Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

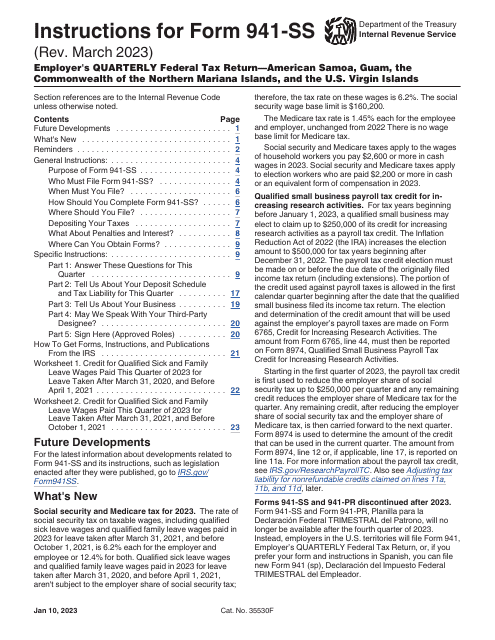

This form is filed to report Guam wages and tax deductions. The document was issued by the Internal Revenue Service (IRS), which can send you this form in a paper format, if you wish.

Use this document to report the amount of withheld wages and taxes to the employee and appropriate authorities. The form is also known as a W-2 and is one of the crucial annual tax documents.

If you are an employer and have to file Form W-2, Wage and Tax Statement, you need to fill out this form. This form is needed for transmitting a paper Copy A of Form W-2, to the SSA. Make sure you supply your employees with a copy of Form W-2.

This document is designed to inform the Internal Revenue Service (IRS) about the United States Virgin Islands salaries and the amount of taxes deducted from them. This document was issued by the IRS, which can send you this form in a paper format, if you wish.

File this document with the Social Security Administration (SSA) if you are a payer or employer who needs to transmit a paper Copy A of forms W-2 (AS), W-2 (CM), W-2 (GU), and W-2 (VI) to the above-mentioned organization.

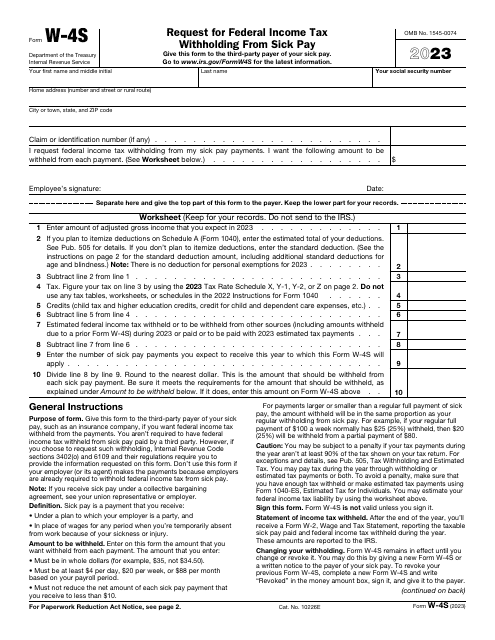

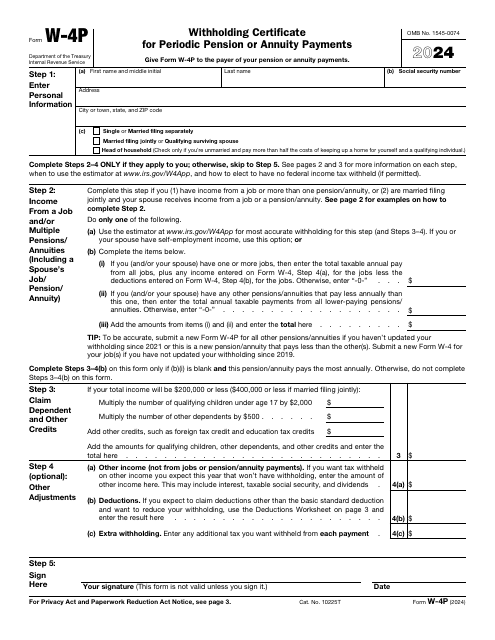

This is a formal document used by taxpayers to figure out the amount of deduction applied to regular payments they are entitled to receive.

Use Instructions to Form 926 to fill in IRS Form 926 and report certain transfers of tangible or intangible property to a foreign corporation, as required by section 6038B.

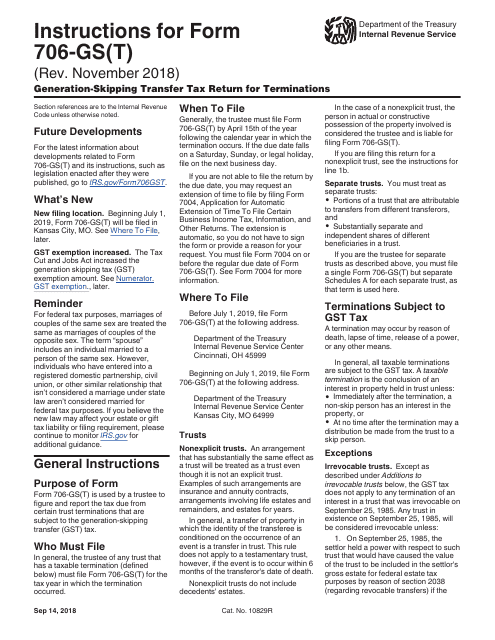

This Form is used for reporting the Generation-Skipping Transfer Tax for terminations on the IRS Form 706-GS (T). It provides instructions on how to fill out the form and report any transfers subject to the tax.

Instructions for IRS Form 709 United States Gift (And Generation-Skipping Transfer) Tax Return, 2023