Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

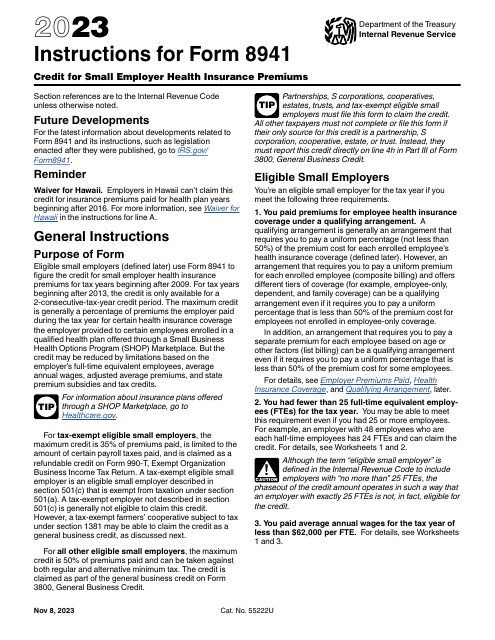

This Form is used for reporting Health Coverage Exemptions to the IRS and provides instructions for calculating your Shared Responsibility Payment.

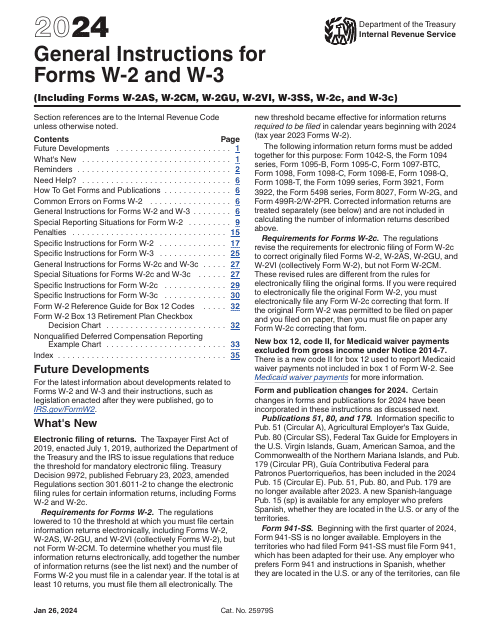

This document provides instructions for completing the IRS Form W-3PR, which is used to transmit withholding statements. The instructions are available in both English and Spanish.

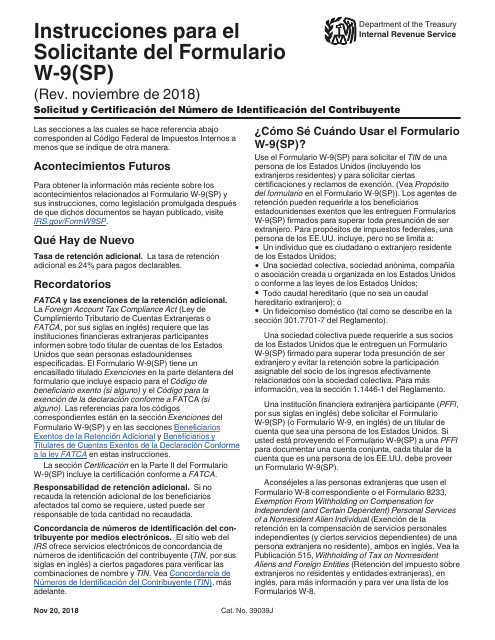

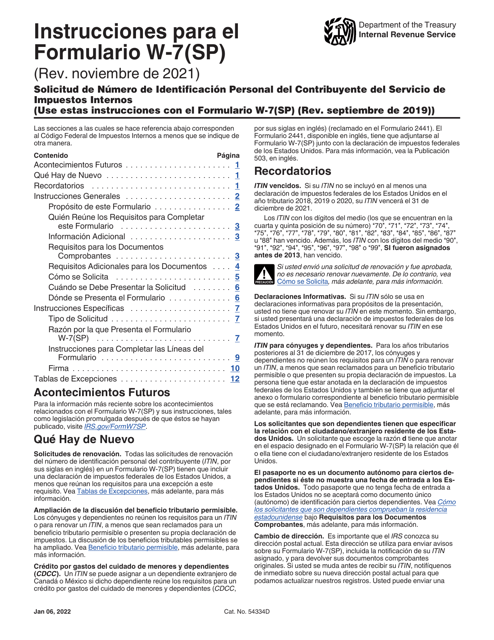

Este tipo de documento es utilizado para solicitar y certificar el número de identificación del contribuyente en el Servicio de Impuestos Internos (IRS) de los Estados Unidos.

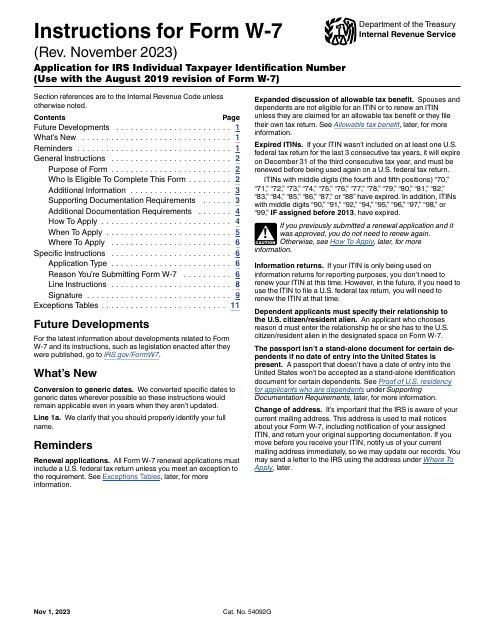

These are the IRS-issued Instructions for the IRS Form W-7, Application for IRS Individual Taxpayer Identification Number - also known as the individual tax identification number application.

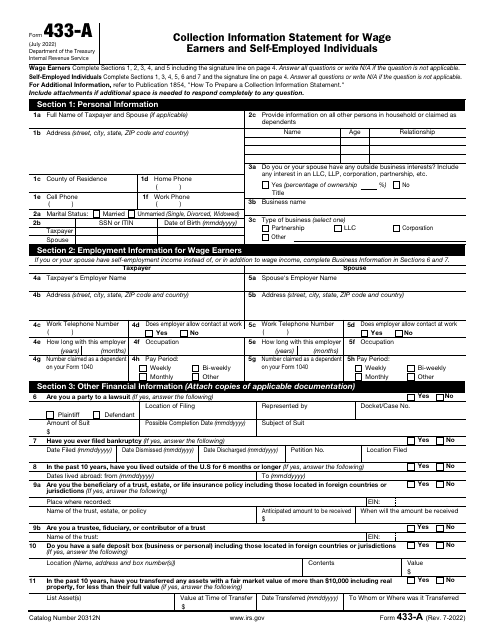

This is a formal IRS document that outlines the financial health of a business entity that owes a tax debt to the government.

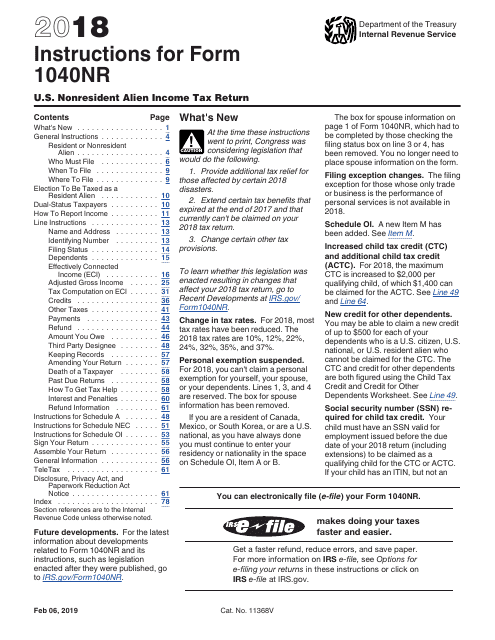

This form is used for reporting income and paying taxes for nonresident aliens in the United States.

This document is a test for volunteers who assist with tax preparation through the IRS Volunteer Income Tax Assistance (VITA) or Tax Counseling for the Elderly (TCE) programs.

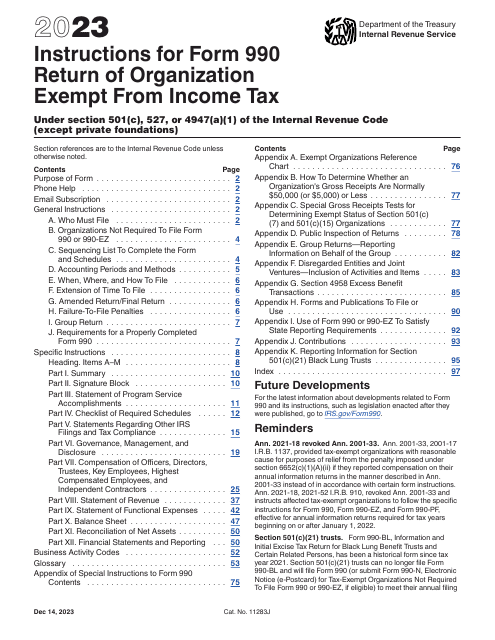

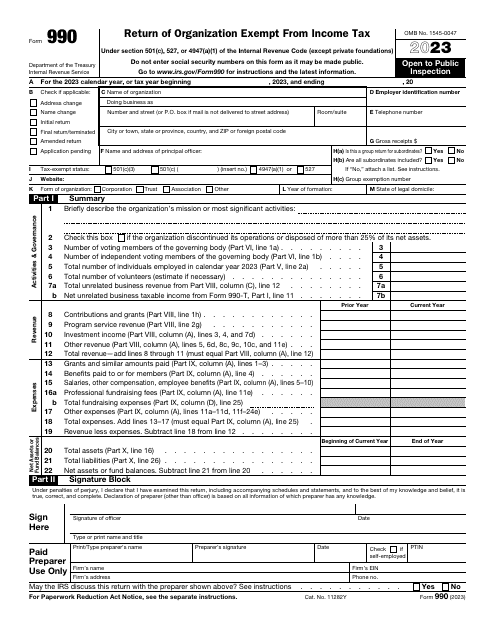

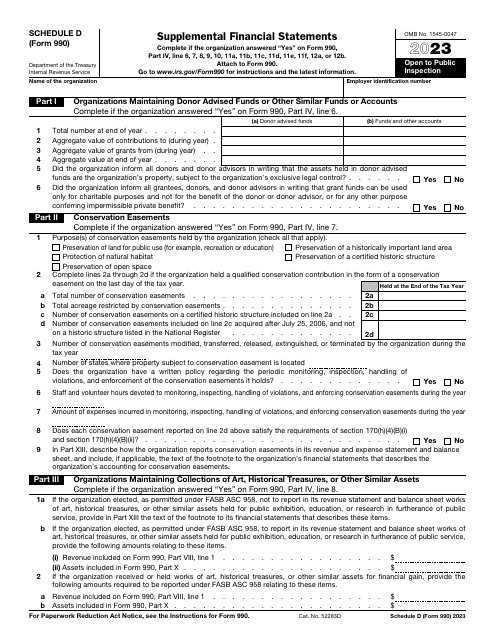

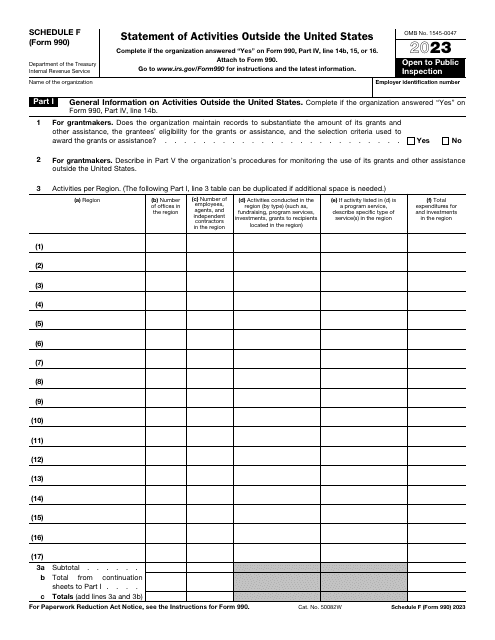

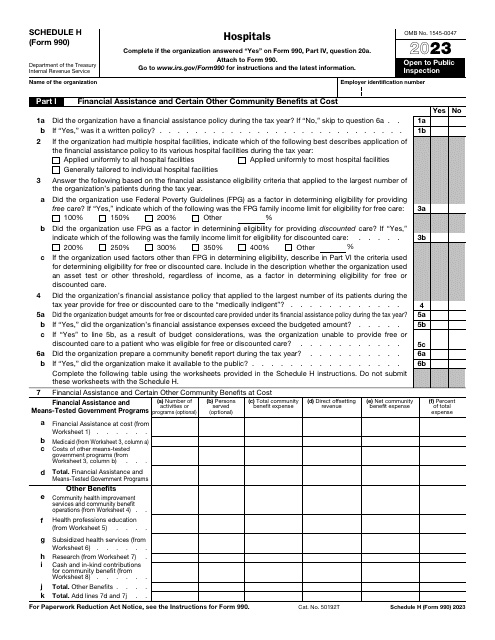

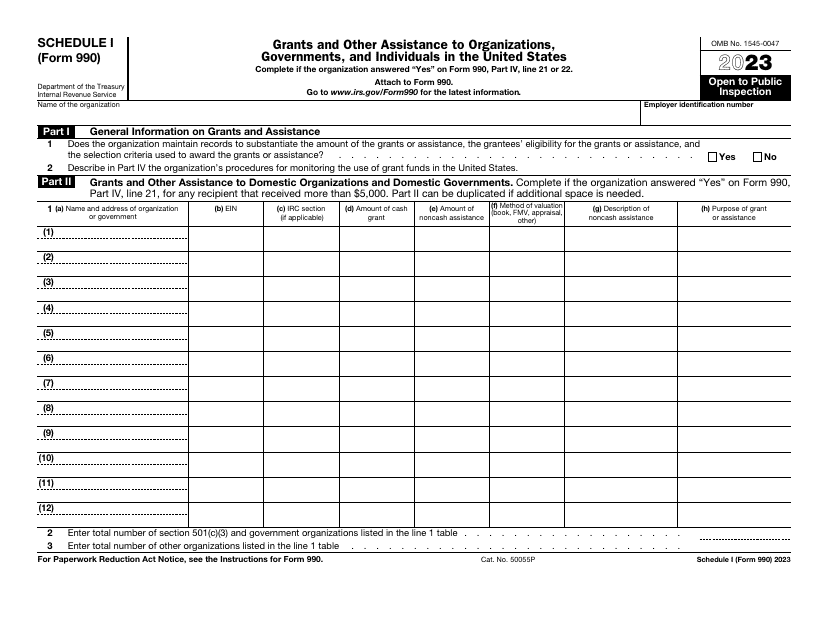

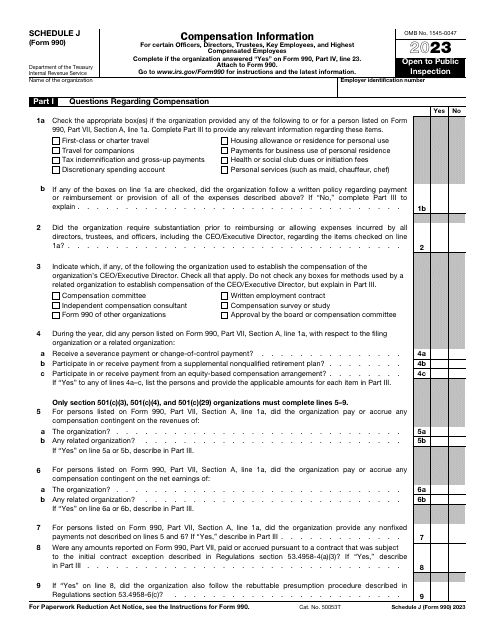

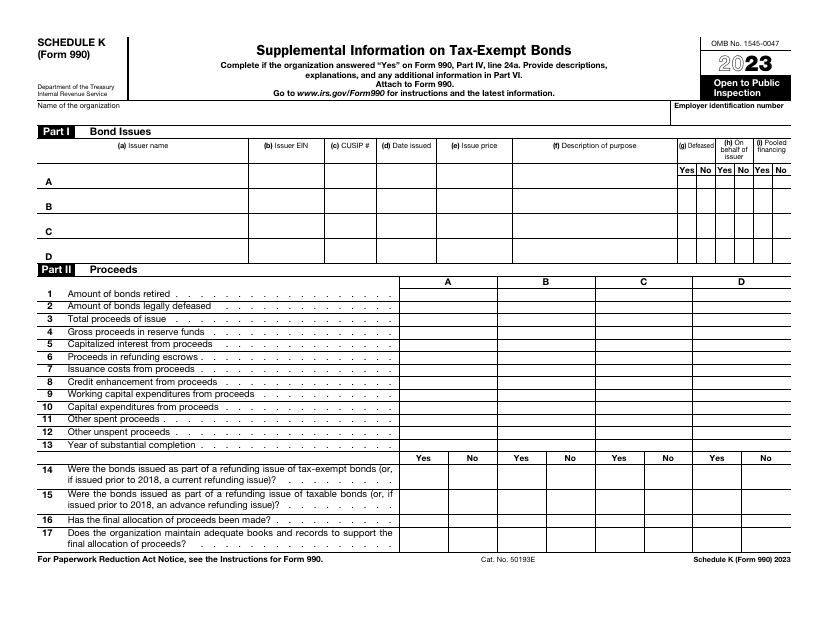

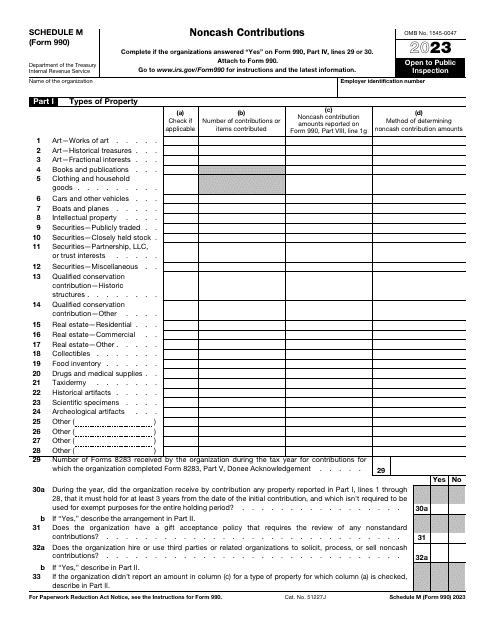

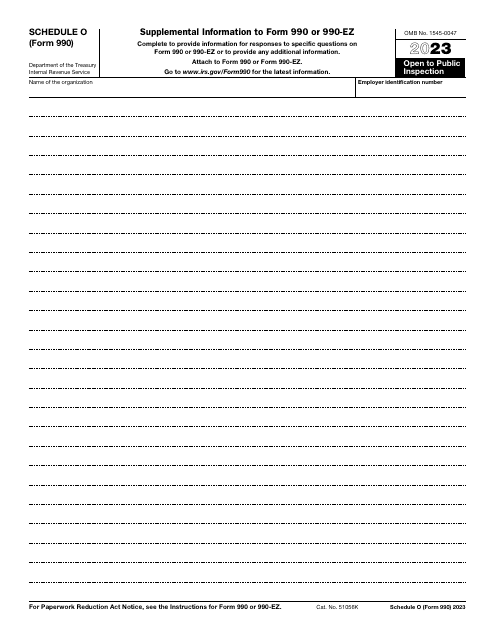

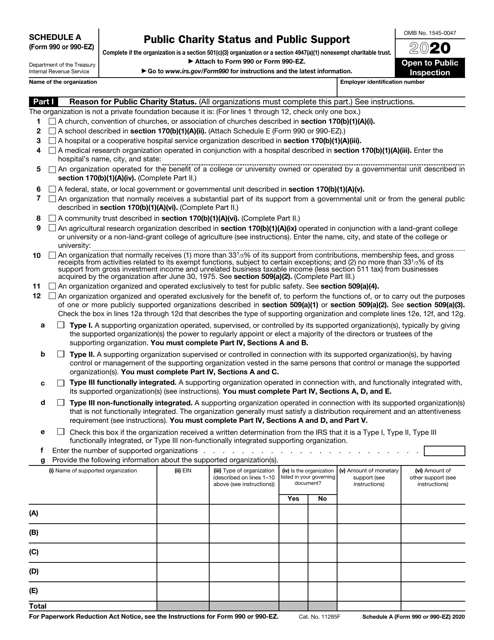

This form is used to supply the Internal Revenue Service (IRS) with information regarding receipts, gross income, disbursements, and other data used by tax-exempt organizations to summarize their work during the tax year.

This is a formal statement prepared by an employee after figuring out how much tax an employer has to deduct from their paycheck.

This is a fiscal document used by nonprofit organizations to report the main specifics of their operations to tax authorities.

This Form is used for reporting and paying certain excise taxes as mandated by Chapter 43 of the Internal Revenue Code. It provides instructions on how to accurately file the IRS Form 8928 and fulfill your tax obligations.

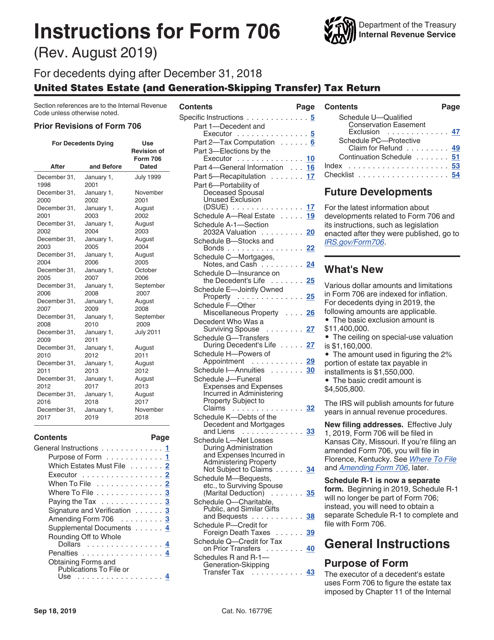

This Form is used for reporting and paying the generation-skipping transfer tax when there is a termination of a trust.