Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

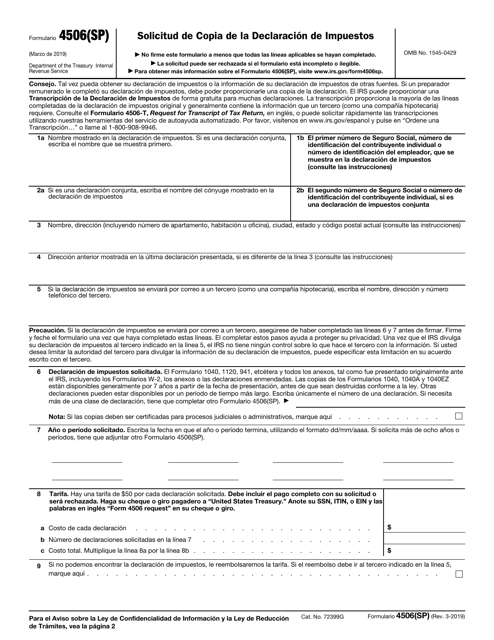

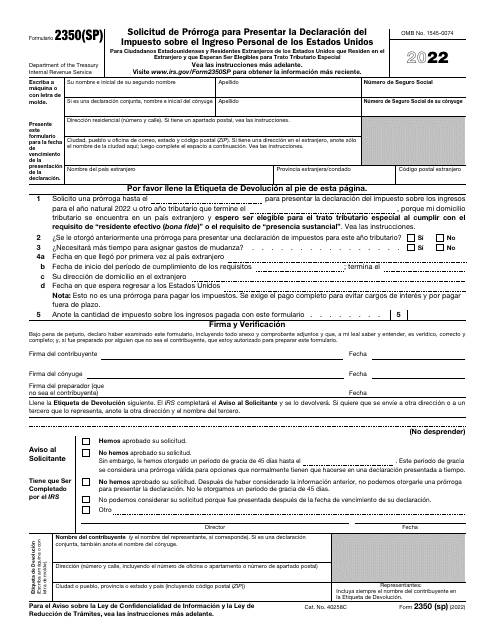

This document is used for requesting a copy of your tax return in Spanish.

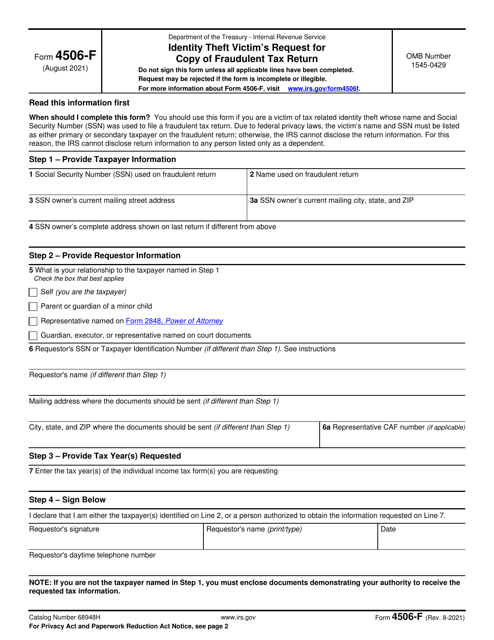

This is an IRS form designed for a victim of identity theft to allow them to get a copy of the income statement that was submitted in their name.

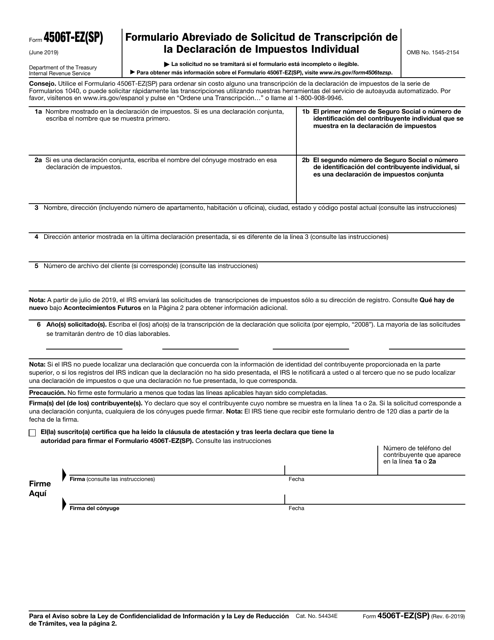

This Form is used for requesting a transcript of an individual tax return in Spanish.

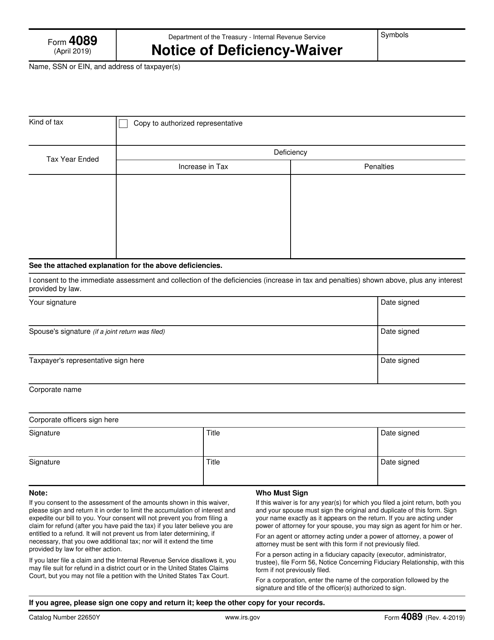

This Form is used for taxpayers who receive a notice from the IRS stating that they owe additional taxes. The form allows taxpayers to either agree with the IRS's assessment or to request a waiver of the additional taxes.

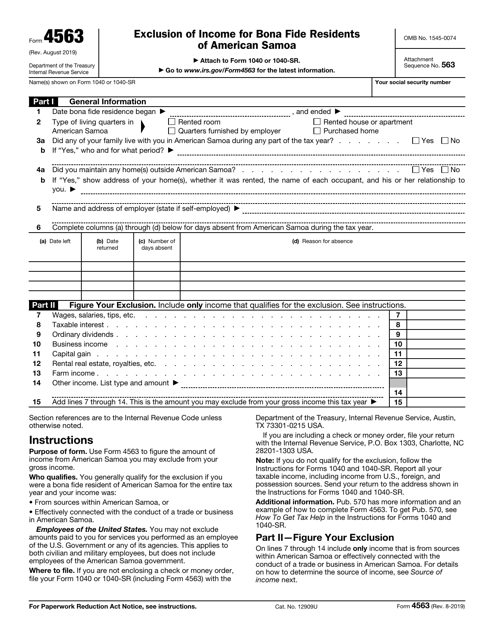

This is a tax form people permanently residing in American Samoa can use to exclude certain income from their gross income.

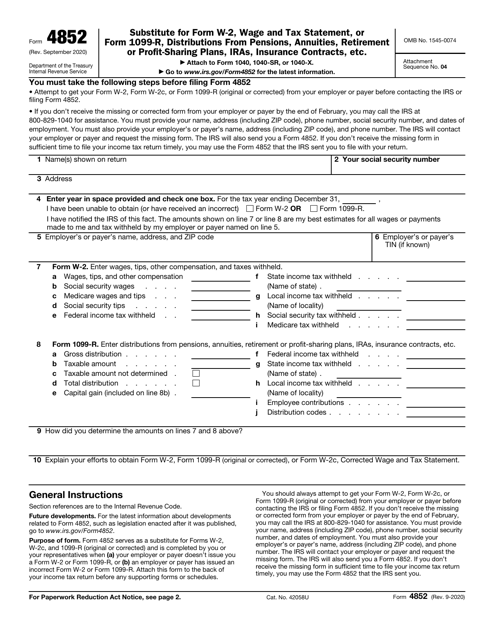

This is a formal statement taxpayers should use to report their income correctly in case they did not receive the main documentation they are expected to file.

This is an IRS form that includes the details of an installment sale.

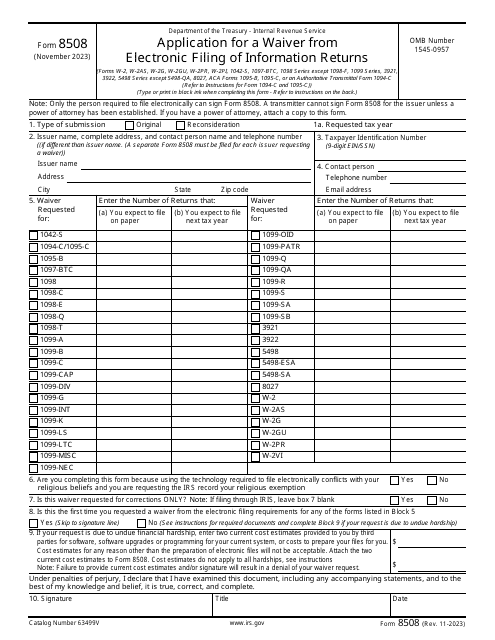

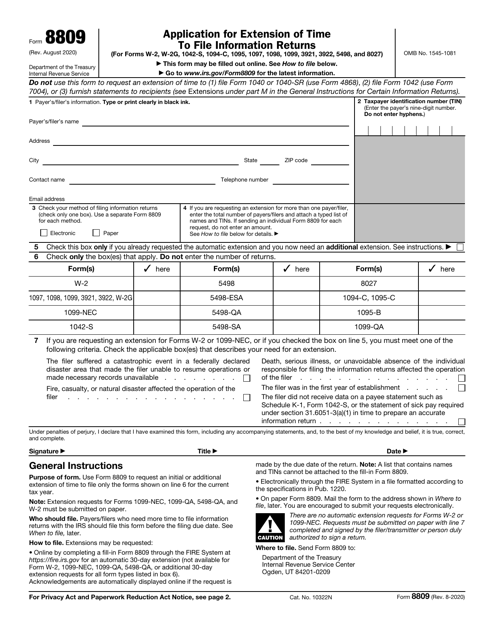

This is a fiscal form filled out by a taxpayer asking for additional time to submit an information return.

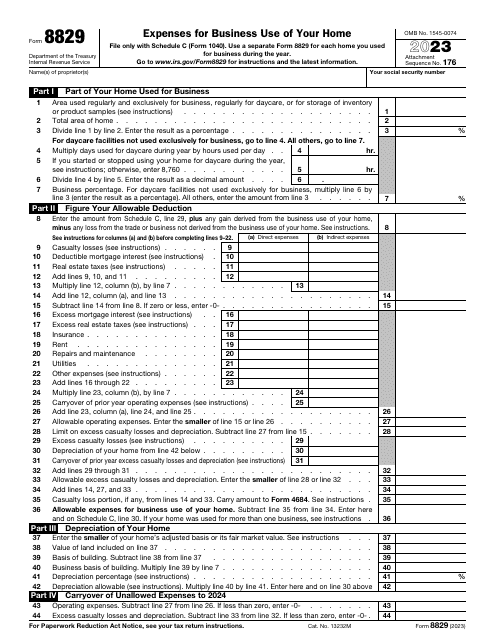

This is an IRS form used by taxpayers who work from home and want to inform tax organizations about the business expenses they wish to deduct from their taxes.

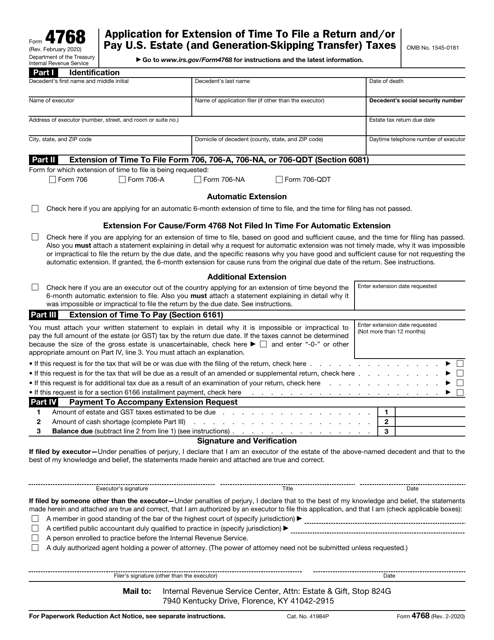

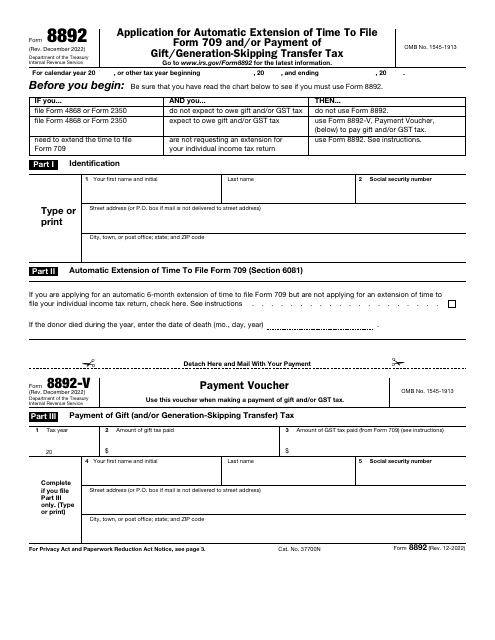

This is a fiscal document generally used by taxpayers in order to request six months of extra time to file IRS Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return.

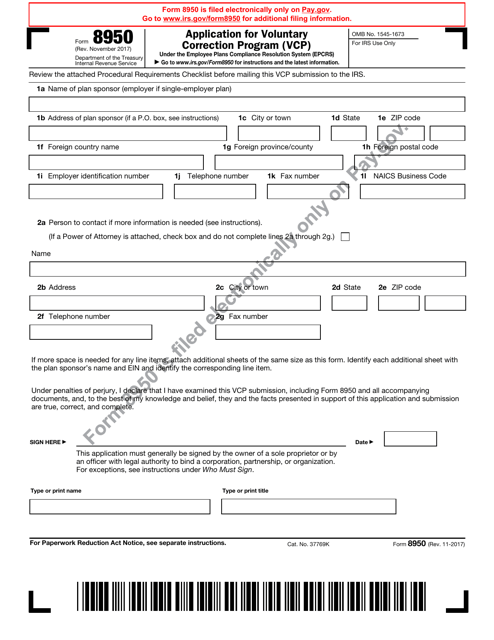

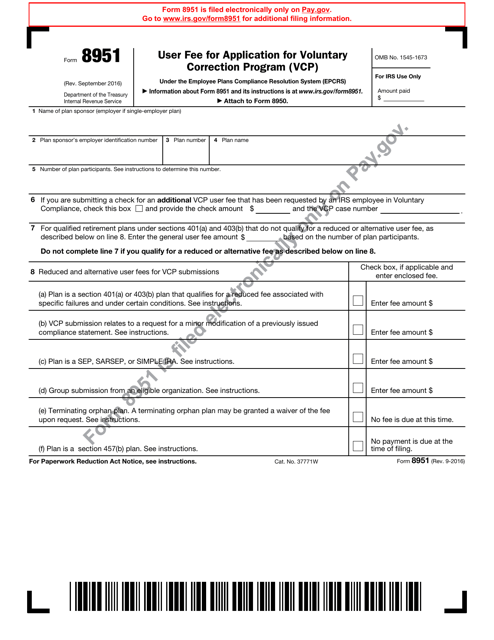

This form is used for applying to the IRS Voluntary Correction Program (VCP). The VCP allows employers to correct errors in their retirement plans and avoid penalties.