Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

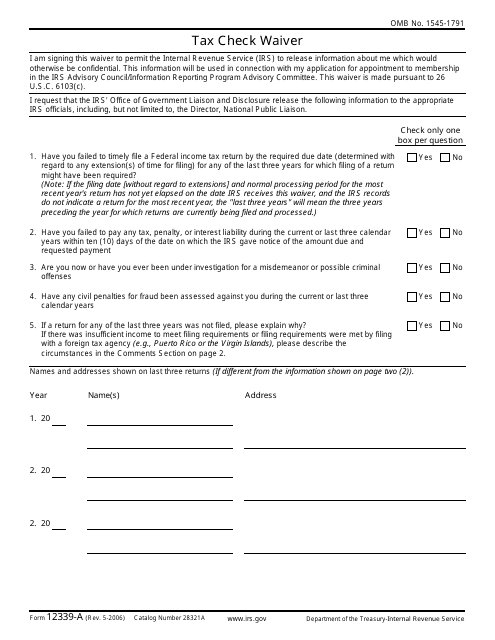

This form is used for requesting a waiver of tax check requirements from the IRS. It allows individuals or businesses to bypass the usual process of having their tax refund or payment checks verified.

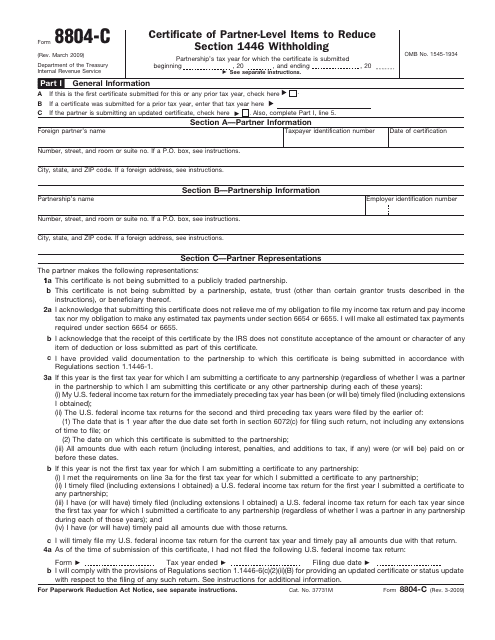

This form is used for reporting partner-level items to reduce the amount of withholding tax under Section 1446.

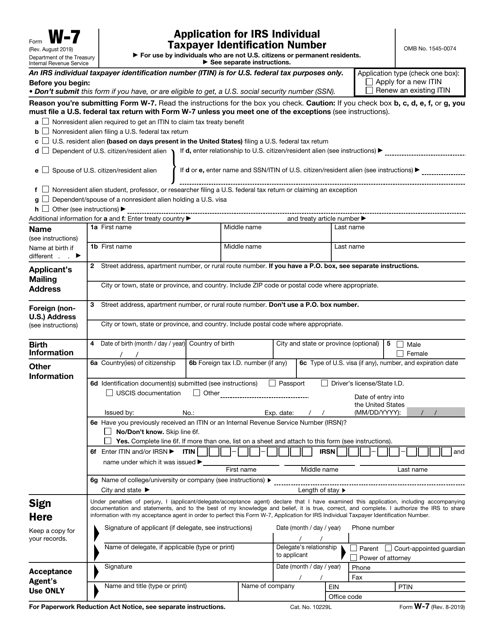

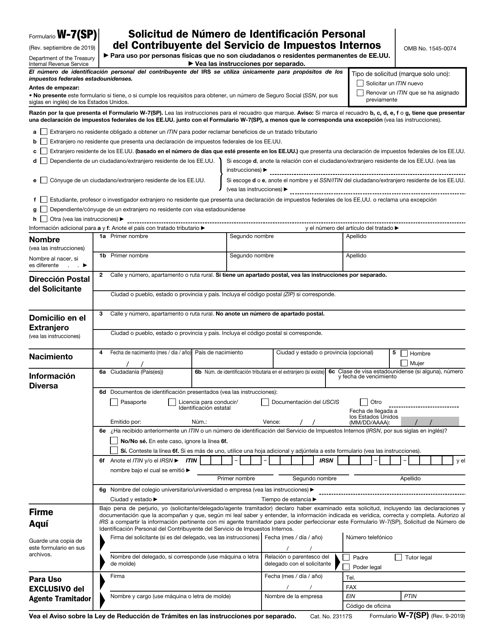

This is a formal statement filled out by individuals that want to obtain an identification number that will confirm their identity to fiscal organizations and let them communicate with the government as taxpayers. Additionally, it may be completed to renew a number they received before.

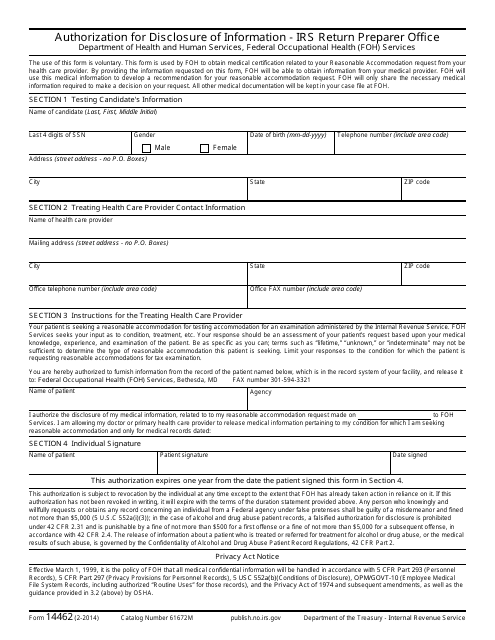

This document for authorizing disclosure of information to the IRS Return Preparer Office.

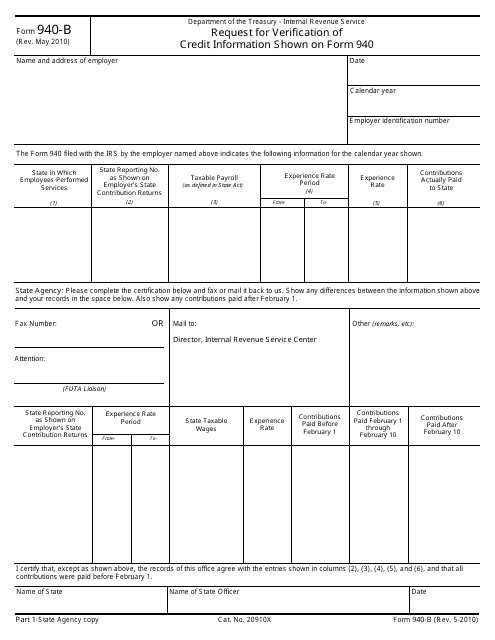

This document is used to request verification of credit information shown on Form 940 for the IRS.

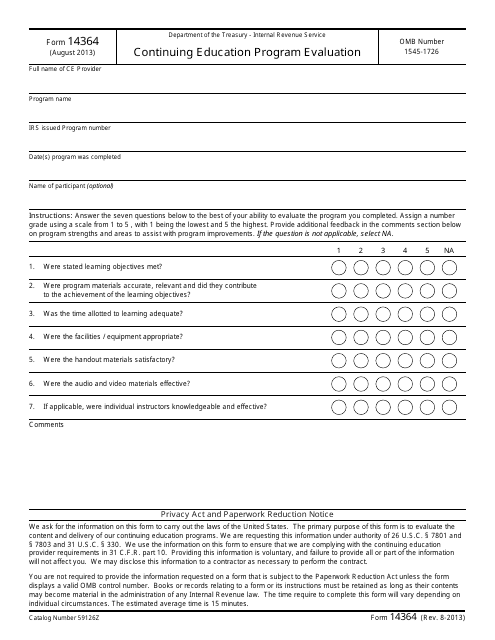

This Form is used for evaluating a Continuing Education Program offered by the IRS.

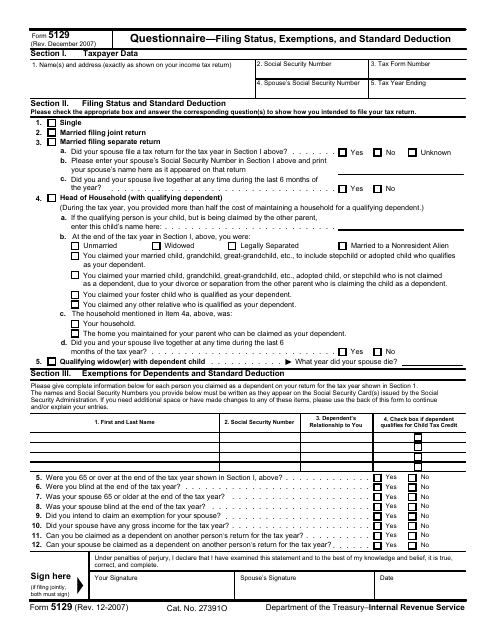

This type of document, IRS Form 5129 Questionnaire, is used for determining your filing status, exemptions, and standard deduction when filing your taxes with the Internal Revenue Service (IRS).

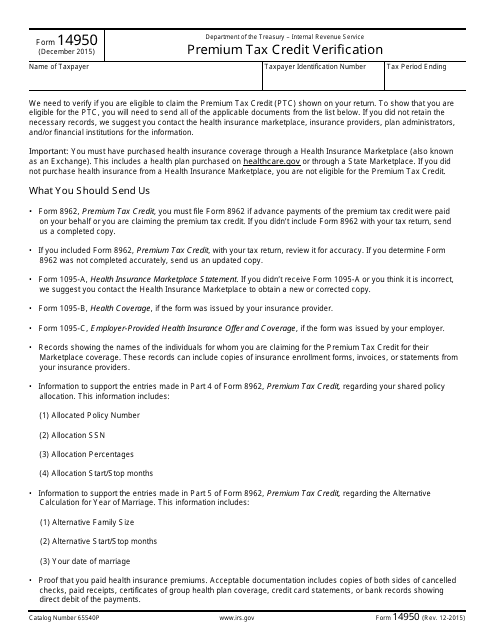

This document is used for verifying eligibility for the Premium Tax Credit, a subsidy provided by the government to help lower-income individuals and families afford health insurance.

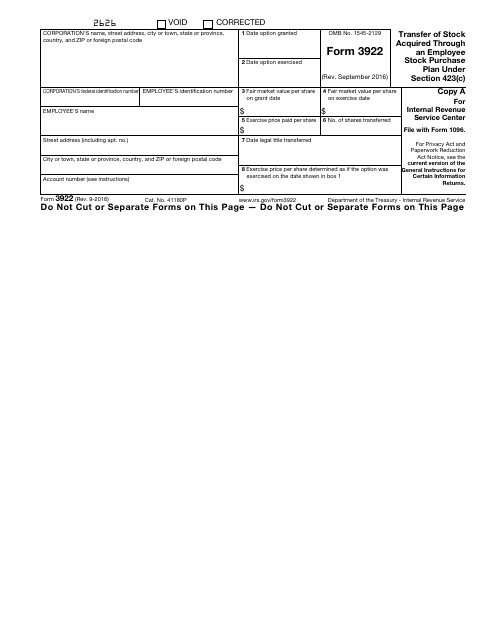

This is a formal statement used by employers to describe the details of a stock transfer if the shares were acquired by their employee.

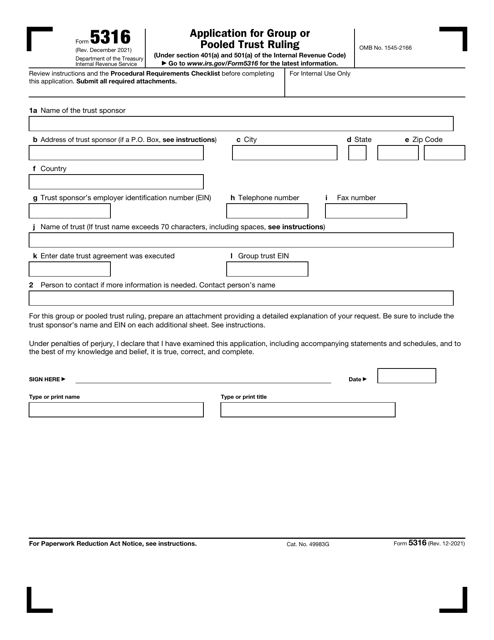

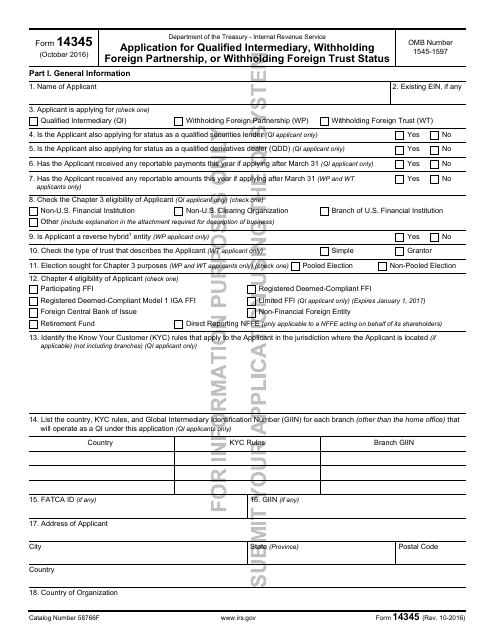

This Form is used for applying for Qualified Intermediary, Withholding Foreign Partnership, or Withholding Foreign Trust Status.

This is a formal instrument used by taxpayers that need to fix the mistakes they have discovered upon filing IRS Form 941, Employer's Quarterly Federal Tax Return.

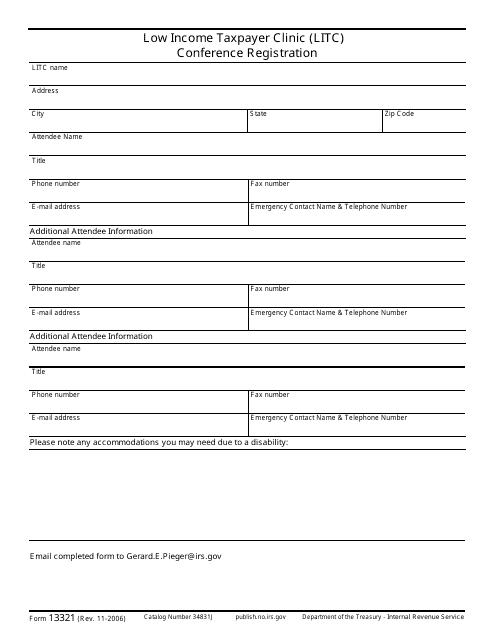

This form is used for registering for the Low Income Taxpayer Clinic (LITC) Conference organized by the IRS.

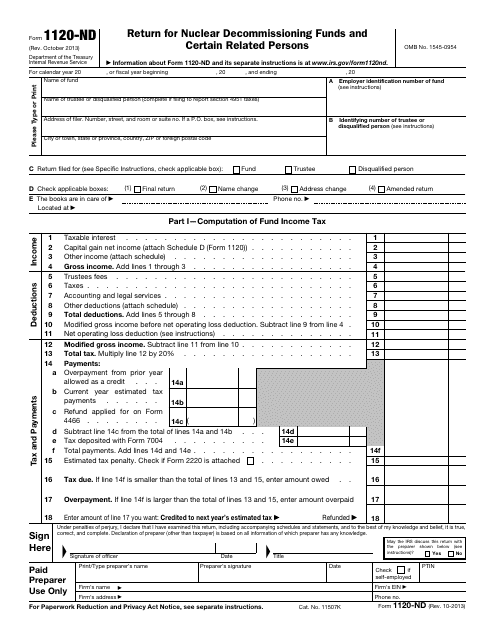

This document is used by the Nuclear Decommissioning Funds to inform the Internal Revenue Service (IRS) about their income, contributions, and administrative expenses of fund operation.

This is a supplementary document used by taxpayers to file IRS Form W-2C, Corrected Wage and Tax Statement. This form works as a summary of changes you have made to IRS Form W2, Wage and Tax Statement.

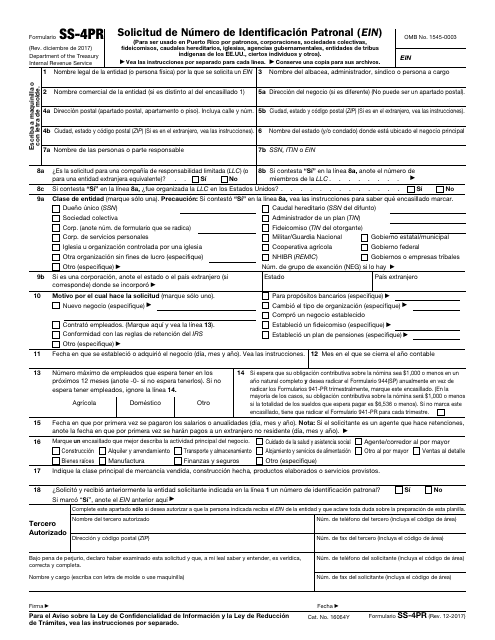

This form is used to apply for an Employer Identification Number (EIN) in Puerto Rico.

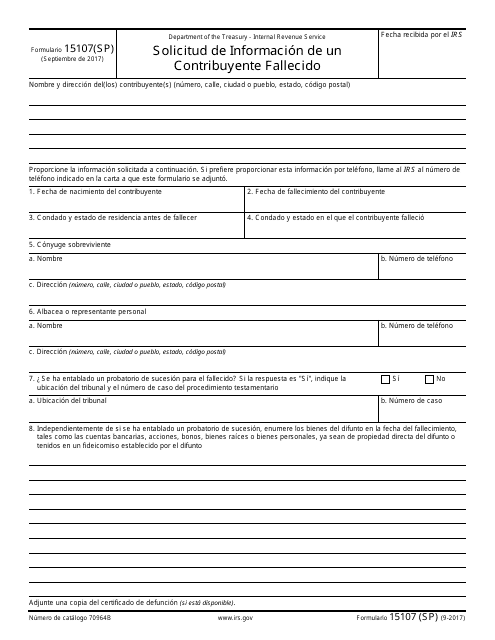

This document is a Spanish version of IRS Form 15107 (SP), which is used to request information about a deceased taxpayer.

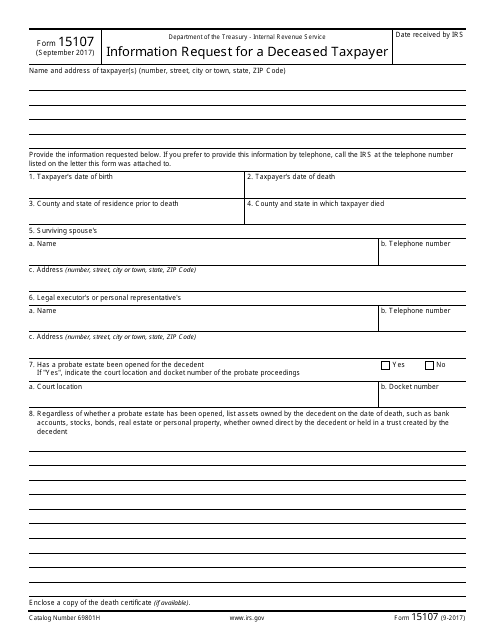

This form is used for requesting information from the IRS for a deceased taxpayer.

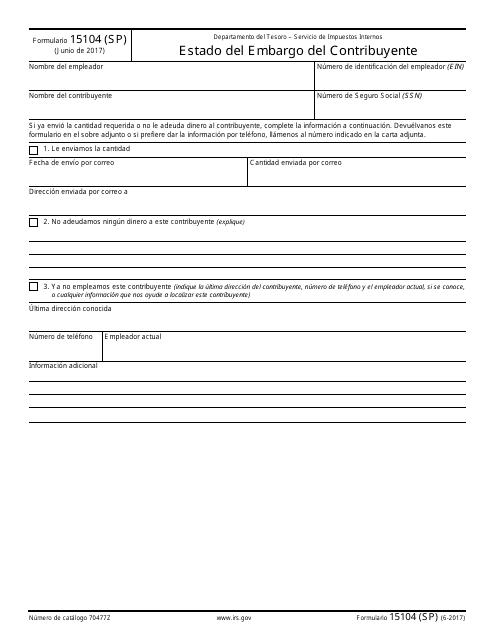

This Form is used for reporting the status of a taxpayer's embargo by the IRS. It is written in Spanish.

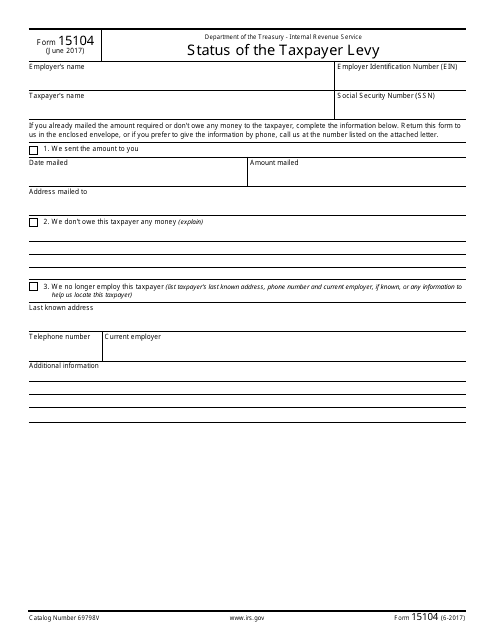

This form is used to check the status of a taxpayer levy with the IRS.

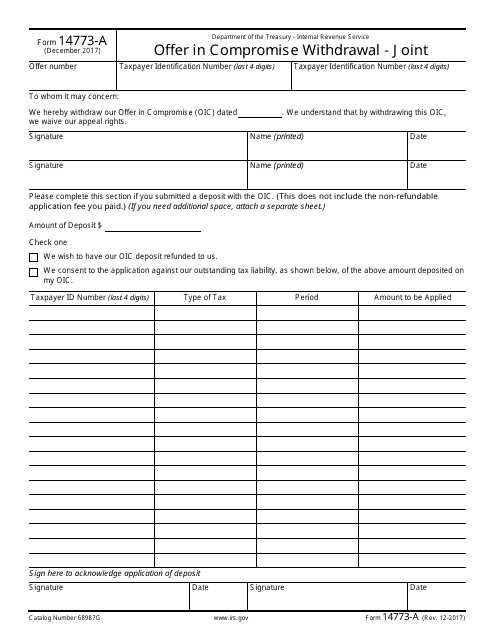

This form is used for withdrawing a joint offer in compromise submission to the IRS.

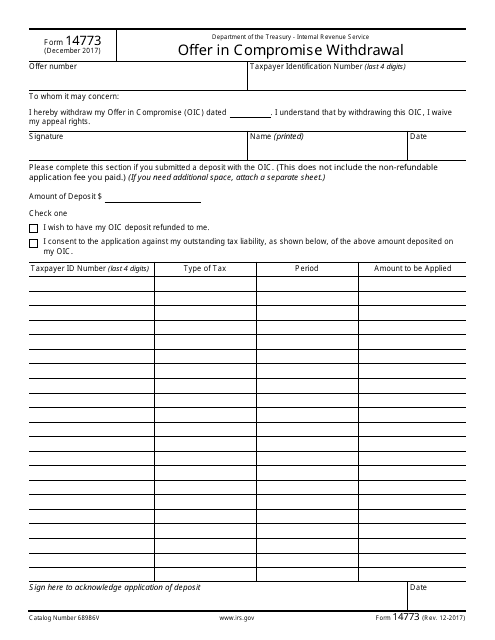

This Form is used for withdrawing an offer in compromise with the Internal Revenue Service (IRS).

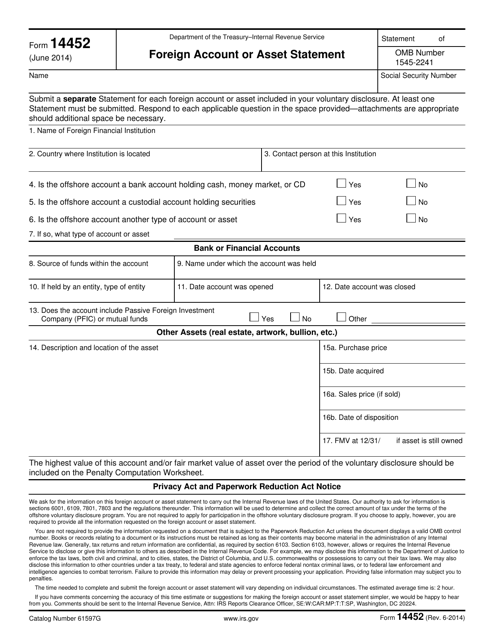

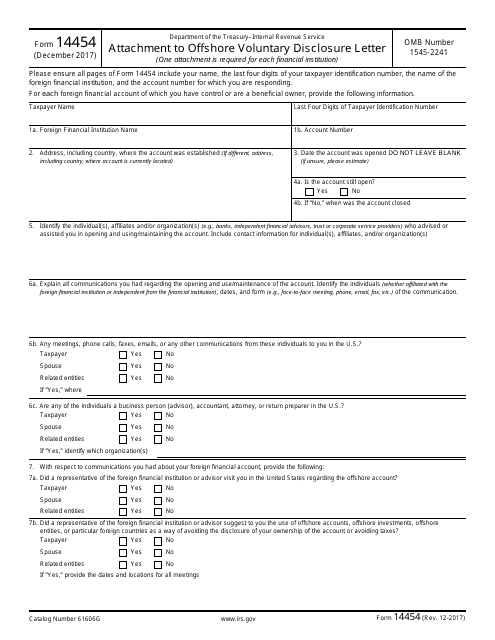

This form is used as an attachment to the Offshore Voluntary Disclosure Letter, which is submitted to the IRS. It provides additional information and documentation related to offshore accounts and income.

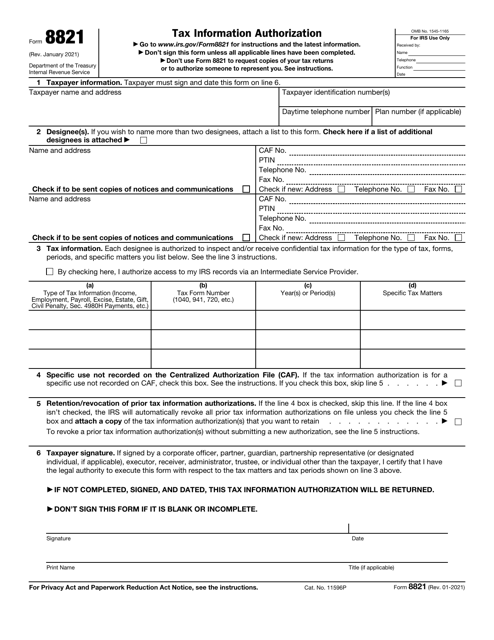

This is a formal document filled out by a taxpayer who wants another individual or company to obtain access to their tax information.

This is an IRS form used by taxpayers to calculate the amount of alternative minimum tax they owe to the government.