Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

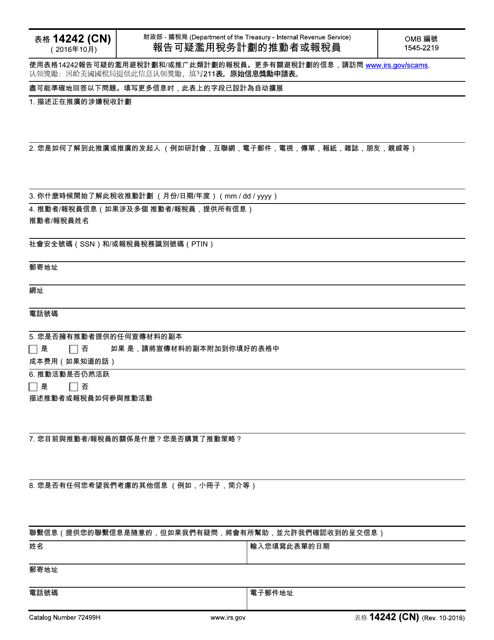

This Form is used for reporting suspected abusive tax promotions or preparers in Mandarin (Chinese) language.

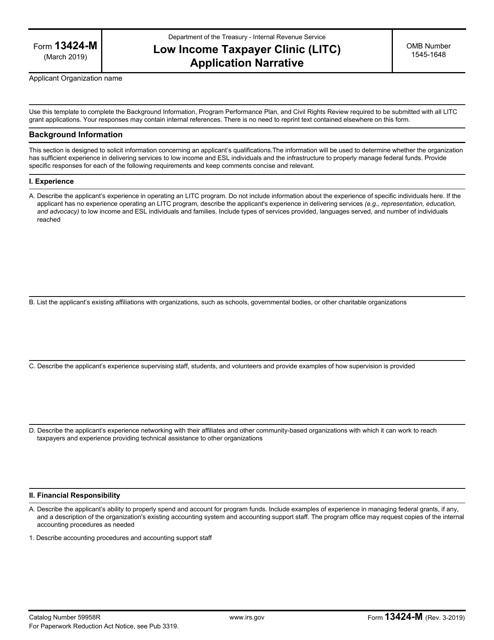

This form is used to apply for the Low Income Taxpayer Clinic (LITC) program offered by the IRS. The application requires a written narrative that provides information about the clinic's qualifications and experience in providing tax assistance to low-income taxpayers.

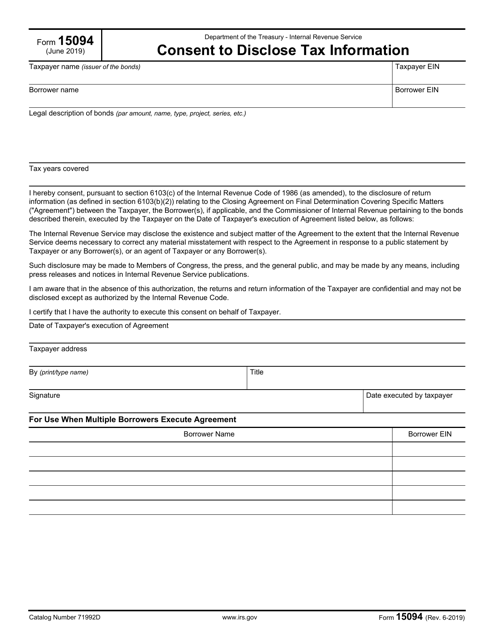

This form is used for giving consent to the IRS to disclose your tax information to another party.

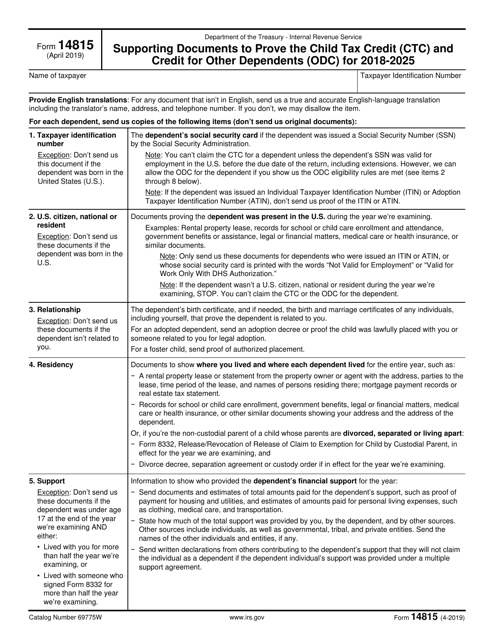

This Form is used for submitting supporting documents to prove eligibility for the Child Tax Credit (CTC) and Credit for Other Dependents (ODC) to the IRS.

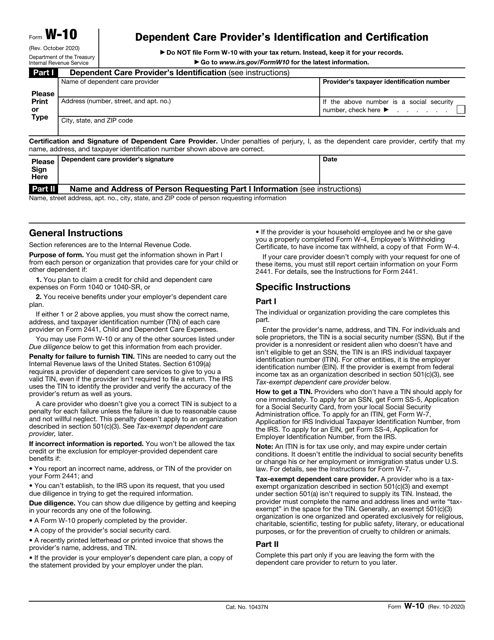

A W-10 Form's purpose is to get the correct information from each entity or individual that provides care for a taxpayer's child or another dependent.

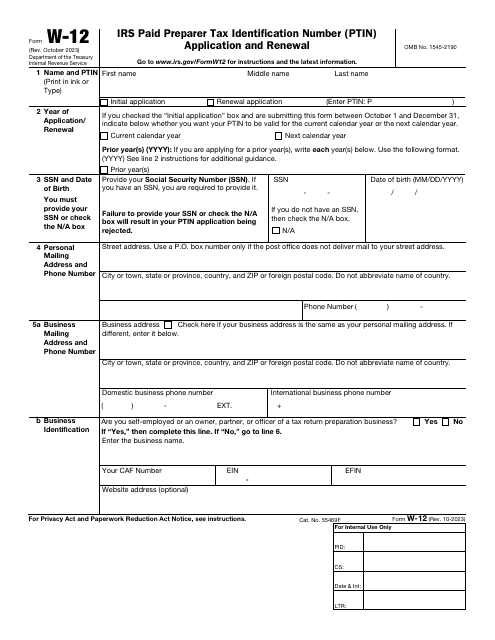

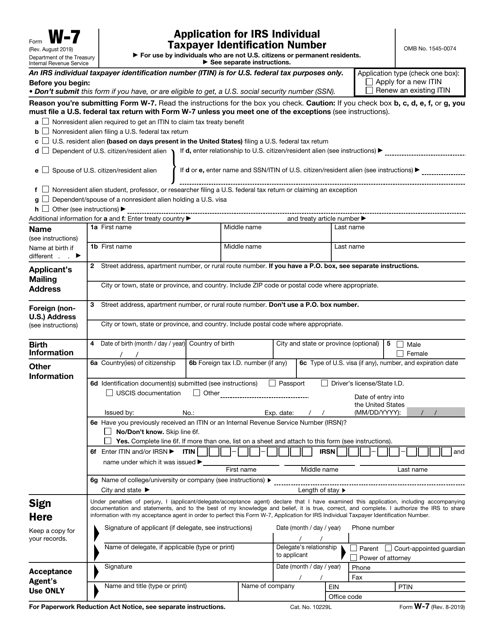

This is a formal statement filled out by individuals that want to obtain an identification number that will confirm their identity to fiscal organizations and let them communicate with the government as taxpayers. Additionally, it may be completed to renew a number they received before.

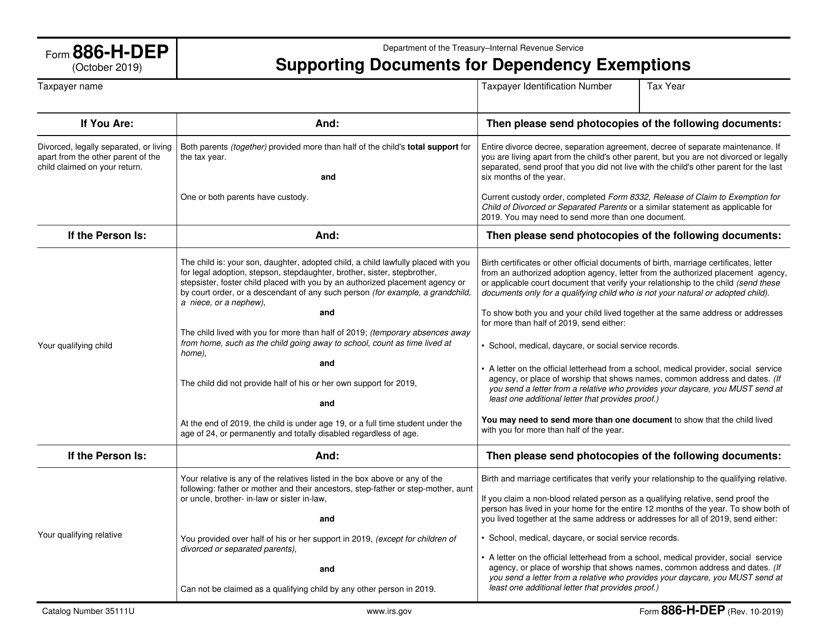

This type of document is used to provide supporting documents for dependency exemptions on Form 886-H-DEP.

This is a fiscal IRS document designed for taxpayers that received different types of interest income.

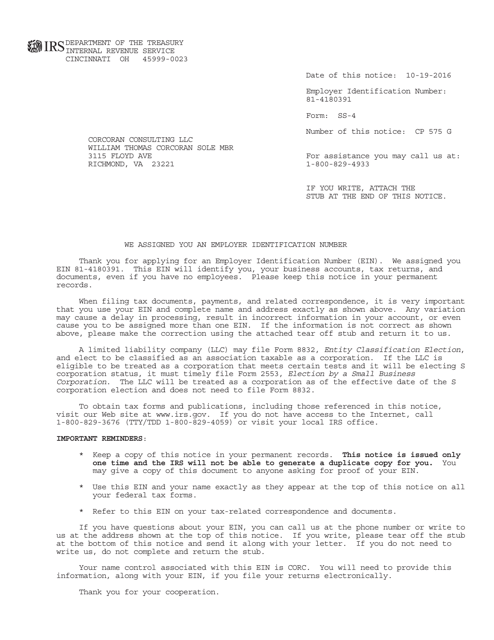

This letter contains and verifies information about a company's Employer Identification Number (EIN).

Use this basic form if you are an American taxpayer and wish to submit an annual income tax return. This form is also known as the Individual Income Tax Return Form.

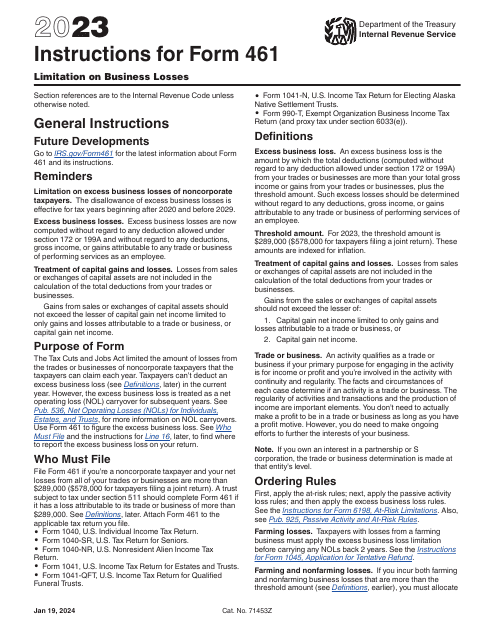

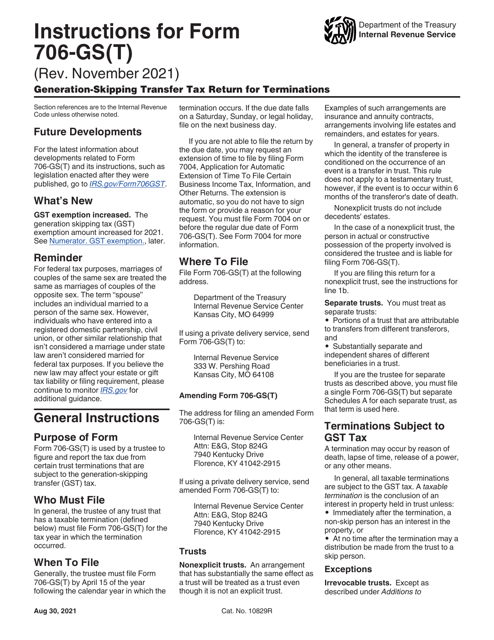

Instructions for IRS Form 709 United States Gift (And Generation-Skipping Transfer) Tax Return, 2023

This document provides instructions for filling out and filing IRS Form 1040 and 1040-SR Schedule SE, which are used to calculate and report self-employment taxes. It includes step-by-step guidance on how to report income, deductions, and calculate the amount of self-employment tax owed.

This is a document you may use to figure out how to properly complete IRS Form 6765

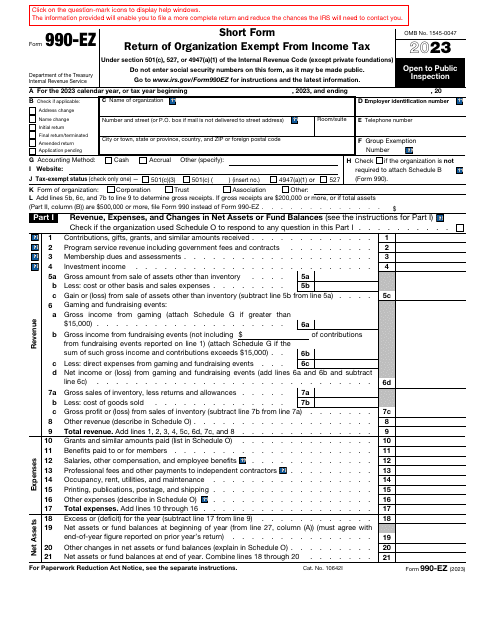

This is a fiscal form used by tax-exempt organizations required to inform tax organizations about their earnings, expenses, and achievements over the course of the year.

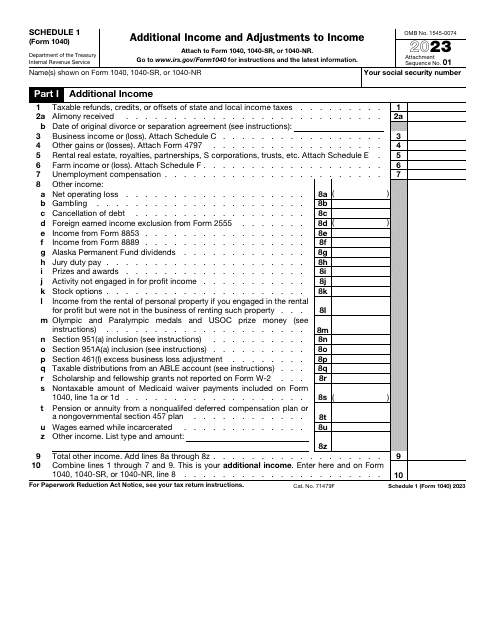

This is a supplementary form used by taxpayers to list income they did not include on the main income statement they file.

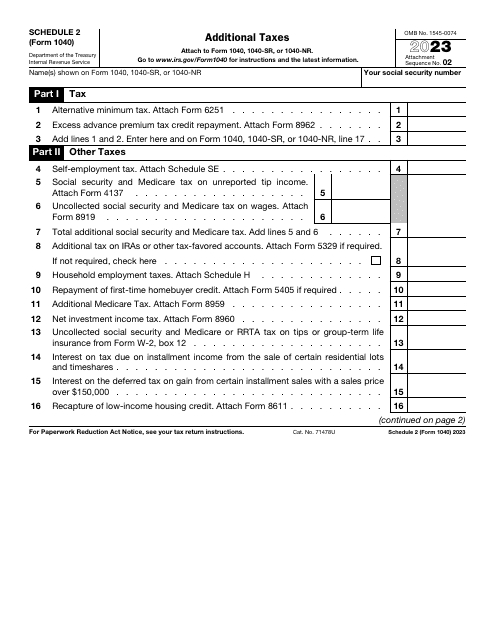

This is a supplementary document designed to allow taxpayers to list taxes they do not outline on the main income statement they are supposed to file annually.