Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

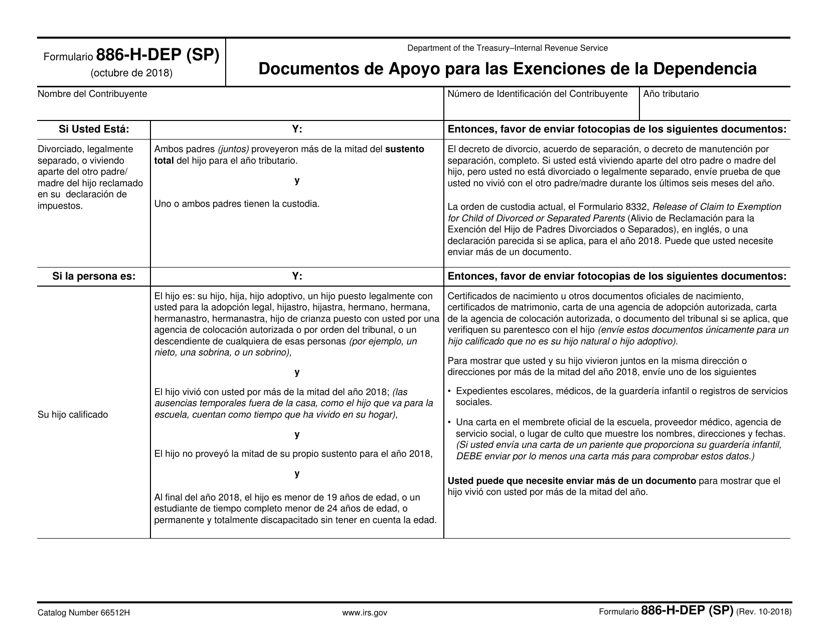

This is a formal document prepared and filed by a taxpayer to clarify the terms of the agreement they wish to enter to settle their tax debt.

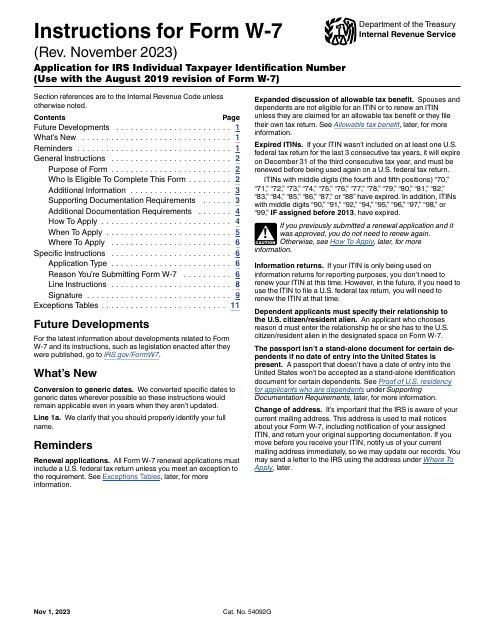

These are the IRS-issued Instructions for the IRS Form W-7, Application for IRS Individual Taxpayer Identification Number - also known as the individual tax identification number application.

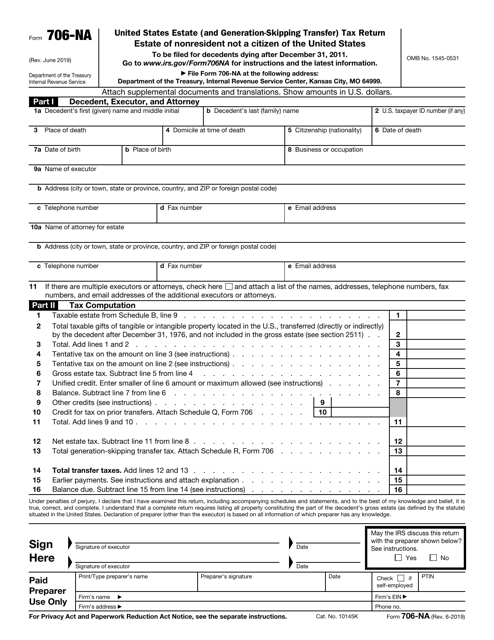

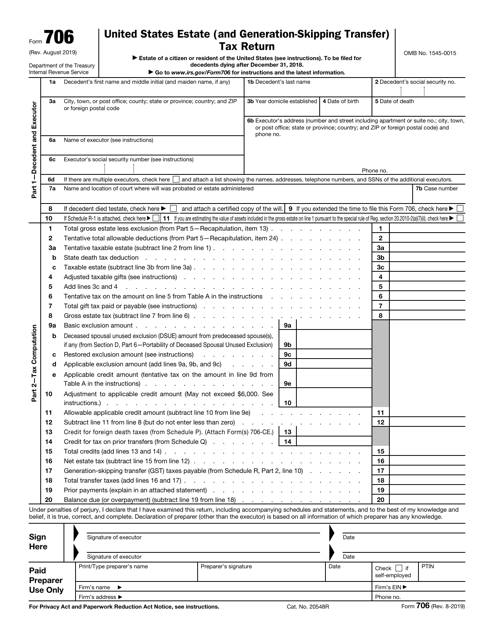

This form is used for filing the United States Estate (And Generation-Skipping Transfer) Tax Return for the estate of a nonresident who is not a citizen of the United States.

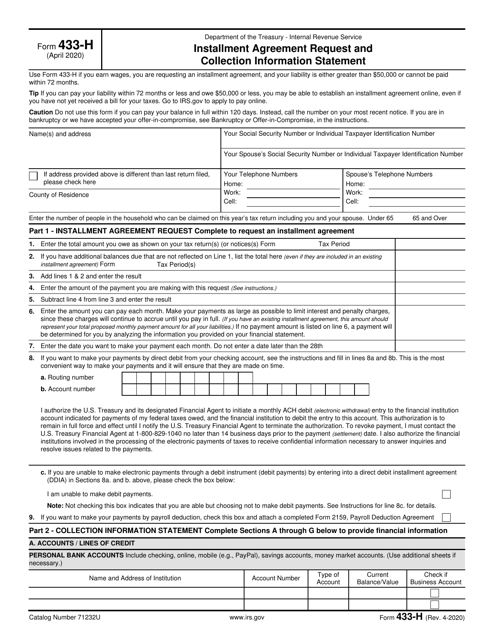

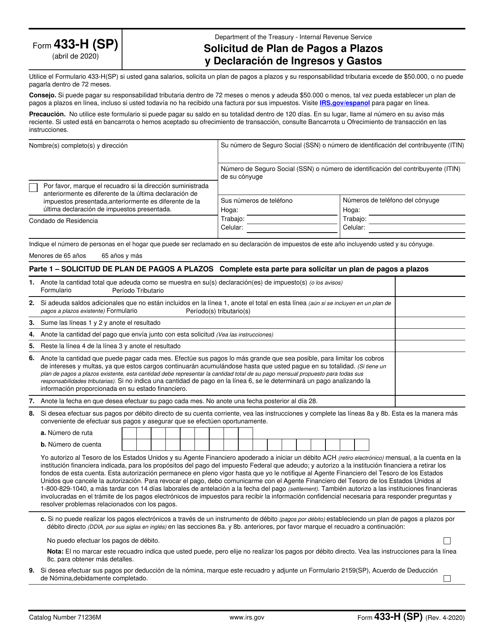

This is a formal IRS statement used by taxpayers to ask the fiscal authorities to let them pay off their tax debts in monthly payments.

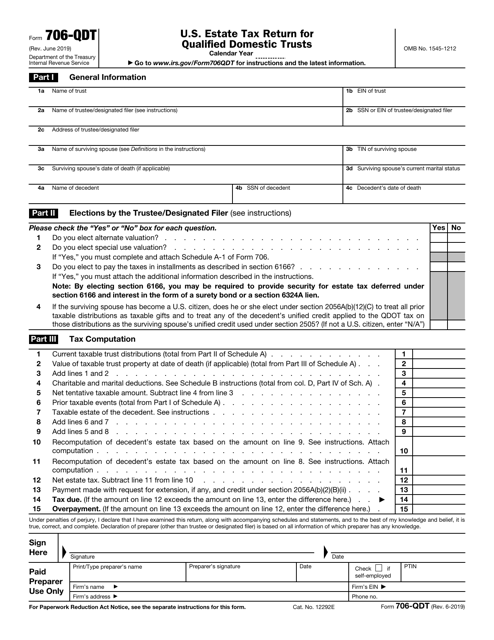

This form is used for reporting and paying estate tax for qualified domestic trusts in the United States.

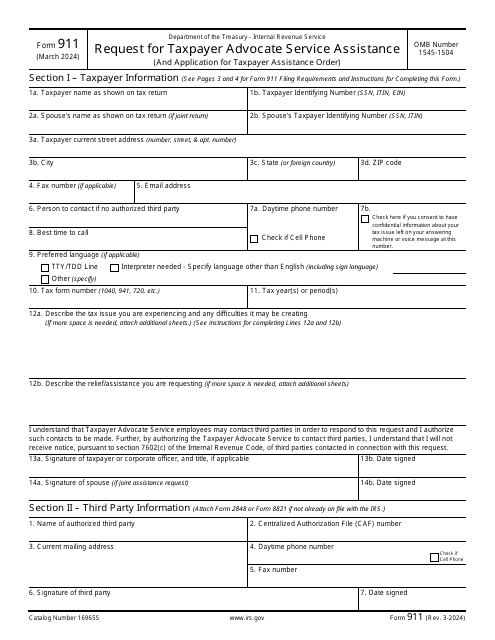

This is a fiscal form used by taxpayers that have already exhausted all other options when dealing with a tax issue.

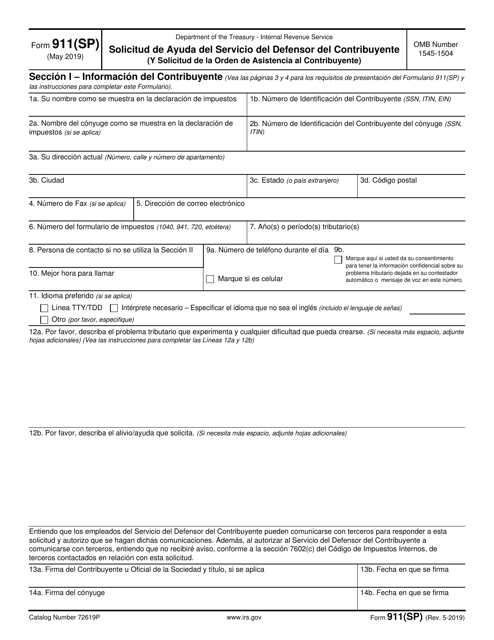

This document is used for requesting assistance from the Taxpayer Advocate Service and for filing a request for the Order of Taxpayer Assistance. (In Spanish)

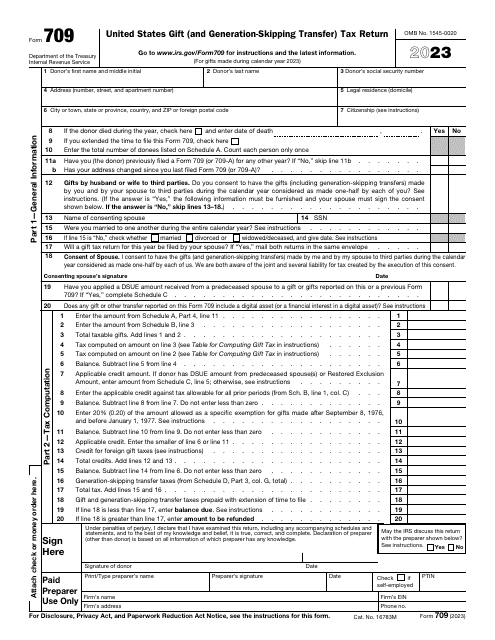

This is a formal document used by taxpayers to outline asset transfers that are considered gifts and are subject to tax.

This is a formal statement prepared and submitted by estate administrators to calculate the estate tax liability of the person that recently died.

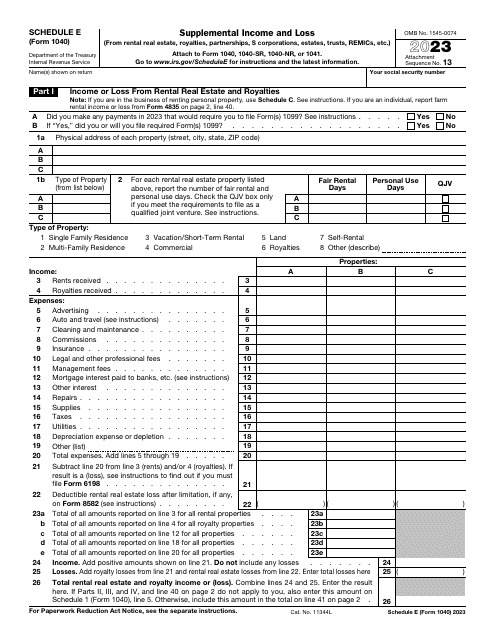

This form is part of the IRS 1040 series, which is used to calculate and submit different types of federal individual income tax returns. File this form to inform the Internal Revenue Service (IRS) about your income and loss from royalties, rental real estate, trusts, and S corporations among others.

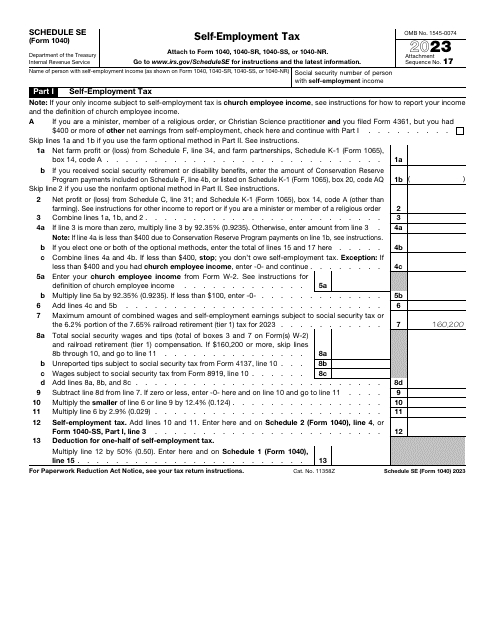

This is an IRS form that contains the breakdown of the self-employment tax the taxpayer figures out after analyzing their net earnings.

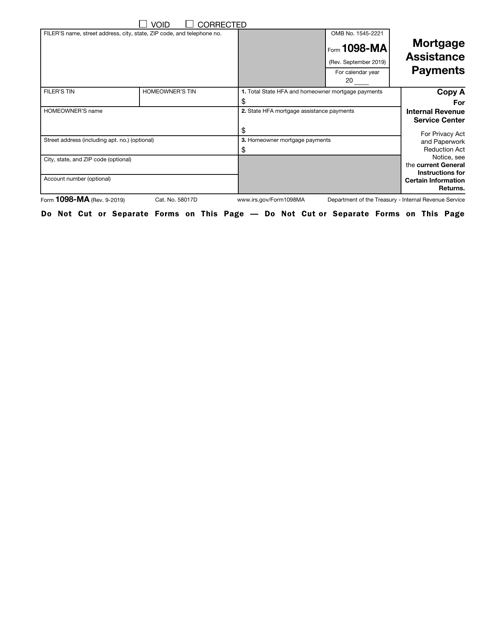

This form is used to report a mortgage interest paid by an individual or sole proprietor during a tax year to the government, in order to receive a mortgage interest deduction on the borrower's federal income tax return.

This form is completed by federal, state, and local government units (payers) and sent to the Internal Revenue Service (IRS), state tax department, and taxpayers (recipients) if certain payments were made over the previous year.

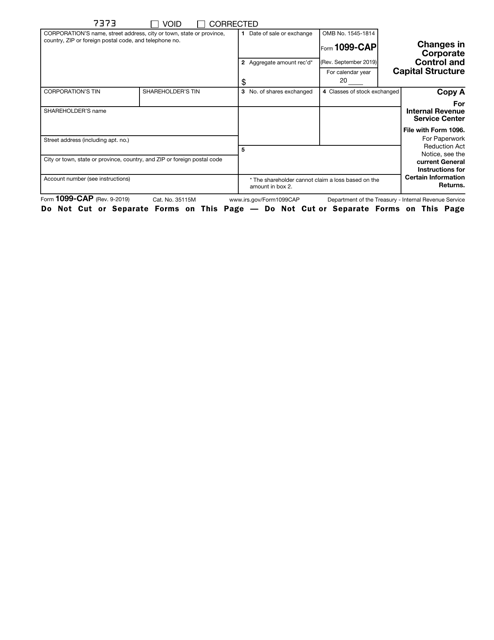

This is a fiscal document completed by financial entities to specify the amount of supplementary income investors have generated during the year.

This is a formal IRS document completed to outline the discount received on particular debt instruments.

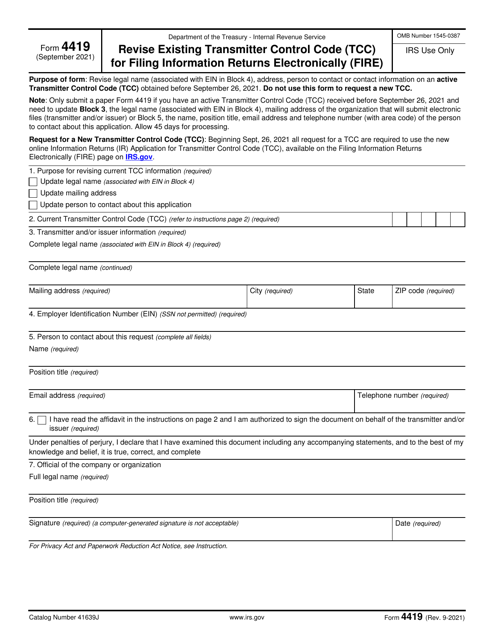

This is a formal IRS statement prepared and submitted by taxpayers that have active Transmitter Control Codes.