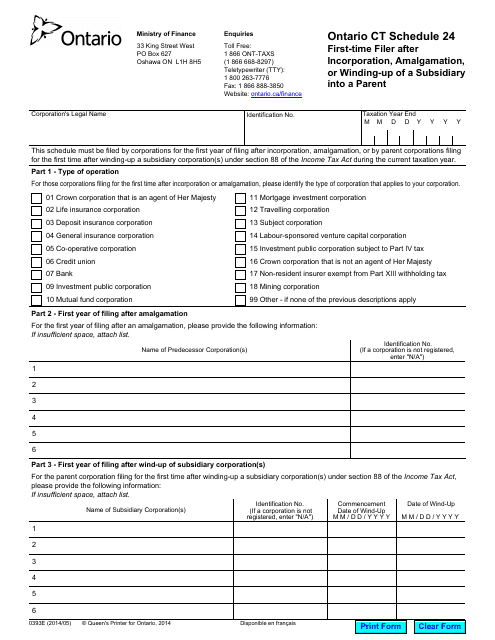

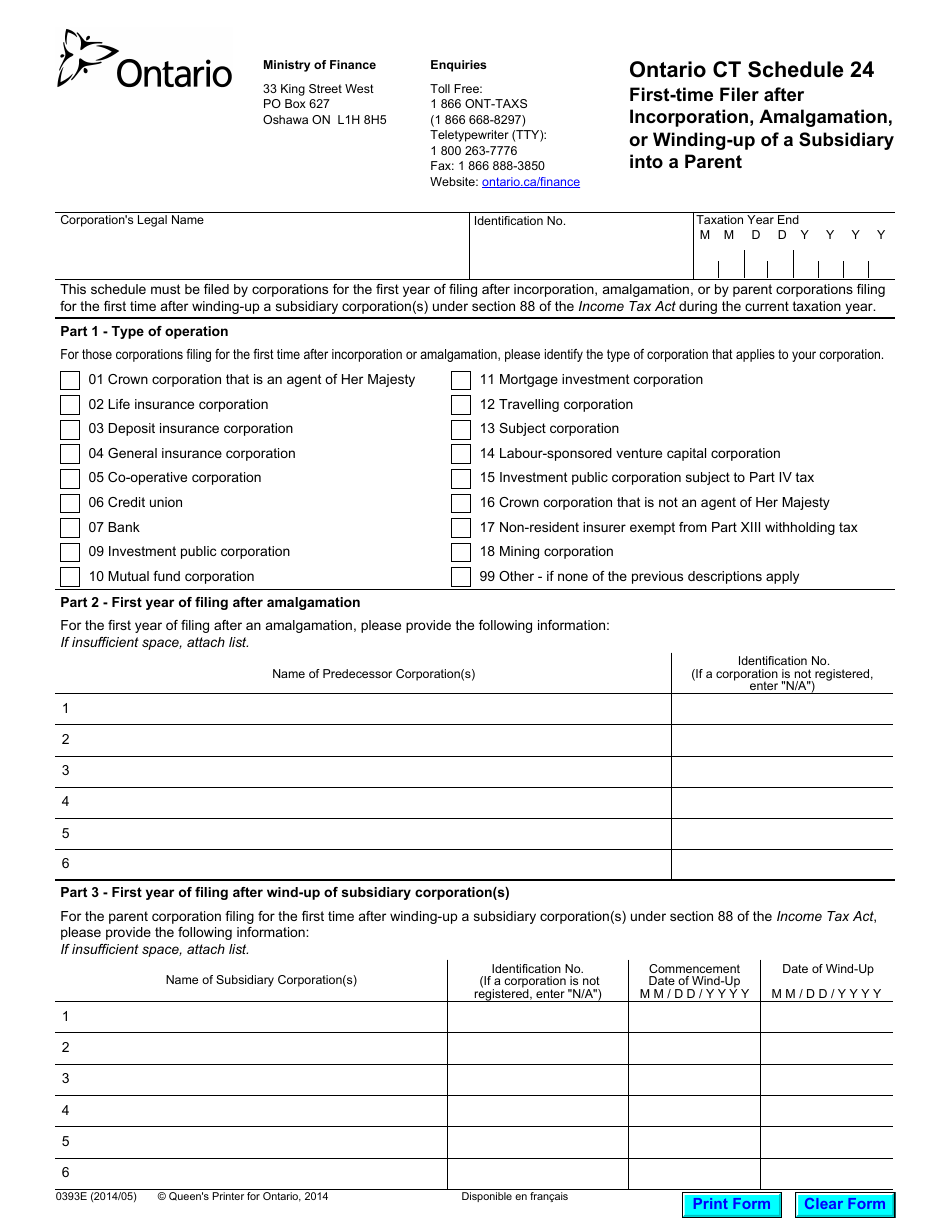

Form 0393E Schedule 24 First-Time Filer After Incorporation, Amalgamation, or Winding-Up of a Subsidiary Into a Parent - Ontario, Canada

Form 0393E Schedule 24 is used in Ontario, Canada by first-time filers after the incorporation, amalgamation, or winding-up of a subsidiary into a parent company. It is specifically used for reporting financial information related to this type of corporate transaction.

The Form 0393E Schedule 24 is filed by the parent company after incorporating, amalgamating, or winding-up a subsidiary in Ontario, Canada.

FAQ

Q: What is Form 0393E?

A: Form 0393E is a schedule used by first-time filers in Ontario, Canada after the incorporation, amalgamation, or winding-up of a subsidiary into a parent company.

Q: Who needs to file Form 0393E?

A: First-time filers in Ontario, Canada who have gone through the incorporation, amalgamation, or winding-up of a subsidiary into a parent company.

Q: What is the purpose of Form 0393E?

A: The purpose of Form 0393E is to report the details of the incorporation, amalgamation, or winding-up of a subsidiary into a parent company.

Q: Is Form 0393E required for all types of businesses?

A: No, Form 0393E is specifically designed for first-time filers in Ontario, Canada after the incorporation, amalgamation, or winding-up of a subsidiary into a parent company.

Q: Are there any deadlines for filing Form 0393E?

A: Yes, the specific deadlines for filing Form 0393E may vary. It is important to refer to the instructions provided with the form or consult with the Ontario Ministry of Finance.

Q: What information is required in Form 0393E?

A: Form 0393E requires information related to the incorporation, amalgamation, or winding-up of a subsidiary into a parent company, including details of the transaction and financial information.

Q: Are there any fees associated with filing Form 0393E?

A: There may be fees associated with filing Form 0393E. It is recommended to check the current fee schedule provided by the Ontario Ministry of Finance.

Q: What should I do if I need help with Form 0393E?

A: If you need assistance with Form 0393E, you can contact the Ontario Ministry of Finance or consult with a tax professional.