Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

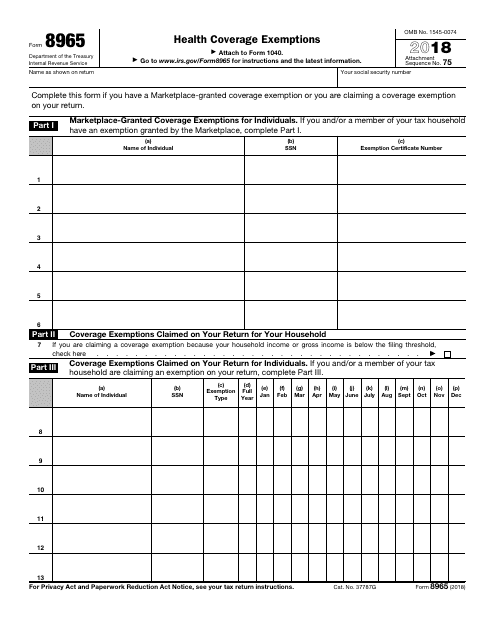

This Form is used for reporting health coverage exemptions on your federal income tax return. It is used to claim exemption from the requirement to have health insurance or pay a penalty.

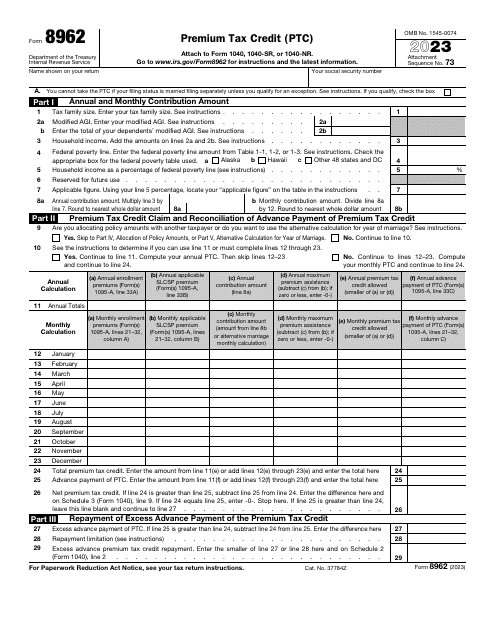

This is an IRS legal document completed by individuals who need to figure out the amount of their Premium Tax Credit and reconcile it with the Advanced Premium Tax Credit (APTC) payments made throughout the reporting year.

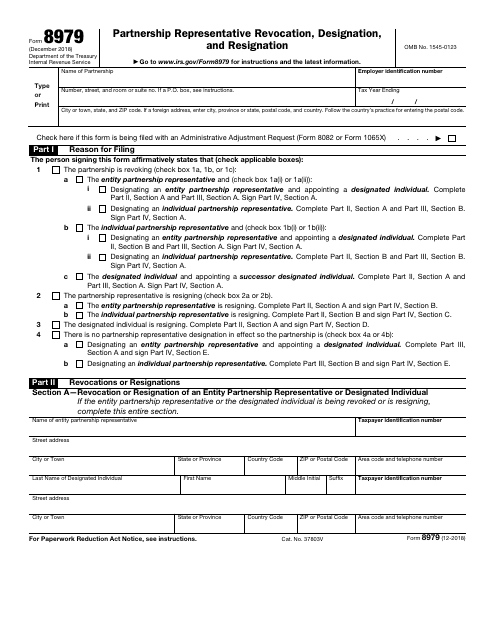

This form is used for revoking, designating, or resigning a partnership representative for tax purposes.

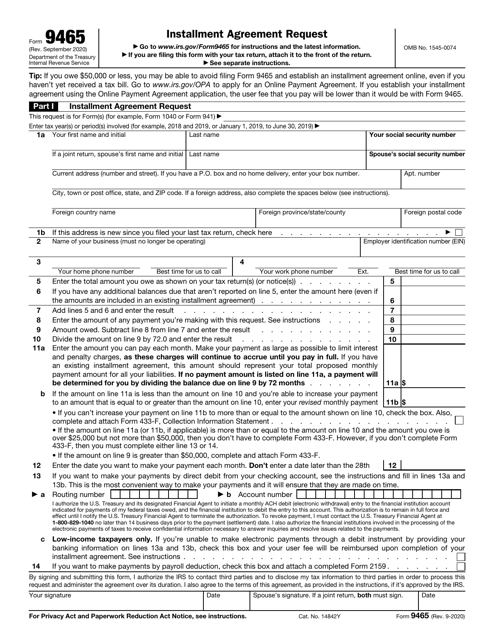

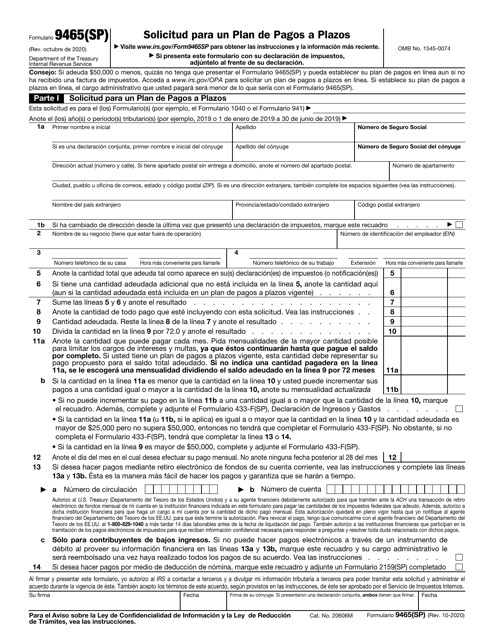

This is a formal document used by taxpayers to ask tax organizations to set up an elaborate payment plan to handle tax debt.

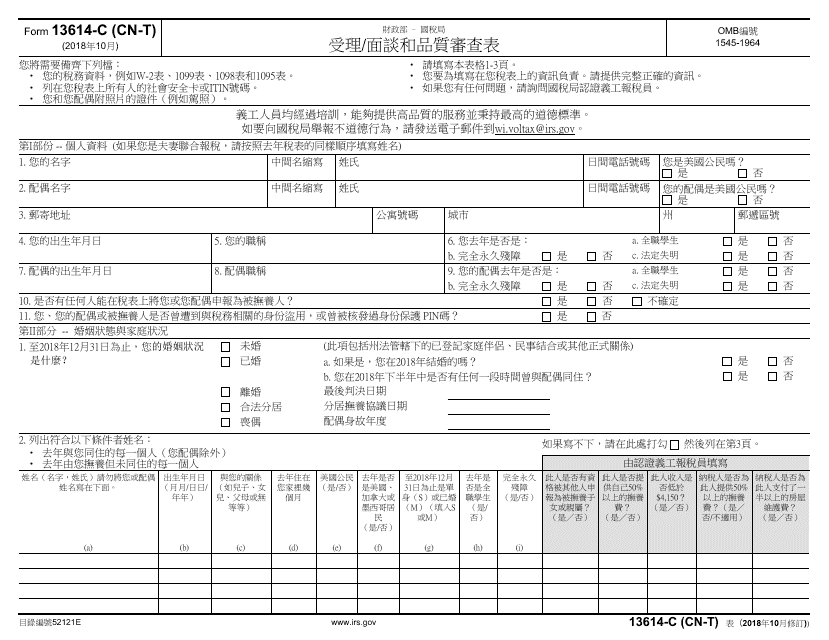

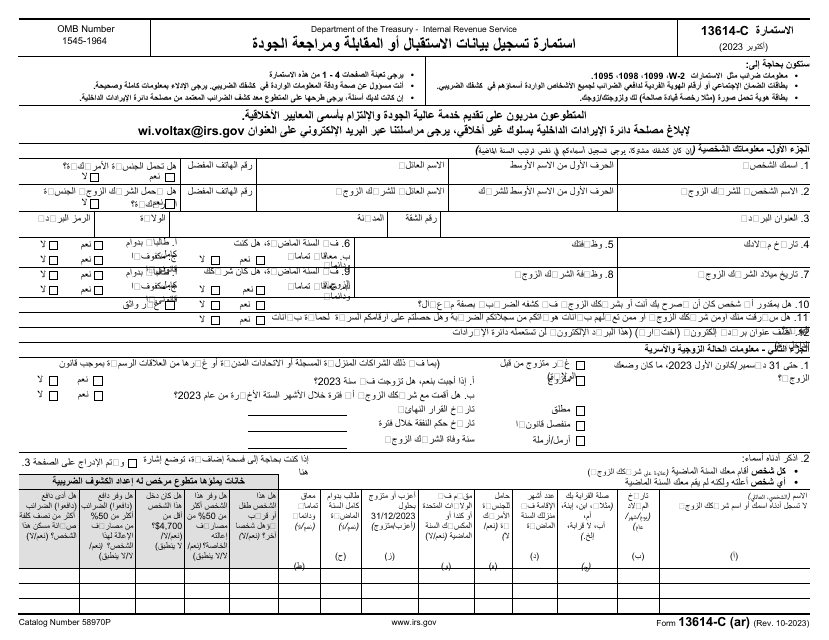

This form is used for the intake, interview, and quality review process conducted by the IRS. It is specifically designed for Chinese individuals or those who prefer to use Chinese language.

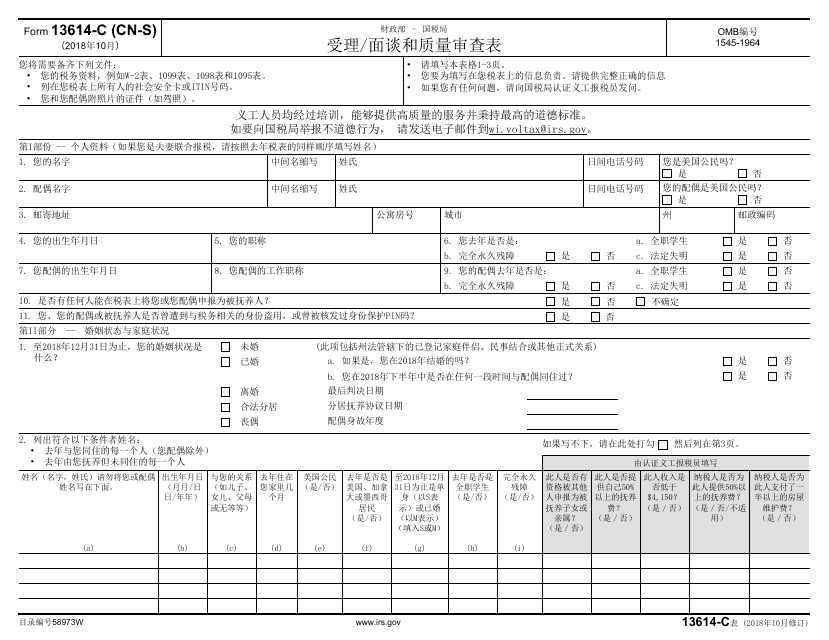

This document is used for intake, interviews, and quality review for the IRS. It is specifically designed for Chinese speakers.

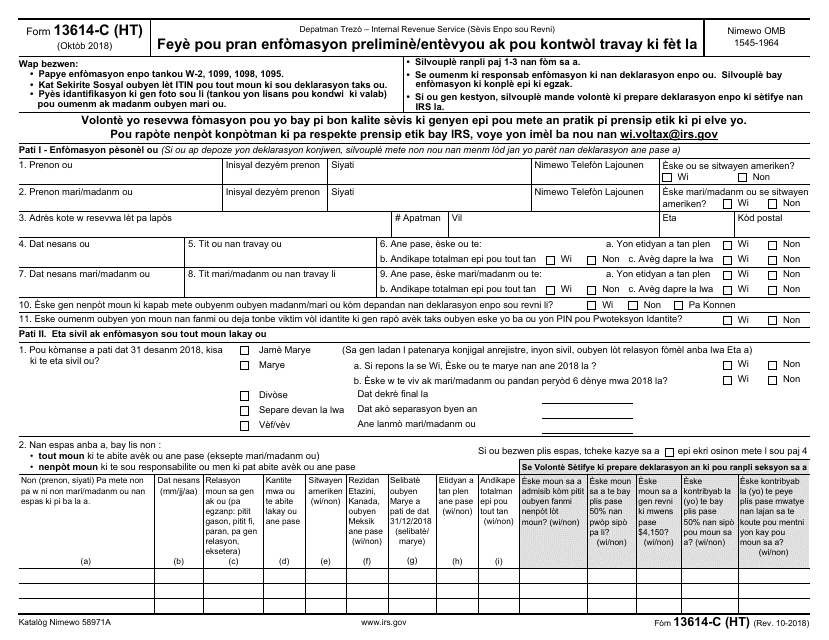

This document is used for intake and quality review of tax information in Creole language for individuals by the IRS.

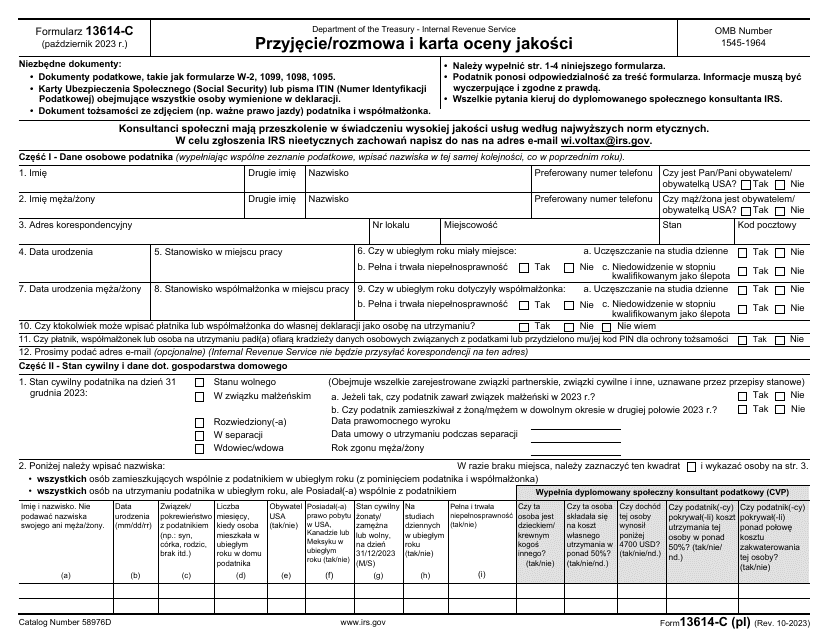

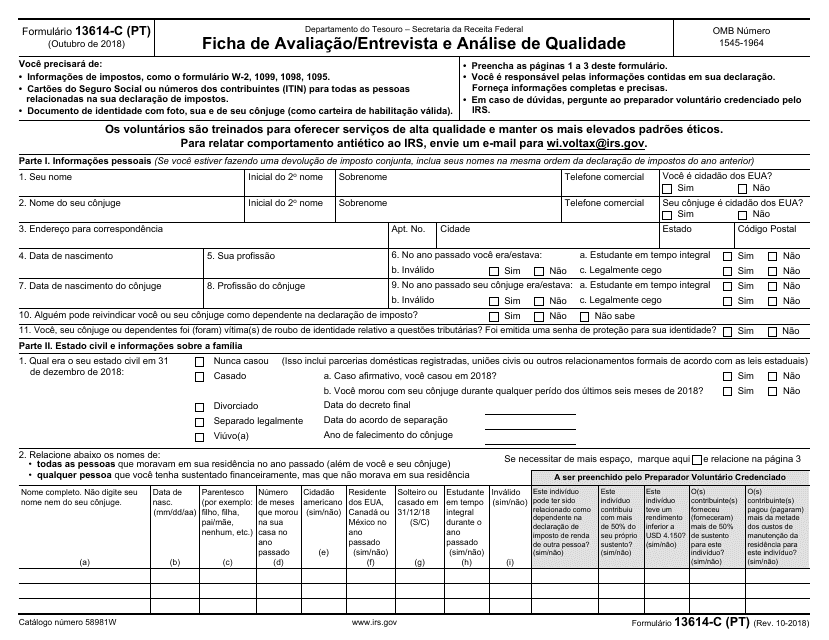

This document is used for the intake, interview, and quality review process for taxpayers who speak Portuguese. It is a form provided by the IRS.

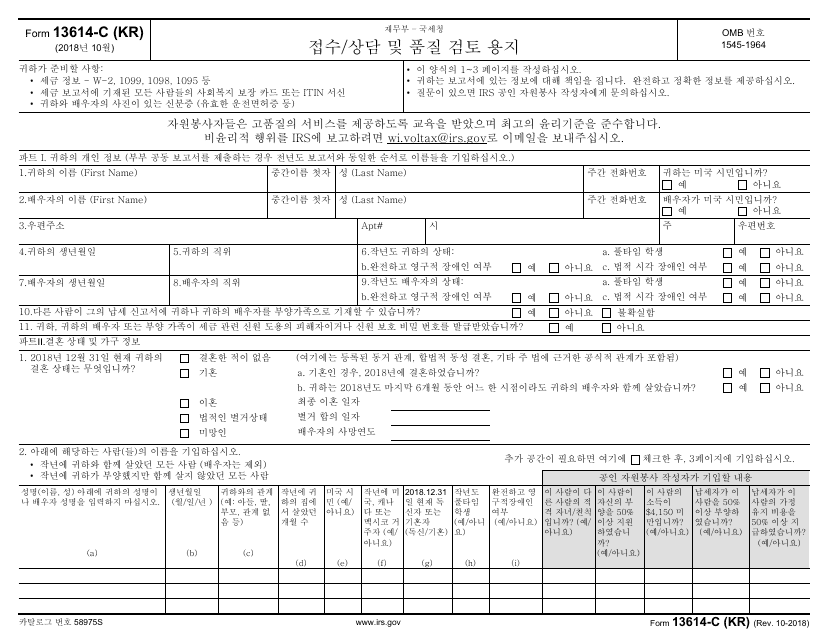

This document is used for the intake, interview, and quality review process by the Internal Revenue Service (IRS). It is specifically for Korean-speaking individuals.

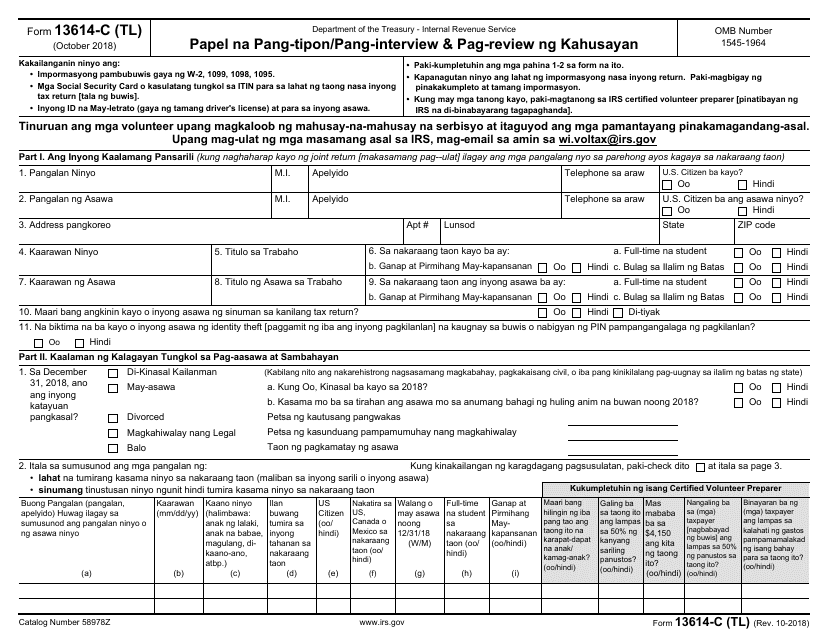

This document is for individuals who speak Tagalog and need assistance with their tax intake process. It is used to gather information about the taxpayer's financial situation for the IRS.

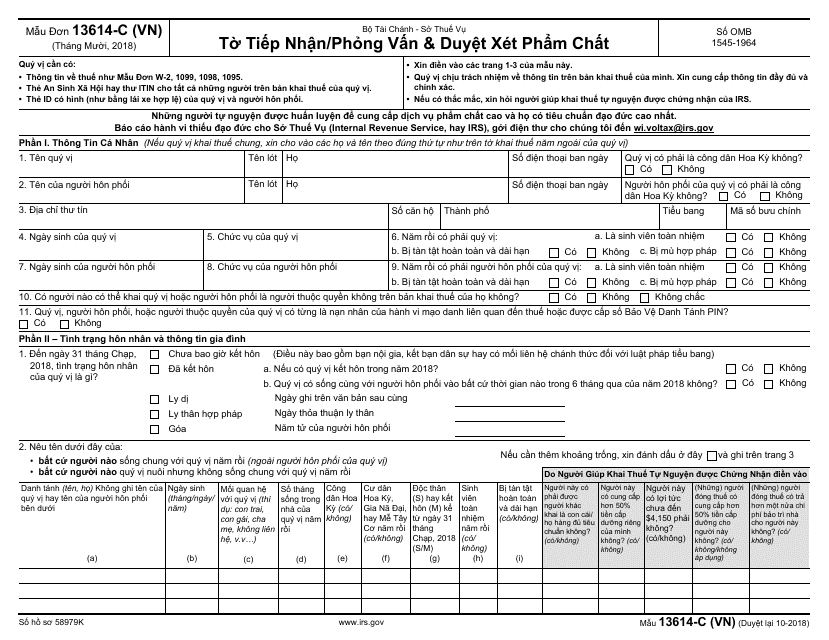

This document is used for gathering information and conducting interviews with taxpayers who speak Vietnamese. It is also used for quality review purposes by the IRS.

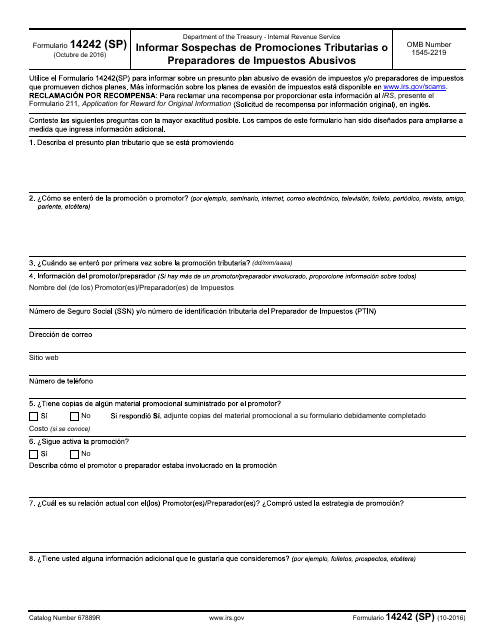

This form is used for reporting suspicious tax promotions or abusive tax preparers.

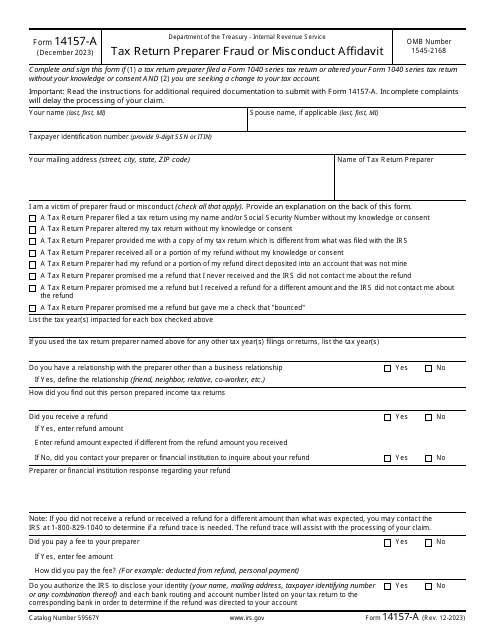

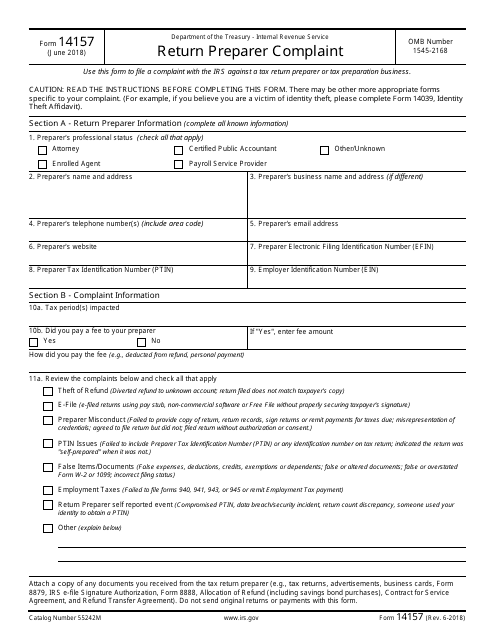

This form is used for filing a complaint against a return preparer who has engaged in fraudulent or unethical behavior.

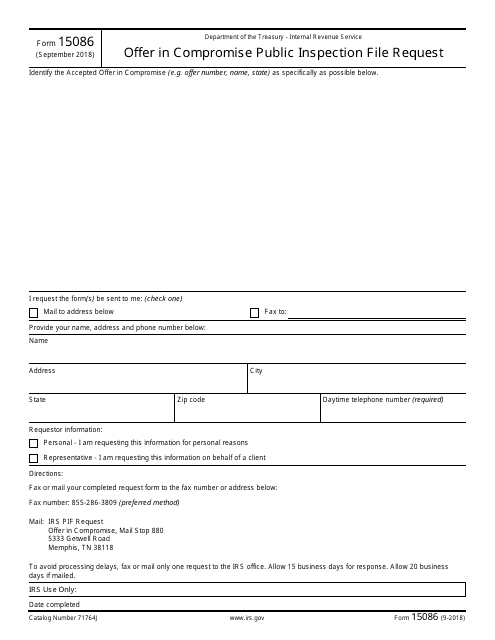

This form is used for requesting access to the public inspection file for Offer in Compromise records with the IRS.

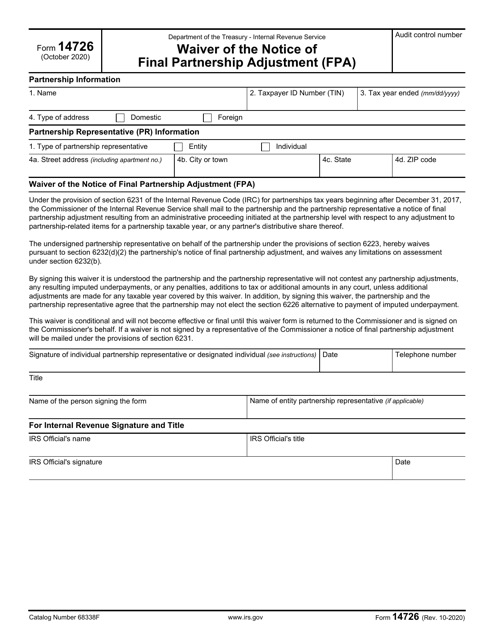

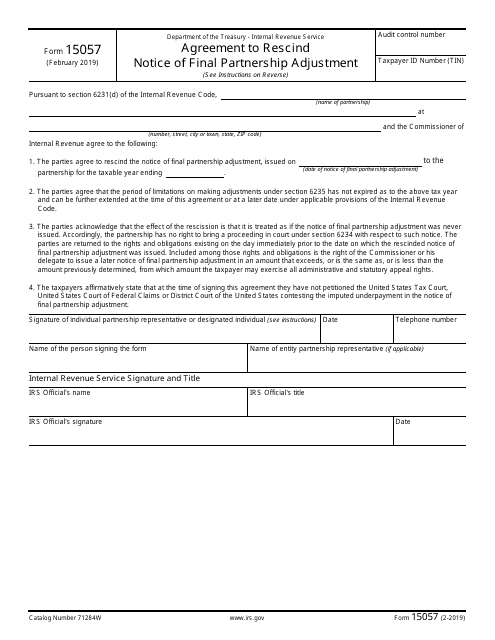

This form is used for agreeing to cancel a notification of final partnership adjustment issued by the IRS.

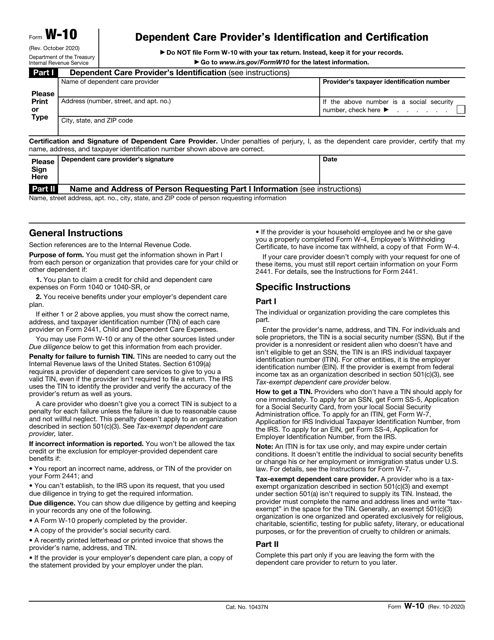

A W-10 Form's purpose is to get the correct information from each entity or individual that provides care for a taxpayer's child or another dependent.

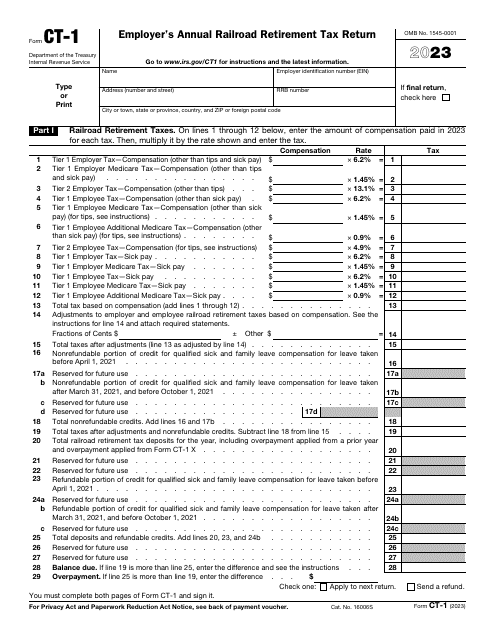

This is a fiscal form railroad industry employers are supposed to fill out in order to report the compensation they paid to their employees if that compensation is taxed in accordance with the Railroad Retirement Tax Act.

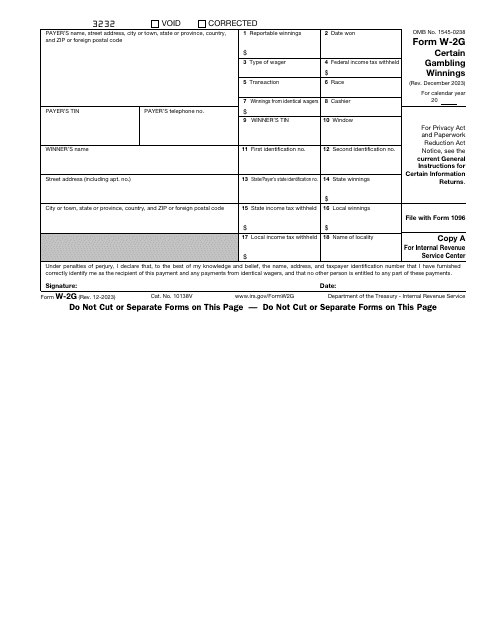

This is a formal report filed by gambling facilities to outline the winnings of their clients and certify they deducted taxes from the sum of money won.

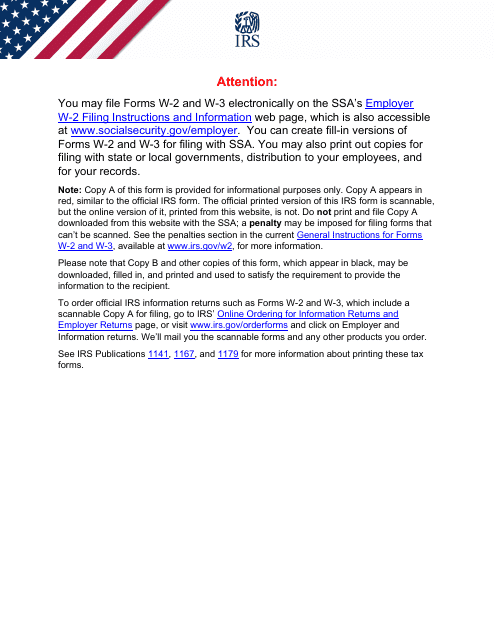

This form is filed to report American Samoa wages and withheld taxes. It is not used for reporting income taxes in the United States. IRS Form W-2, Wage and Tax Statement is used in these cases.