Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

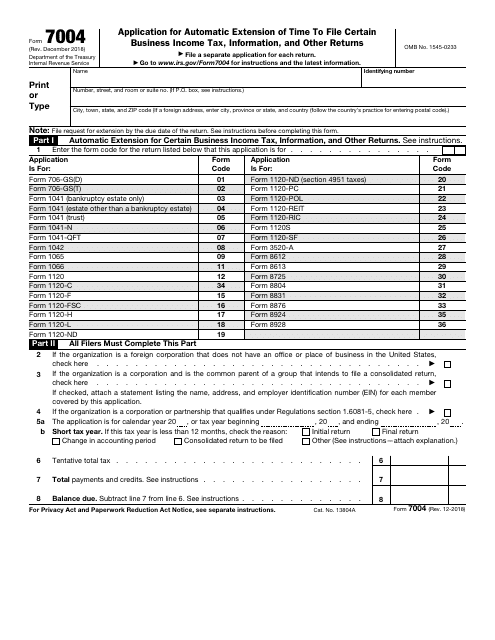

This form is used to request an automatic extension of time to file certain business income tax returns.

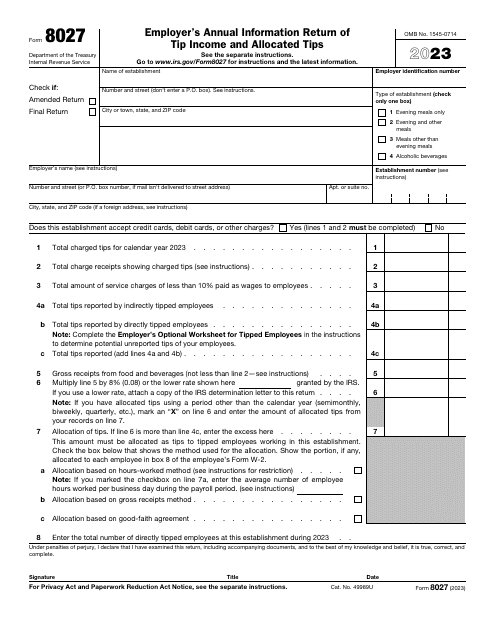

Every year, this form is filled out by employers wishing to report to the Internal Revenue Service (IRS) the receipts and tips their employee received, as well as to determine allocated tips.

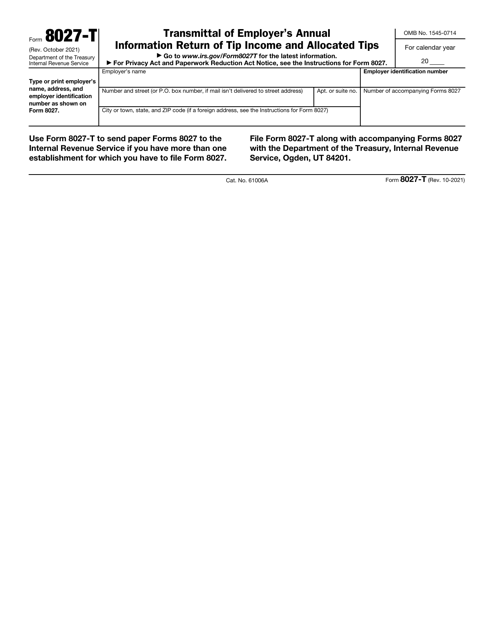

IRS Form 8027-T Transmittal of Employer's Annual Information Return of Tip Income and Allocated Tips

Download this supplemental form if you are an employer who owns one or more food or beverage establishments and wishes to submit Form 8027 in a paper format.

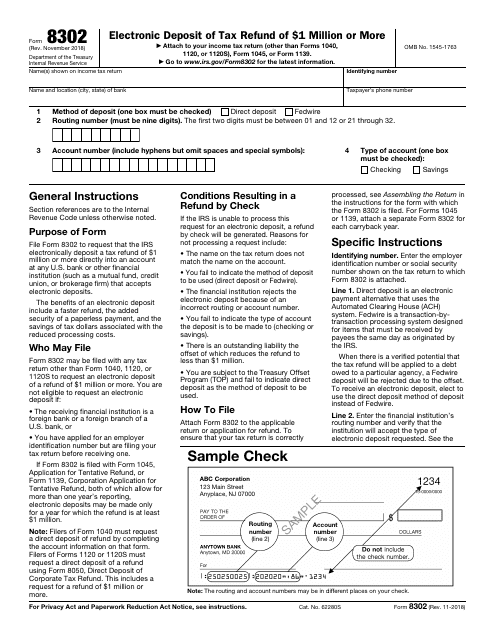

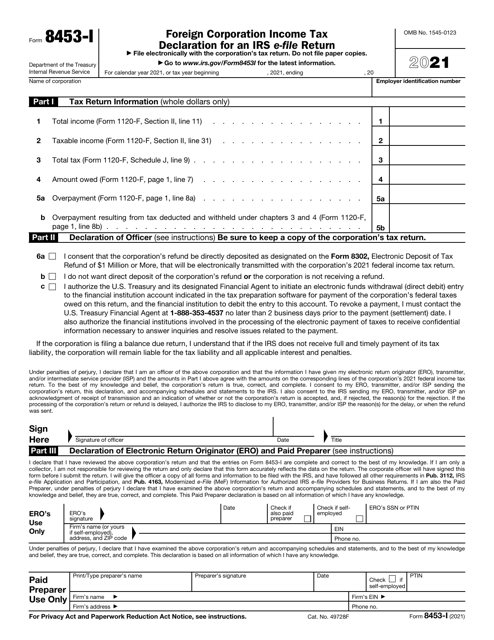

This form is used for electronically depositing tax refunds of $1 million or more.

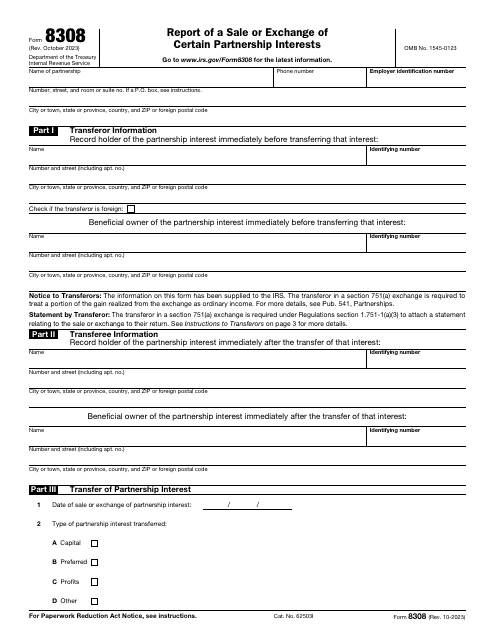

This IRS form is used by a partnership to report the exchange or sale by a partner of a partnership interest.

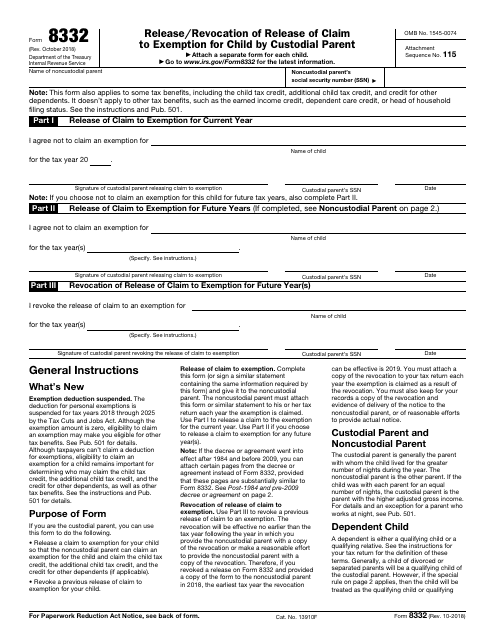

This form is used for releasing or revoking the claim to exemption for a child by the custodial parent on their tax return.

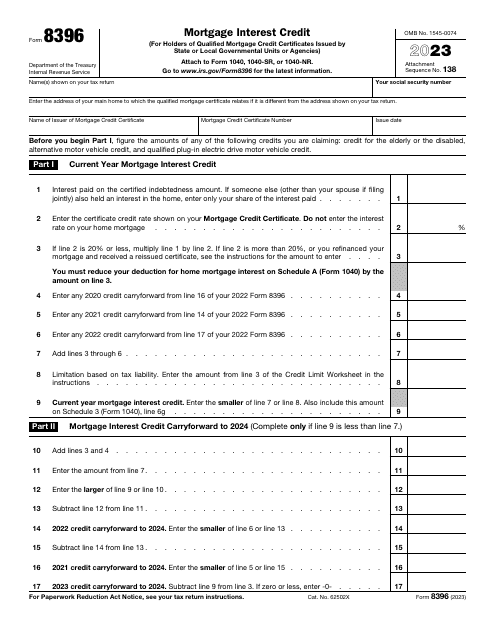

This is a formal document filled out by taxpayers in order to compute the amount of mortgage interest credit over the course of the year and report the information to fiscal authorities.

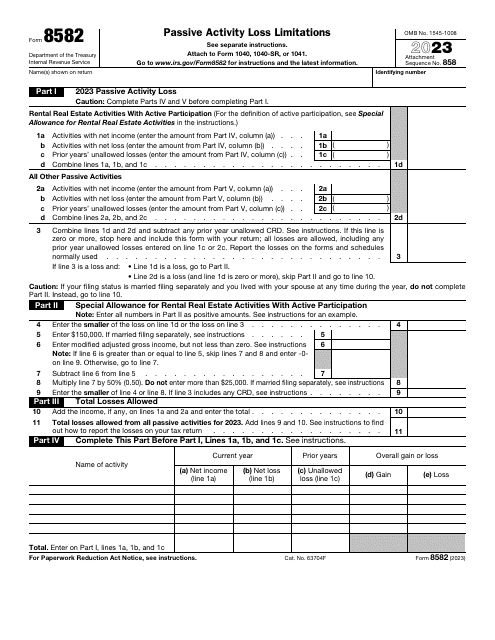

Download this form if you are a noncorporate taxpayer. The main purpose of this document is to help you calculate the amount of Passive Activity Loss (PAL). You can also use this form to claim for non allowed PALs for the past tax year.

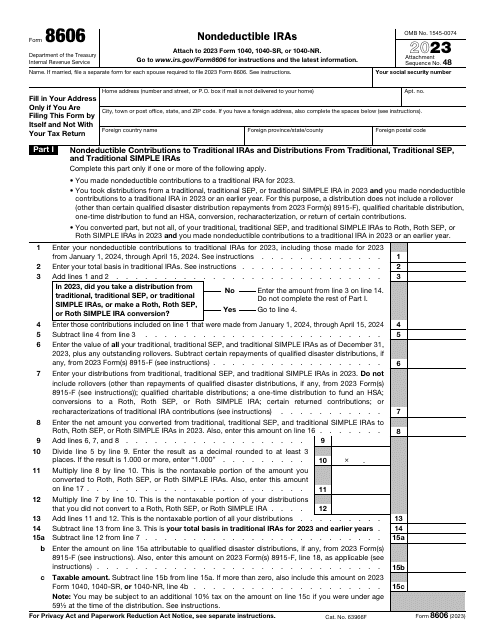

The purpose of this form is to provide the IRS with information on taxpayers who make nondeductible contributions to their Individual Retirement Account (IRA).

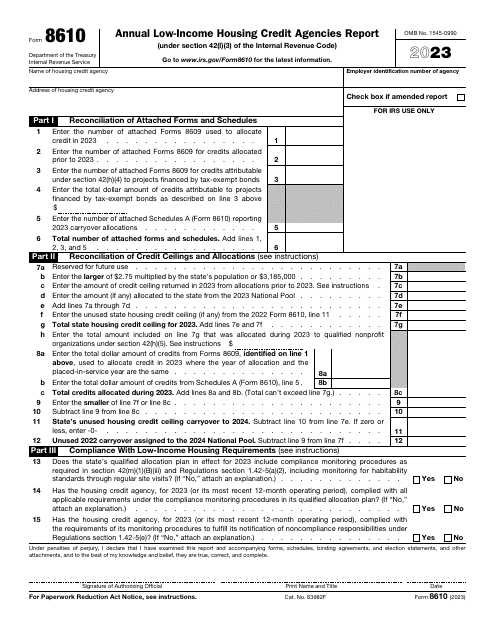

This is a formal IRS statement a housing credit agency is supposed to complete to inform the fiscal authorities about the total amount of housing credits their entity has allocated during the twelve months outlined in the form.

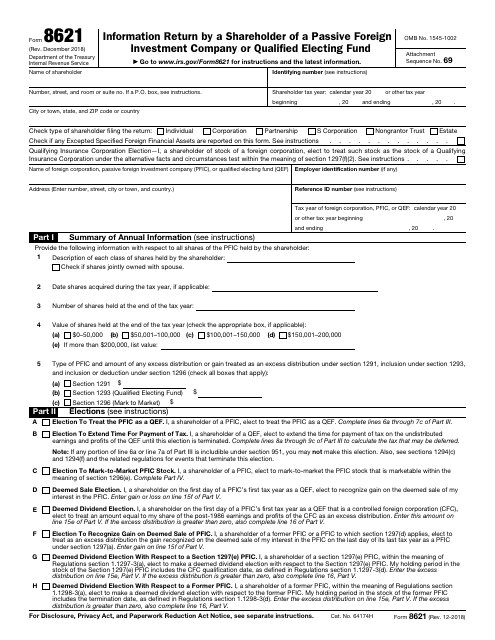

This form is used for reporting information about a shareholder's investment in a passive foreign investment company or qualified electing fund to the IRS.

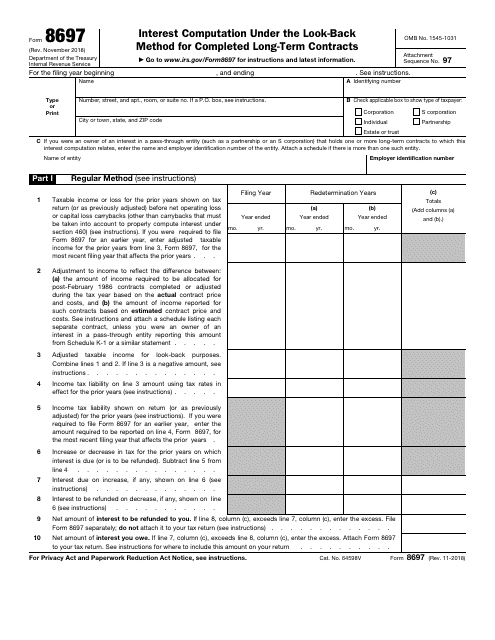

This form is used for calculating interest using the look-back method for completed long-term contracts.

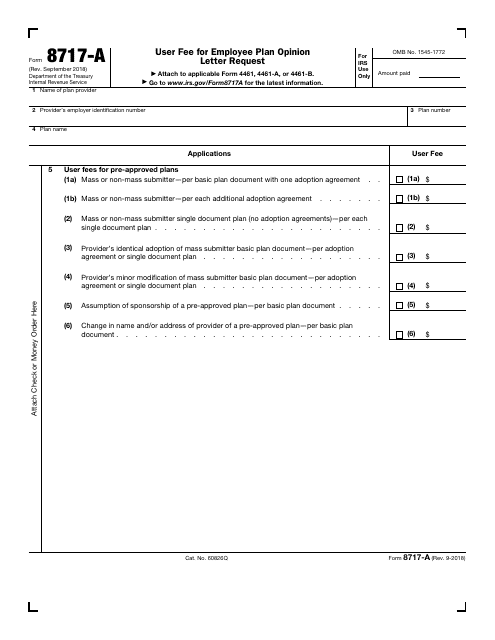

This form is used for requesting an opinion letter for an employee plan and paying the associated user fee.

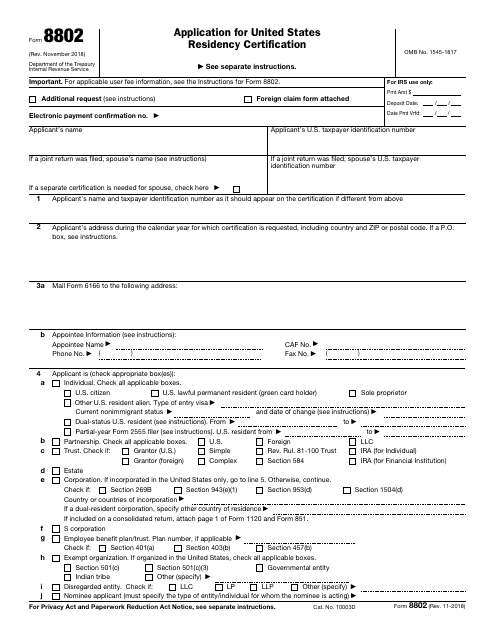

This Form is used for individuals applying for Certification of United States Residency.