Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

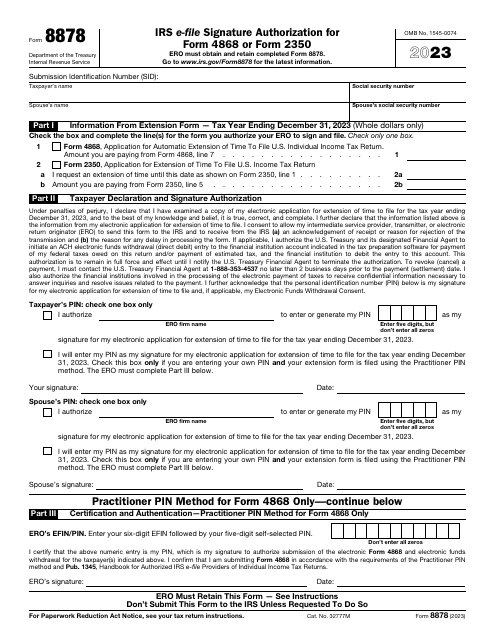

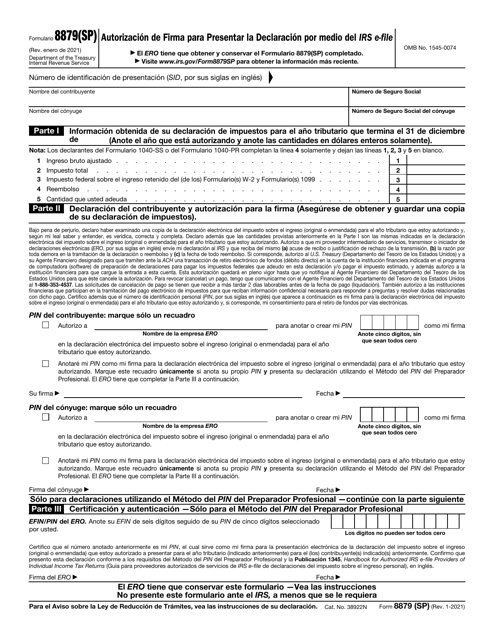

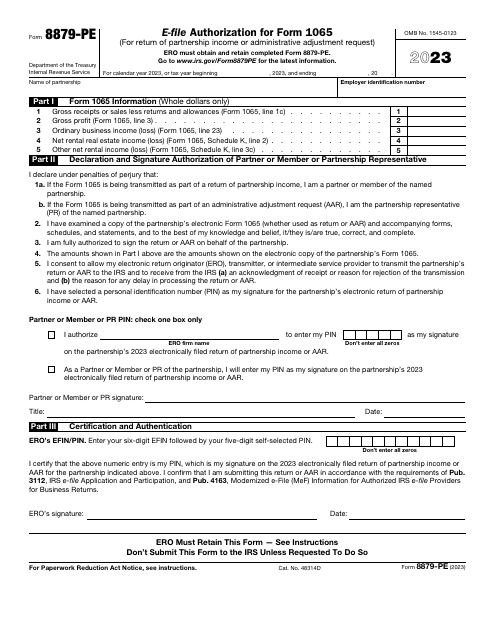

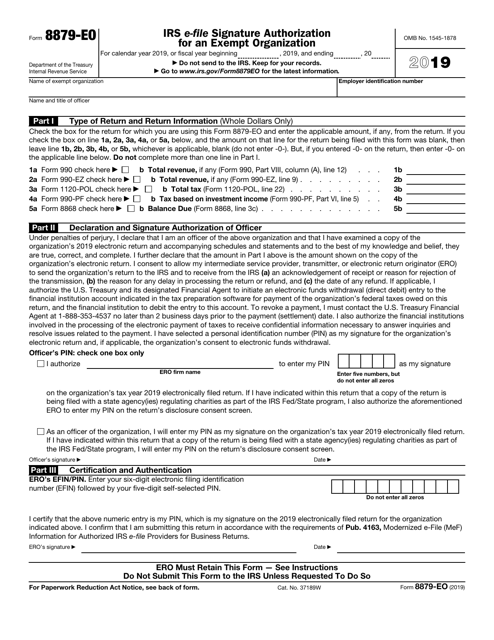

This is a form designed for taxpayers that want to grant an electronic return originator the right to use a unique identification number when filing tax documentation on behalf of the person that hired them.

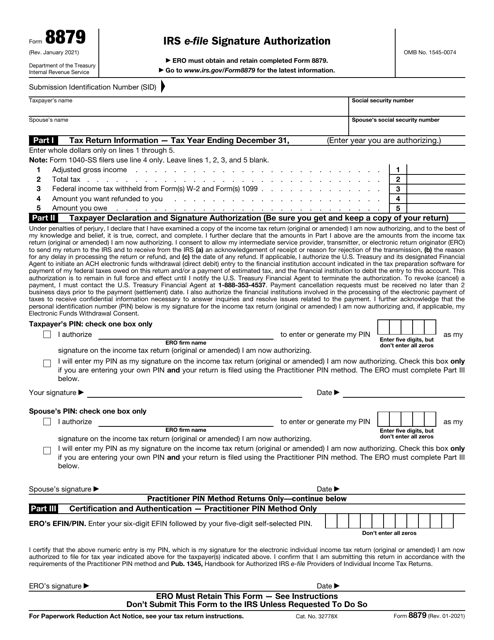

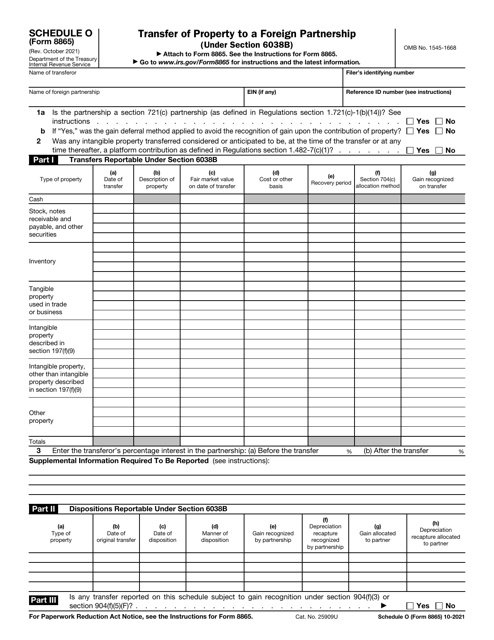

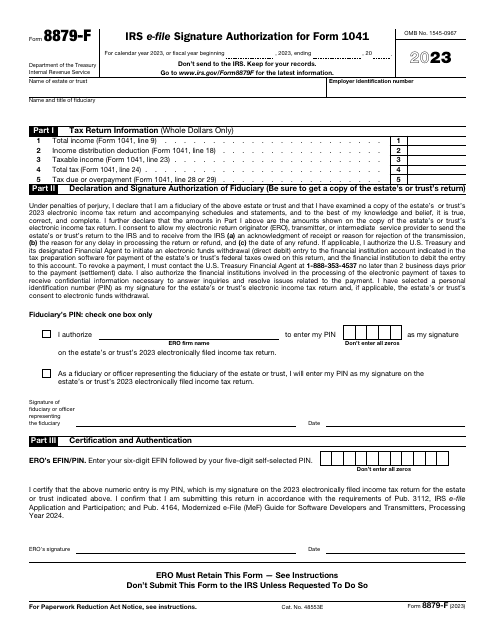

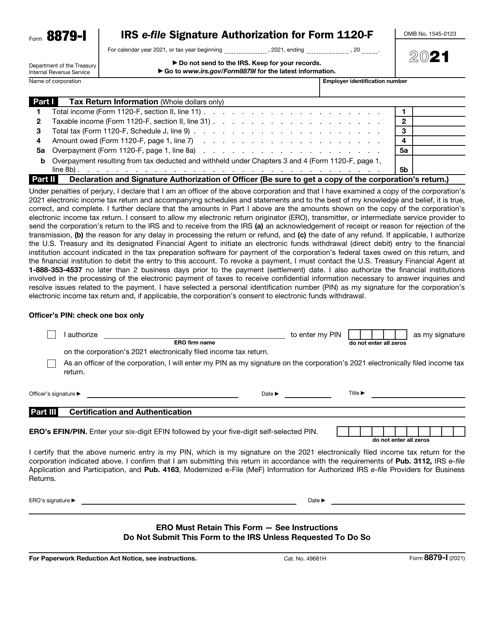

This is an IRS form that allows taxpayers to authorize an electronic return originator to use their e-signature while filing tax returns on behalf of their client.

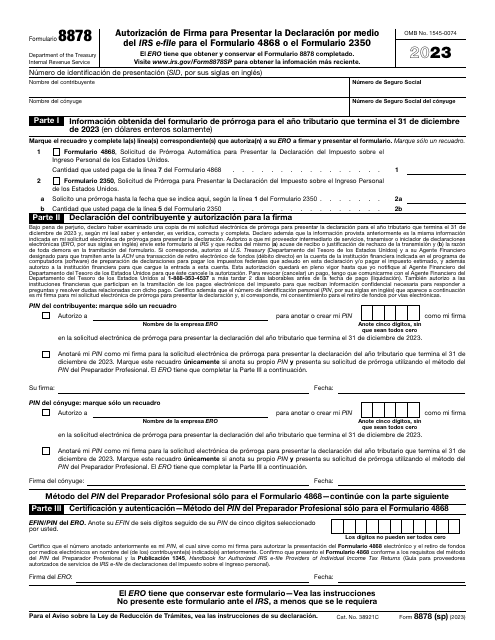

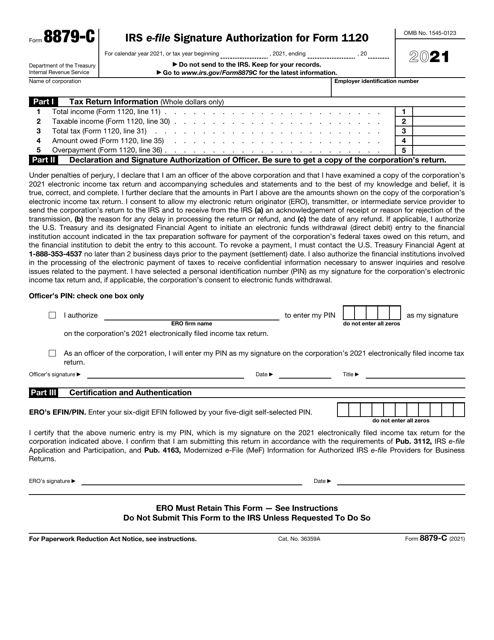

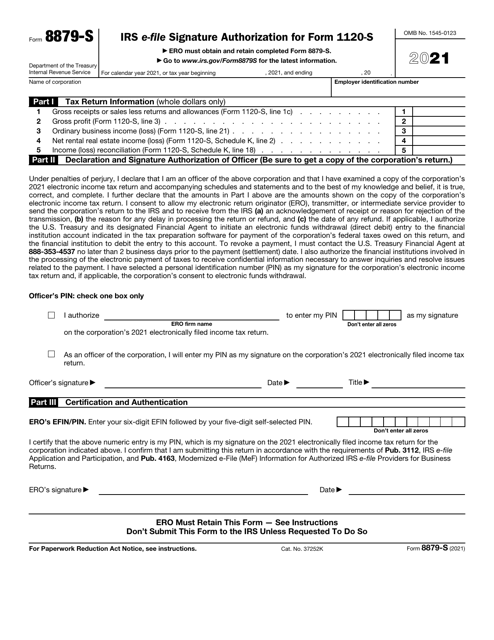

This is a fiscal document corporations use to create personal identification numbers in order to let electronic return originators sign tax returns on their behalf.

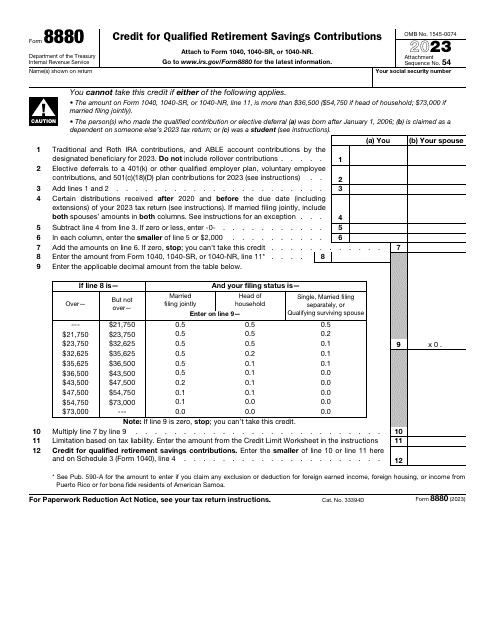

This is a formal instrument that allows individuals to express their intention to receive a saver's credit after contributing money to their retirement savings plans.

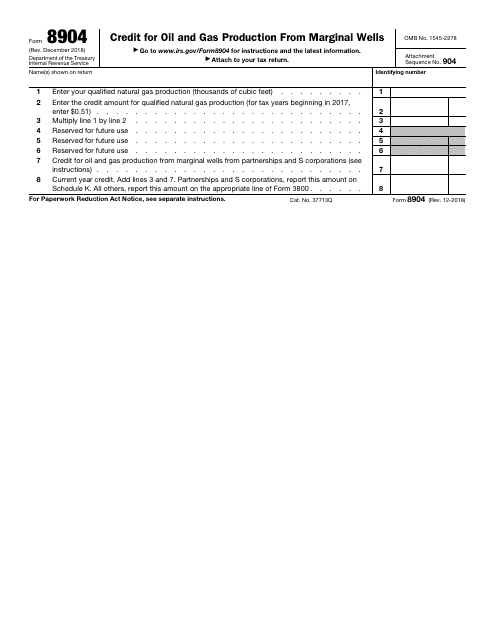

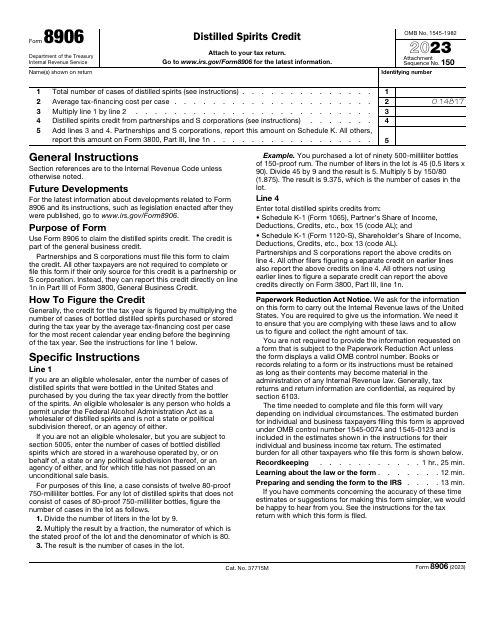

This form is used for claiming a credit for oil and gas production from marginal wells.

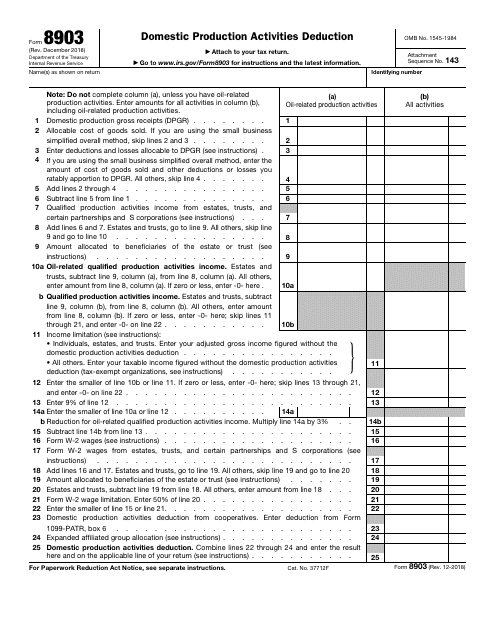

This Form is used for claiming the Domestic Production Activities Deduction on your federal tax return. It is for businesses that engage in certain qualified production activities within the United States.

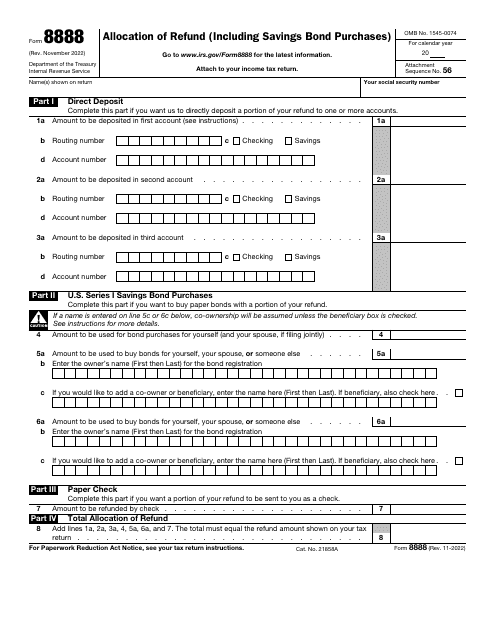

This is an IRS form filled out and submitted by a taxpayer that chooses to spread their tax refund across several accounts.

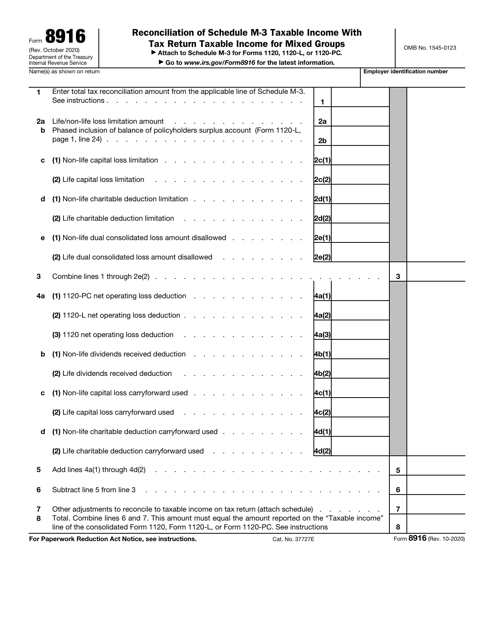

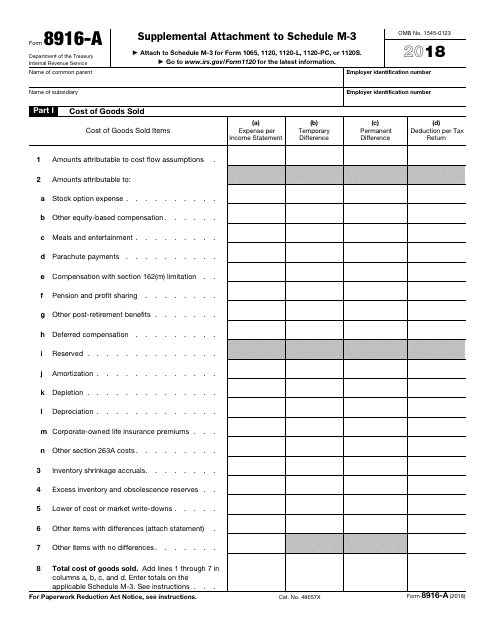

This form is used for providing additional information and attachments to the Schedule M-3 when filing taxes with the IRS.

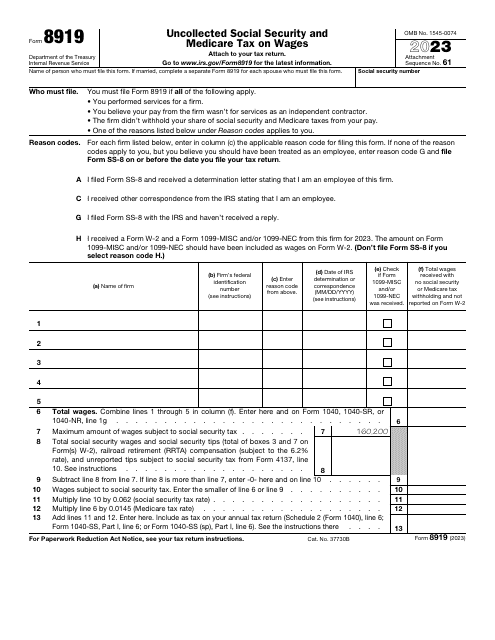

This is a formal report filed by an individual who believes they have to receive compensation in the form of social security and Medicare taxes.

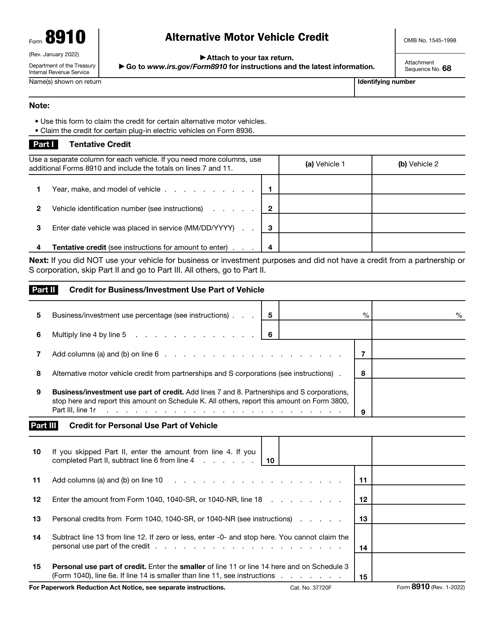

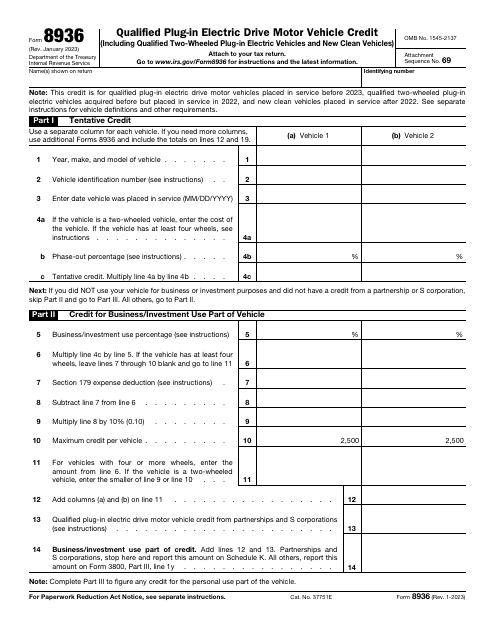

This is a formal IRS form used by taxpayers that purchased electric vehicles in order to claim a tax credit when filing their tax returns.

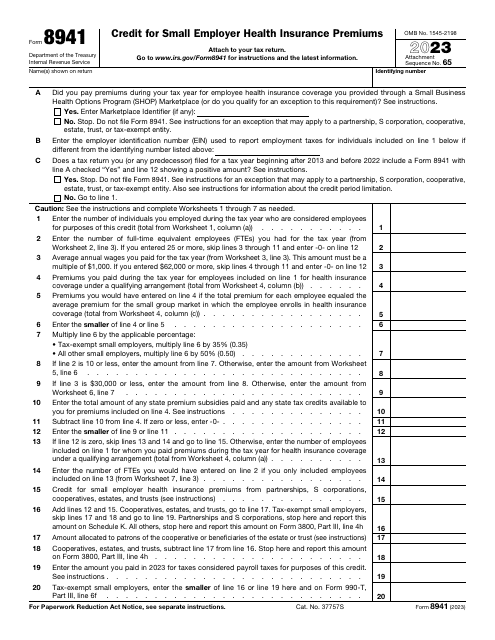

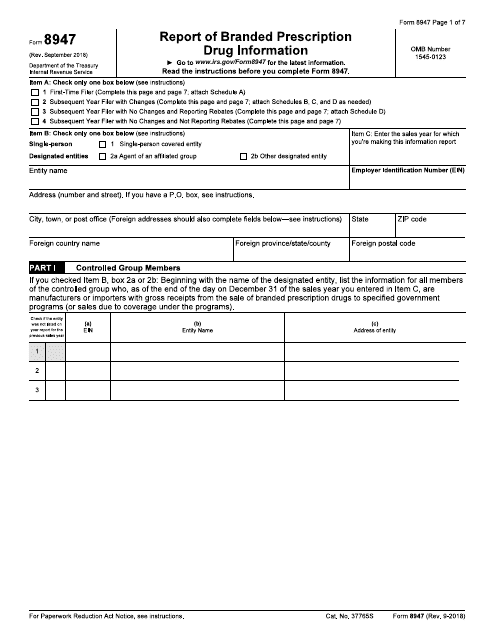

This Form is used for reporting information on branded prescription drugs to the IRS. It helps the IRS track and analyze data related to the Affordable Care Act's health insurance coverage provisions.

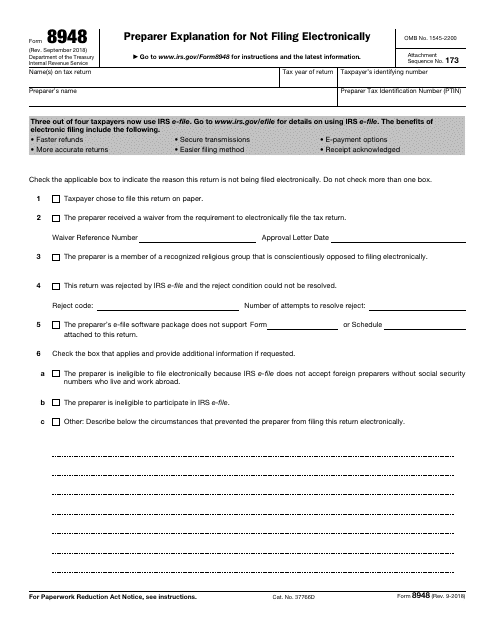

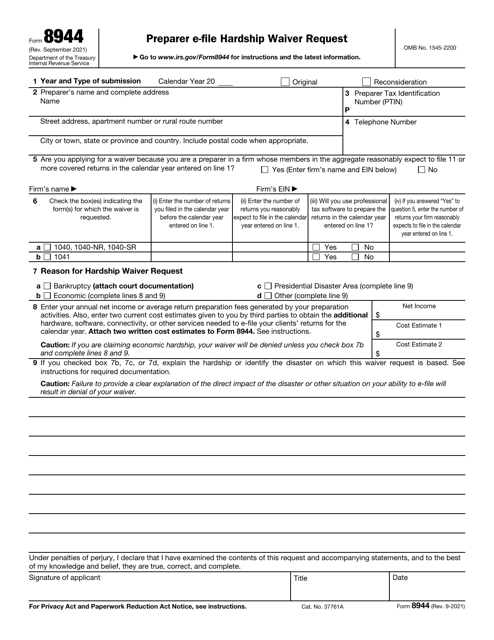

This Form is used for explaining why a tax preparer did not file a tax return electronically.

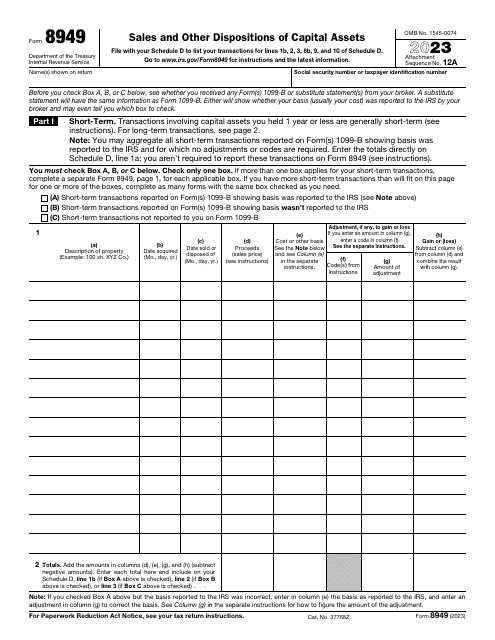

This is a legal document used to report exchanges and sales of capital assets, both long- and short-term capital gains and losses, to the IRS.

This is a formal statement completed by specified tax return preparers that cannot e-file income tax returns because of economic hardship, bankruptcy, or presidentially declared disaster.

This is a formal instrument used by taxpayers to clarify how much investment income they have received and to figure out the amount of supplementary tax they have to pay.