Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

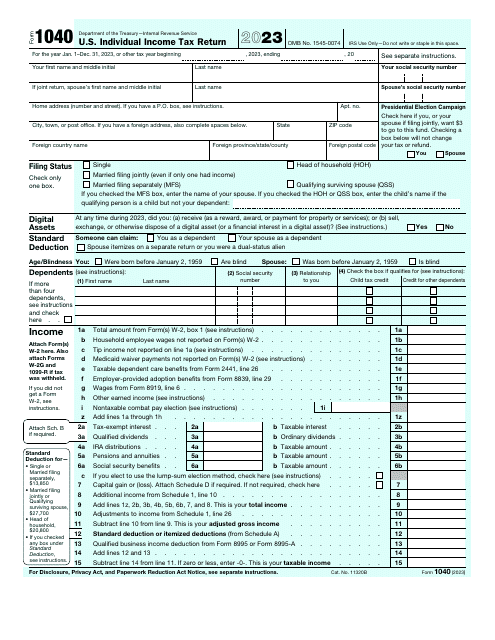

Use this basic form if you are an American taxpayer and wish to submit an annual income tax return. This form is also known as the Individual Income Tax Return Form.

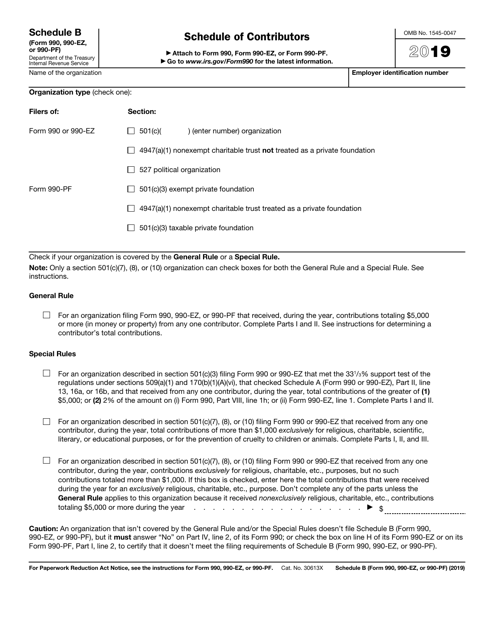

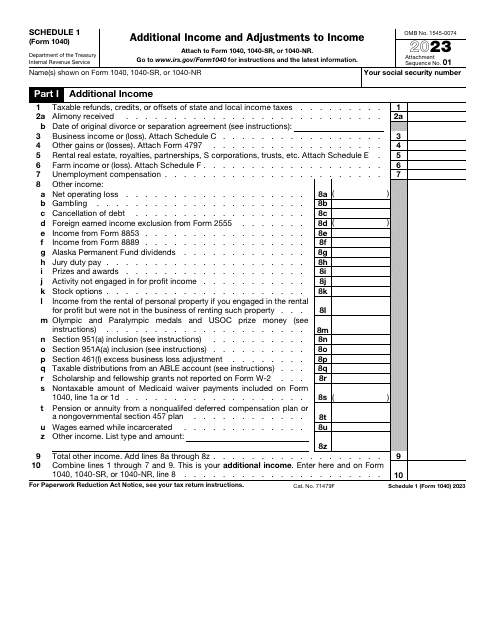

This is a supplementary form used by taxpayers to list income they did not include on the main income statement they file.

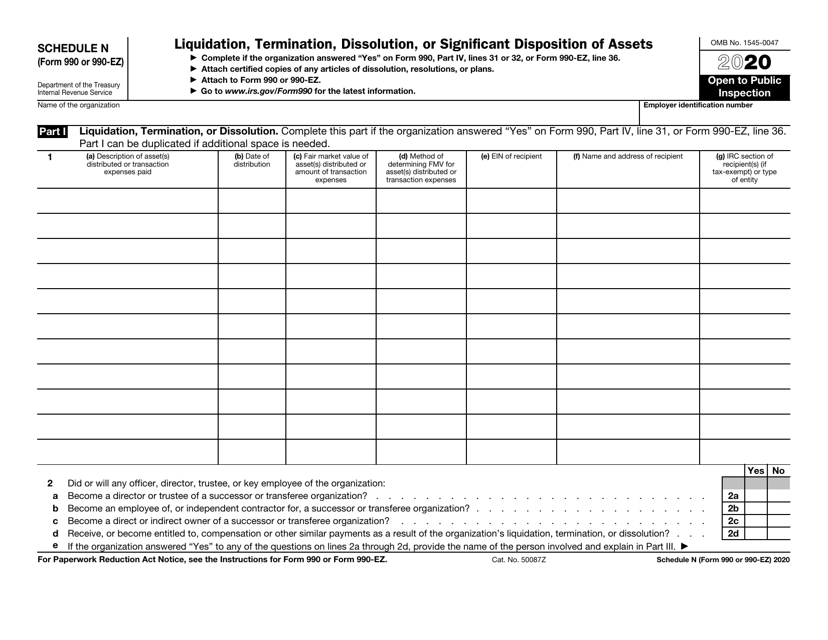

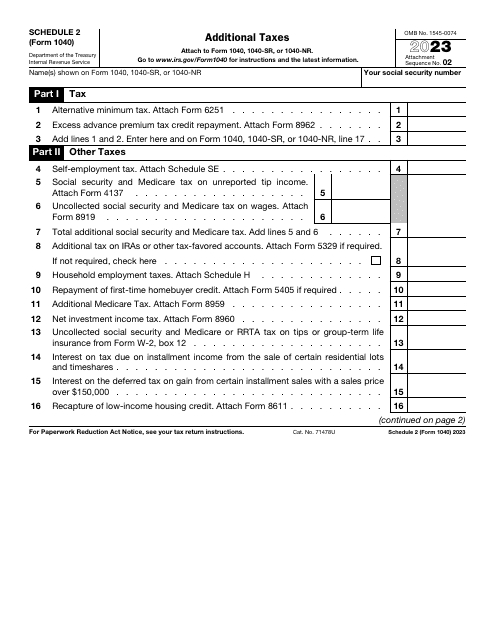

This is a supplementary document designed to allow taxpayers to list taxes they do not outline on the main income statement they are supposed to file annually.

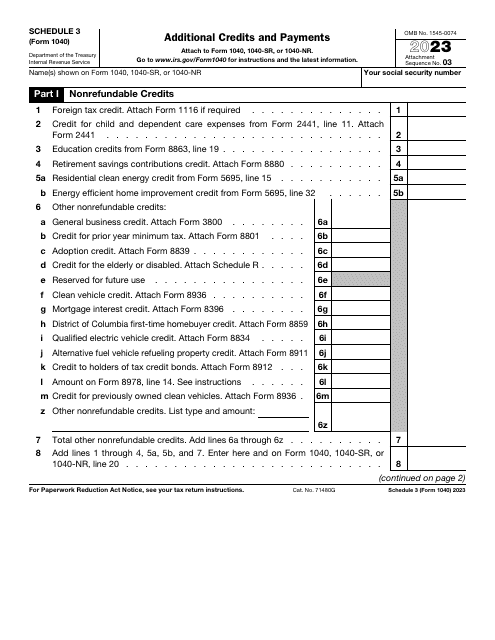

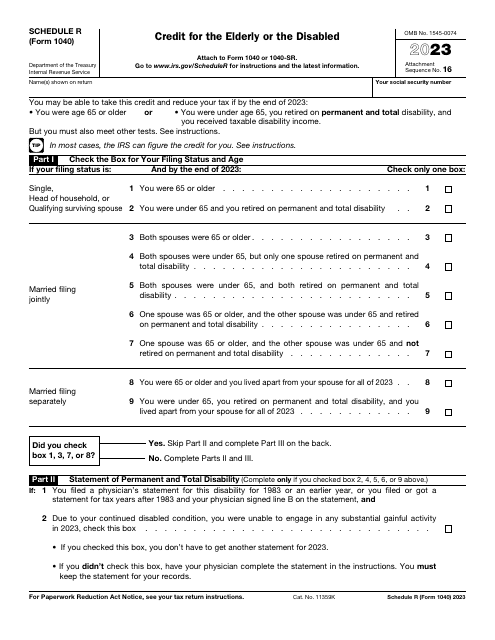

This is a fiscal form that elaborates on payments and credits that may let an individual lower the taxes they would otherwise have to pay in full or add to the amount of tax refund they are claiming.

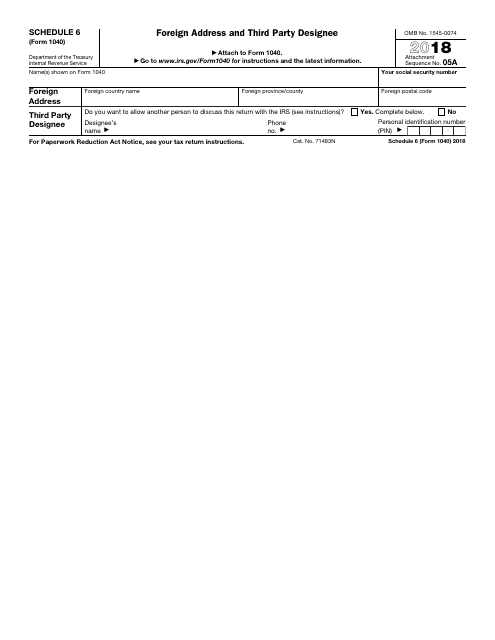

This form is used for providing a foreign address and designating a third party for tax purposes on IRS Form 1040.

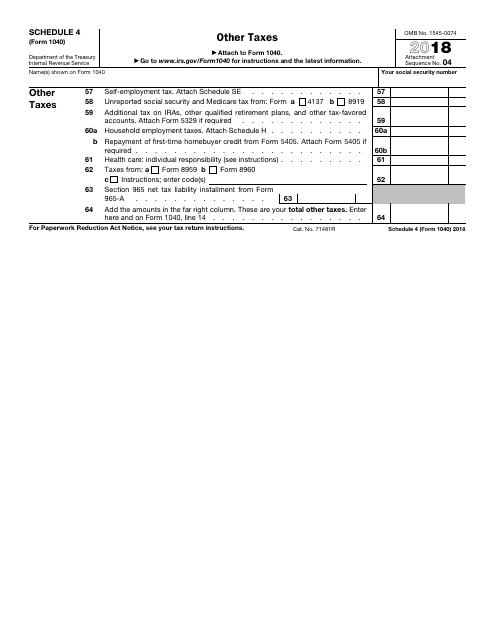

This Form is used for reporting other types of taxes that do not fit on the main IRS Form 1040.

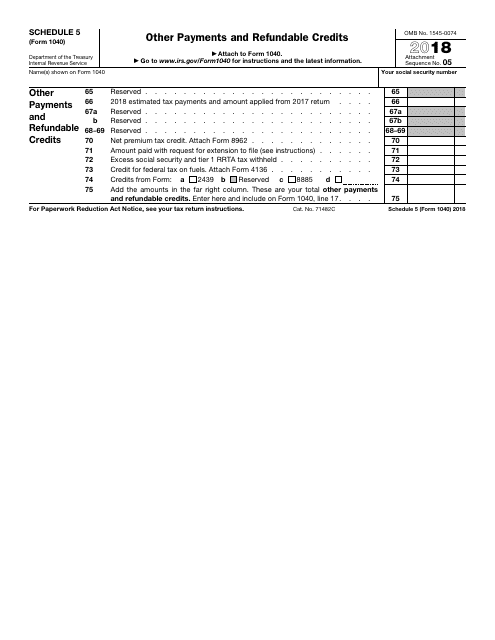

This form is used for reporting other types of payments and refundable credits that are not included in the standard IRS Form 1040.

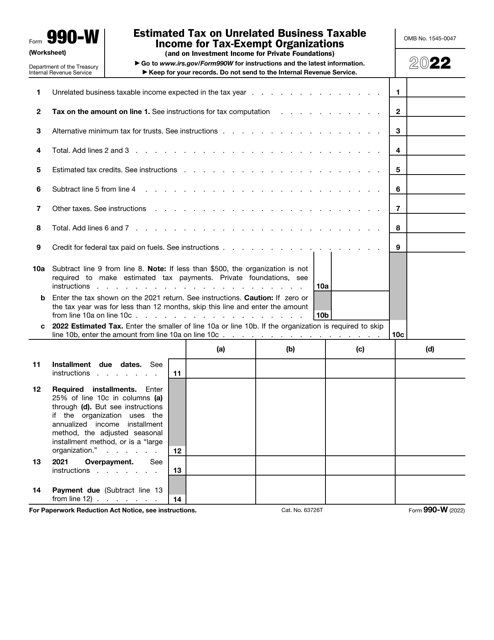

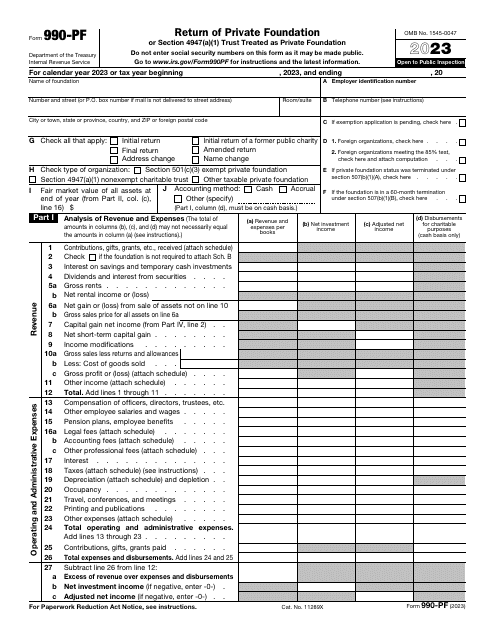

This form, also known as the private foundation tax return, can also substitute Form 1041, if a trust has no taxable income. Use this form to calculate the tax on the income from an investment and to report charitable activities and distributions.

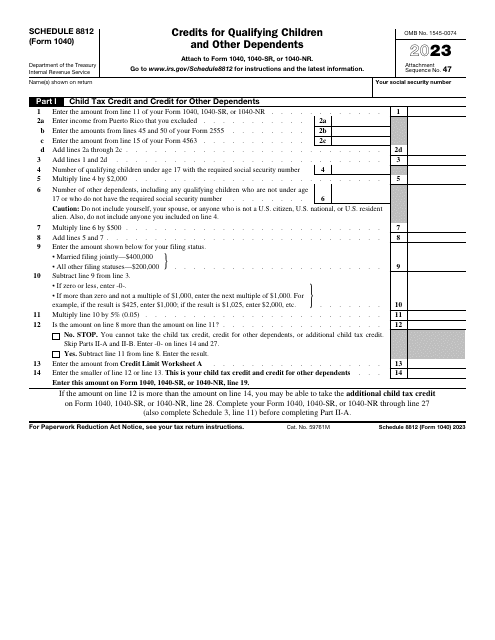

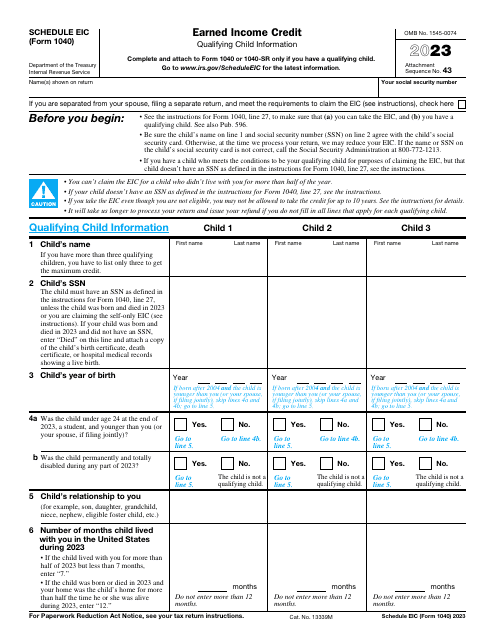

This is a fiscal statement created to let taxpayers with children make the most of the tax benefits they qualify for via extra tax credit.

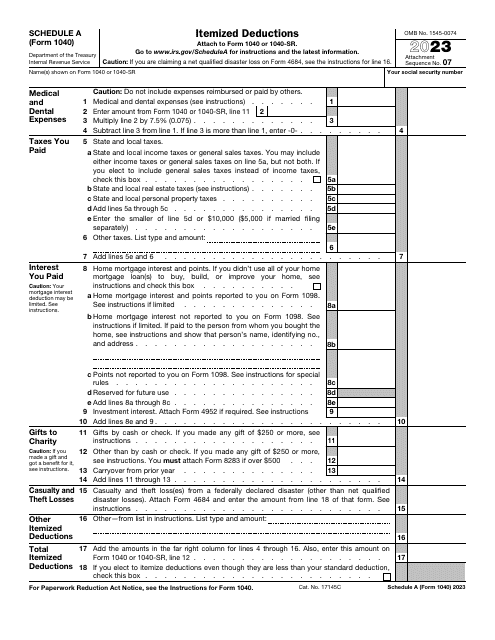

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

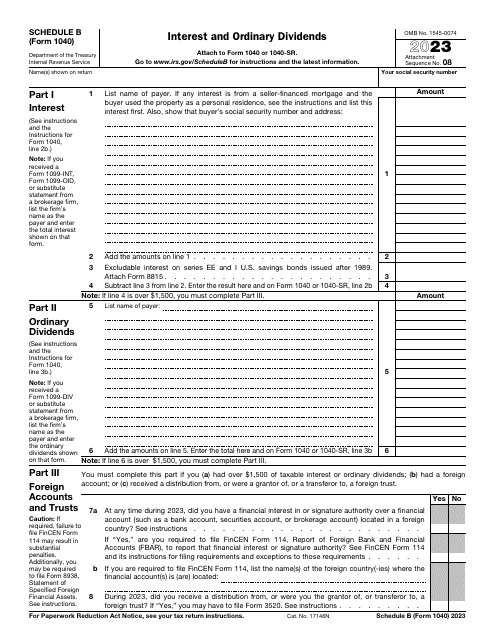

This is a supplementary form individuals are supposed to use to calculate income tax they owe after receiving interest from bonds and earning dividends.

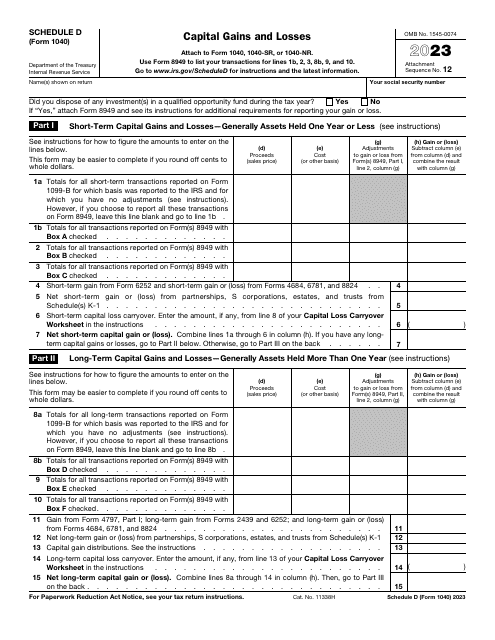

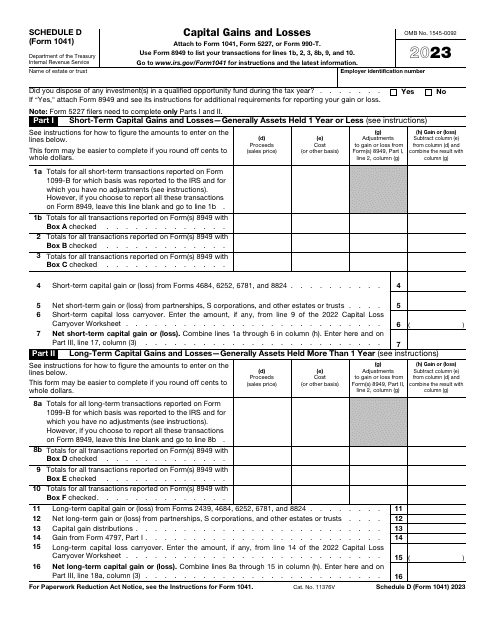

This is a supplementary document taxpayers have to attach to their tax return to outline capital gains and losses that were the result of property sales.

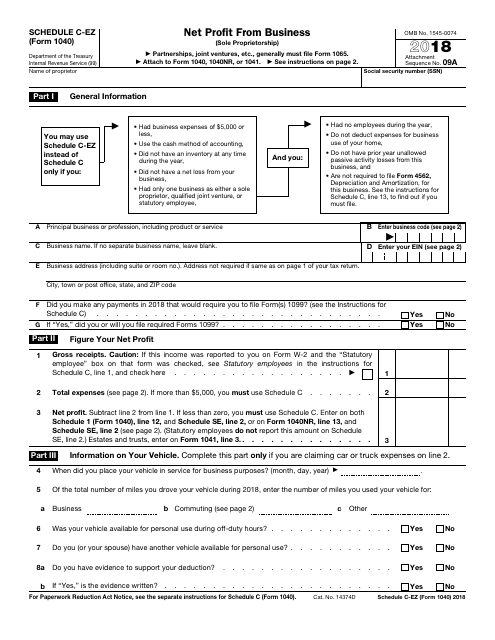

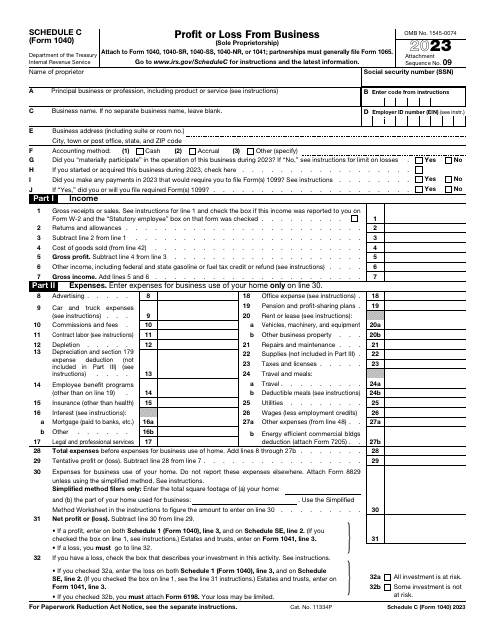

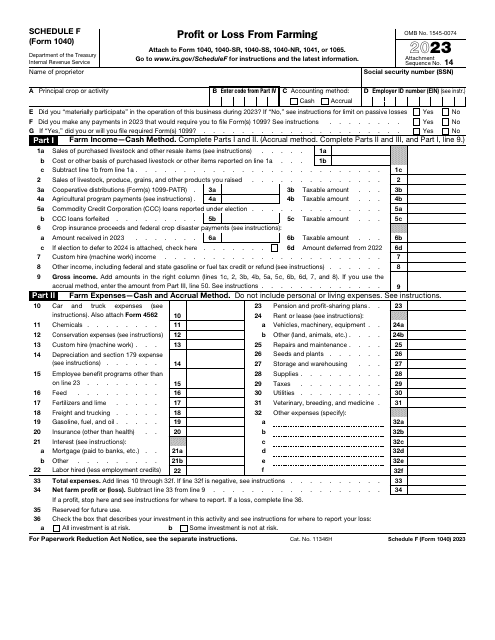

Complete this form in order to report income and loss from a business, qualified joint venture, or profession where you were the sole proprietor. This form is a simplified version of Schedule C. The document relates to the series of IRS 140 form series that is used for reporting and deducting of various types of income and losses.

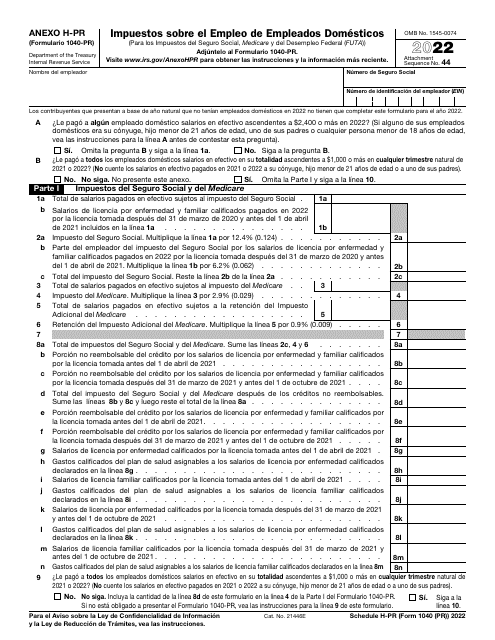

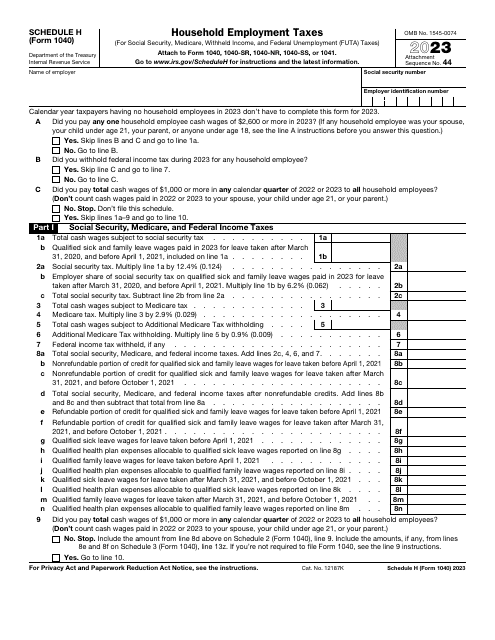

This is a supplementary document that has to be attached to a tax return, if the taxpayer employed people that worked in their house helping the owner to manage the place in a certain capacity.

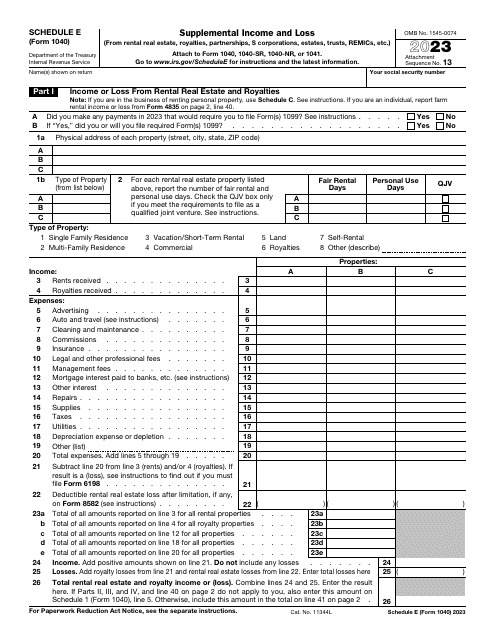

This form is part of the IRS 1040 series, which is used to calculate and submit different types of federal individual income tax returns. File this form to inform the Internal Revenue Service (IRS) about your income and loss from royalties, rental real estate, trusts, and S corporations among others.

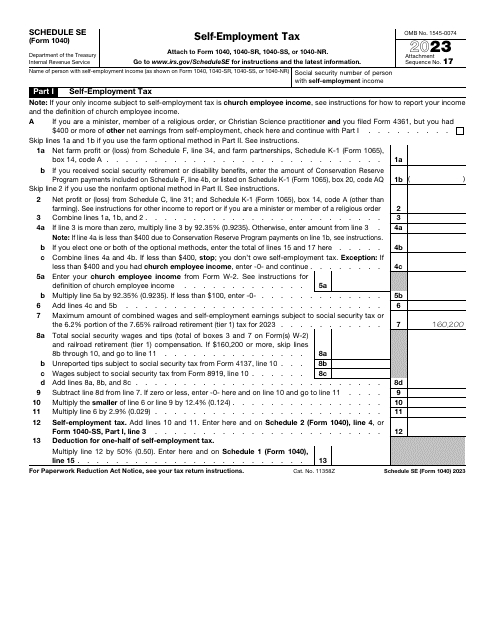

This is an IRS form that contains the breakdown of the self-employment tax the taxpayer figures out after analyzing their net earnings.

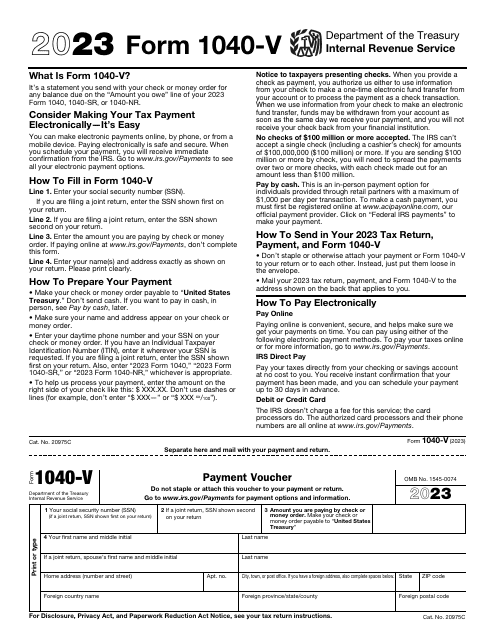

This is a supplementary document completed by taxpayers that chose to fulfill their financial obligations to fiscal organizations with the help of a check or money order.

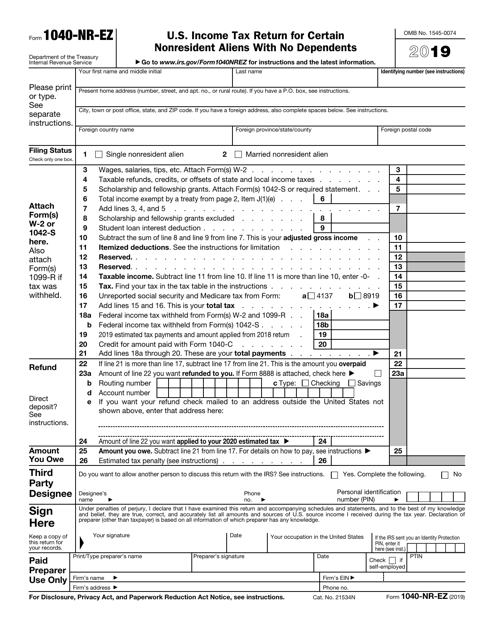

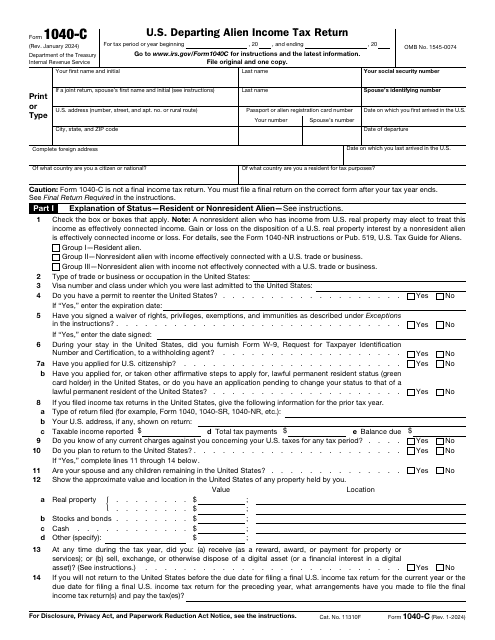

Use this form if you are a non-resident alien (non-United States citizen who has not passed the green card or the substantial presence test) and claim no dependents. This form was issued by the Internal Revenue Service (IRS).

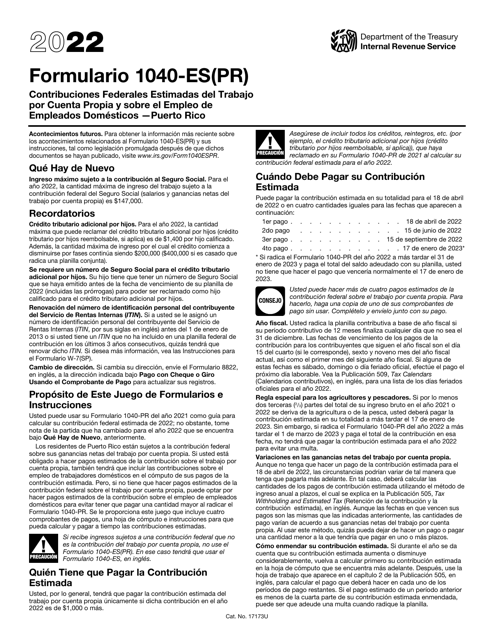

Use this form to report the income you received or expect to receive for the tax year and to pay the expected tax on that income (only if you are required to do so).

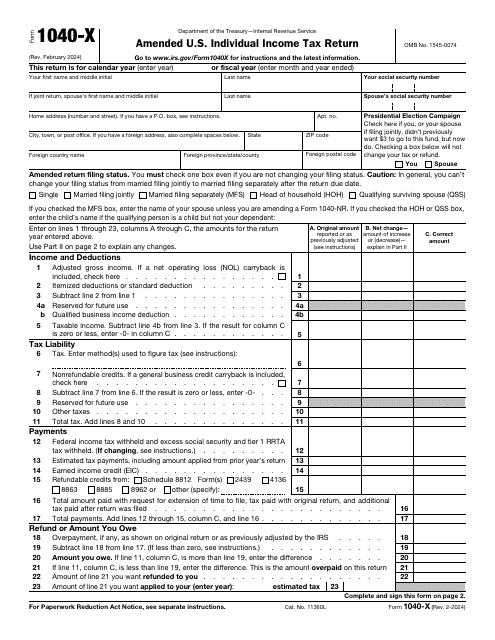

This document is used for correcting records on your tax return form. A separate form is used every year for which information is changed. Do not submit this document to request a refund of interest and penalties, or addition to the tax you have already paid.

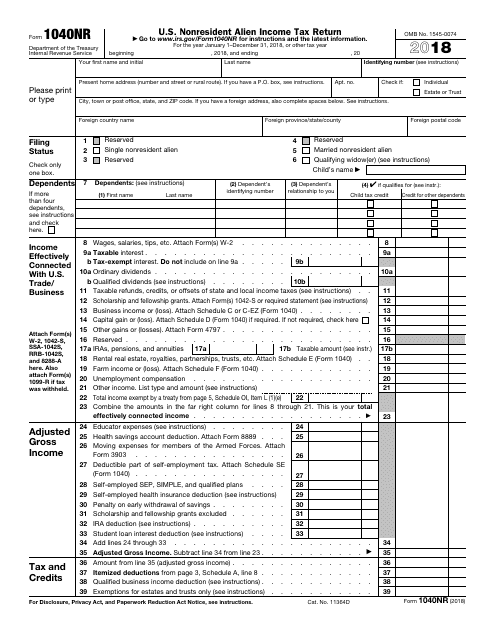

This Form is used for filing U.S. income taxes by nonresident aliens who have earned income in the United States.

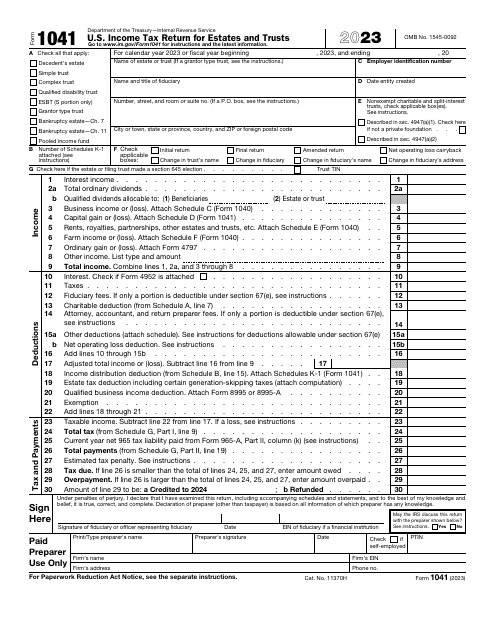

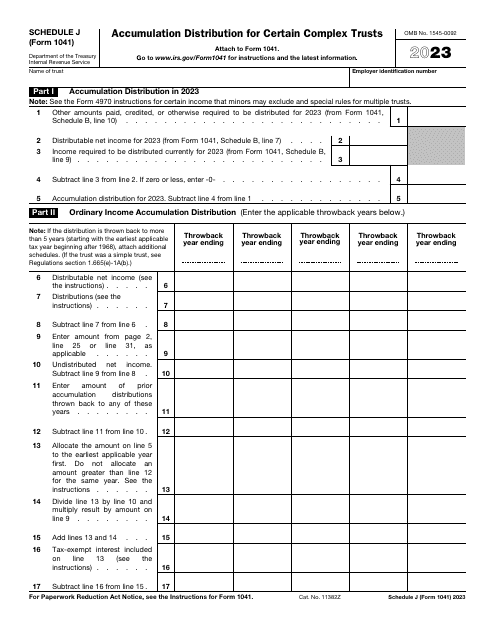

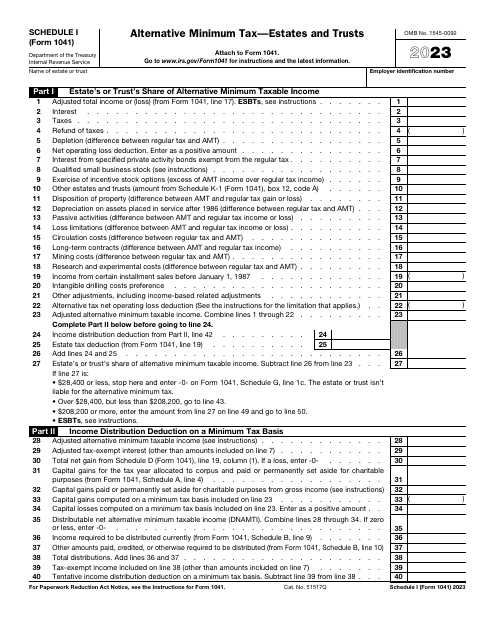

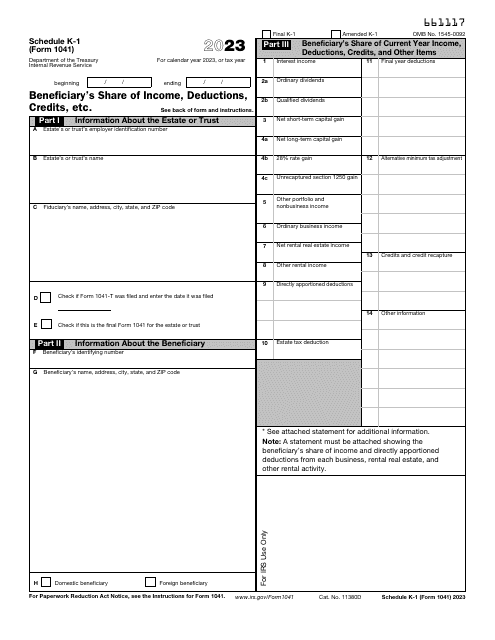

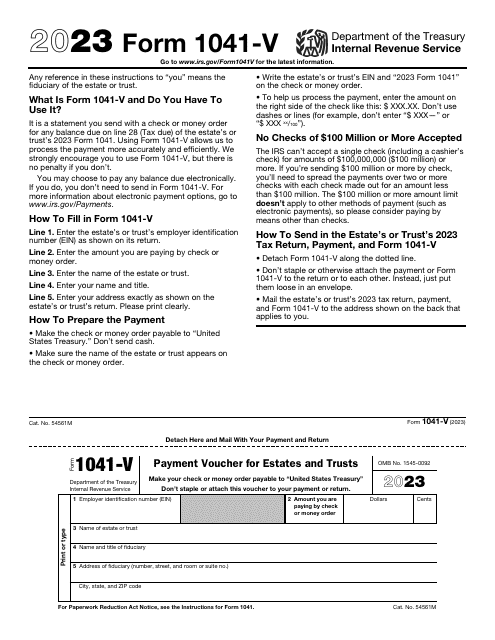

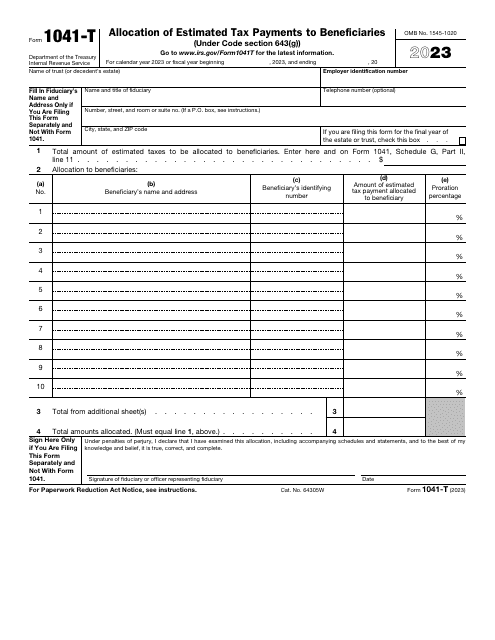

File this document, also known as the Estates and Trusts Tax Return, as an income tax return to the Internal Revenue Service (IRS) if you are a fiduciary of a bankruptcy estate, domestic decedent's estate, or a trust.

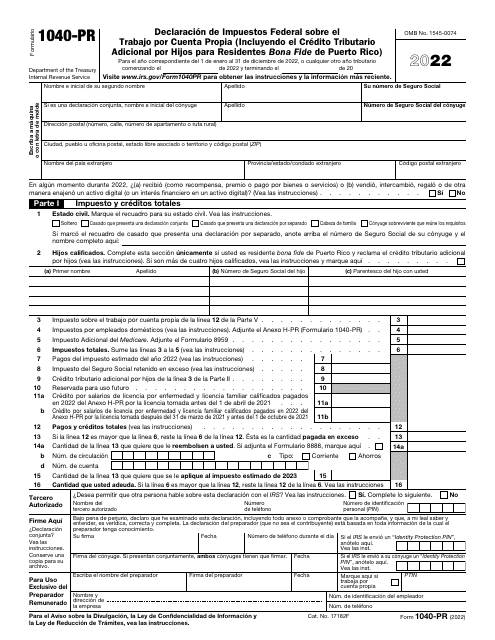

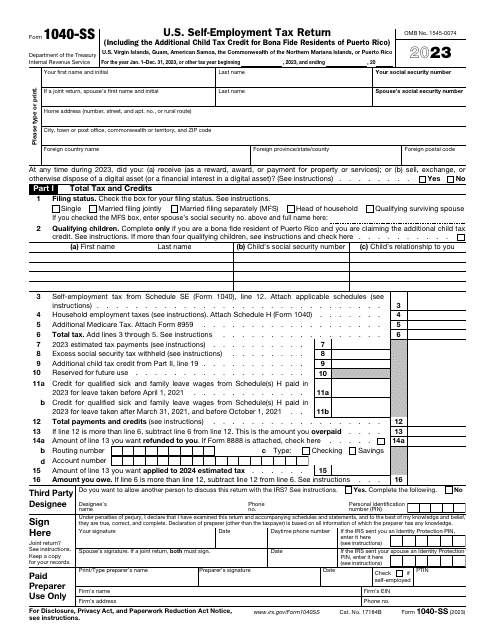

Use this document only if you are a resident of the United States Virgin Islands (USVI), Commonwealth of Puerto Rico, Commonwealth of the Northern Mariana Islands (CNMI), Guam, and American Samoa and wish to report your self-employment net earnings to the United States.