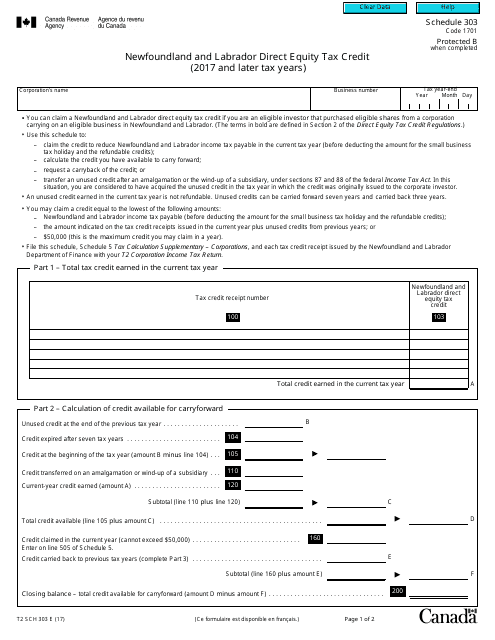

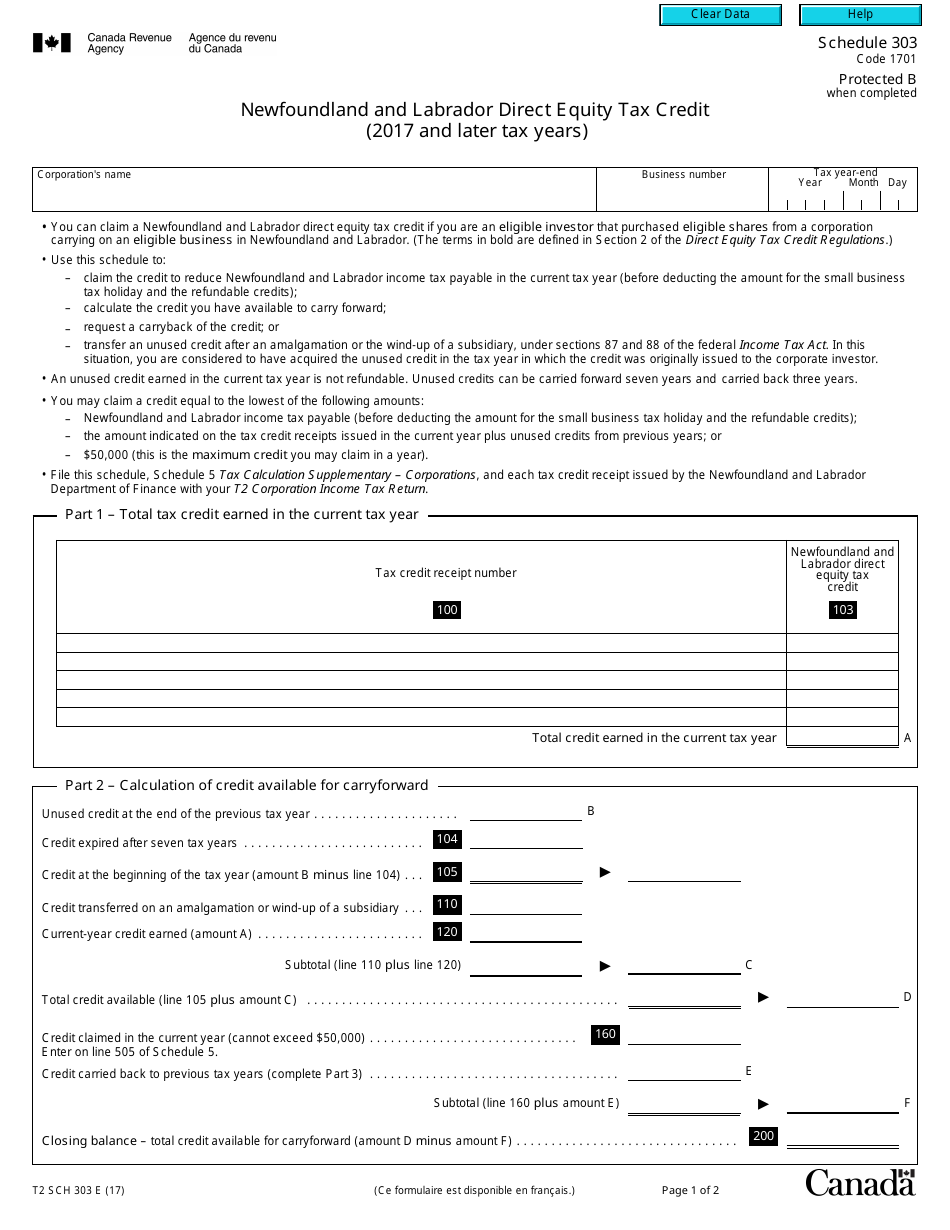

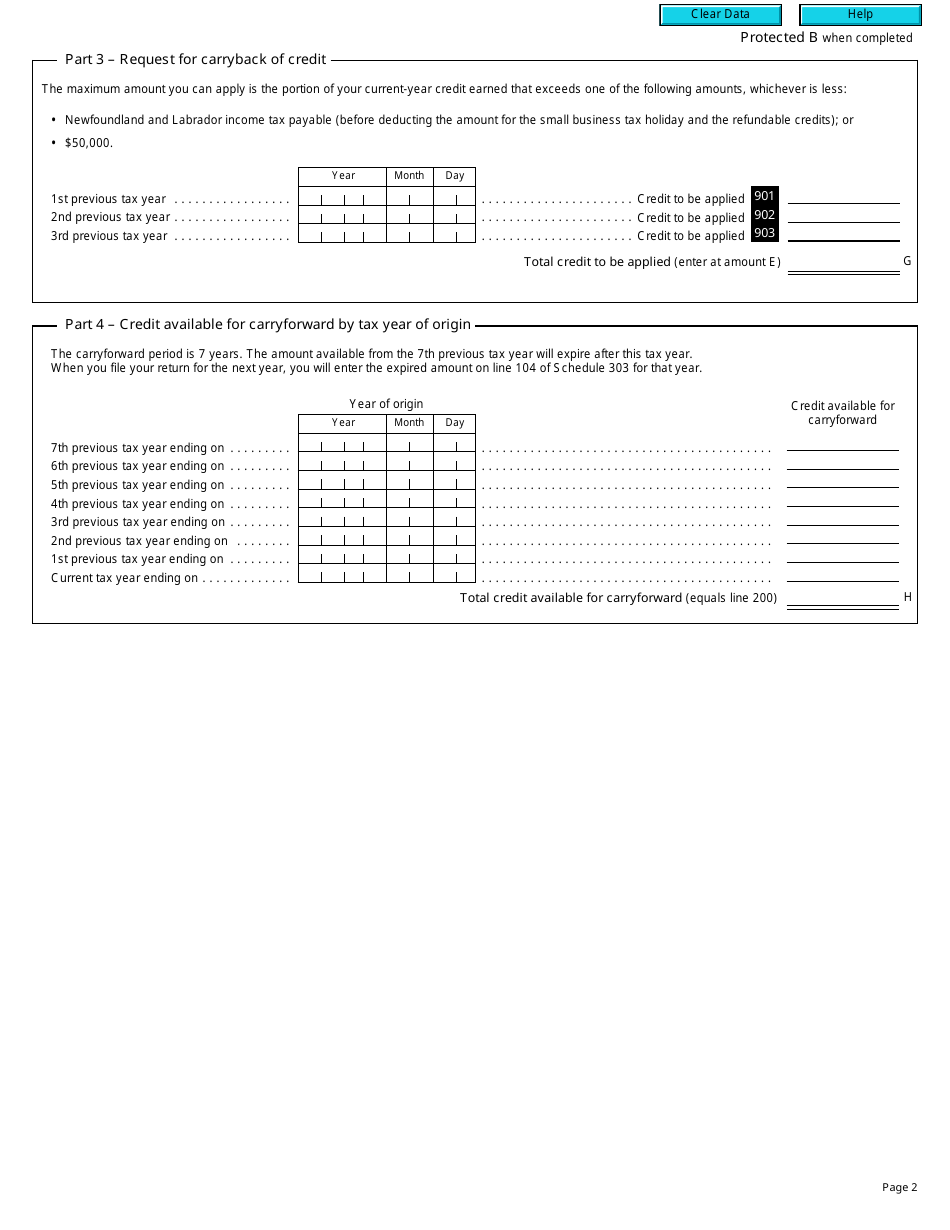

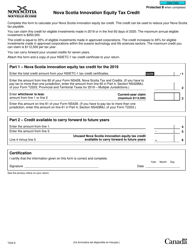

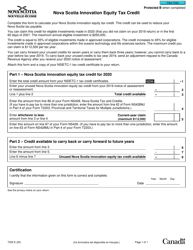

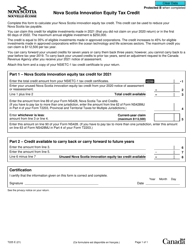

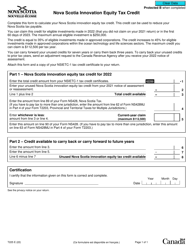

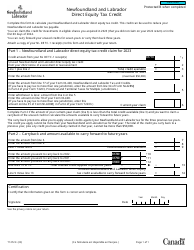

Form T2 Schedule 303 Newfoundland and Labrador Direct Equity Tax Credit (2017 and Later Taxation Years) - Canada

Form T2 Schedule 303 is used in Canada for claiming the Newfoundland and Labrador Direct Equity Tax Credit for the taxation years 2017 and later. This tax credit is specifically related to equity investments made in eligible businesses in Newfoundland and Labrador.

The Form T2 Schedule 303 Newfoundland and Labrador Direct Equity Tax Credit is filed by corporations in Canada.

FAQ

Q: What is Form T2 Schedule 303?

A: Form T2 Schedule 303 is a tax form in Canada.

Q: What is the Newfoundland and Labrador Direct Equity Tax Credit?

A: The Newfoundland and Labrador Direct Equity Tax Credit is a tax credit available in Newfoundland and Labrador, Canada.

Q: What are the eligibility criteria for the Newfoundland and Labrador Direct Equity Tax Credit?

A: To be eligible for the Newfoundland and Labrador Direct Equity Tax Credit, you must meet certain criteria set by the government of Newfoundland and Labrador.

Q: When can Form T2 Schedule 303 be used?

A: Form T2 Schedule 303 can be used for the 2017 and later taxation years.

Q: What should I do with Form T2 Schedule 303?

A: You need to fill out and submit Form T2 Schedule 303 along with your corporate tax return.

Q: Are there any deadlines to submit Form T2 Schedule 303?

A: The deadline for submitting Form T2 Schedule 303 is the same as the deadline for filing your corporate tax return.