Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

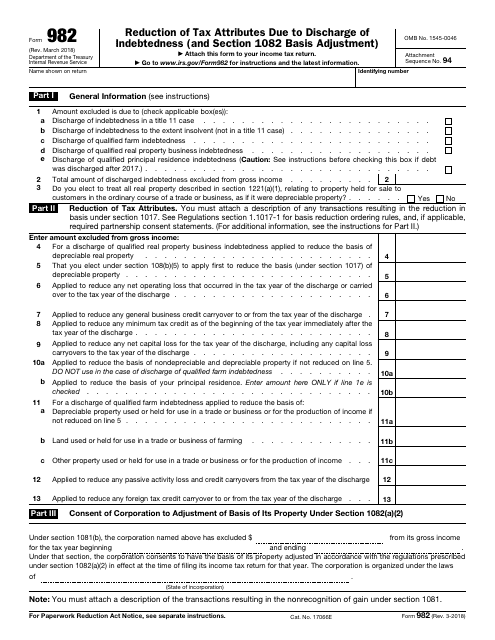

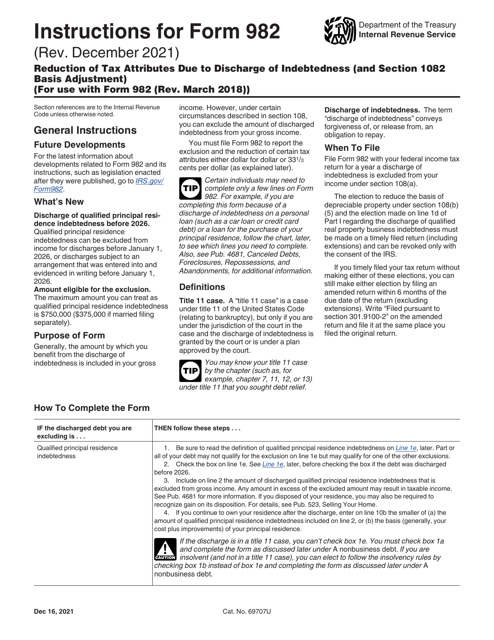

This is a formal instrument used by taxpayers to explain to fiscal authorities why certain debts should not be taken into account as a part of their income.

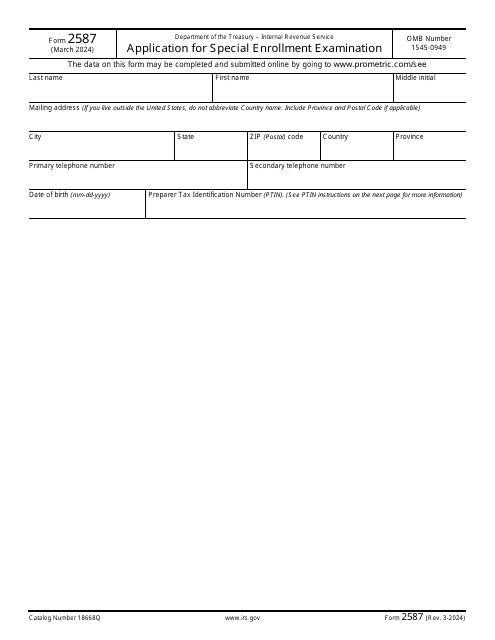

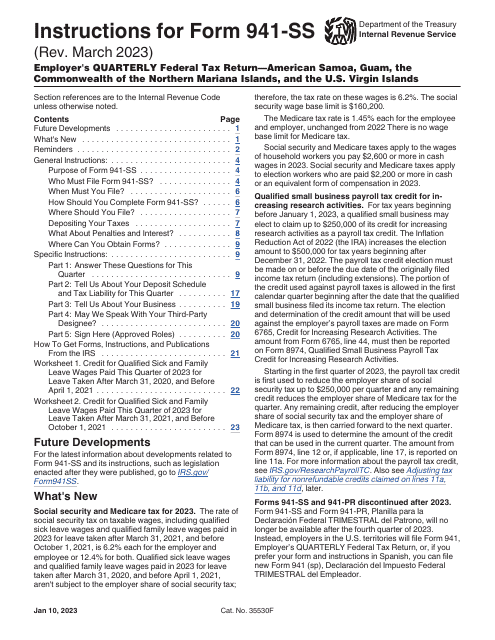

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

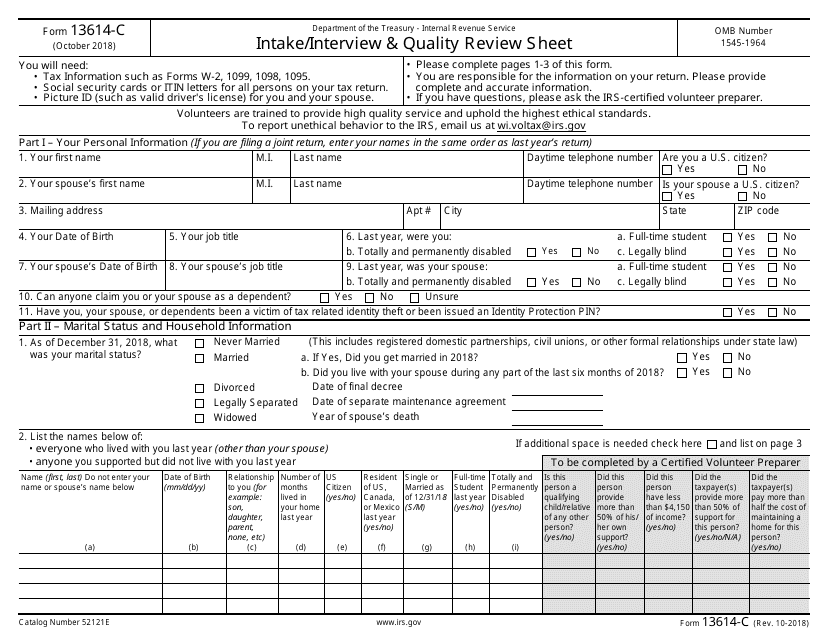

This Form is used for gathering information and conducting interviews with taxpayers to ensure the quality and accuracy of their tax returns.

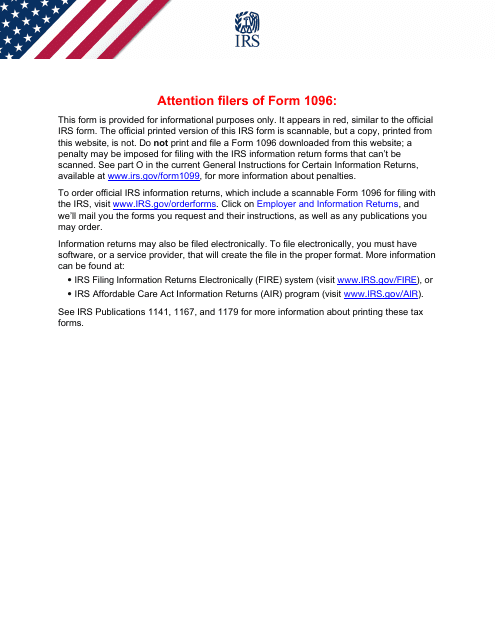

Use this document as a compilation or a summary information sheet to physically transmit paper Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G to the Internal Revenue Service (IRS). If you opt to file the forms electronically, you are not required to submit a 1096 transmittal form.

This is a fiscal document completed by financial entities to specify the amount of supplementary income investors have generated during the year.

This is a fiscal document used by organizations that made payments to individuals and companies that were not treated as employees over the course of the tax year.

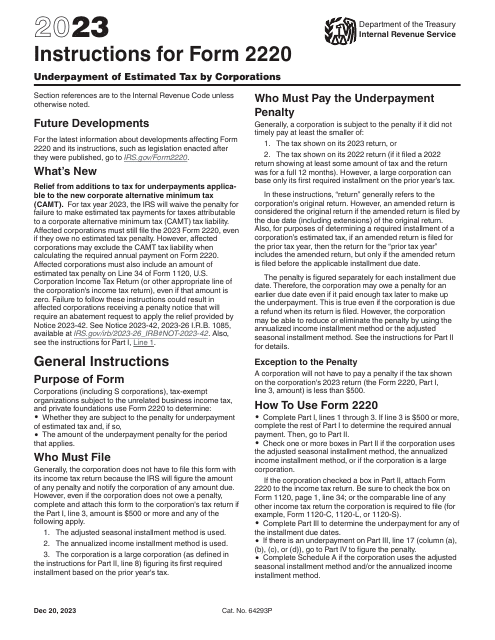

This is a supplementary form corporations were expected to fill out to compute the amount of estimated tax they owe to fiscal authorities.

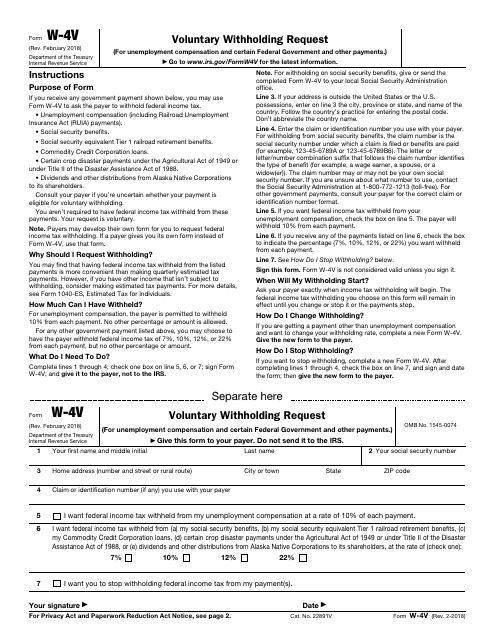

This is a fiscal document used by recipients of government payments to secure tax deductions from those amounts before the payments are sent to them.

This Form is used for reporting a partner's share of income or loss from an electing large partnership. It is specifically for the partner's use only.

This Form is used for reporting income and expenses of electing large partnerships in the United States.