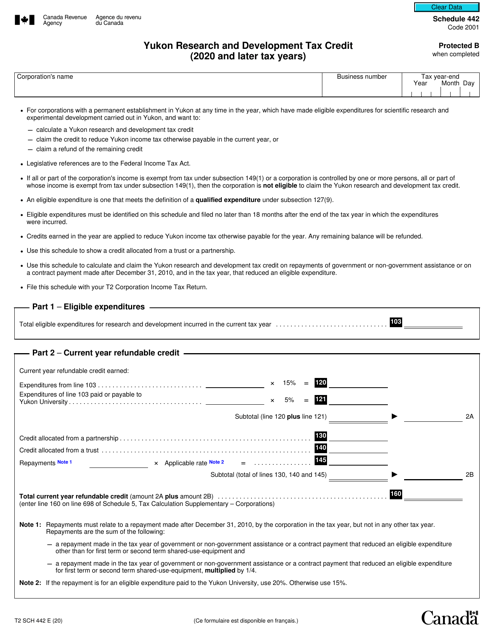

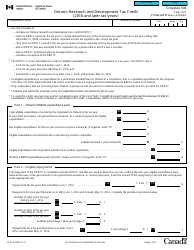

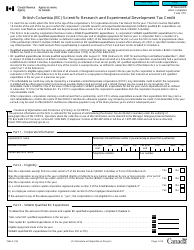

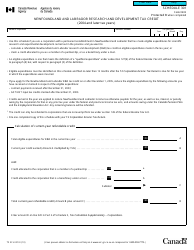

Form T2 Schedule 442 Yukon Research and Development Tax Credit (2020 and Later Tax Years) - Canada

Form T2 Schedule 442 Yukon Research and Development Tax Credit is used in Canada for claiming the research and development tax credit specific to the Yukon territory for the tax years 2020 onwards. It allows eligible businesses to receive a credit for qualifying research and development expenditures incurred in the Yukon.

The form T2 Schedule 442 Yukon Research and Development Tax Credit is filed by corporations that are claiming the tax credit in Yukon, Canada.

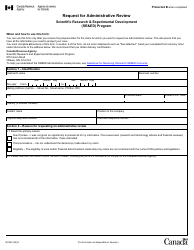

Form T2 Schedule 442 Yukon Research and Development Tax Credit (2020 and Later Tax Years) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2 Schedule 442?

A: Form T2 Schedule 442 is a tax schedule used in Canada for claiming the Yukon Research and Development Tax Credit.

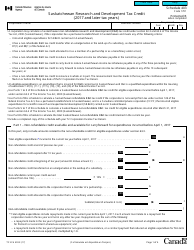

Q: What is the Yukon Research and Development Tax Credit?

A: The Yukon Research and Development Tax Credit is a tax credit available to businesses in Yukon, Canada, that engage in eligible research and development activities.

Q: What tax years does Form T2 Schedule 442 apply to?

A: Form T2 Schedule 442 applies to tax years starting in 2020 and later.

Q: Who is eligible for the Yukon Research and Development Tax Credit?

A: Businesses in Yukon, Canada, that engage in eligible research and development activities are eligible for the tax credit.

Q: What kind of activities qualify for the tax credit?

A: Activities that qualify for the Yukon Research and Development Tax Credit include scientific research, experimental development, and certain engineering, design, and computer programming activities.

Q: What information is required on Form T2 Schedule 442?

A: Form T2 Schedule 442 requires businesses to provide information about their research and development expenditures and the related tax credit calculations.