Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

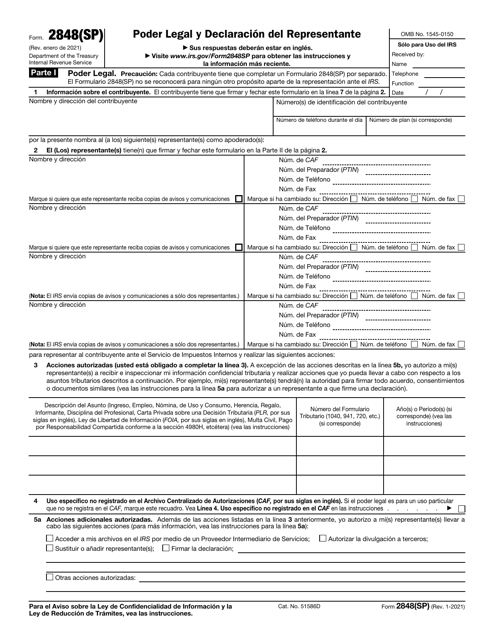

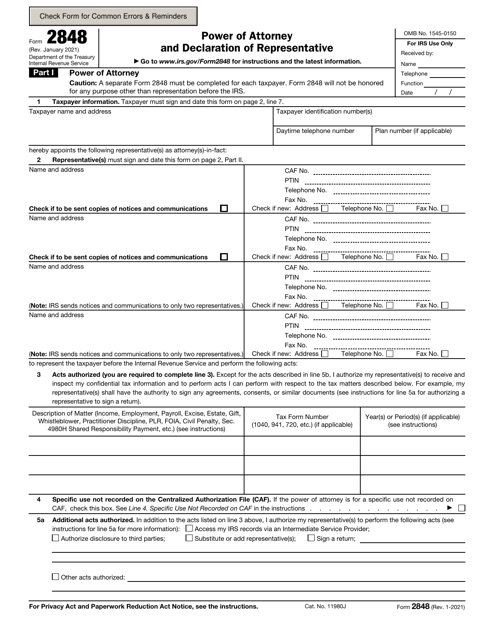

This is a formal statement used by a taxpayer to entrust their representative to perform specific actions in their name.

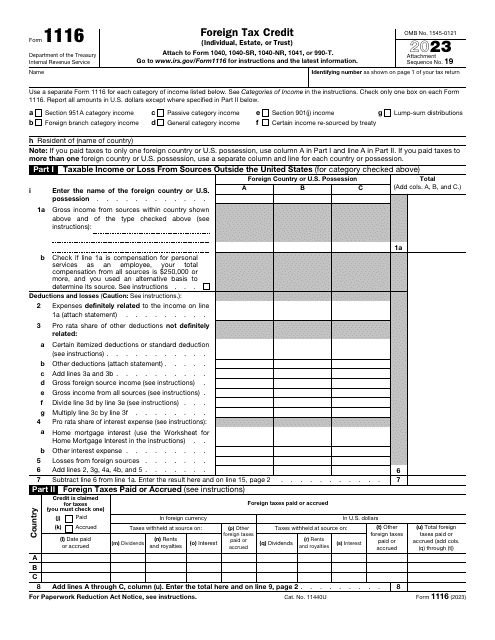

This is a formal document that allows American taxpayers that reside, work, and manage businesses overseas to lower the amount of tax they owe to the U.S. government.

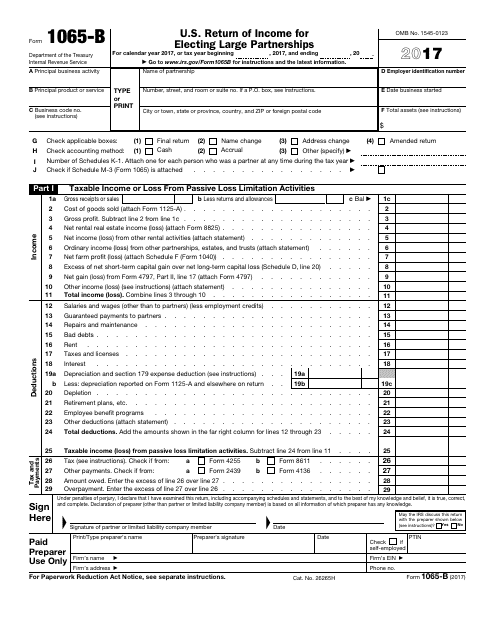

Use this form to report information on deductions, credits, and income relevant to the operation of an electing large partnership (e.g. engaged in the business of farming) to the Internal Revenue Service (IRS).

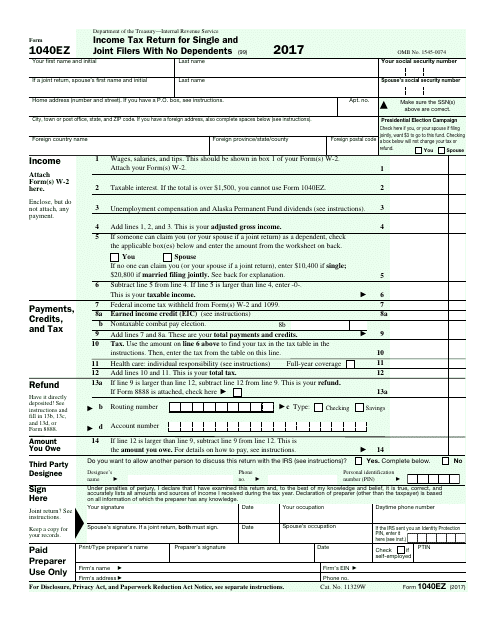

This Form is used for filing a simplified version of the U.S. Individual Income Tax Return. It is intended for taxpayers who have limited income and deductions.

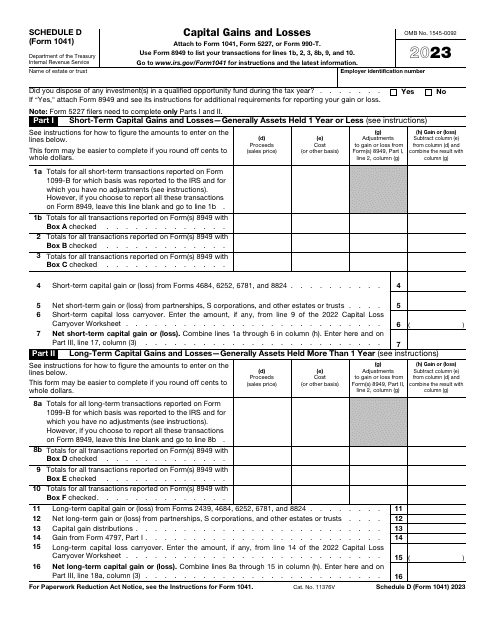

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

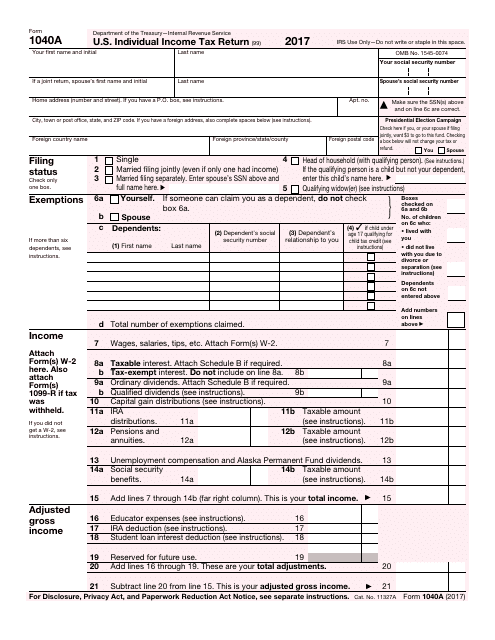

Use this basic form if you are an American taxpayer and wish to submit an annual income tax return. This form is also known as the Individual Income Tax Return Form.

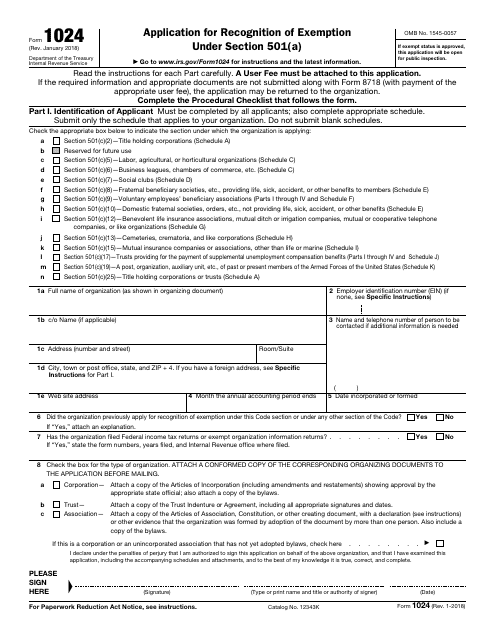

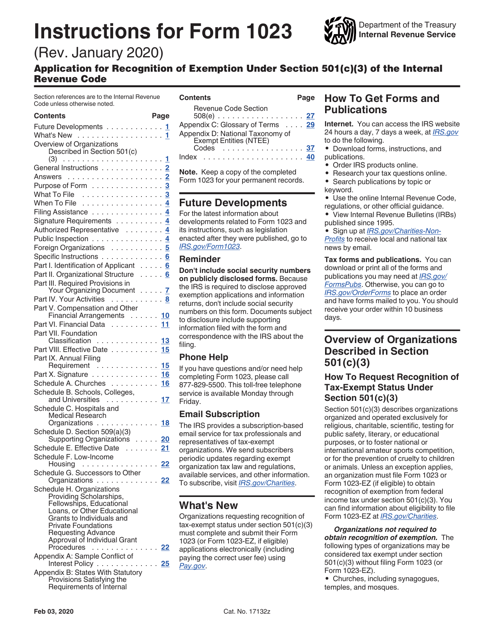

This Form is used for applying for recognition of exemption under Section 501(a) of the Internal Revenue Code. It is required by the IRS for organizations seeking tax-exempt status.

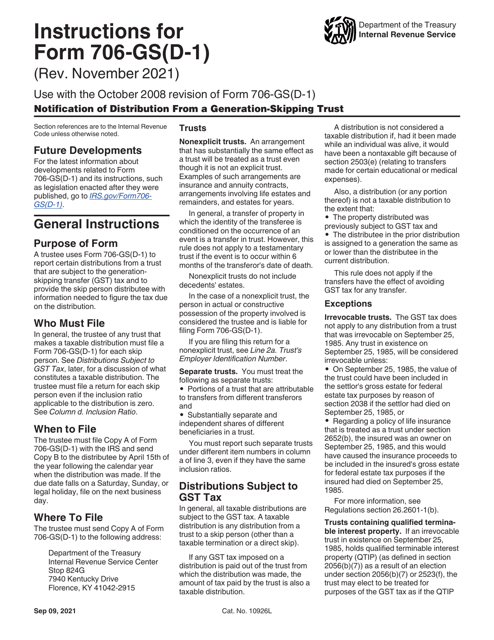

This type of document provides instructions for reporting organizational actions that affect the basis of securities to the Internal Revenue Service (IRS). It is used by individuals and organizations to accurately file their tax returns.

These instructions for IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), explain how to utilize this form when claiming costs for post-secondary schooling.

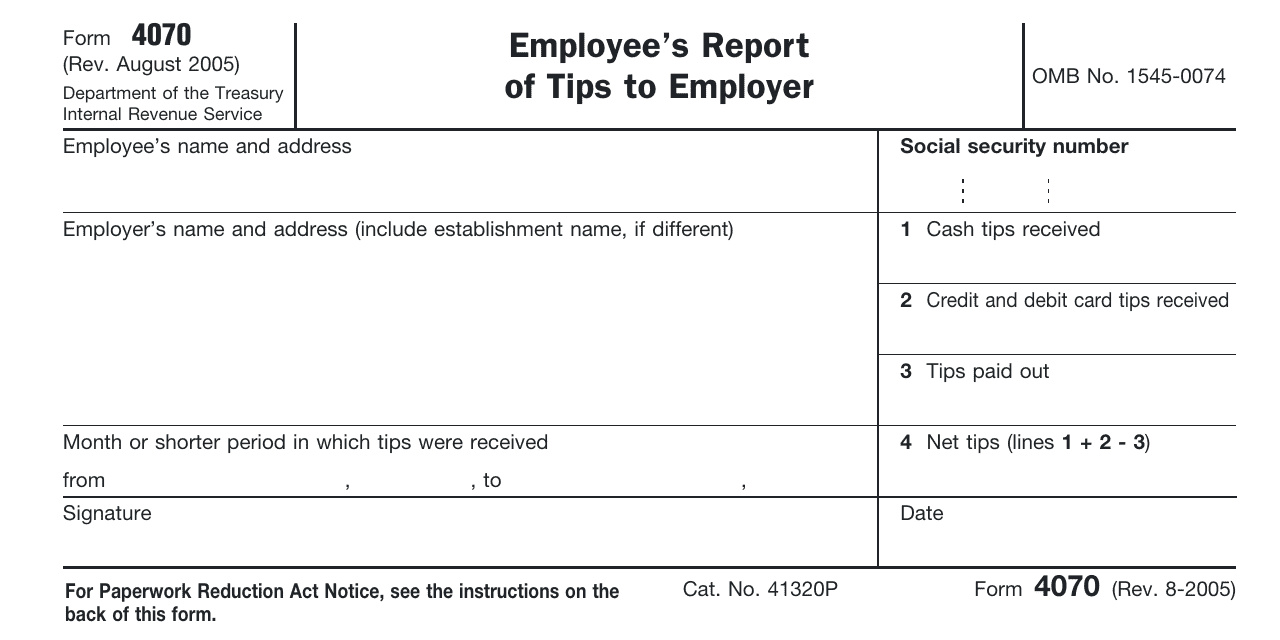

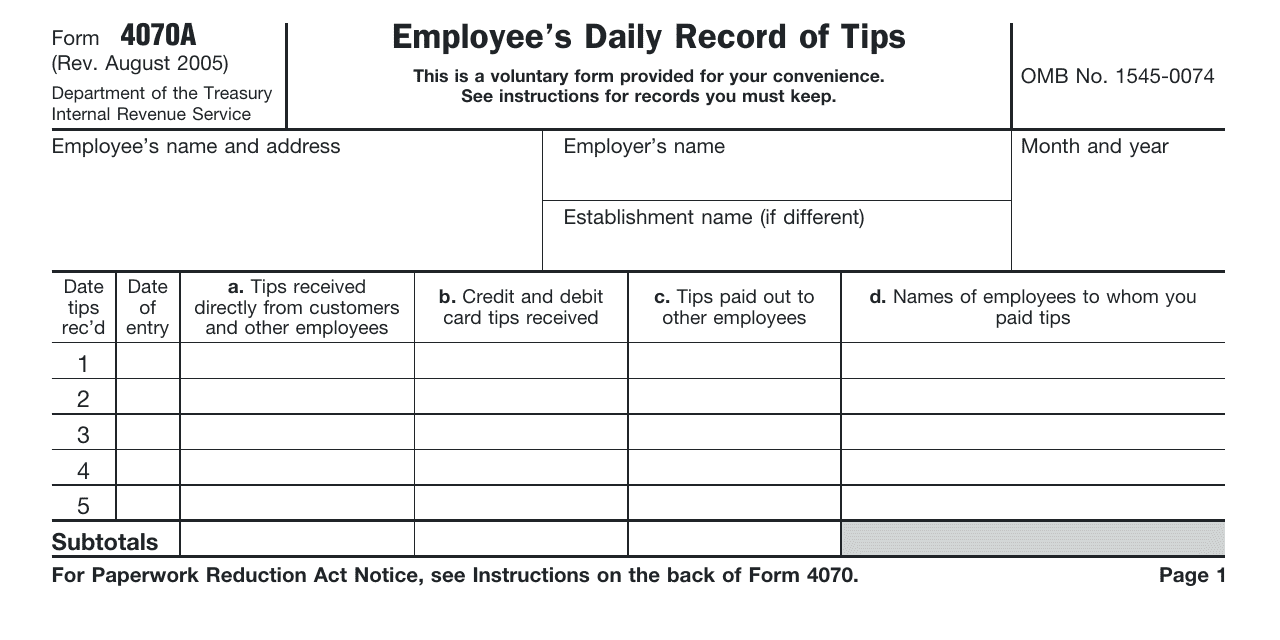

This form is a formal instrument used by employees to elaborate on the amount of tips they get every month.

Download this form if you are an employee receiving daily tips in order to keep track of tips you received from customers. These tips may include cash tips, as well as tips received from customers' debit or credit cards and items of value, such as tickets or passes.

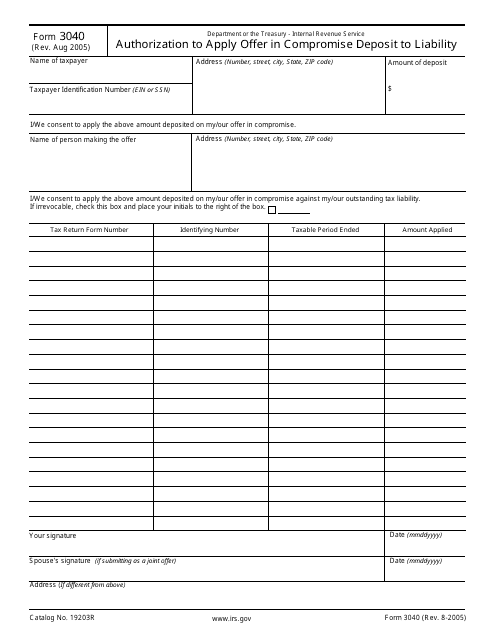

This Form is used for authorizing the IRS to apply an Offer in Compromise deposit to your tax liability.

This is a formal statement prepared by an employee after figuring out how much tax an employer has to deduct from their paycheck.

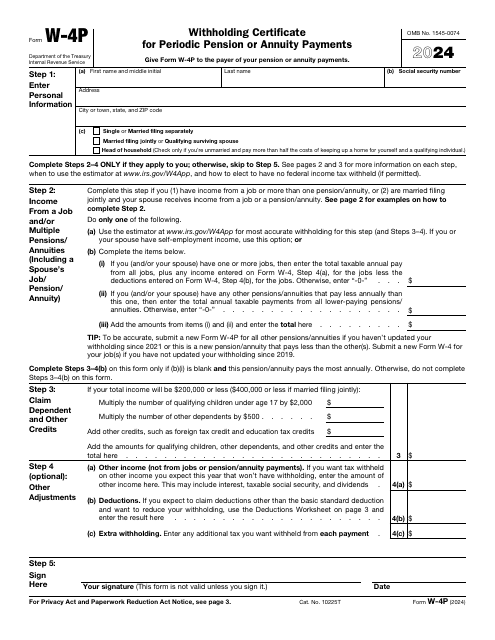

This is a formal document used by taxpayers to figure out the amount of deduction applied to regular payments they are entitled to receive.

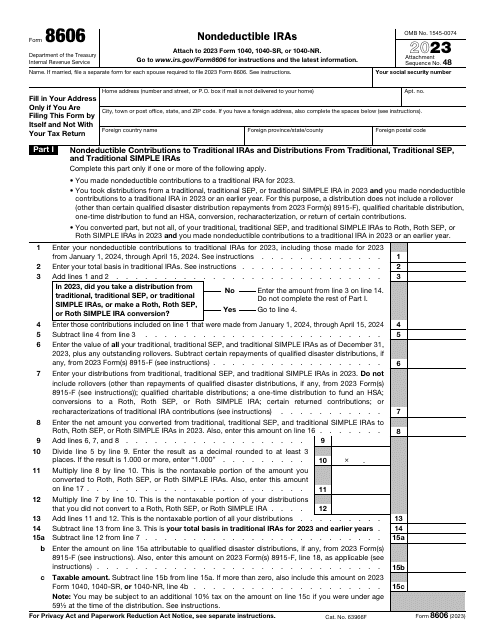

The purpose of this form is to provide the IRS with information on taxpayers who make nondeductible contributions to their Individual Retirement Account (IRA).

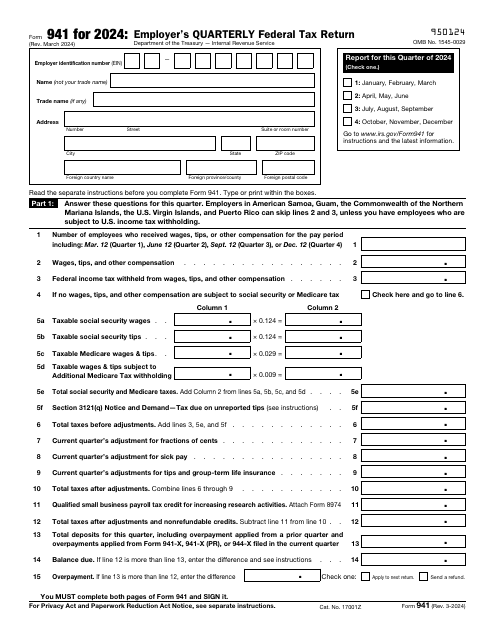

This is a formal statement used by companies to tell tax organizations about the salaries and tips their employees have received over the course of the previous quarter and the tax already subtracted from the workers' salaries.