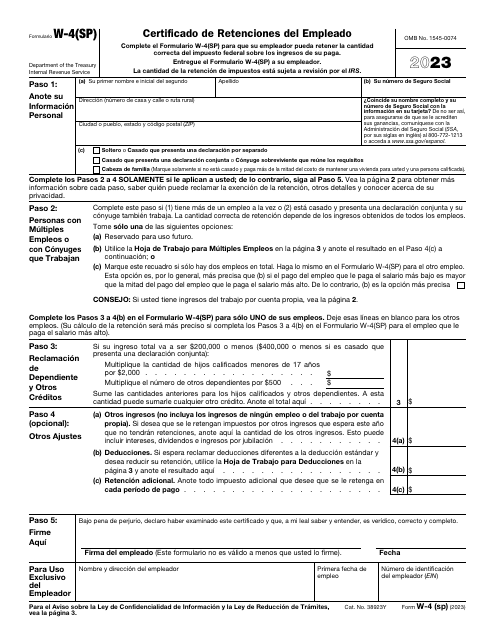

Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

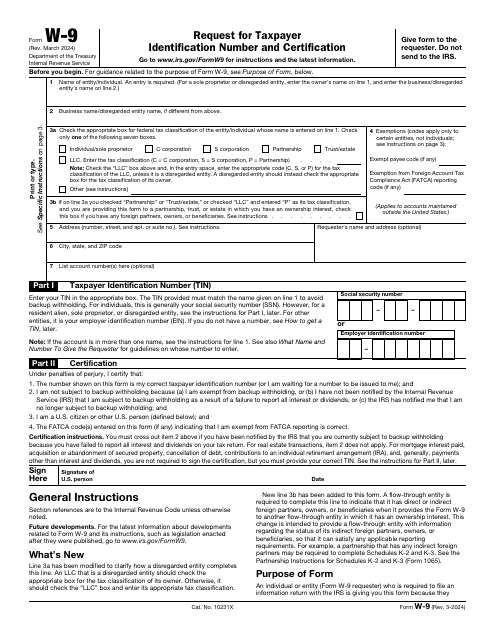

This is a formal instrument completed by a taxpayer to list their full name, contact details, and taxpayer identification number when requested by a party they worked with.

This is an IRS form that includes the details of an installment sale.

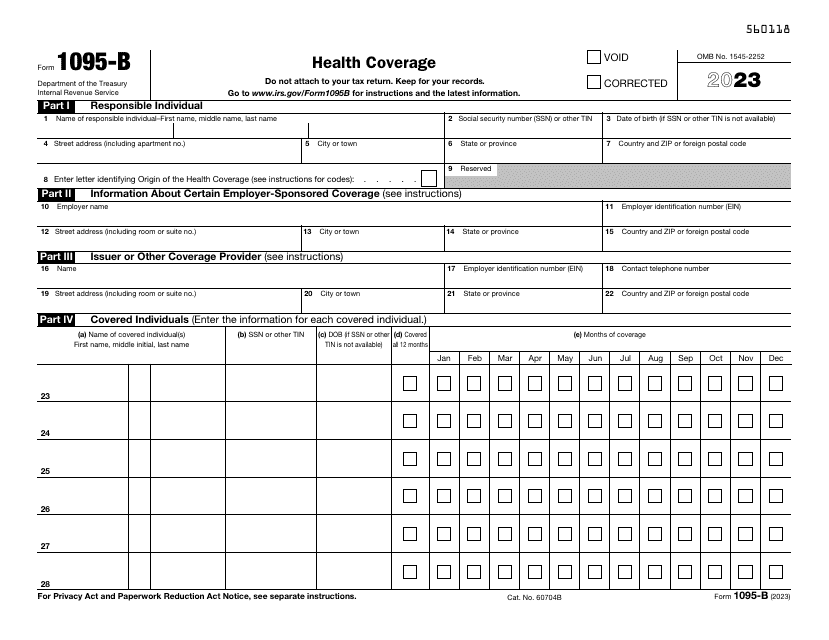

Use this document, otherwise known as the IRS Health Coverage Form, for submitting a report to the Internal Revenue Service (IRS) and to taxpayers about individuals with minimum essential coverage who are not liable for the individual shared responsibility payment.

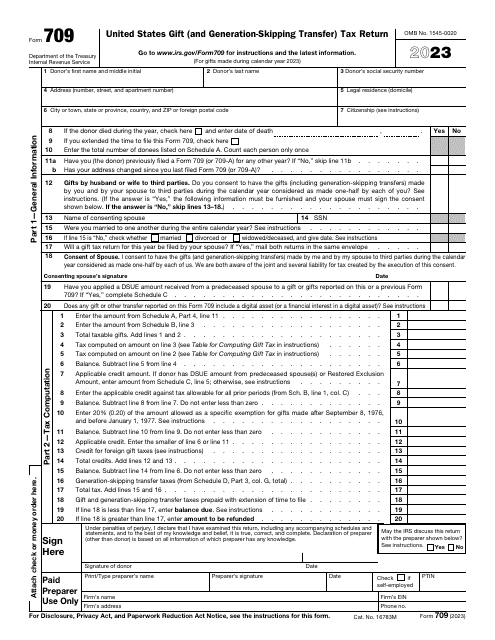

This is a formal document used by taxpayers to outline asset transfers that are considered gifts and are subject to tax.

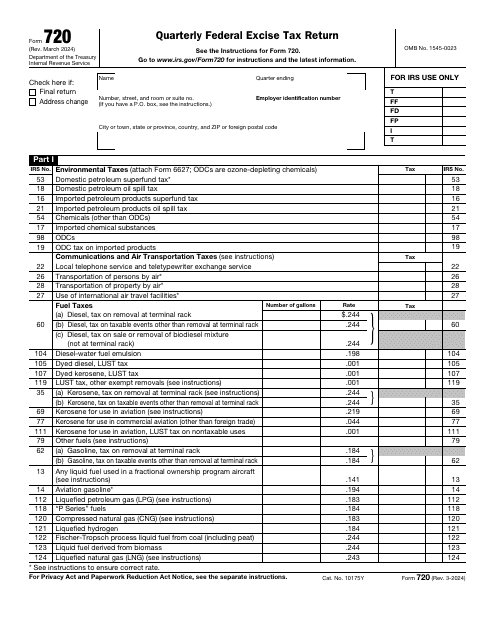

This is a fiscal document used by taxpayers to outline the excise taxes charged on certain services and goods.

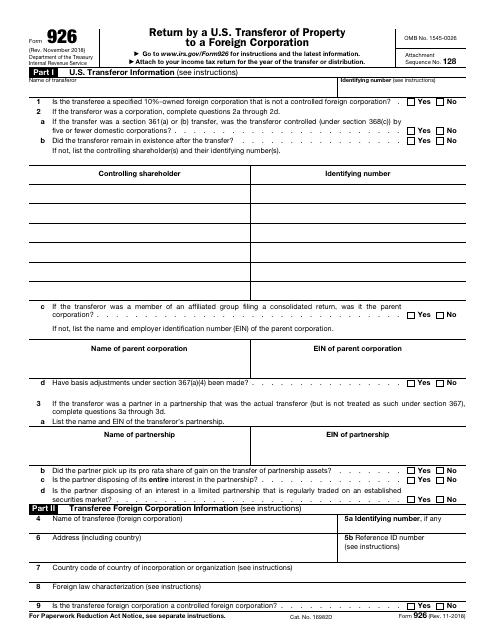

Fill in this form developed for U.S. citizens and residents, domestic corporations, and domestic estate or trusts, to report certain transfers of property to a foreign corporation.

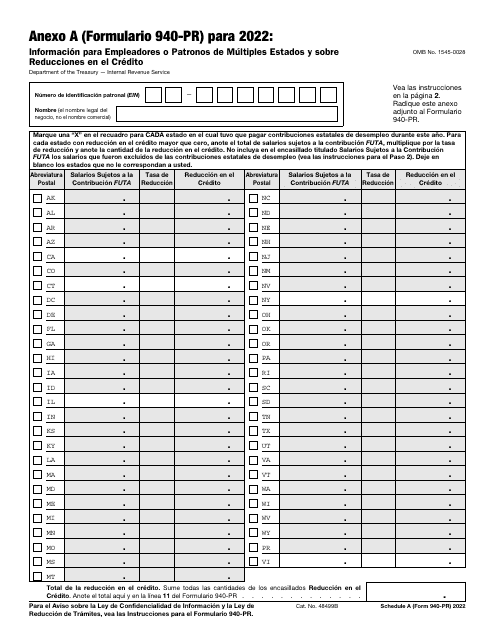

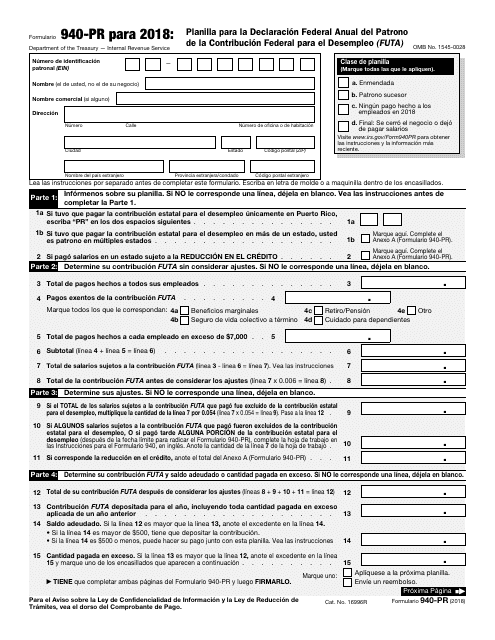

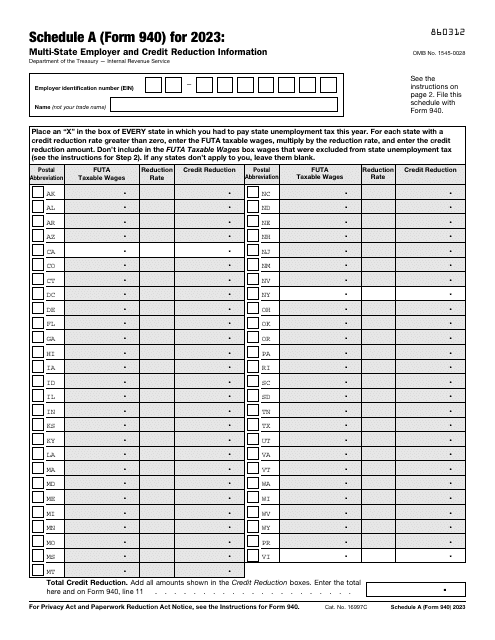

This is a supplementary form used by a taxpayer to figure out their annual federal unemployment tax.

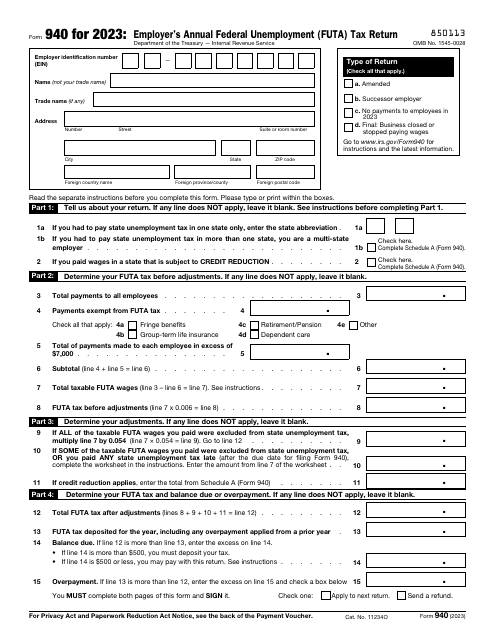

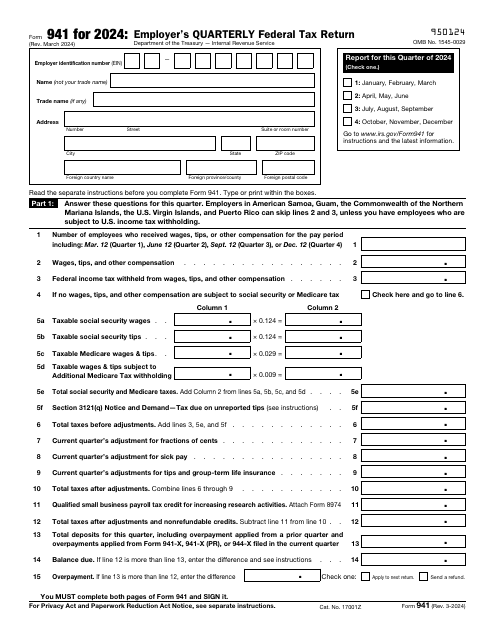

This is a formal statement used by companies to tell tax organizations about the salaries and tips their employees have received over the course of the previous quarter and the tax already subtracted from the workers' salaries.

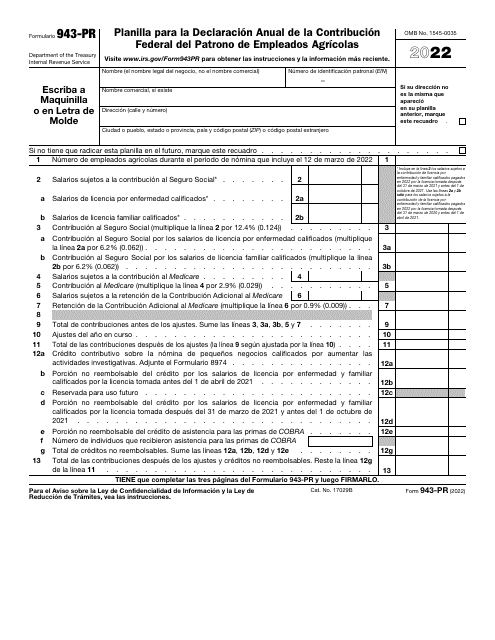

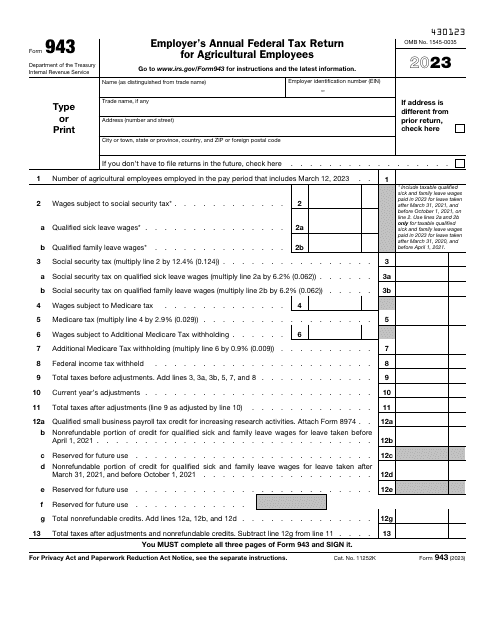

If you paid wages in the reported tax year to one or more farm workers, file this form for your annual federal tax return in case the wages you paid to your farmworkers were subject to the federal income, Medicare, or social security tax withholdings.

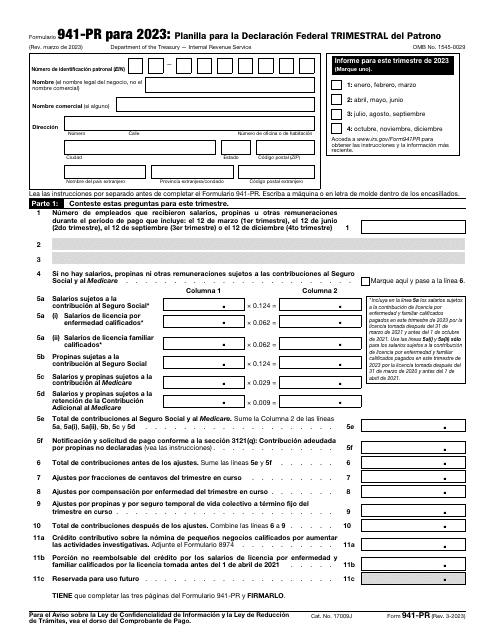

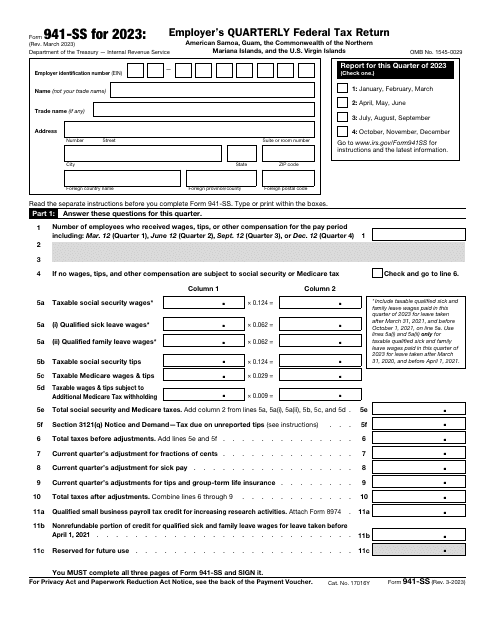

This document, otherwise known as the Employer's Quarterly Federal Tax Return, is a form downloaded to report about your social security and Medicare taxes. This form is used only if the official place of business is located within the specified territories.

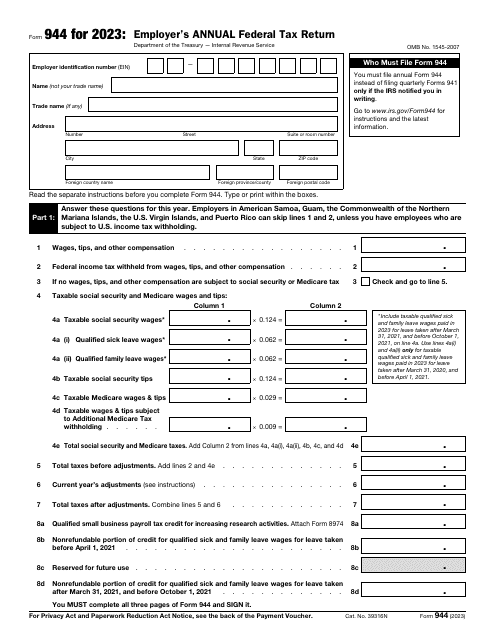

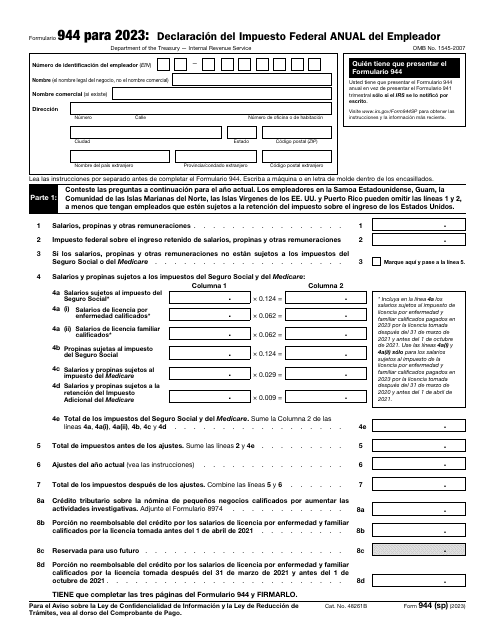

This is a fiscal document filled out by employers with a low annual tax liability to report their payroll activities to tax organizations.

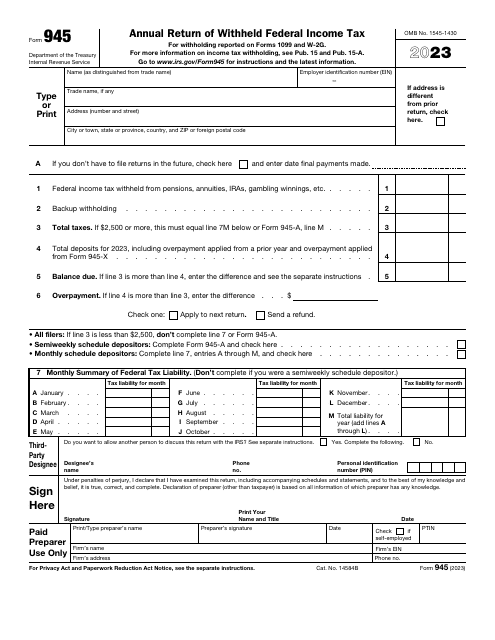

This is a fiscal form taxpayers are obliged to prepare and submit to provide information about nonpayroll payments subject to tax and confirm they are paying an accurate amount of tax for the last year.

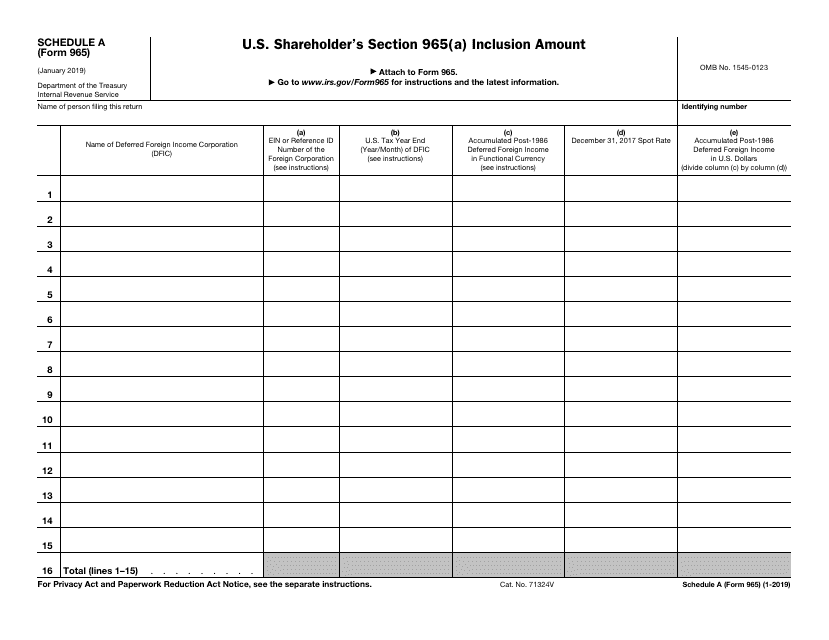

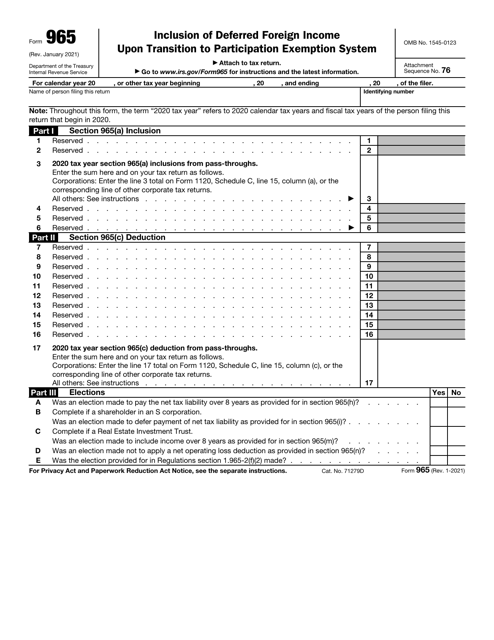

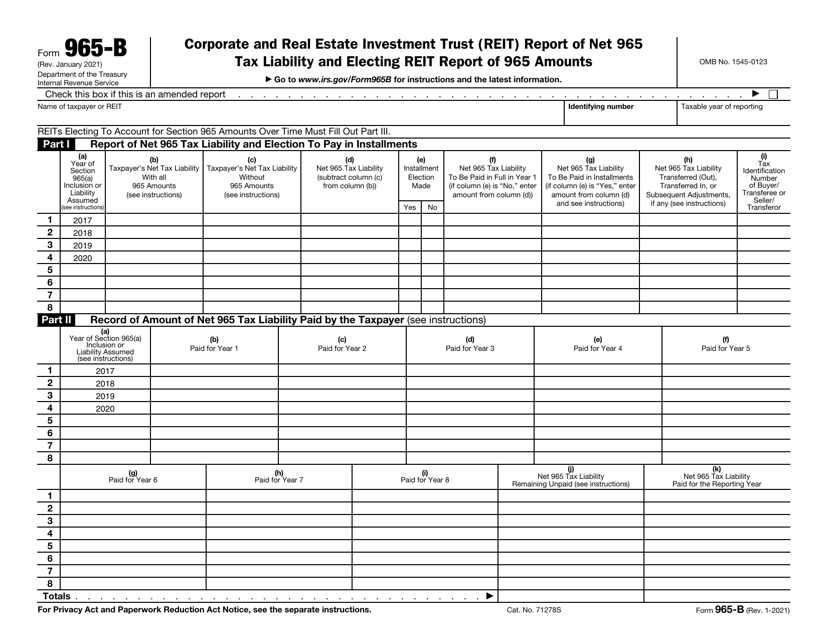

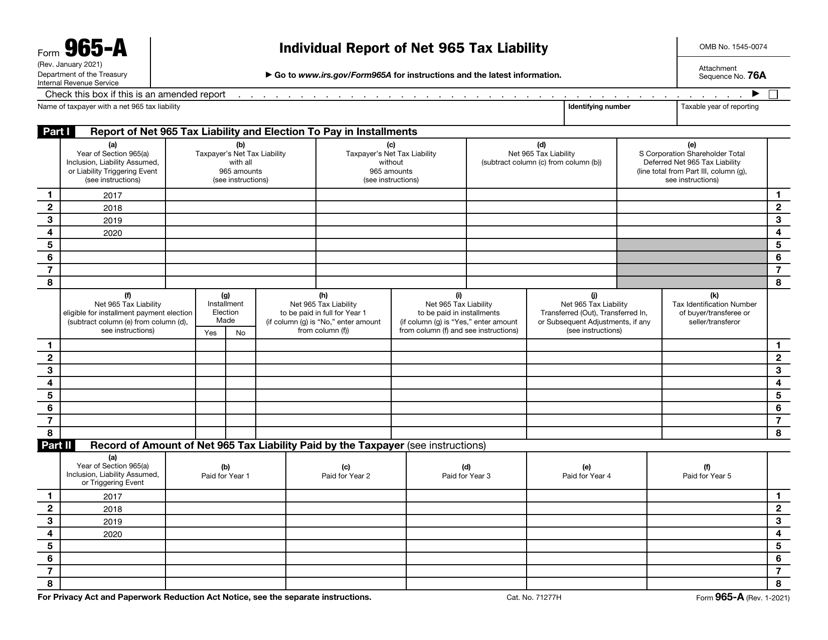

This Form is used for reporting the Section 965(A) Inclusion Amount for U.S. shareholders.

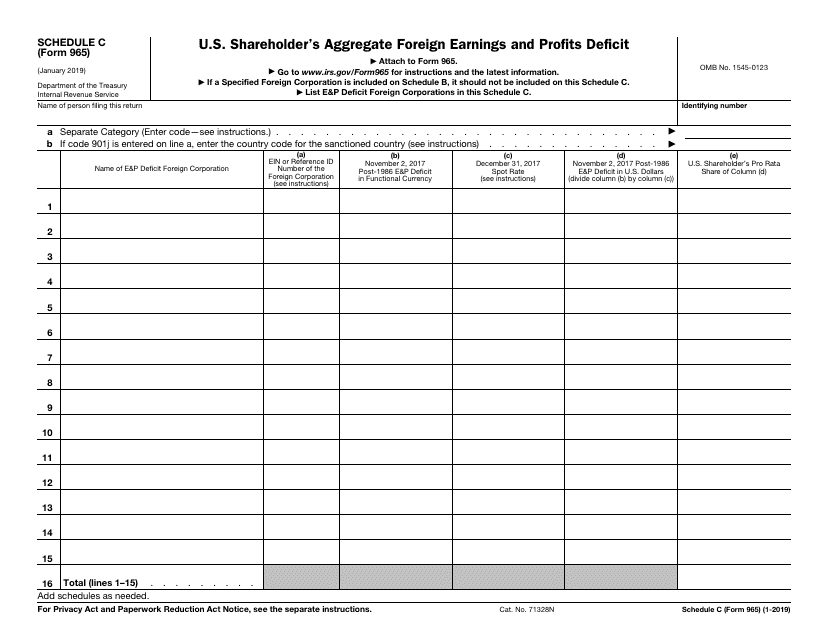

This Form is used for reporting the U.S. shareholder's aggregate foreign earnings and profits deficit to the IRS.

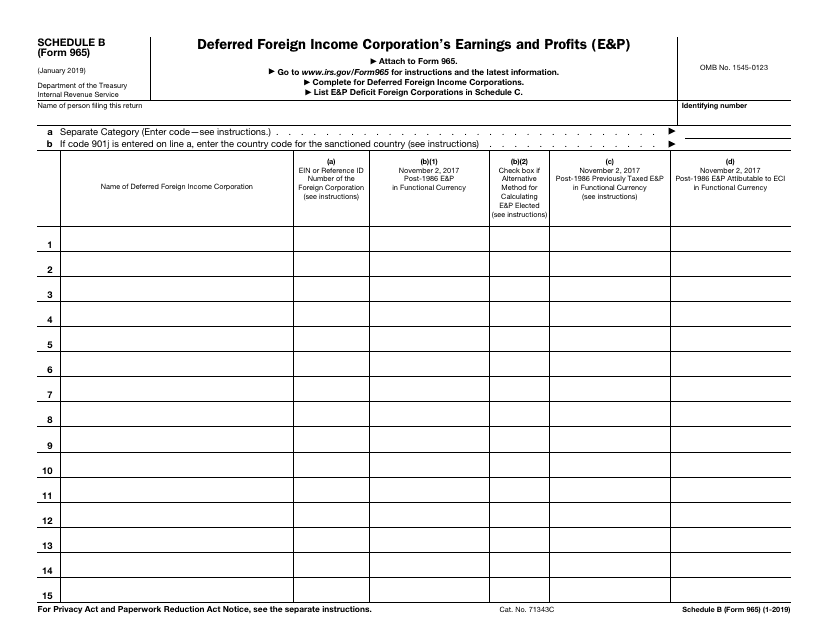

This Form is used for reporting the deferred foreign income and the earnings and profits of a foreign corporation.

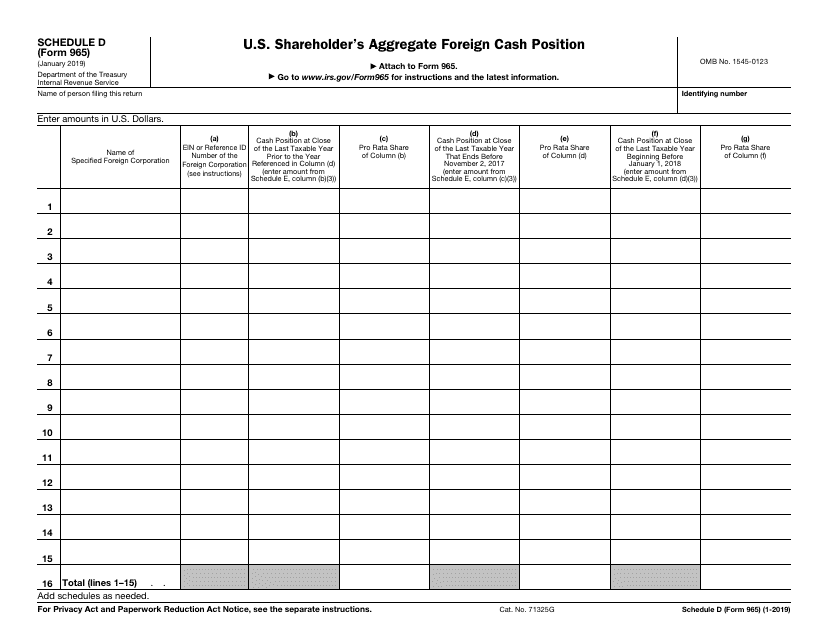

This form is used for reporting a U.S. shareholder's aggregate foreign cash position on Schedule D.

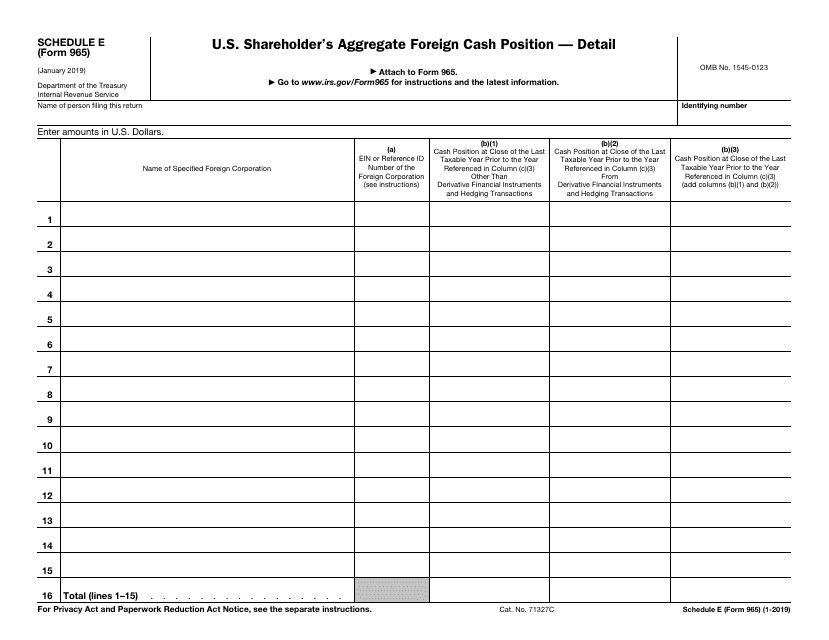

This form is used for reporting the aggregate foreign cash position of a U.S. shareholder on Schedule E.

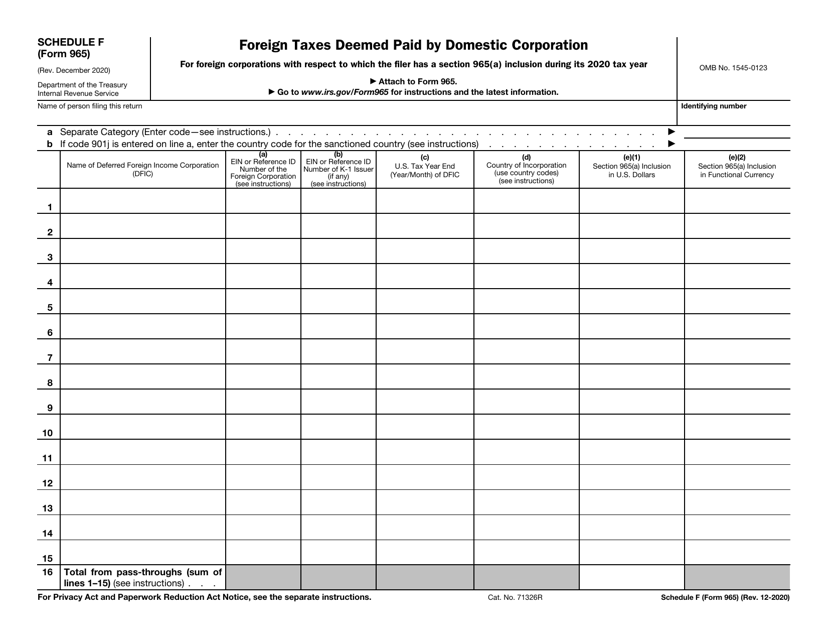

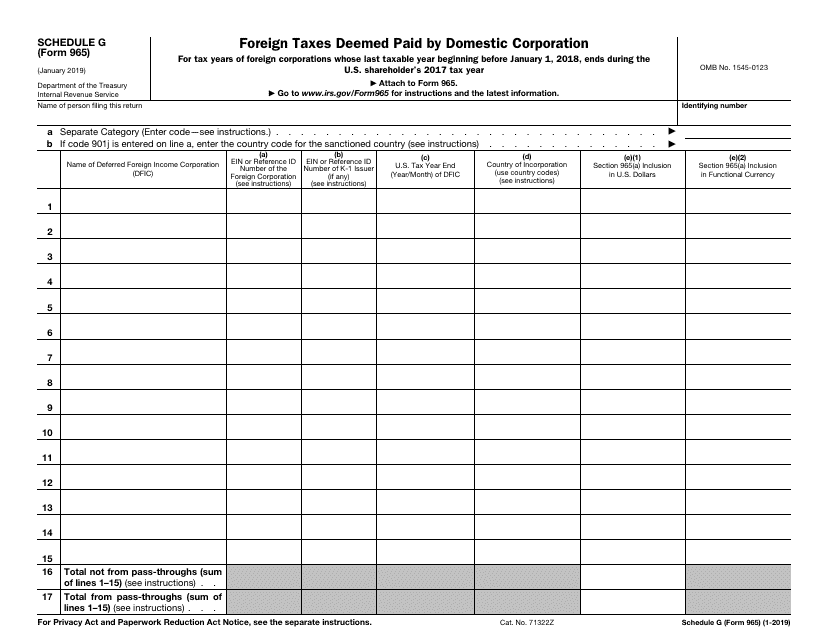

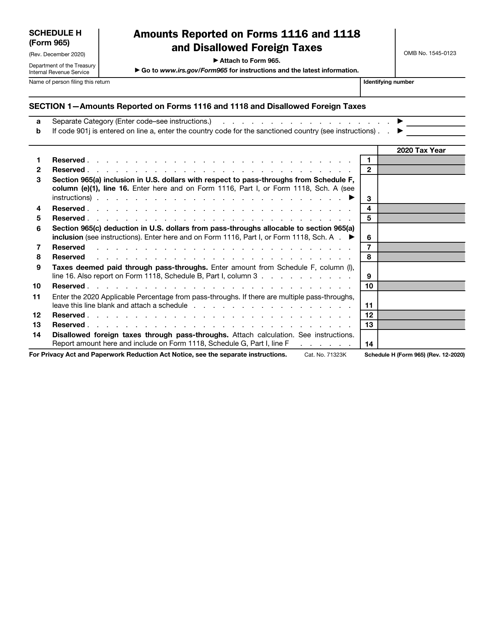

This Form is used for reporting foreign taxes deemed paid by a domestic corporation. It is required by the IRS for tax purposes.

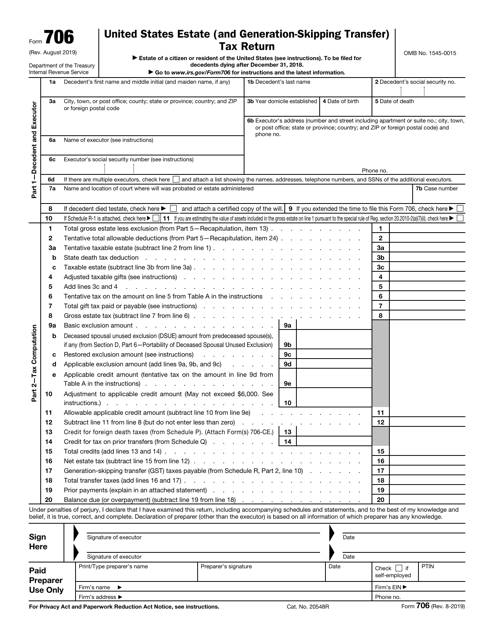

This is a formal statement prepared and submitted by estate administrators to calculate the estate tax liability of the person that recently died.

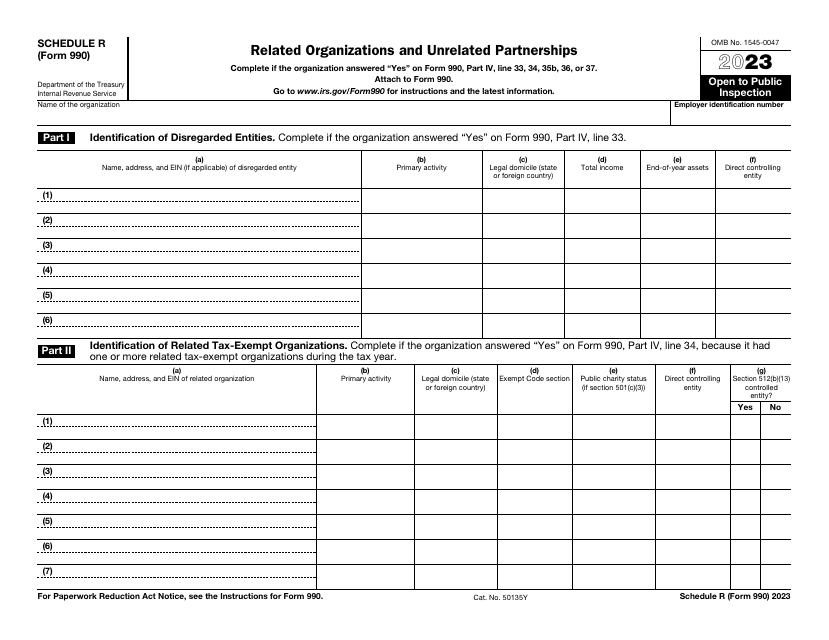

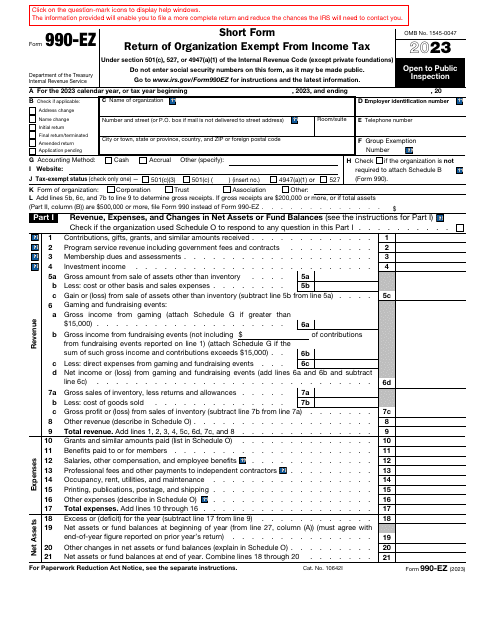

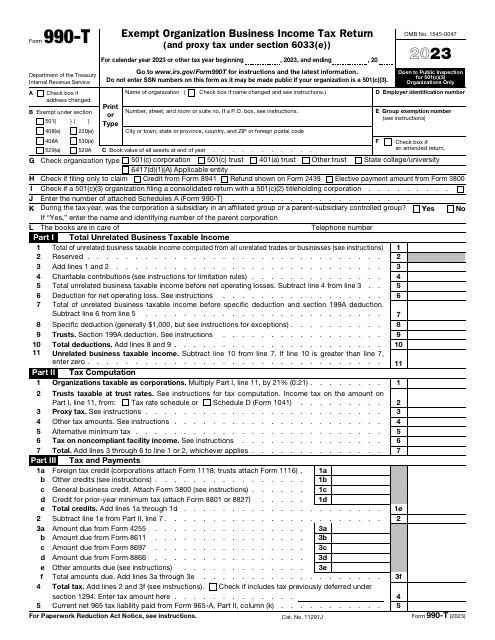

This is a fiscal form used by tax-exempt organizations required to inform tax organizations about their earnings, expenses, and achievements over the course of the year.