Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

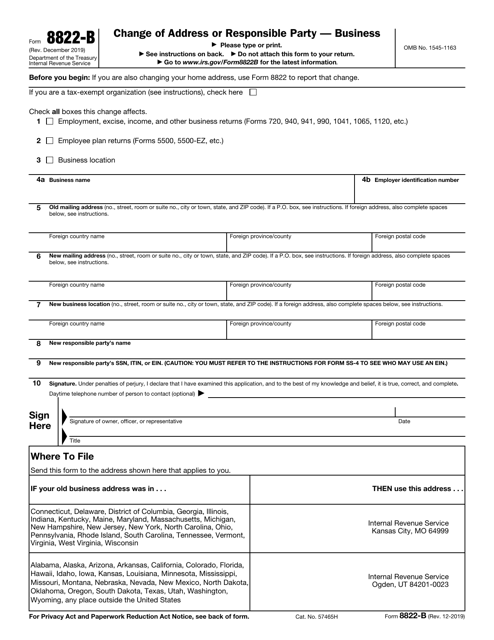

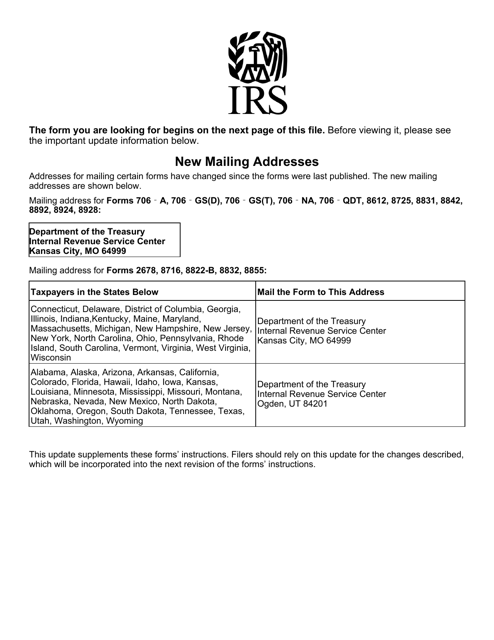

This is a formal document prepared by an entity to share a new mailing address with fiscal authorities or identify the person who will be in charge of managing the funds and assets of the business from now on.

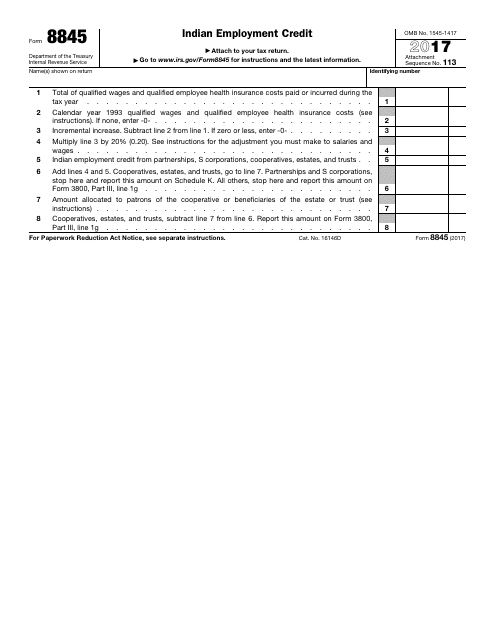

This Form is used for claiming the Indian Employment Credit, which provides tax incentives to businesses that hire Native Americans in certain geographic areas.

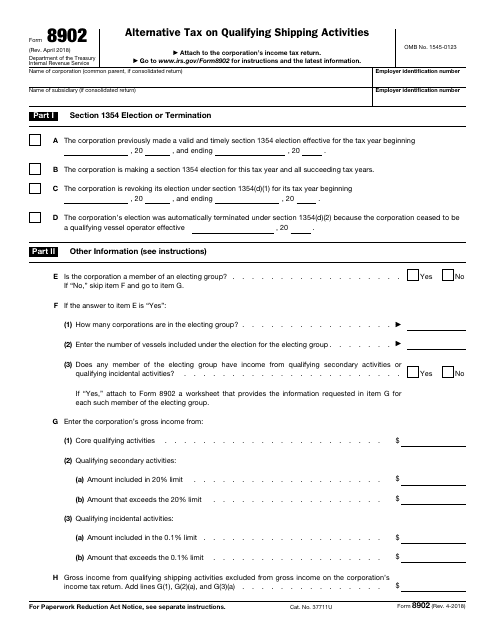

This form is used for reporting and calculating the alternative tax on qualifying shipping activities to the Internal Revenue Service (IRS). It is used by businesses involved in shipping activities to determine the amount of tax they owe.

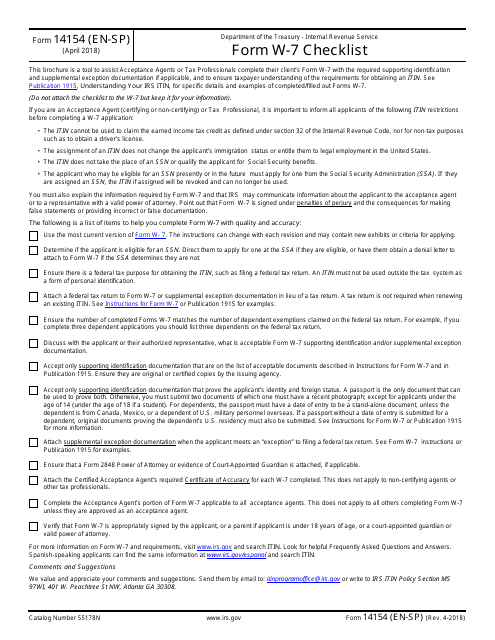

This document is a checklist for Form W-7, which is used to apply for an Individual Taxpayer Identification Number (ITIN). It is available in both English and Spanish.

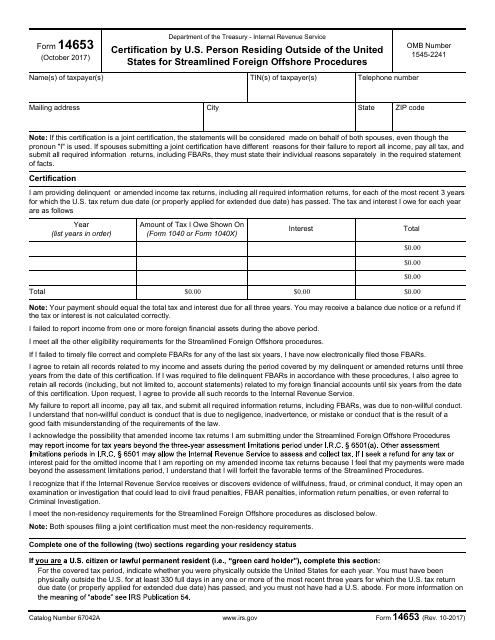

This form is used for certifying that a U.S. person residing outside of the United States is eligible for the Streamlined Foreign Offshore Procedures offered by the IRS.

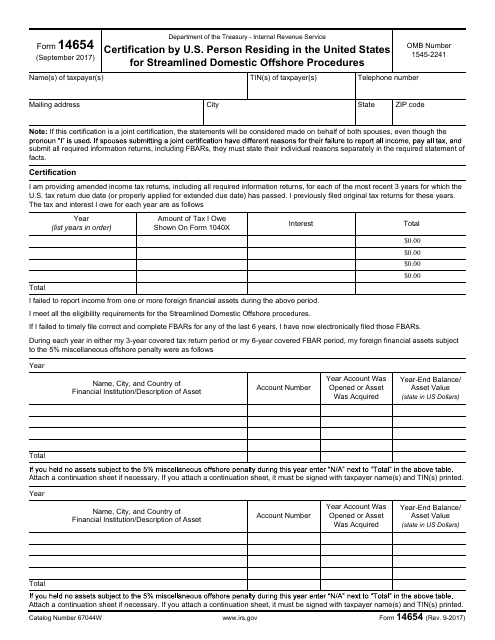

This form is used for U.S. persons who reside in the United States and want to certify their compliance with the streamlined domestic offshore procedures for reporting offshore income and assets to the IRS.

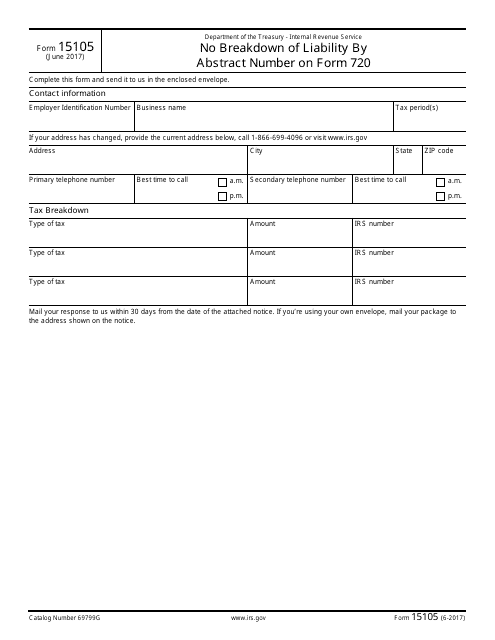

This type of document, IRS Form 15105, does not provide a breakdown of liability by abstract number on Form 720.

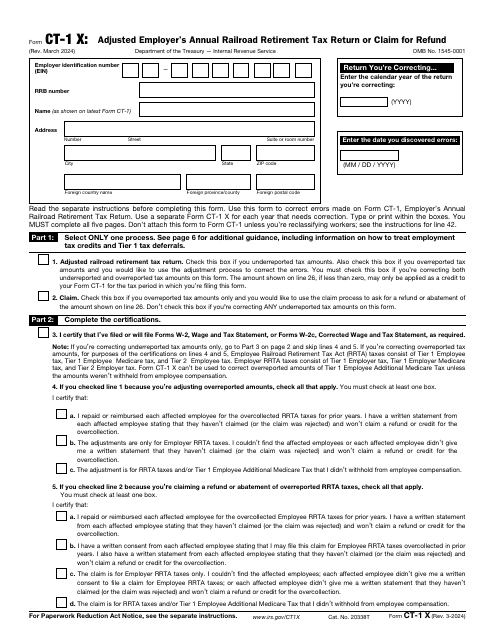

This is a formal document used by railroad industry employers to correct errors they have noticed upon filing IRS Form CT-1, Employer's Annual Railroad Retirement Tax Return.

This form is filed to report American Samoa wages and withheld taxes. It is not used for reporting income taxes in the United States. IRS Form W-2, Wage and Tax Statement is used in these cases.

Use this document to report the amount of withheld wages and taxes to the employee and appropriate authorities. The form is also known as a W-2 and is one of the crucial annual tax documents.

This form is filed to report Guam wages and tax deductions. The document was issued by the Internal Revenue Service (IRS), which can send you this form in a paper format, if you wish.

This document is designed to inform the Internal Revenue Service (IRS) about the United States Virgin Islands salaries and the amount of taxes deducted from them. This document was issued by the IRS, which can send you this form in a paper format, if you wish.

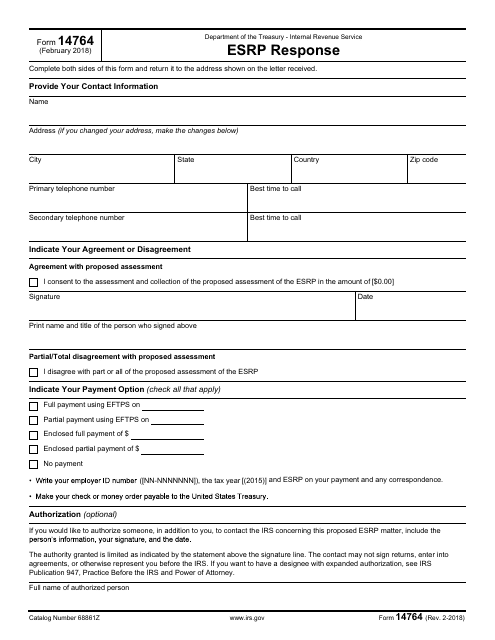

This form is used to respond to an IRS notice regarding the Employer Shared Responsibility Payment (ESRP). It is used to provide an explanation or dispute the proposed penalty.