Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

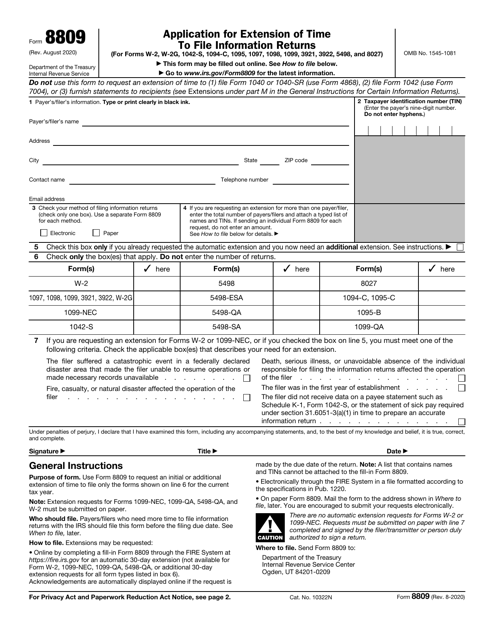

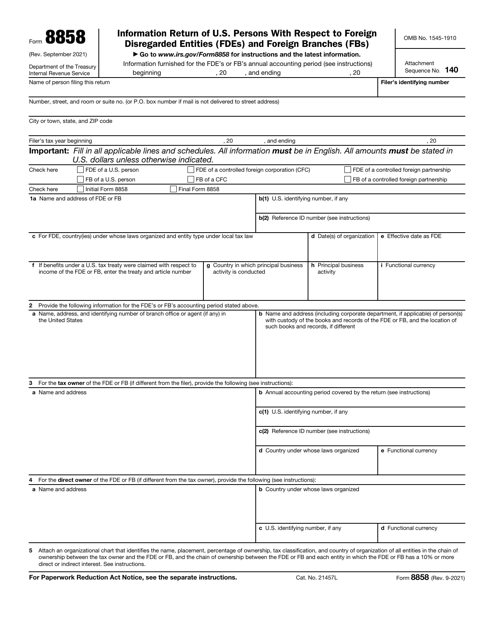

This is a fiscal form filled out by a taxpayer asking for additional time to submit an information return.

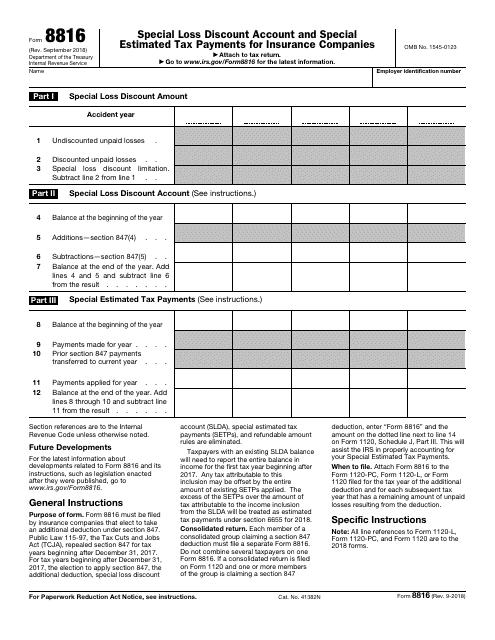

This form is used for insurance companies to report special loss discount account and special estimated tax payments to the IRS.

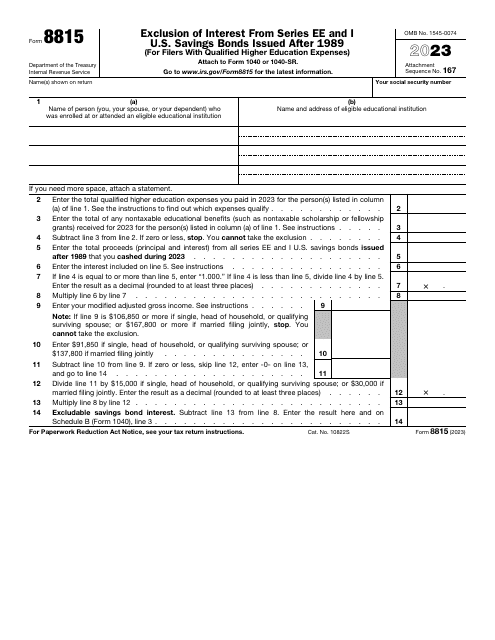

This is a fiscal document used by individual taxpayers to exclude the specific bond interest from their income.

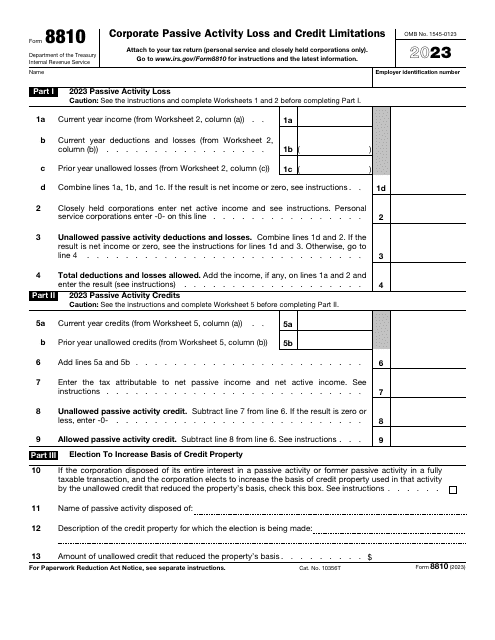

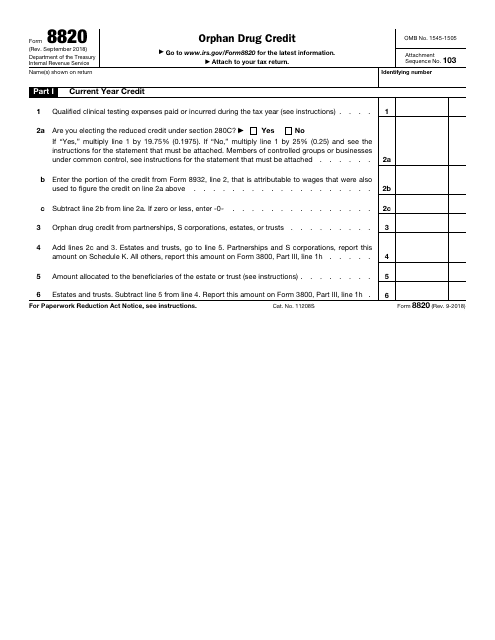

This Form is used for claiming the orphan drug credit on your tax return. It helps businesses calculate and report the tax credit they are eligible for when developing certain drugs for rare diseases.

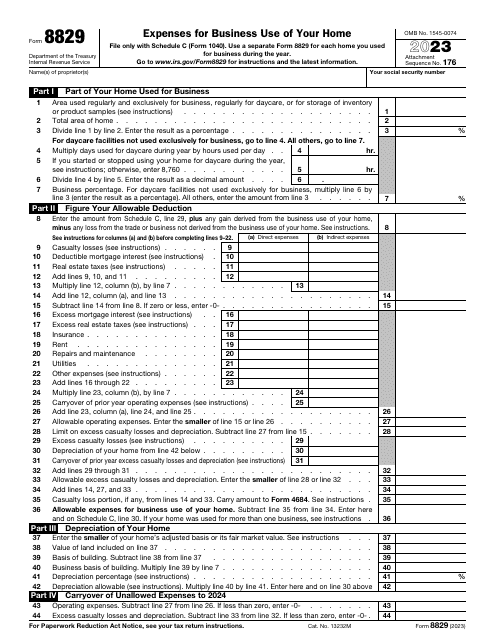

This is an IRS form used by taxpayers who work from home and want to inform tax organizations about the business expenses they wish to deduct from their taxes.

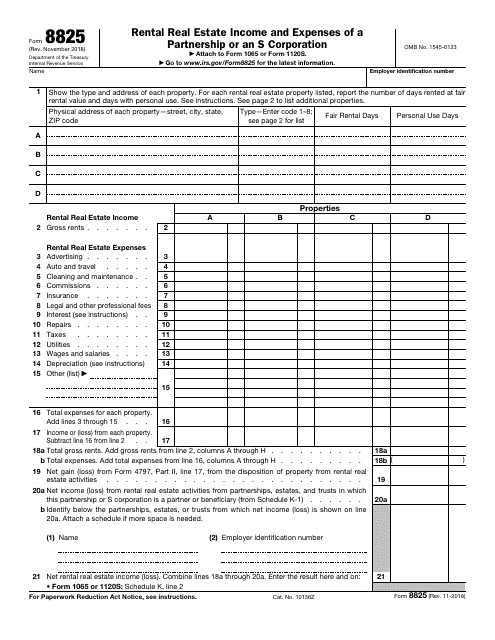

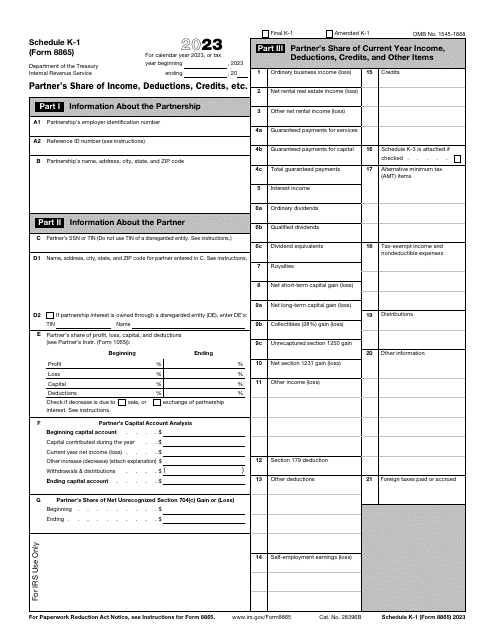

This is a tax statement prepared by S corporations and partnerships to calculate and notify the fiscal authorities about the income they have earned by renting out real estate as well as deductible expenses related to those activities such as maintenance, repairs, advertising, and legal fees.

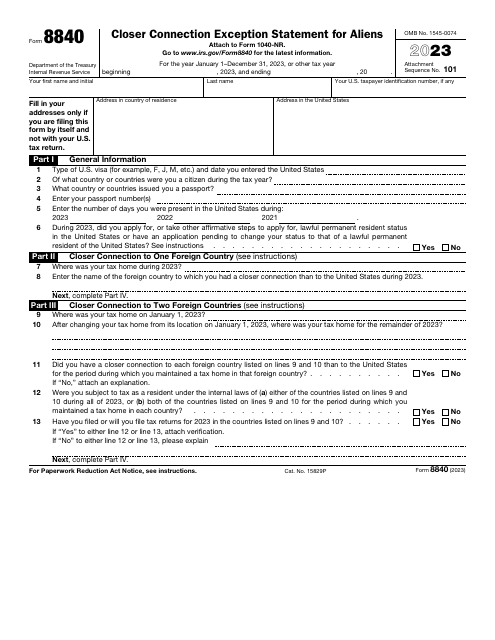

This is an application issued by the Internal Revenue Service (IRS) especially for alien individuals who use it to claim the closer connection to a foreign country exception to the substantial presence test.

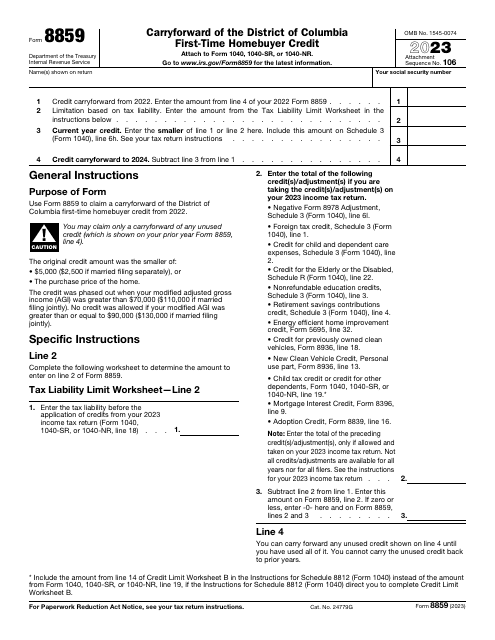

This is a fiscal document residents of the District of Columbia are permitted to complete in order to claim a carryforward credit they will be able to use in the future.

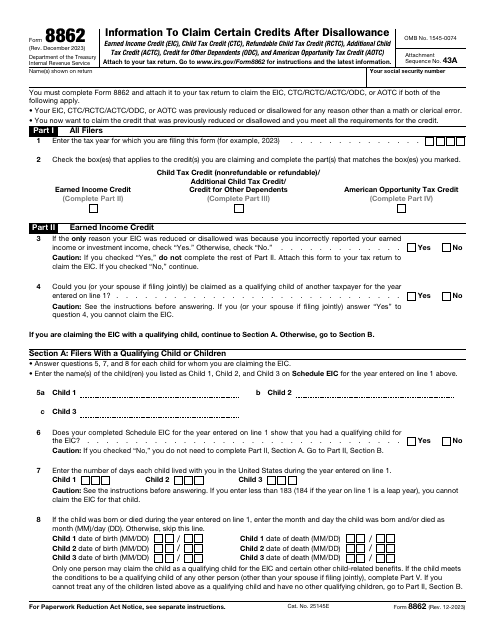

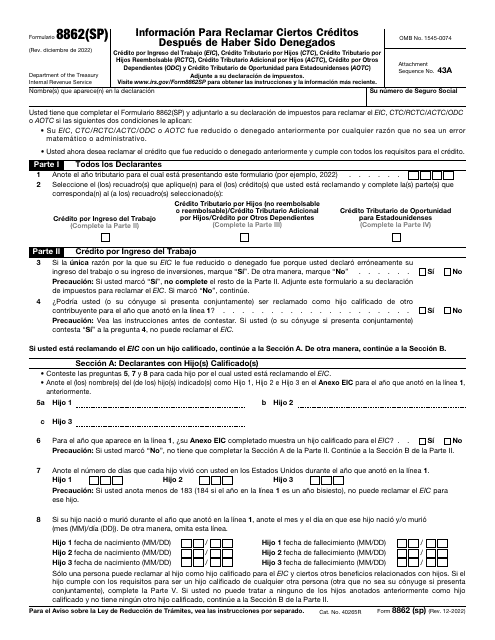

This is a fiscal form used by taxpayers to request the payment of a tax credit that was disallowed in the past.

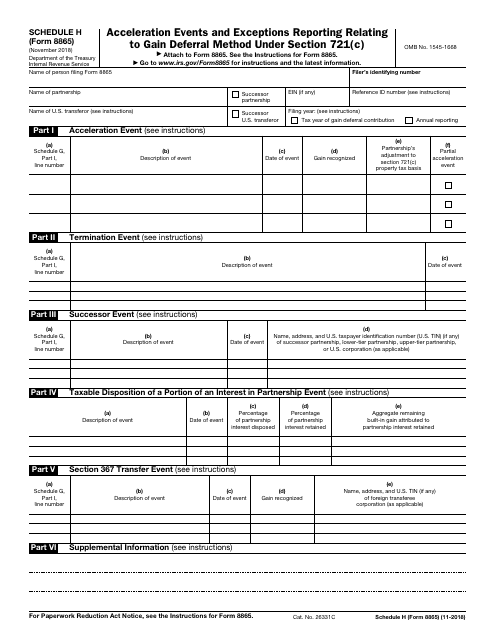

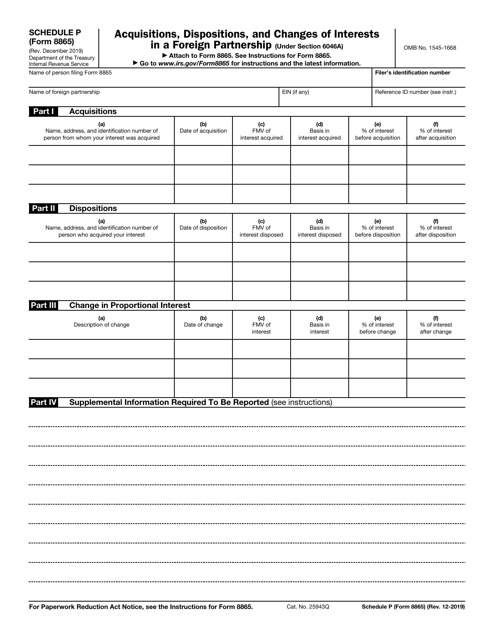

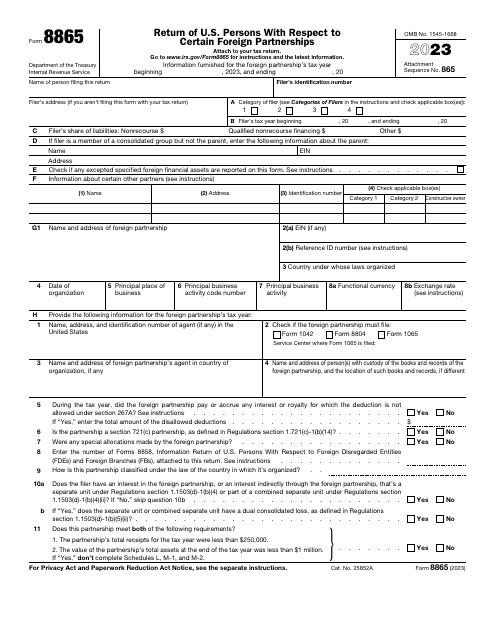

This document is used for reporting acceleration events and exceptions related to the gain deferral method under Section 721(c) on IRS Form 8865 Schedule H.

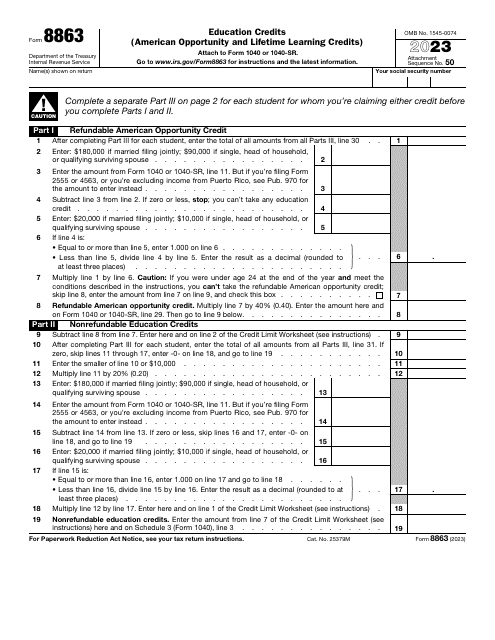

Fill in this form to claim one of the Internal Revenue Service (IRS) educational tax credits. It will provide a dollar-for-dollar reduction in the amount of tax owed at the end of the reporting year for the expenses incurred to attend educational institutions that participate in the student aid programs.

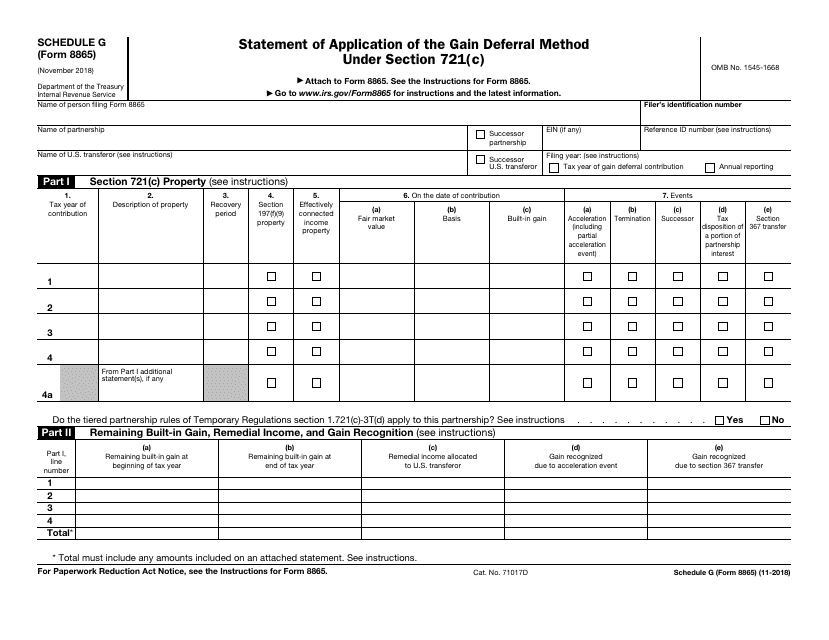

This Form is used for reporting the application of the gain deferral method under Section 721(c) on IRS Form 8865 Schedule G.

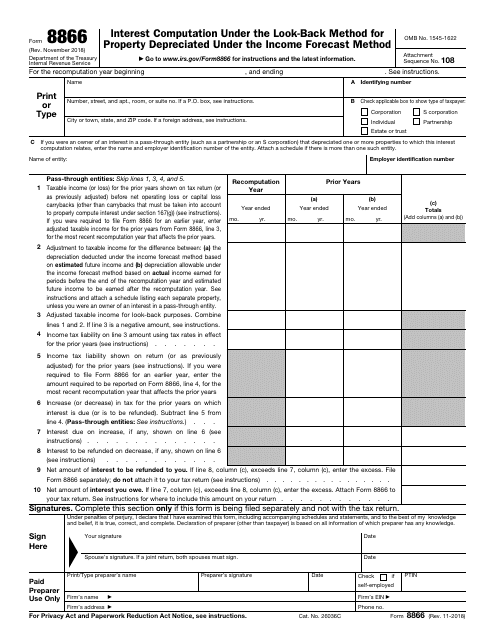

This form is used for calculating interest under the look-back method for property that has been depreciated using the income forecast method.

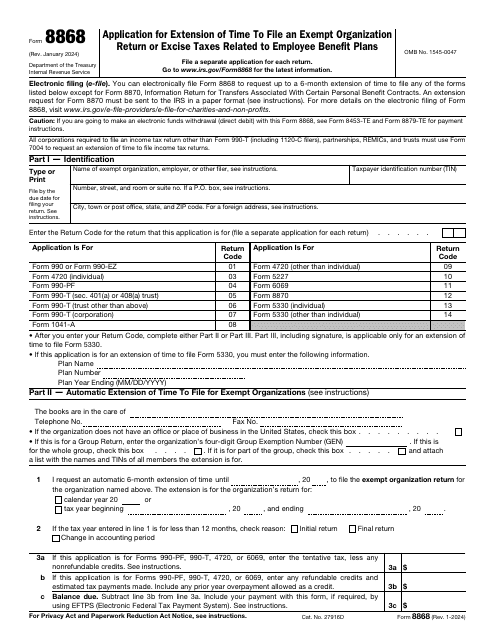

This is a formal IRS form that exempt organizations have to use to inform the fiscal authorities about late filing of a return.