This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule CL

for the current year.

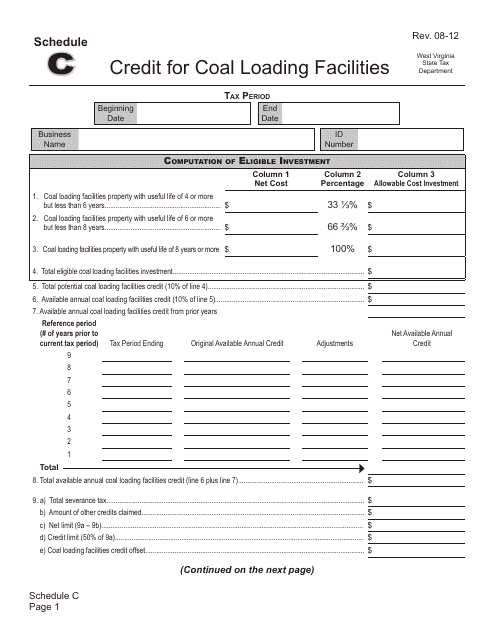

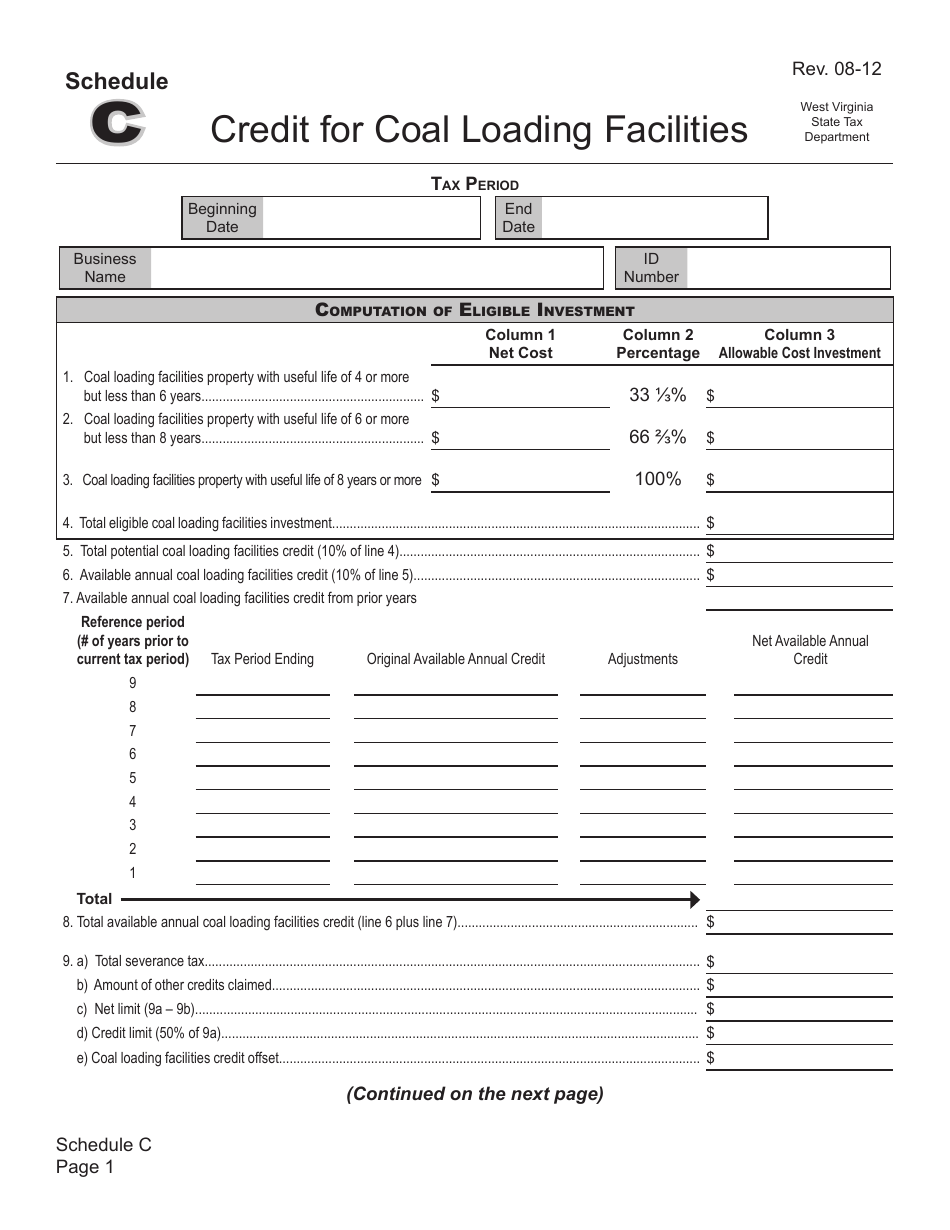

Schedule CL Credit for Coal Loading Facilities - West Virginia

What Is Schedule C?

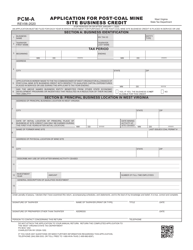

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule C?

A: Schedule C is a tax form used by businesses to report income or loss from a sole proprietorship.

Q: What is the Credit for Coal Loading Facilities?

A: The Credit for Coal Loading Facilities is a tax credit available to eligible taxpayers who own or lease qualified coal loading facilities.

Q: Who is eligible for the Credit for Coal Loading Facilities?

A: Taxpayers who own or lease qualified coal loading facilities in West Virginia may be eligible for the credit.

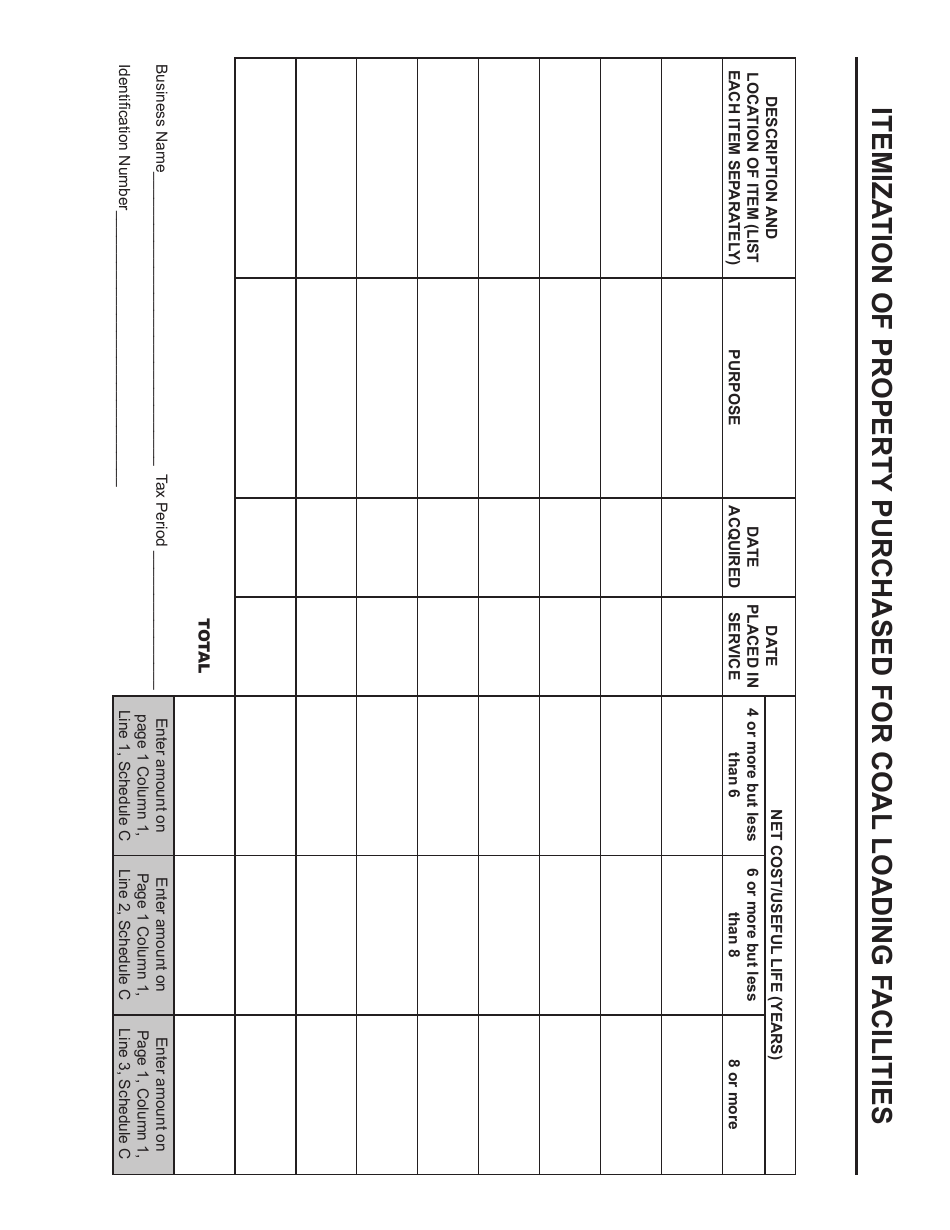

Q: What is a qualified coal loading facility?

A: A qualified coal loading facility is a facility used primarily for the purpose of loading coal onto trains or barges for transportation.

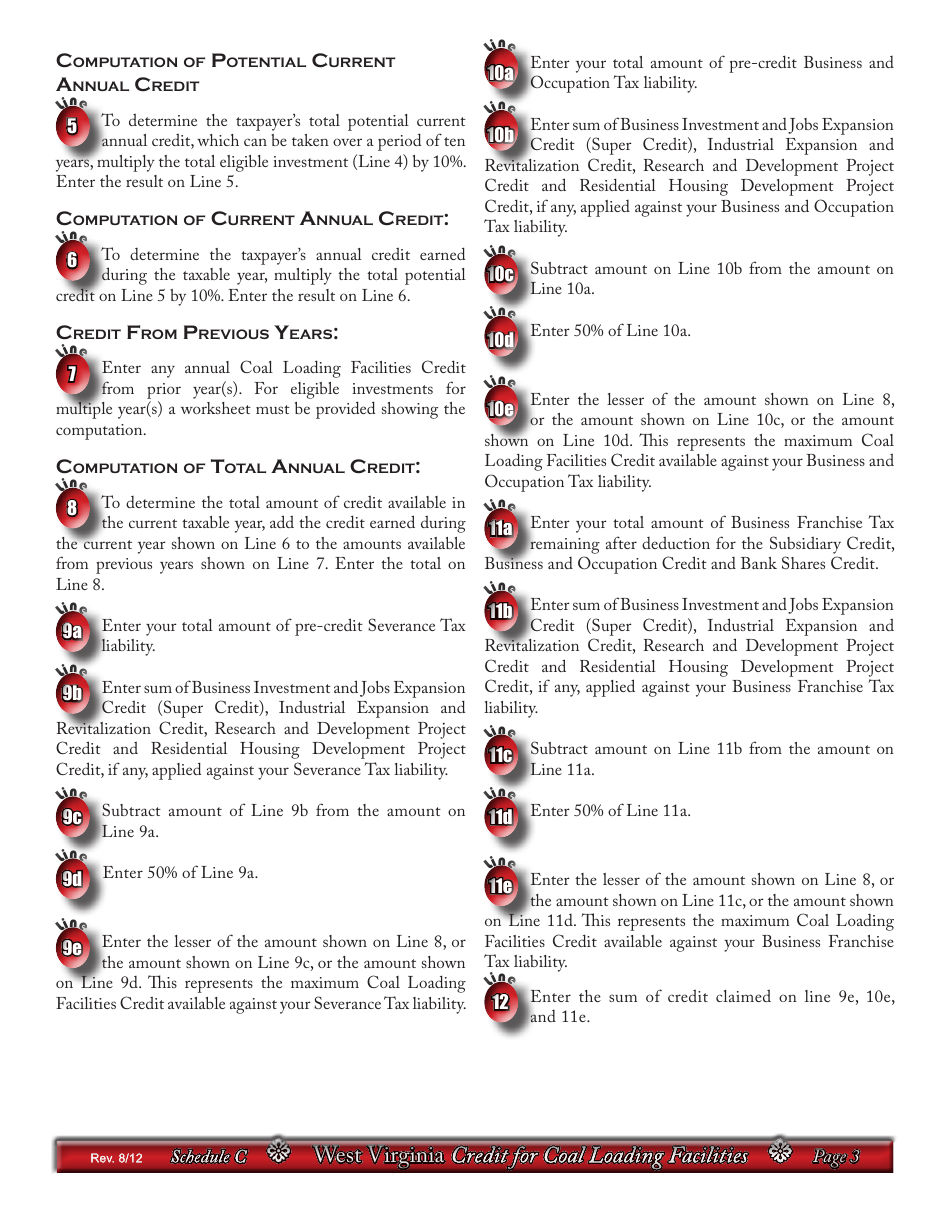

Q: How much is the Credit for Coal Loading Facilities?

A: The amount of the credit is based on the eligible capital costs of the facility, up to a maximum credit amount determined by the West Virginia Division of Energy.

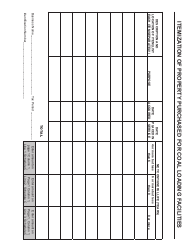

Q: How do I claim the Credit for Coal Loading Facilities?

A: To claim the credit, taxpayers must complete and attach Schedule C to their West Virginia state tax return, along with any required supporting documentation.

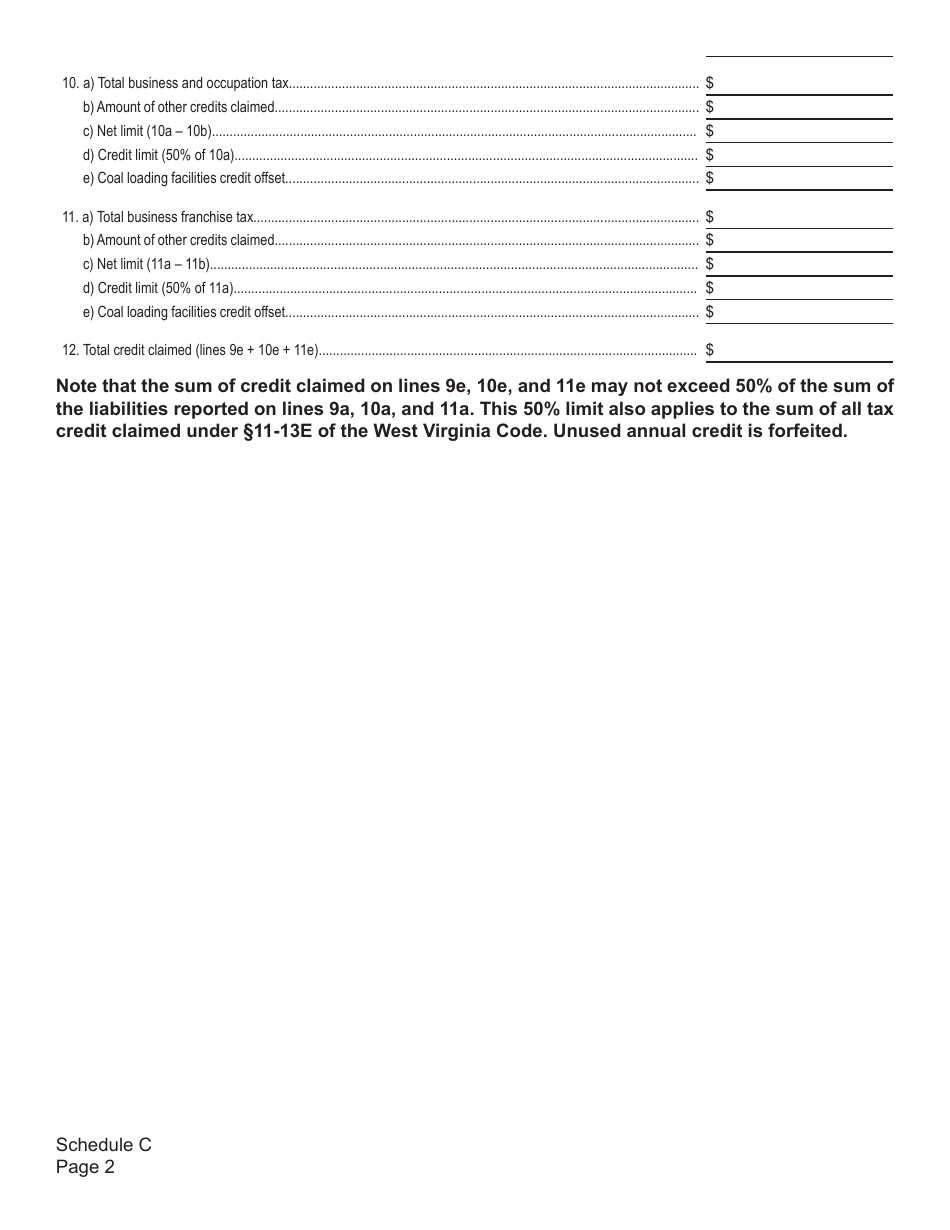

Q: Are there any limitations or restrictions on the Credit for Coal Loading Facilities?

A: Yes, there are certain limitations and restrictions on the credit, such as a maximum credit amount and a phased reduction in the credit for facilities placed in service after a specific date.

Form Details:

- Released on August 1, 2012;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule C by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.