Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

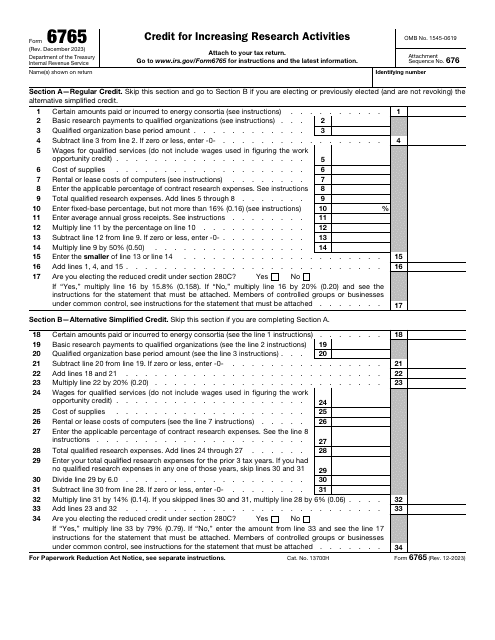

This is a document you may use to figure out how to properly complete IRS Form 6765

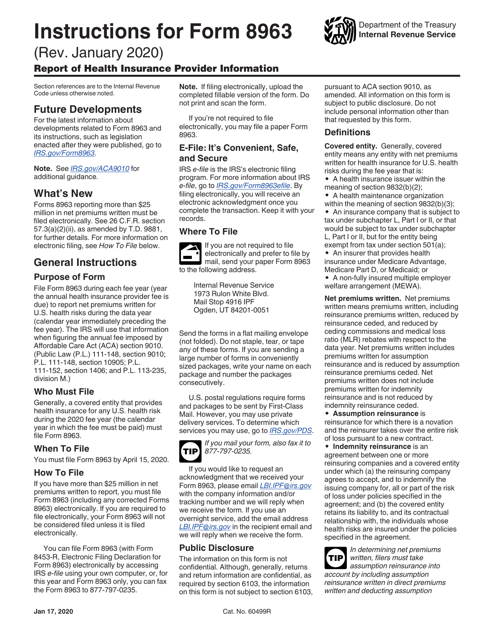

This form is used for reporting the alternative tax on qualifying shipping activities to the IRS. It provides instructions on how to calculate and report the tax owed related to shipping activities.

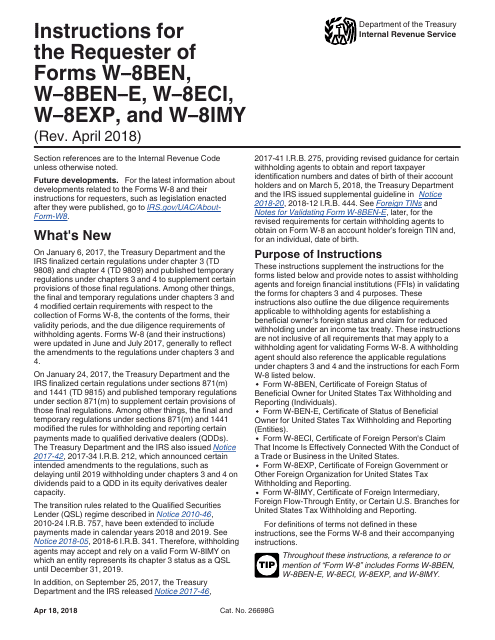

This document provides instructions for various IRS forms including W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY. These forms are used to certify the foreign status of the taxpayer and claim eligibility for tax treaty benefits, exemption from withholding, or reduced withholding rates. The instructions guide taxpayers on how to complete these forms correctly and provide required information to the IRS.

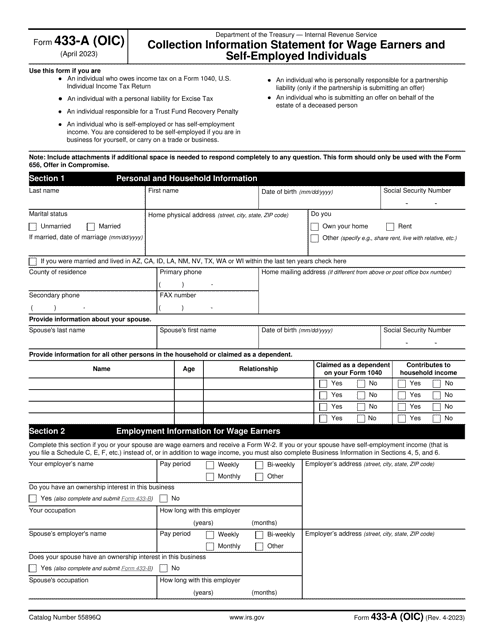

This is a formal IRS document that outlines the financial health of a business entity that owes a tax debt to the government.

IRS Form 433-A (OIC) Collection Information Statement for Wage Earners and Self-employed Individuals

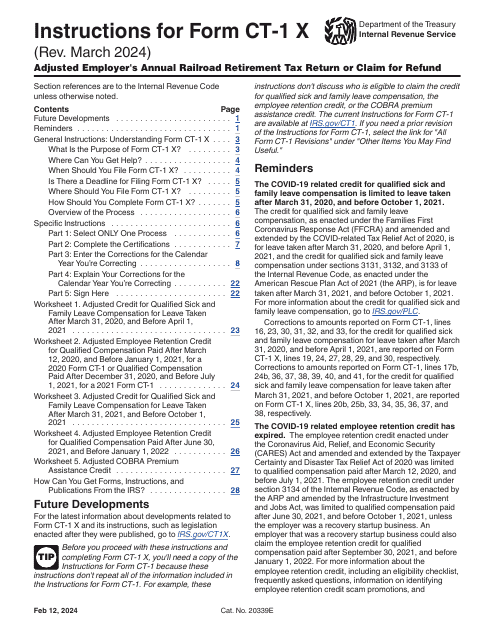

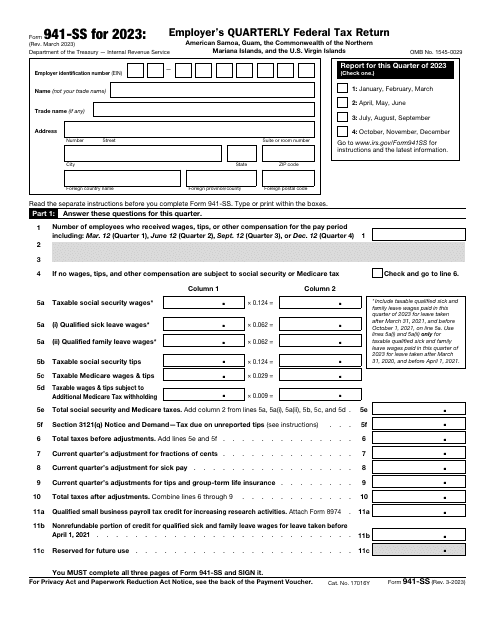

This document, otherwise known as the Employer's Quarterly Federal Tax Return, is a form downloaded to report about your social security and Medicare taxes. This form is used only if the official place of business is located within the specified territories.

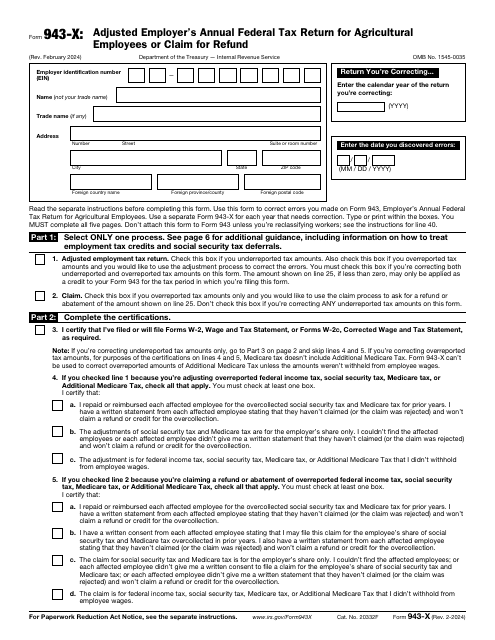

This is an IRS form designed to allow taxpayers to amend the information they previously filed reporting tax deducted from an employee's wages.

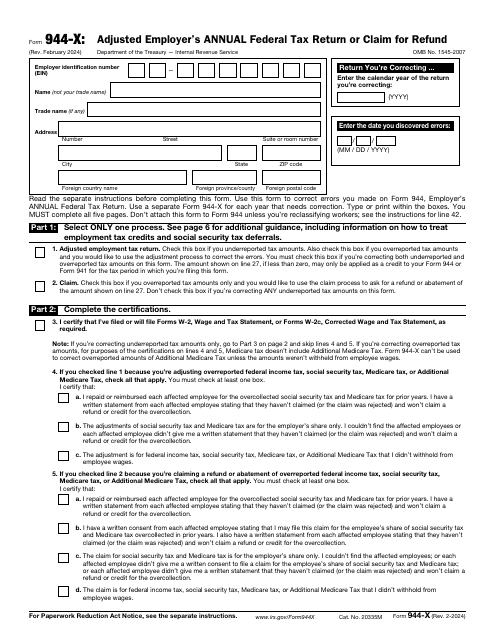

This is a fiscal form used by employers that learned about the need to correct a previously filed IRS Form 944, Employer's Annual Federal Tax Return.

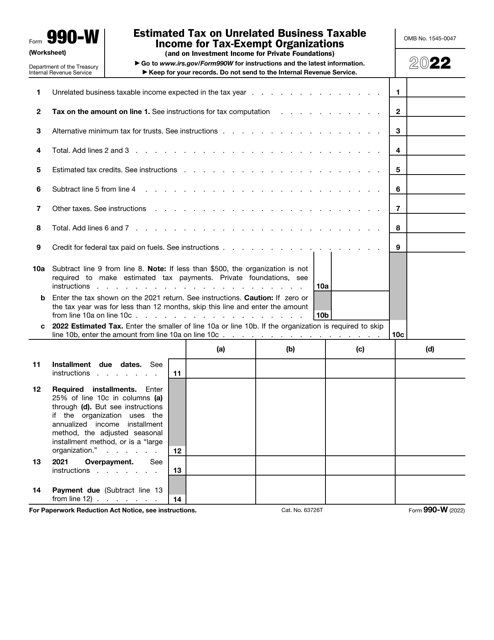

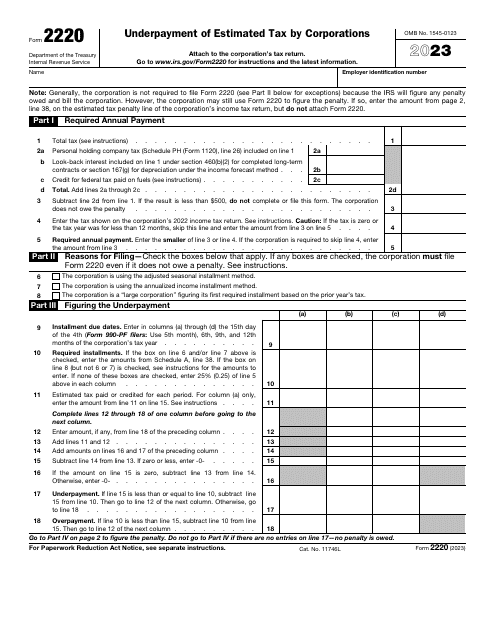

Use this form to report the income you received or expect to receive for the tax year and to pay the expected tax on that income (only if you are required to do so).

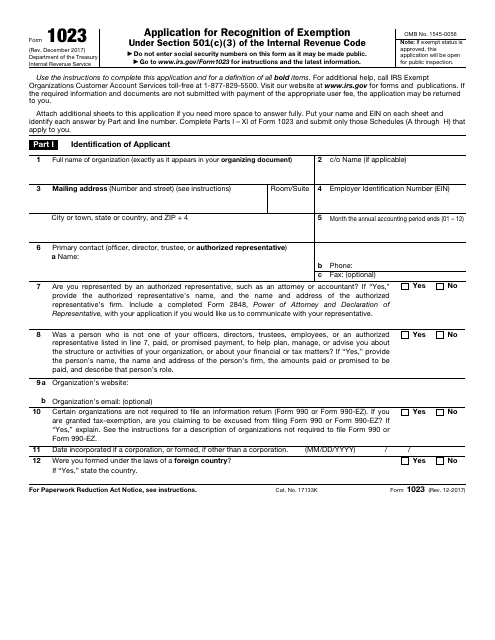

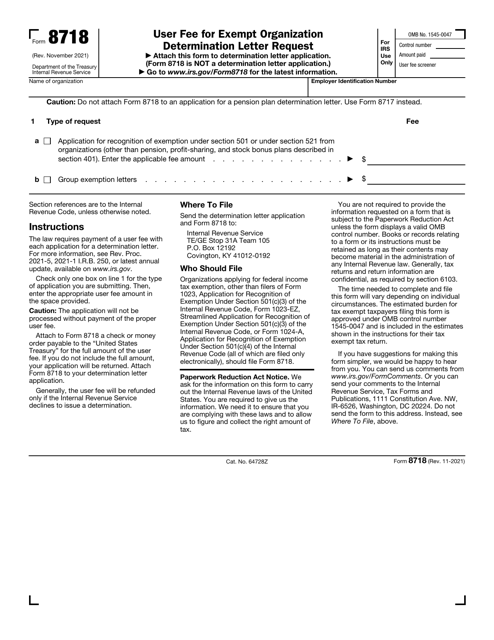

This Form is used for applying for tax-exempt status for charitable organizations with the IRS.

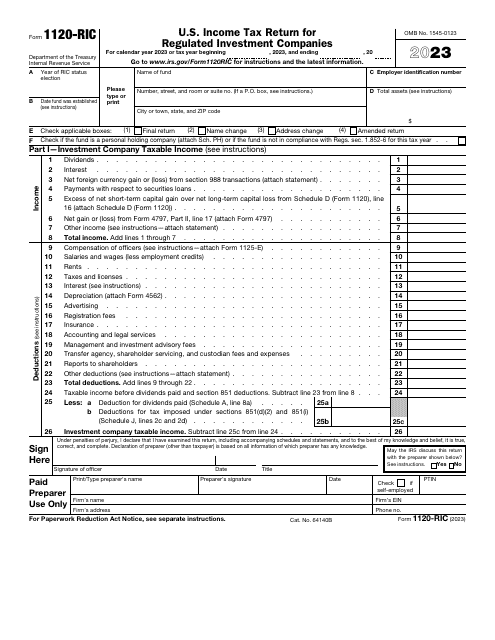

This is a fiscal form used by regulated investment companies to inform the government about their revenue over the course of the tax year, describe their losses and gains, claim tax deductions and credits, and compute their tax liability correctly.

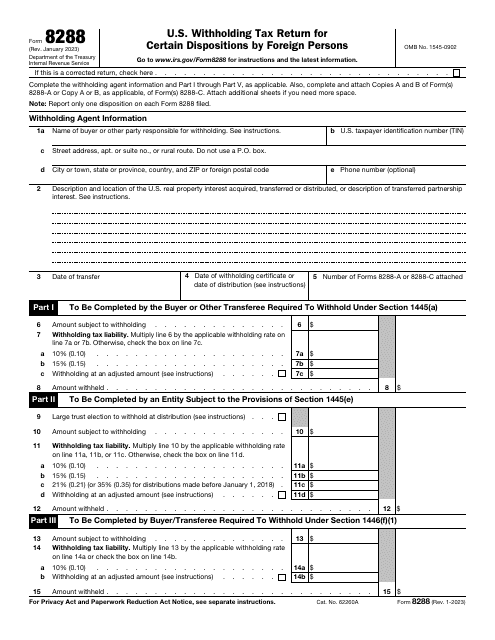

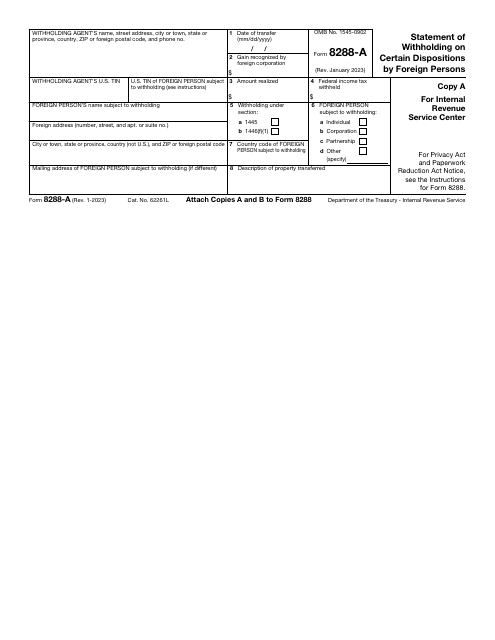

This is a supplementary document used by a withholding agent to describe the disposition of real property and report how much tax was withheld as a result of the transaction.