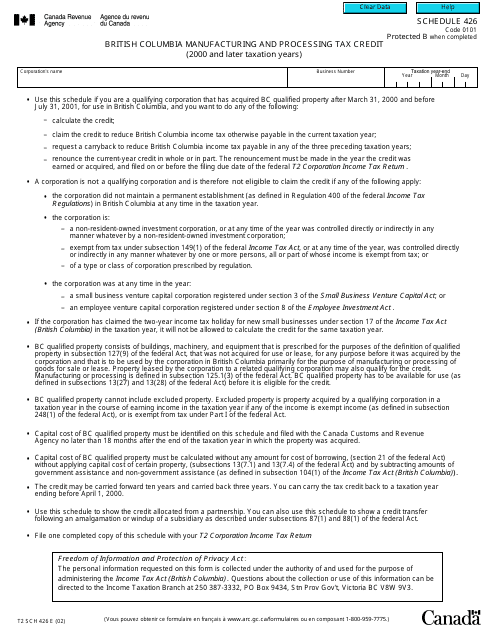

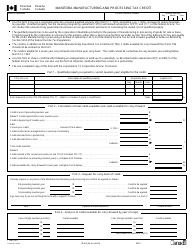

Form T2 Schedule 426 British Columbia Manufacturing and Processing Tax Credit (2000 and Later Taxation Years) - Canada

Form T2 SCH 426 is a Canadian Revenue Agency form also known as the "Form T2 Sch 426 Schedule 426 "british Columbia Manufacturing And Processing Tax Credit (2000 And Later Taxation Years)" - Canada" . The latest edition of the form was released in January 1, 2002 and is available for digital filing.

Download a PDF version of the Form T2 SCH 426 down below or find it on Canadian Revenue Agency Forms website.

FAQ

Q: What is T2 Schedule 426?

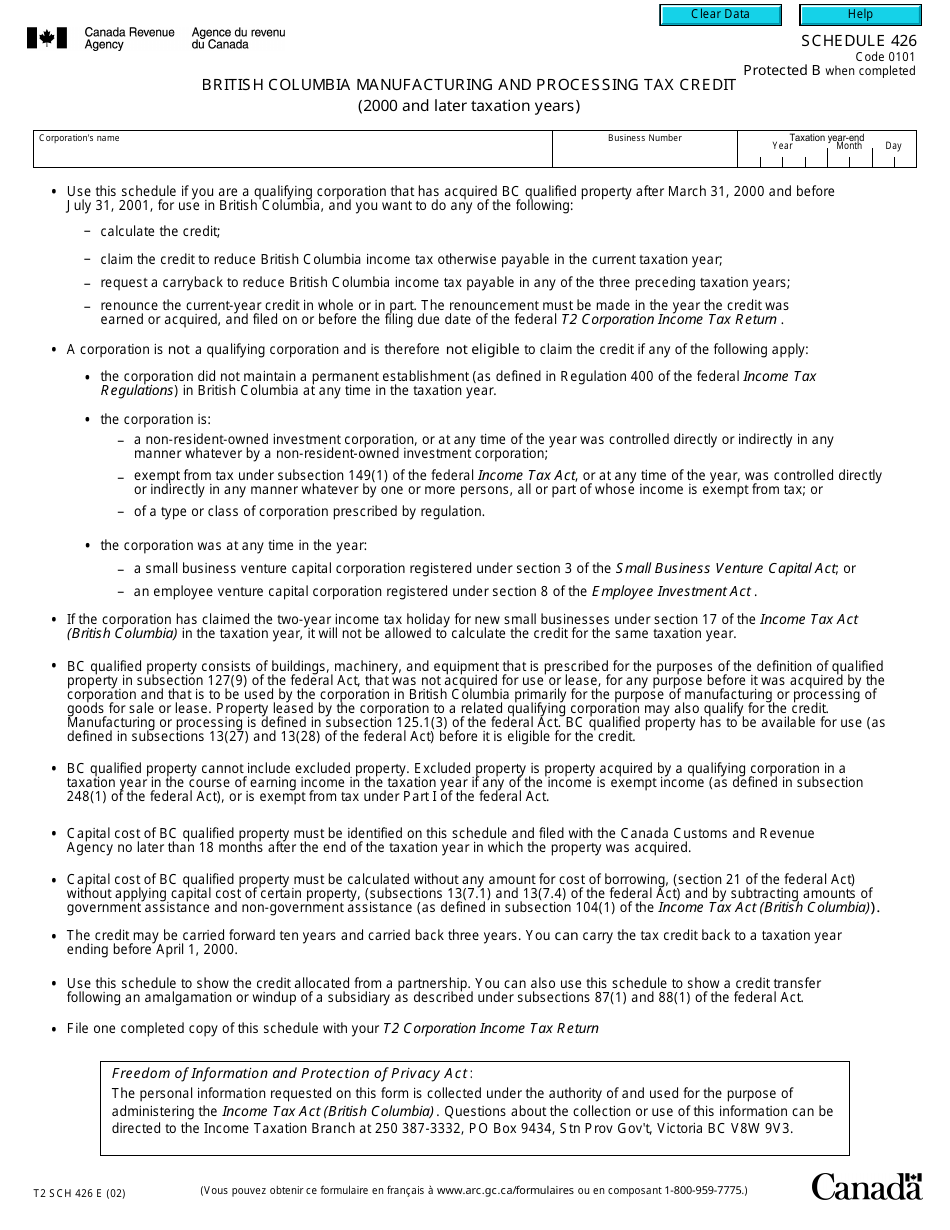

A: T2 Schedule 426 is a tax form in Canada.

Q: What is the British Columbia Manufacturing and Processing Tax Credit?

A: The British Columbia Manufacturing and Processing Tax Credit is a tax credit available to businesses in British Columbia.

Q: Which tax years does T2 Schedule 426 apply to?

A: T2 Schedule 426 applies to tax years 2000 and later.

Q: Who is eligible for the British Columbia Manufacturing and Processing Tax Credit?

A: Businesses engaged in eligible manufacturing and processing activities in British Columbia may be eligible for the tax credit.

Q: What is the purpose of T2 Schedule 426?

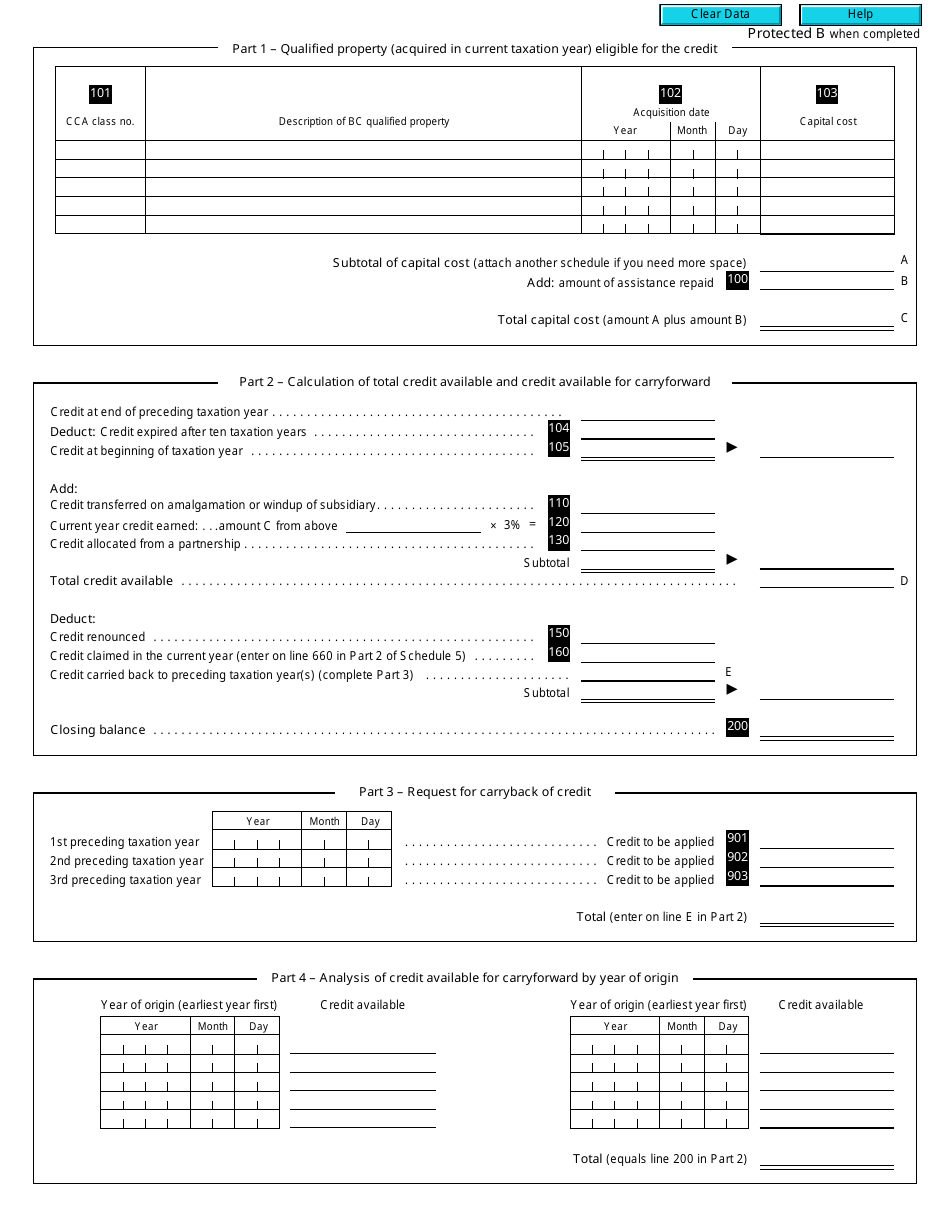

A: The purpose of T2 Schedule 426 is to calculate and claim the British Columbia Manufacturing and Processing Tax Credit on the corporate tax return.