Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

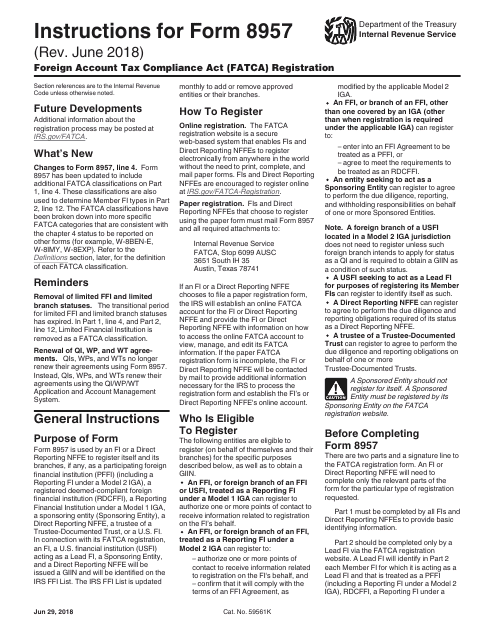

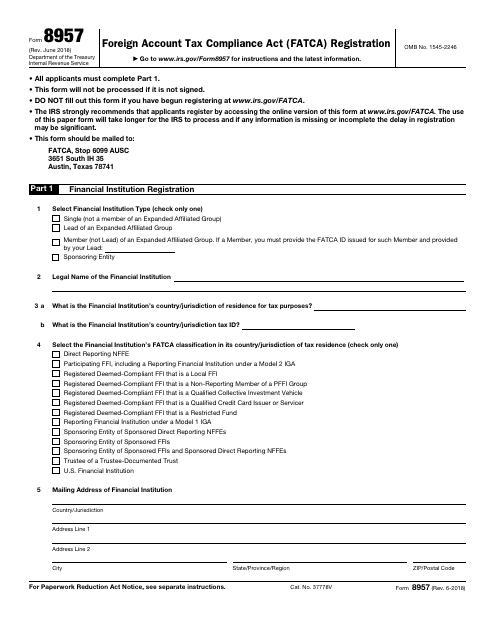

This document provides instructions for completing IRS Form 8957 for the registration of Foreign Account Tax Compliance Act (FATCA). It guides individuals and entities on how to properly fill out the form to comply with FATCA regulations.

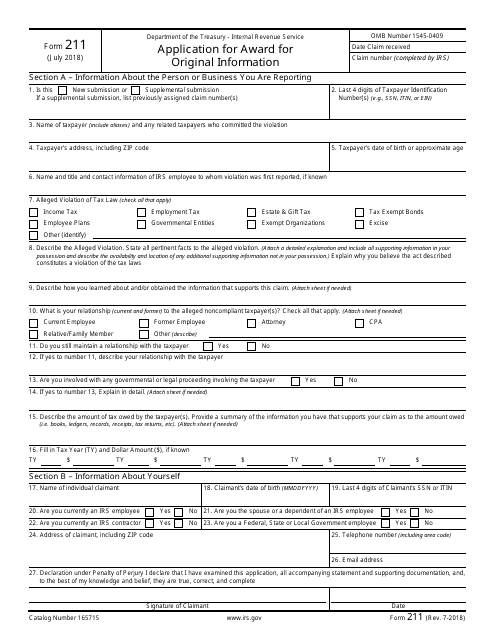

This Form is used for applying for a monetary award with the IRS by providing original information about possible tax fraud.

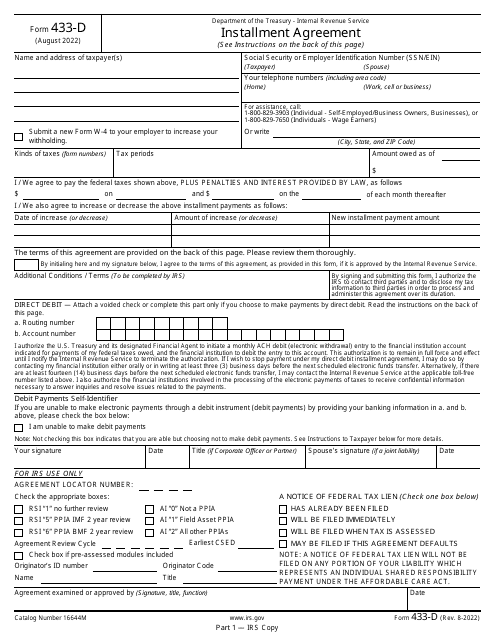

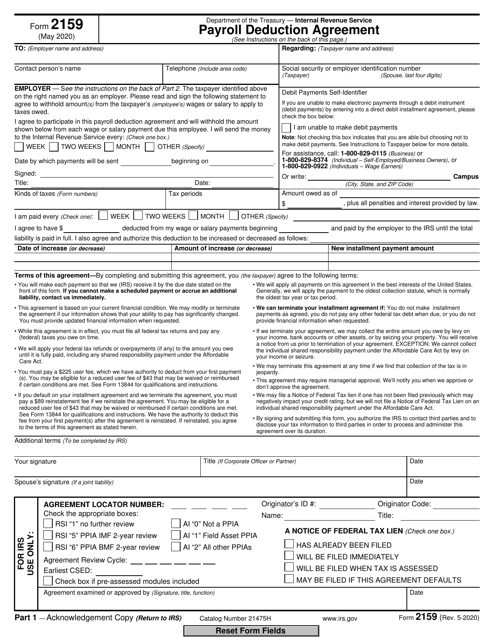

This is a fiscal form used by a taxpayer to express their intention to pay off their tax debt via a direct debit payment.

This is a fiscal IRS form filled out by the cooperative that paid patronage dividends during the tax year.

This is a formal IRS document completed to outline the discount received on particular debt instruments.

This is a formal statement filled out by the organization that manages certain retirement accounts to inform the recipient of the distribution about the income they generated and report the details to tax organizations.

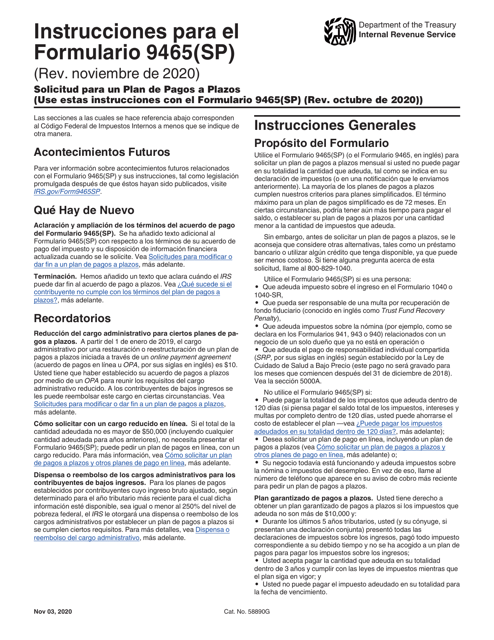

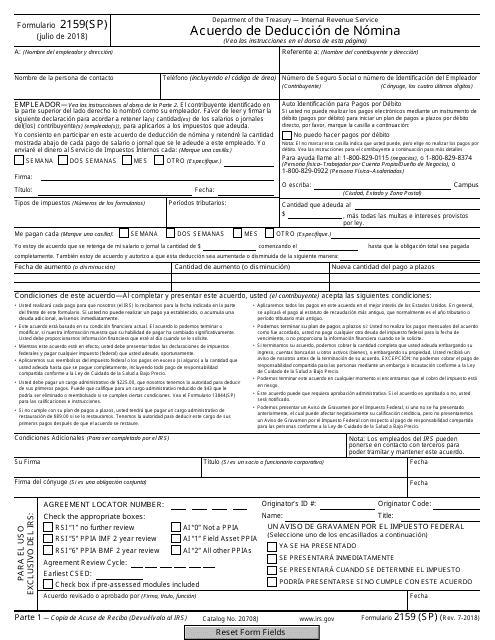

This Form is used for making an agreement for payroll deduction with the IRS. It is available in Spanish language.

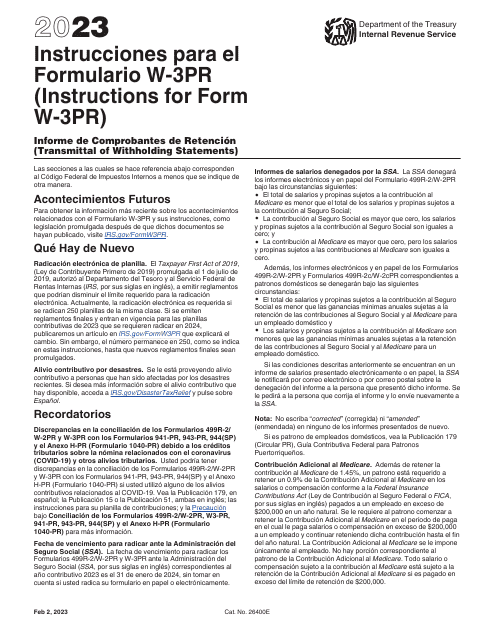

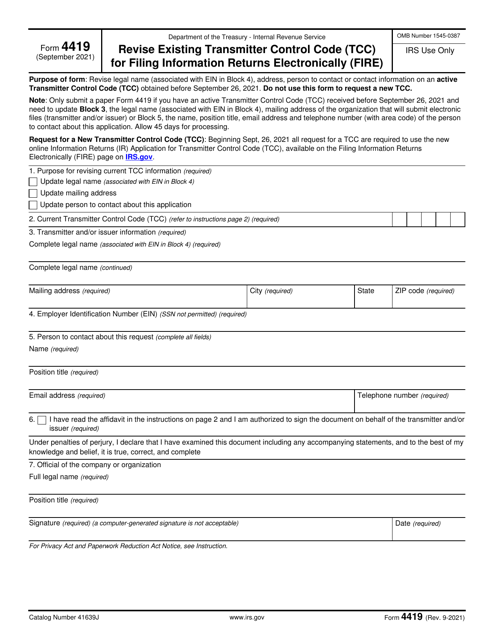

This is a formal IRS statement prepared and submitted by taxpayers that have active Transmitter Control Codes.

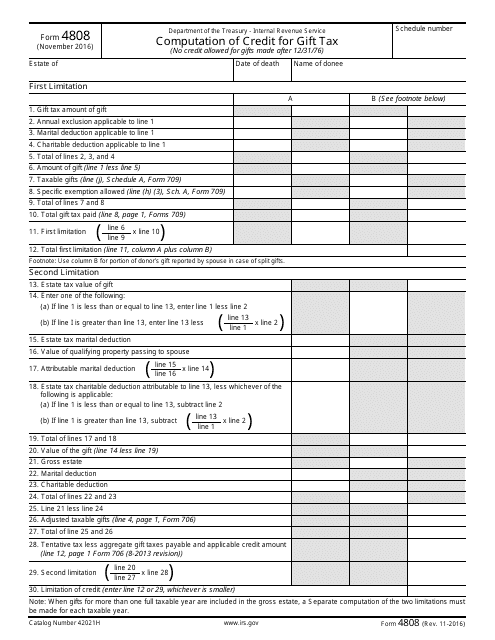

This is a supplementary form designed by the tax authorities to help a taxpayer figure out the credit they are allowed to claim while executing the estate of a deceased individual.

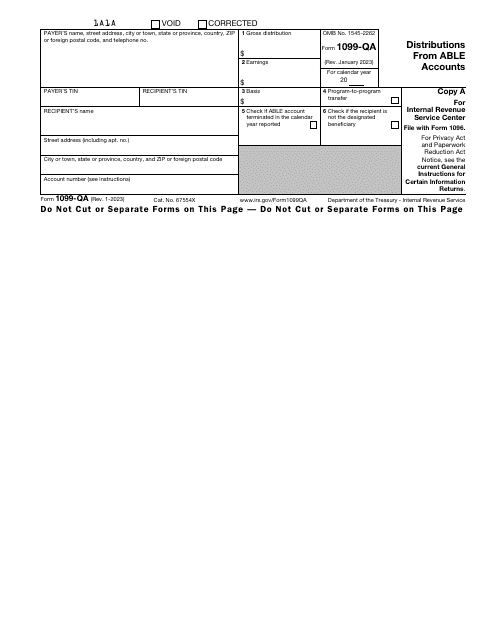

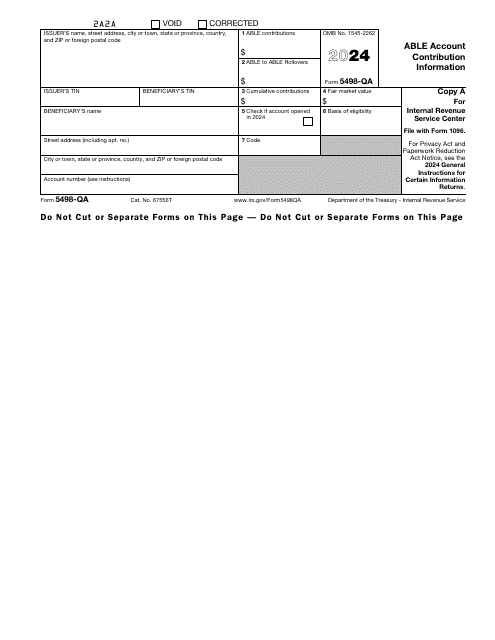

Download this form if you are an issuer of the savings account called Achieving a Better Life Experience (ABLE). This form is used to report the rollover contributions and program-to-program transfers, as well as other types of contributions made to an ABLE account.

This is a fiscal document used by issuers and trustees to report the amount of individual retirement arrangement contributions formalized during the calendar year covered in the paperwork.

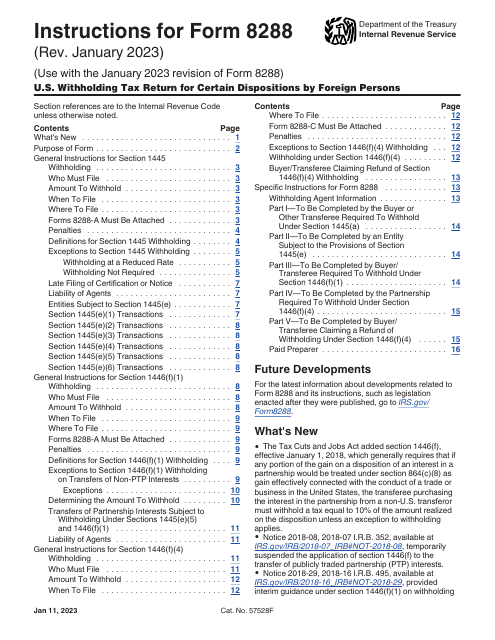

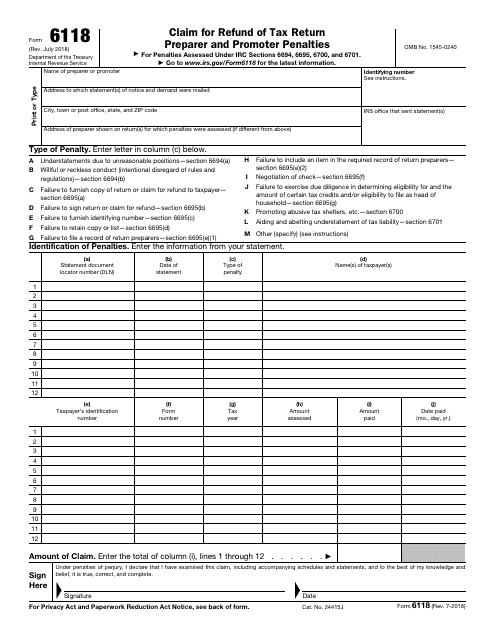

This form is used for claiming a refund of tax return preparer and promoter penalties imposed by the IRS.

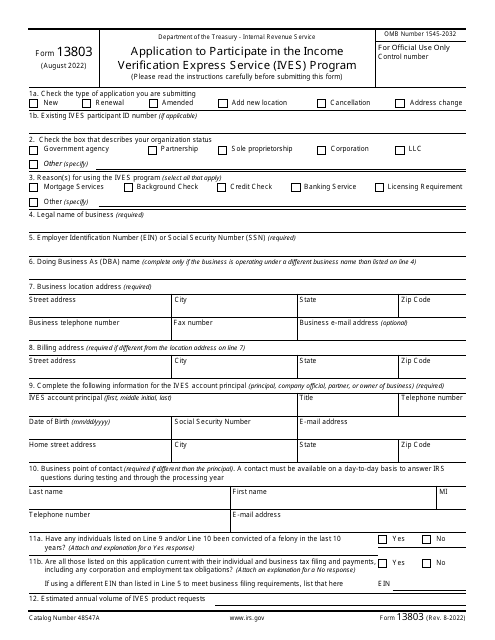

This form is used for registering under the Foreign Account Tax Compliance Act (FATCA) with the IRS to report foreign financial accounts.

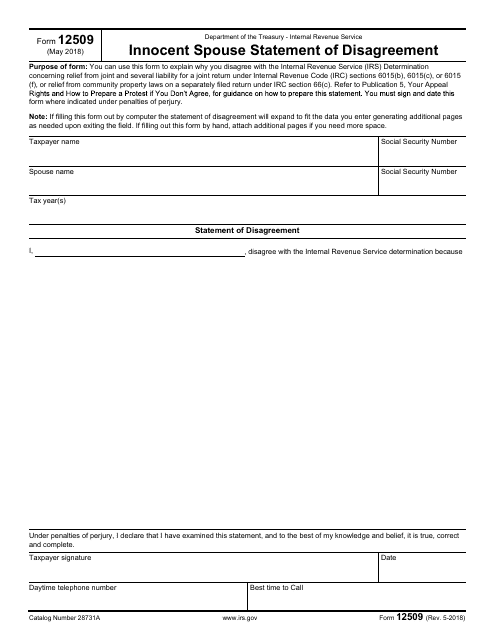

Use and send this legal document to the Internal Revenue Service (IRS) if you're a taxpayer who wants to express an objection to a decision made by the IRS.

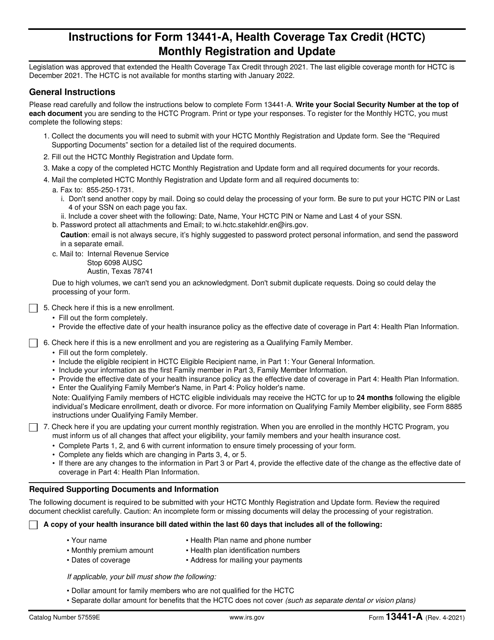

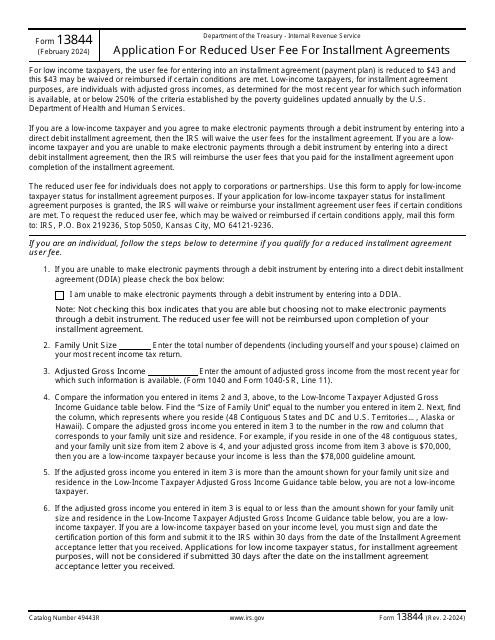

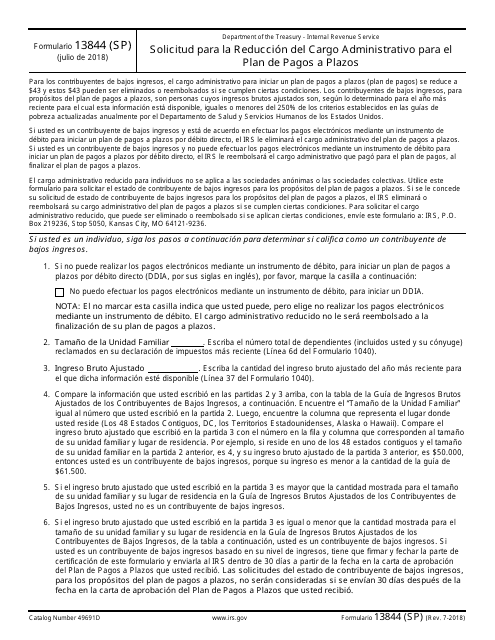

This Form is used for requesting a reduction in administrative fees for an installment payment plan.

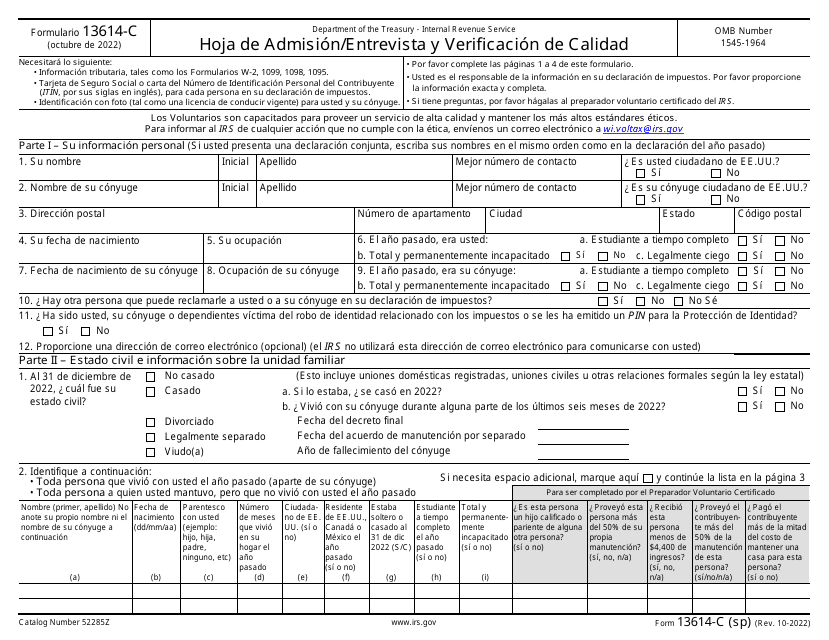

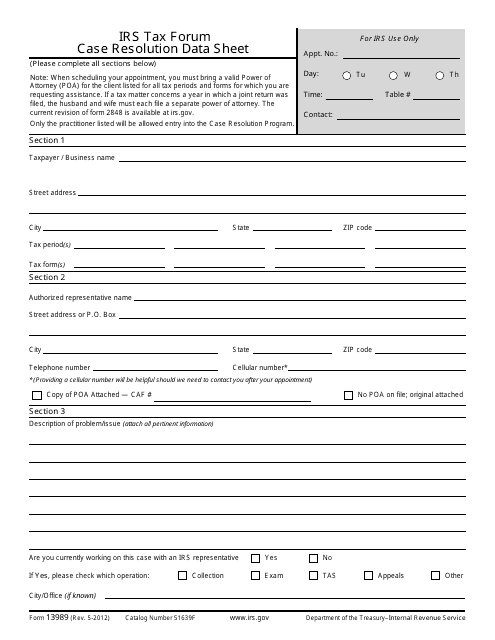

This form is used for collecting data and resolving cases discussed in the IRS Tax Forum.

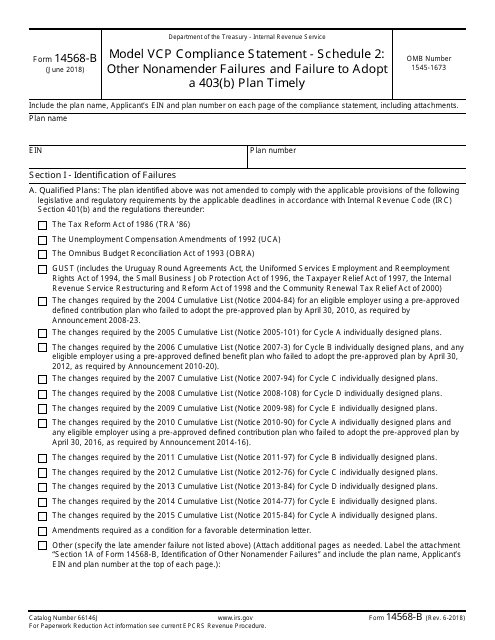

This document is used for reporting nonamender failures and failure to adopt a 403(b) plan on time. It is a schedule associated with the IRS Form 14568-B Model VCP Compliance Statement.

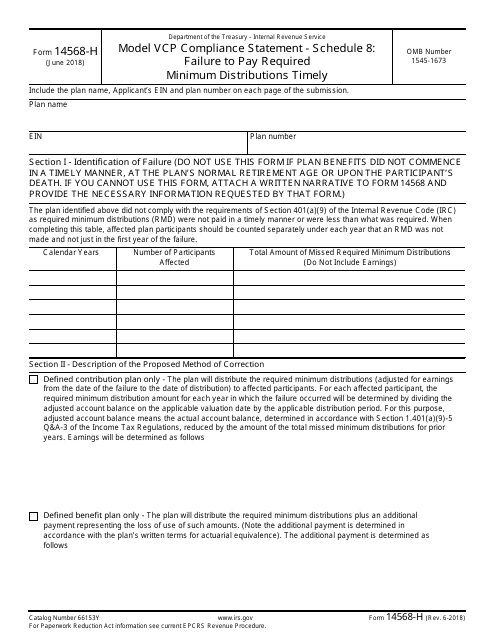

This document is used for submitting a VCP compliance statement to the IRS for failure to pay required minimum distributions on time.

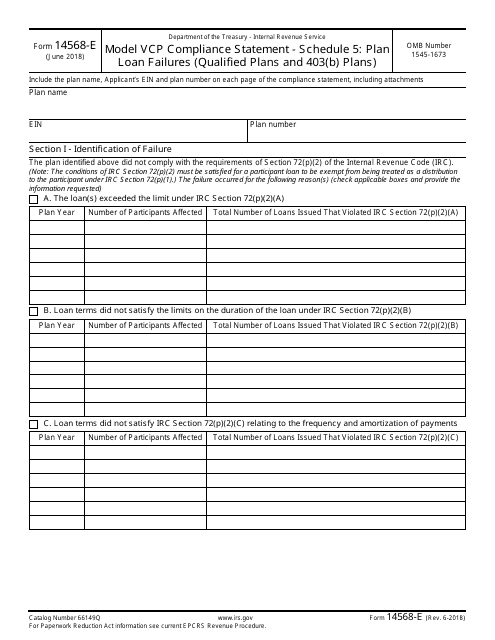

This document is used for reporting plan loan failures for qualified plans and 403(b) plans as part of the IRS voluntary correction program.