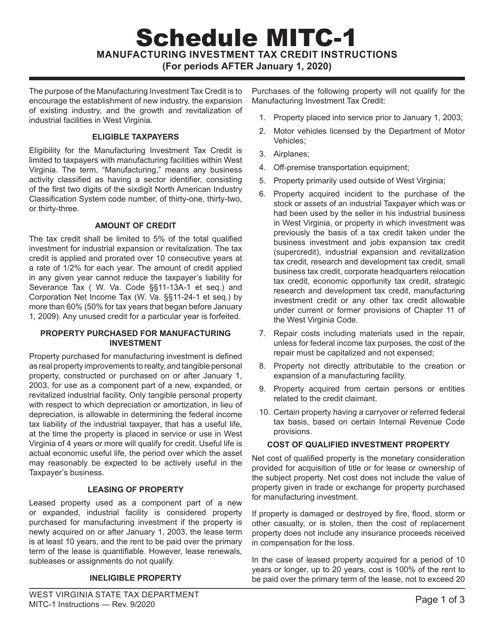

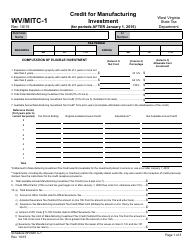

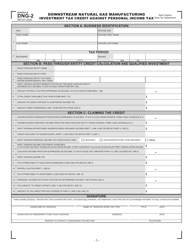

Instructions for Schedule WV / MITC-1 Credit for Manufacturing Investment - West Virginia

This document contains official instructions for Schedule WV/MITC-1 , Credit for Manufacturing Investment - a form released and collected by the West Virginia State Tax Department.

FAQ

Q: What is Schedule WV/MITC-1?

A: Schedule WV/MITC-1 is a form used to claim credits for manufacturing investment in West Virginia.

Q: Who can use Schedule WV/MITC-1?

A: This schedule can be used by individuals or businesses that have made qualifying investments in manufacturing in West Virginia.

Q: What is the purpose of Schedule WV/MITC-1?

A: The purpose of this schedule is to calculate and claim credits for manufacturing investment as provided by the state of West Virginia.

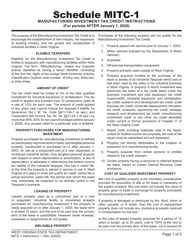

Q: What qualifies as a manufacturing investment?

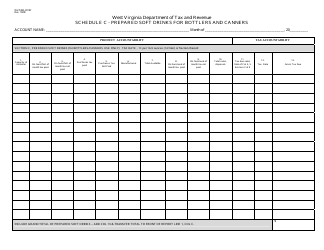

A: Qualifying investments include the purchase or lease of tangible personal property to be used in the manufacturing process, as well as the construction or expansion of manufacturing facilities in West Virginia.

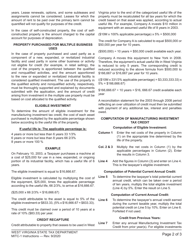

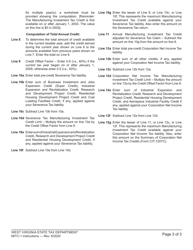

Q: What information is needed to complete Schedule WV/MITC-1?

A: You will need to provide details about your manufacturing investment, including the amount spent, the property or facilities involved, and any other relevant information.

Q: How do I claim credits using Schedule WV/MITC-1?

A: You must complete Schedule WV/MITC-1 and attach it to your West Virginia tax return, along with any supporting documentation.

Q: Are there any specific requirements or limitations for the credits?

A: Yes, there are certain requirements and limitations for claiming credits, such as minimum investment thresholds, job creation requirements, and annual limits on credits.

Q: Can I claim credits for manufacturing investment in Canada?

A: No, Schedule WV/MITC-1 is specific to manufacturing investment in West Virginia and cannot be used to claim credits in Canada.

Q: Is Schedule WV/MITC-1 applicable to all types of manufacturing investments?

A: Schedule WV/MITC-1 is applicable to most types of manufacturing investments, but it is always recommended to refer to the instructions and guidelines provided by the West Virginia State Tax Department.

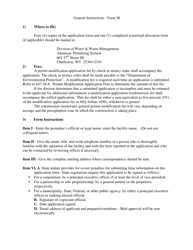

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the West Virginia State Tax Department.