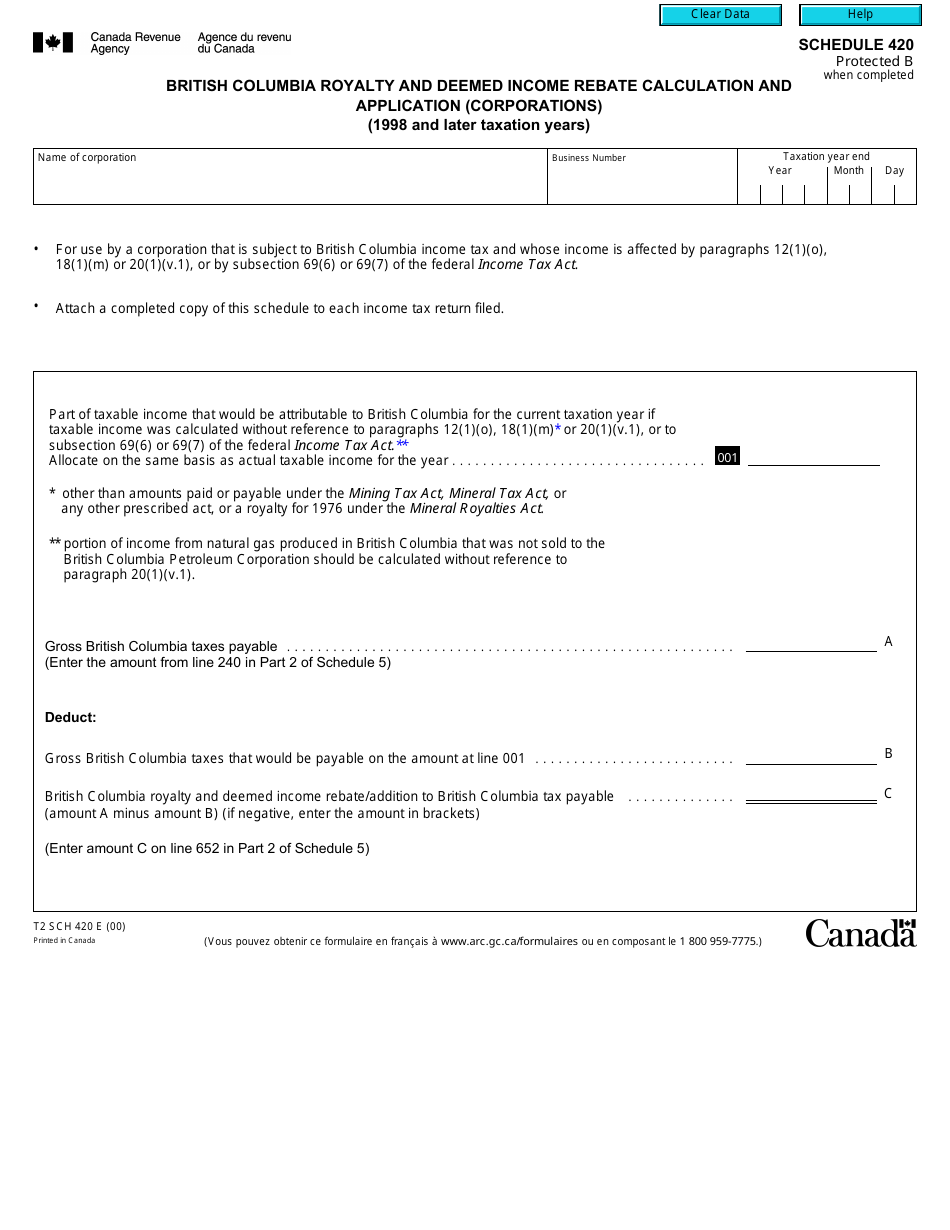

Form T2 Schedule 420 British Columbia Royalty and Deemed Income Rebate Calculation and Application (Corporations) (1998 and Later Taxation Years) - Canada

Form T2 Schedule 420 is used by corporations in British Columbia, Canada to calculate their royalty and deemed income rebate for the taxation years 1998 and later. This form helps corporations determine the amount of rebate they can claim based on their royalty and deemed income.

Corporations in British Columbia file the Form T2 Schedule 420 for royalty and deemed income rebate calculation and application in Canada.

FAQ

Q: What is Form T2 Schedule 420?

A: Form T2 Schedule 420 is a tax form used by corporations in Canada to calculate and apply for the British Columbia Royalty and Deemed Income Rebate.

Q: Who is eligible to use Form T2 Schedule 420?

A: Corporations in Canada who have earned income in British Columbia and are eligible for the royalty and deemed income rebate can use Form T2 Schedule 420.

Q: What is the purpose of the British Columbia Royalty and Deemed Income Rebate?

A: The rebate is meant to provide financial assistance to corporations operating in British Columbia by reducing their tax liability.

Q: What years is Form T2 Schedule 420 applicable for?

A: Form T2 Schedule 420 is applicable for taxation years starting in 1998 and onwards.

Q: How do I calculate the rebate using Form T2 Schedule 420?

A: The form provides instructions and calculations to determine the amount of the rebate based on the corporation's income and other relevant factors.