Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

This form is used for reporting and paying certain excise taxes under Chapter 43 of the Internal Revenue Code.

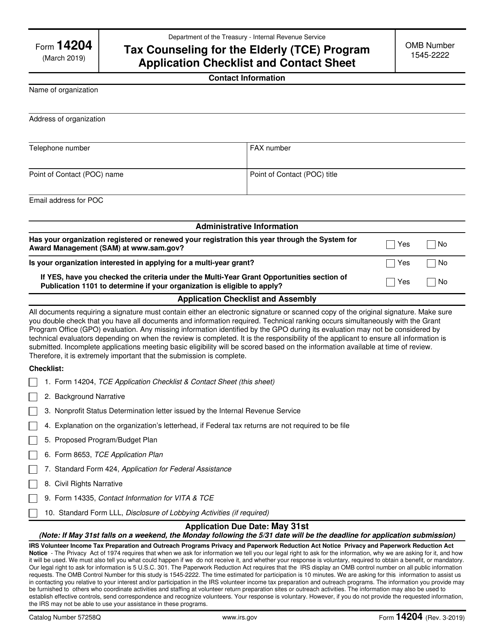

This document is a checklist for applying to the Tax Counseling for the Elderly (TCE) program. It includes a contact sheet for additional information.

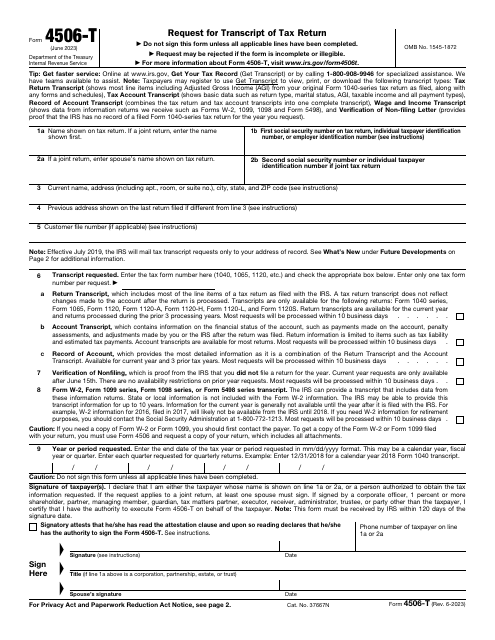

Fill in this form if you would like to request tax return information, such as different types of transcripts, a record of an account, and/or verification of nonfiling.

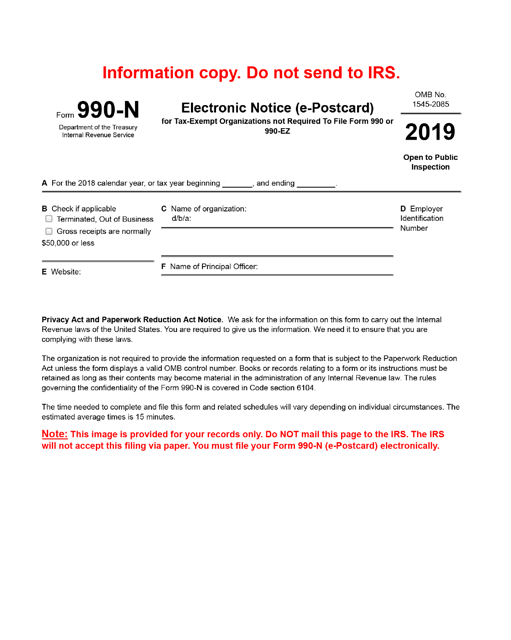

This is a fiscal document used by nonprofit organizations to report the main specifics of their operations to tax authorities.

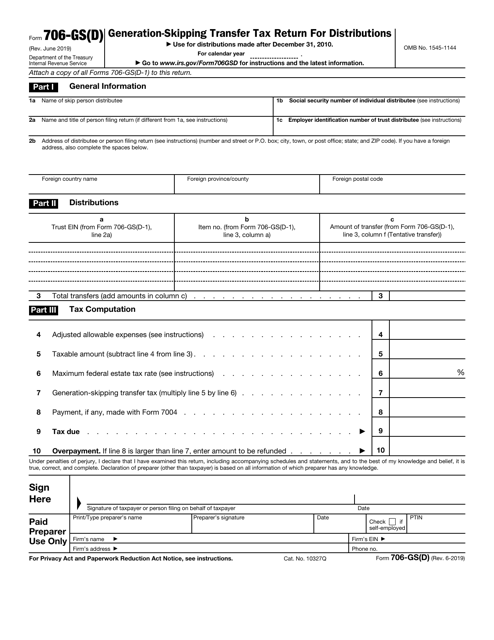

This form is used for reporting generation-skipping transfer tax returns for distributions. It provides instructions on how to accurately complete IRS Form 706-GS(D).

This type of document provides instructions for filling out various IRS forms including 1096, 1097, 1098, 1099, 3921, 3922, 5948, W-2G. It outlines the reporting requirements and guidelines for different types of income and transactions.

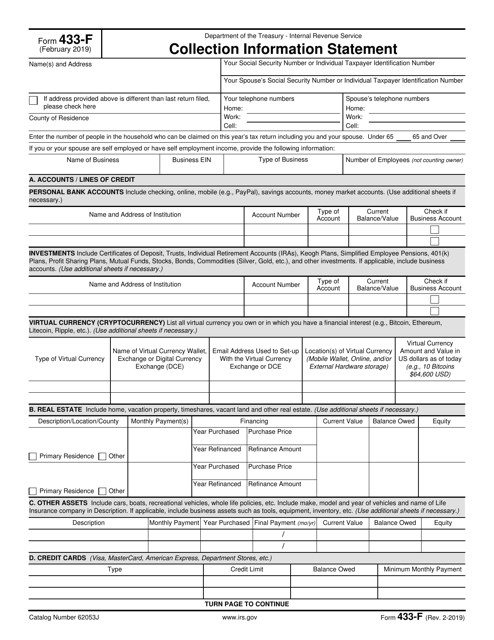

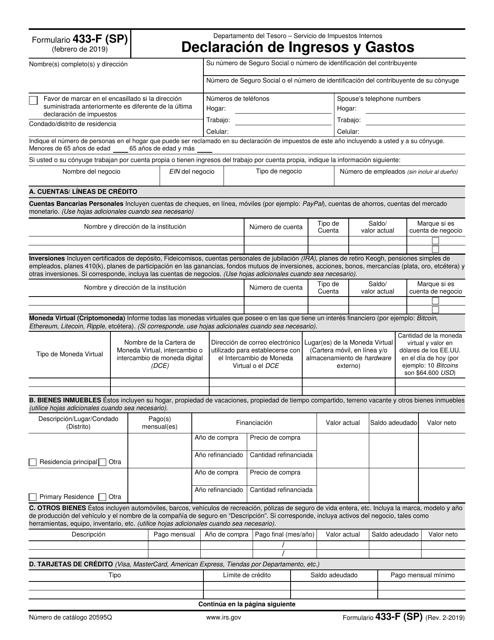

This is a formal document a taxpayer uses to inform fiscal authorities about their current financial position in the event of outstanding tax liability.

This type of document is an IRS form that is used for declaring income and expenses in Spanish.

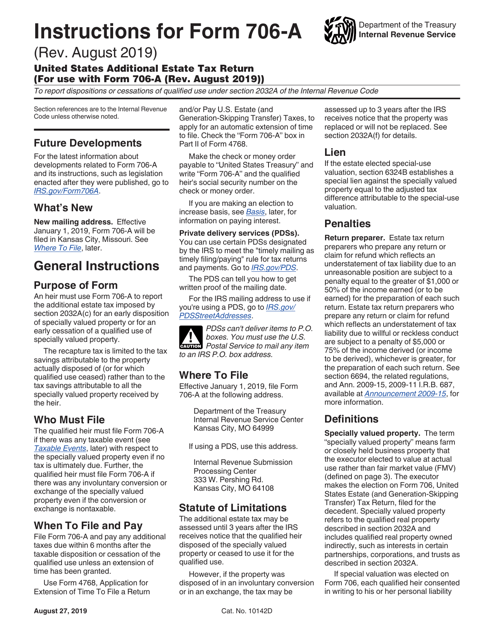

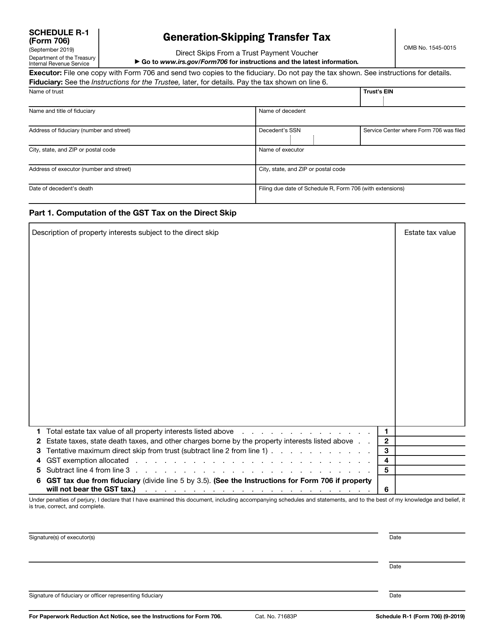

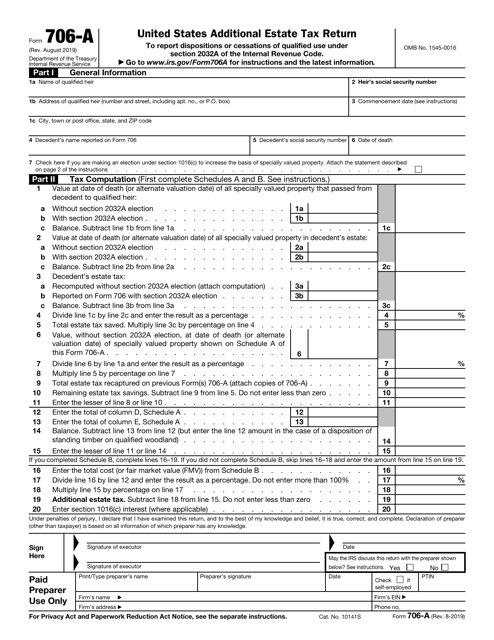

This form is used for filing additional estate taxes in the United States. It is specifically for the IRS and helps calculate and report any additional estate tax owed.

This form is used for reporting and paying the generation-skipping transfer tax on distributions from certain trusts.

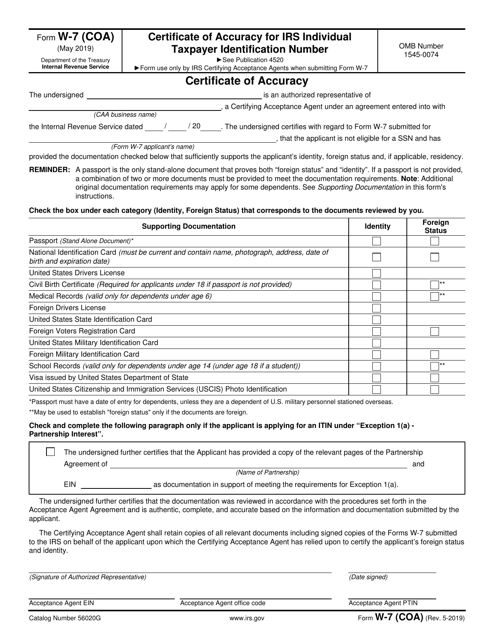

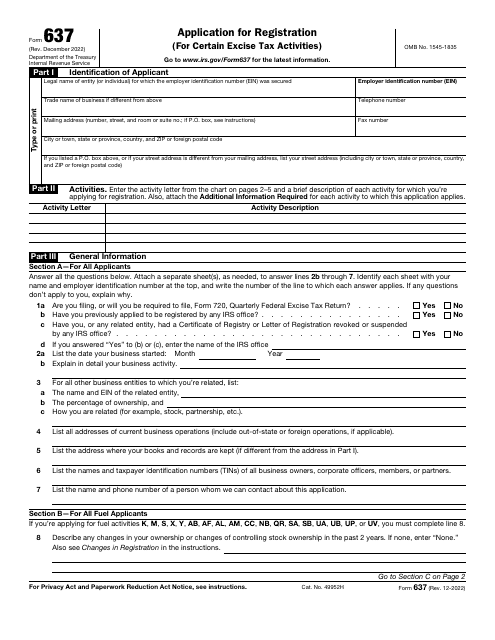

The purpose of this form is to provide filers with a Certificate of Registry or a Letter of Registration issued by the Internal Revenue Service (IRS), which they will then receive after the IRS processes and approves their application.